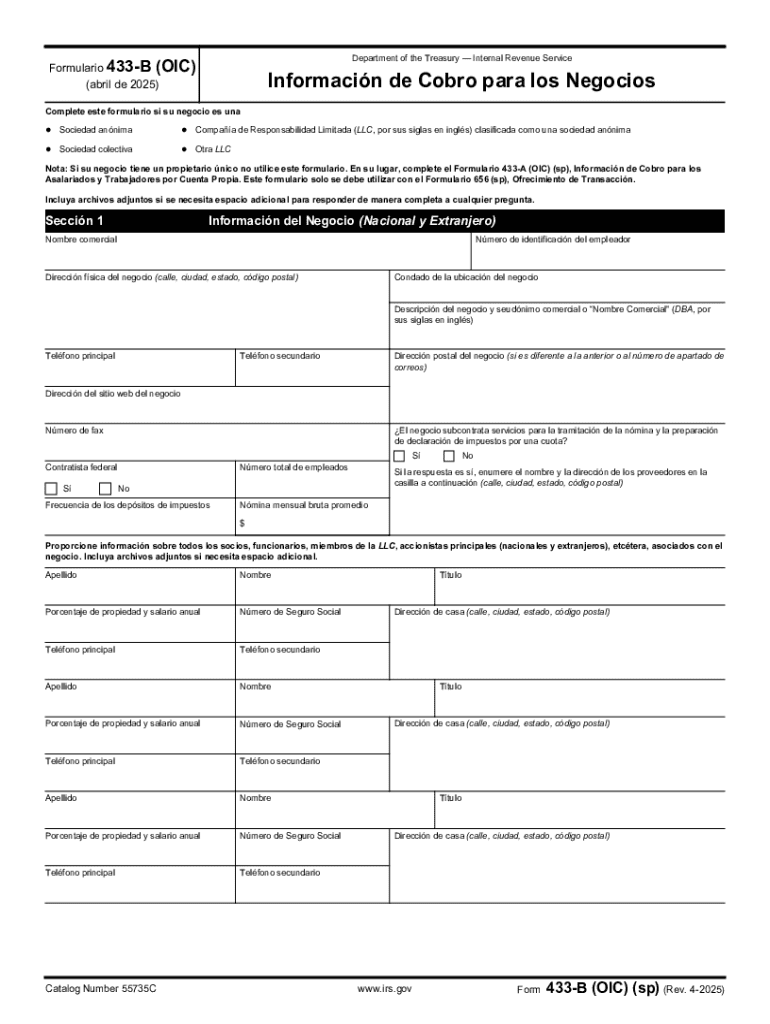

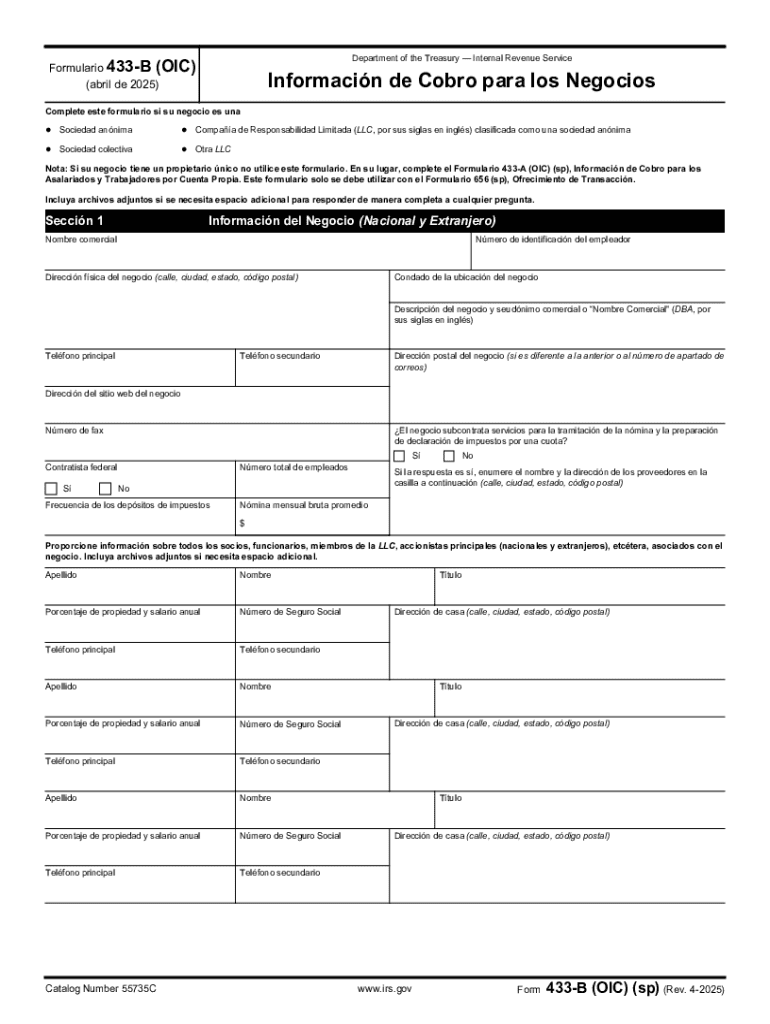

IRS 433-B (OIC) (SP) 2025-2026 free printable template

Get, Create, Make and Sign form 433 b oic

Editing IRS 433-B OIC SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 433-B (OIC) (SP) Form Versions

How to fill out IRS 433-B OIC SP

How to fill out form 433-b oic sp

Who needs form 433-b oic sp?

Understanding IRS Form 433-B OIC SP: A Comprehensive Guide

Overview of IRS Form 433-B OIC SP

IRS Form 433-B OIC SP is a critical document used in the Offer in Compromise (OIC) process specifically tailored for business entities. This form enables businesses facing financial difficulties to settle their tax liabilities with the IRS for less than the total amount owed. The primary purpose of the form is to provide the IRS with a clear and comprehensive snapshot of a business's financial situation, allowing the agency to evaluate the feasibility of accepting a reduced settlement.

Understanding the importance of this form is essential for business owners, as it can provide significant financial relief by resolving overwhelming tax debts. Moreover, it establishes a formal request for the IRS to negotiate a settlement, making it an integral step in addressing tax compliance issues.

Who should use this form?

Form 433-B OIC SP is specifically designed for business entities that are looking to settle their tax obligations through an offer in compromise. Eligible businesses may include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs) that owe back taxes and can demonstrate an inability to pay the full amount. The IRS typically evaluates several criteria, including the business's financial health and potential revenue stream, to determine eligibility.

It is crucial to note that this form is distinct from individual submissions. While individuals complete the Form 433-A for their offers, businesses must use Form 433-B OIC SP. Therefore, understanding the specifications and requirements of this form is key for business entities seeking to resolve their tax debts effectively.

Key components of Form 433-B OIC SP

Completing the Form 433-B OIC SP requires careful attention to its structured sections. Each part serves to gather information crucial for the IRS to assess the tax situation accurately. Below is a detailed breakdown of the major sections of the form:

Instructions for completing Form 433-B OIC SP

Completing Form 433-B OIC SP can be straightforward if approached methodically. Below is a step-by-step guide to help business owners navigate the complexity of this process.

Common challenges and solutions

Completing Form 433-B OIC SP can come with various challenges that business owners may encounter. Here are some of the potential issues and solutions to help address them:

To further assist, it’s important to utilize IRS resources or consult with knowledgeable tax professionals who specialize in tax settlements.

Using pdfFiller for Form 433-B OIC SP

Navigating form completion can greatly benefit from using pdfFiller. This platform offers various tools to streamline the process of managing your form efficiently.

Using pdfFiller not only enhances document management but also ensures compliance with IRS requirements by making the tedious task of form filling simpler.

Additional information about Offer in Compromise

After submitting Form 433-B OIC SP, businesses may wonder what to expect in the OIC process. Typically, the IRS will assess your offer and may request additional details or clarifications within a specific timeframe.

Accepting an Offer in Compromise can lead to significant financial relief, allowing businesses to stabilize and eventually thrive despite earlier tax burdens.

FAQs about Form 433-B OIC SP

Understanding the nuances of Form 433-B OIC SP can bring about many questions, especially among business owners new to the OIC process. Here are several common queries answered:

Final thoughts on Form 433-B OIC SP

Navigating taxes and compliance can be complex, particularly when submitting forms like Form 433-B OIC SP. Understanding when to seek professional help is paramount to ensuring an effective strategy for your tax situation.

Utilizing services like pdfFiller can also help connect you with tax professionals who can provide personalized advice, ensuring that your form is completed effectively and accurately.

Additional tools and features via pdfFiller

pdfFiller additionally provides interactive features that enrich the user experience while managing Form 433-B OIC SP. These resources are designed to elevate the user experience and impact of tax submission processes.

Encouraging continuous learning through webinars and courses on tax regulations can further empower business owners and teams, enhancing their understanding of compliance features.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 433-B OIC SP in Gmail?

How can I modify IRS 433-B OIC SP without leaving Google Drive?

How do I edit IRS 433-B OIC SP on an Android device?

What is form 433-b oic sp?

Who is required to file form 433-b oic sp?

How to fill out form 433-b oic sp?

What is the purpose of form 433-b oic sp?

What information must be reported on form 433-b oic sp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.