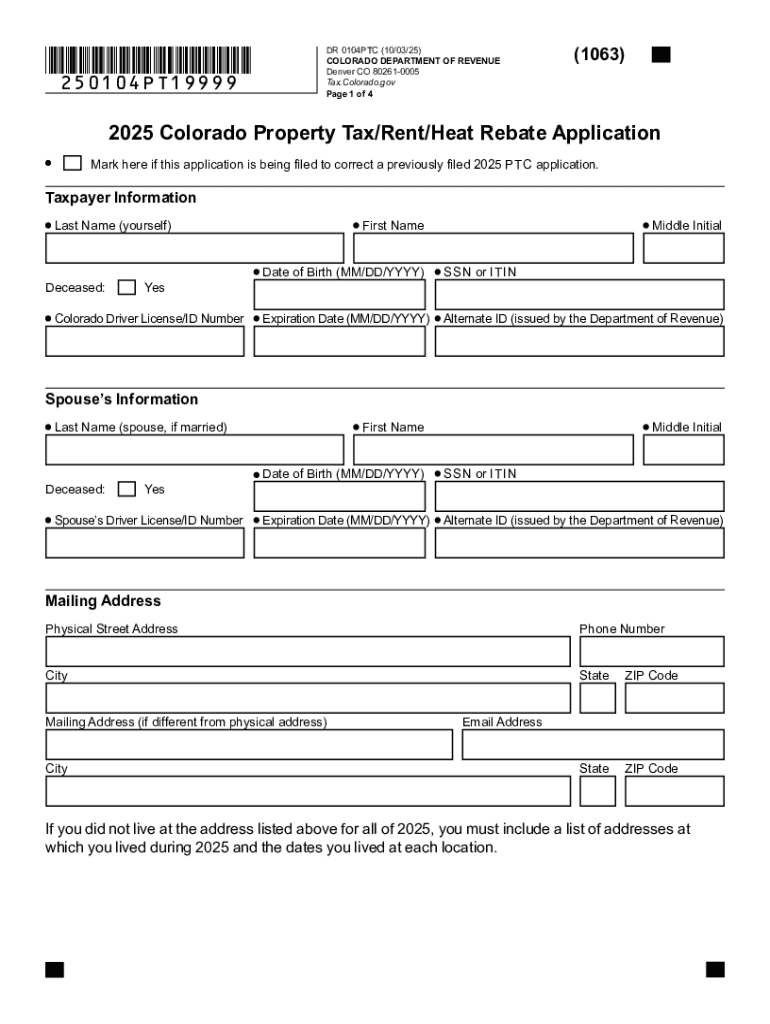

Get the free ptc rebate 2025

Get, Create, Make and Sign ptc rebate 2025 form

How to edit ptc rebate 2025 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptc rebate 2025 form

How to fill out 2025 104ptc book property

Who needs 2025 104ptc book property?

A Comprehensive Guide to the 2025 104ptc Book Property Form

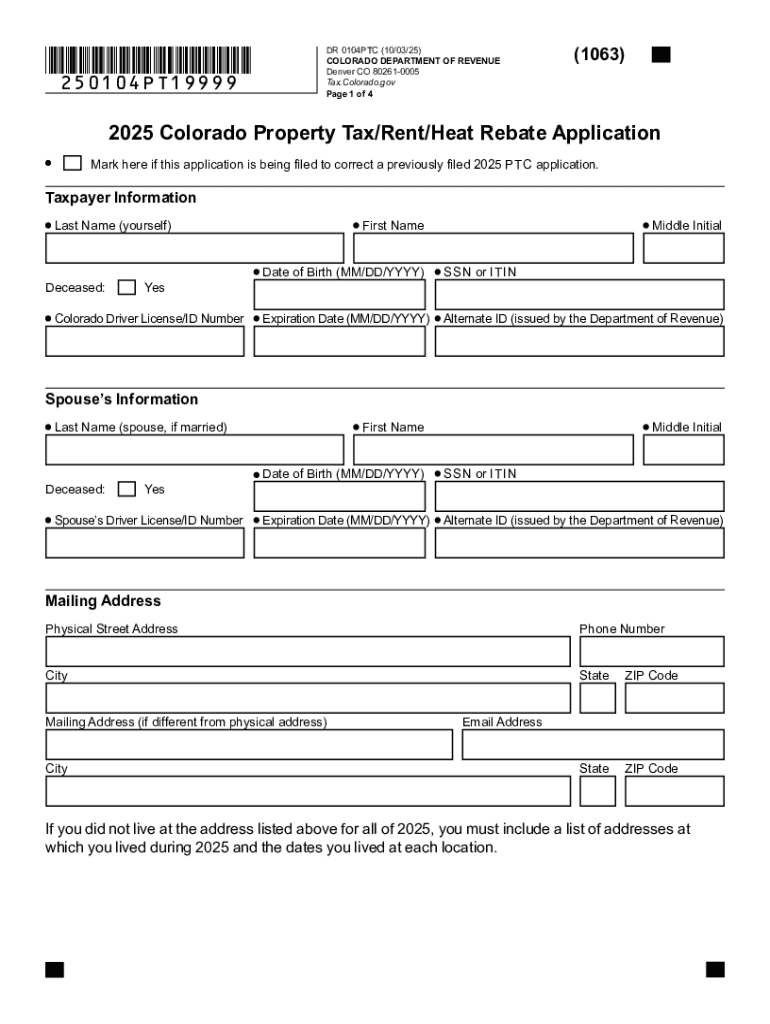

Understanding the 2025 104ptc Book Property Form

The 2025 104ptc Book Property Form serves a crucial role in the property tax process. It is designed to assist taxpayers in claiming property tax rebates, ensuring equitable taxation based on property ownership and related factors. This form is essential for individuals and teams seeking to assert their rights to appropriate tax deductions or credits under tax relief programs.

By clearly documenting property details and income levels, this form provides a standardized method for assessing eligibility for potential tax refunds. Whether you're new to the property tax landscape or an experienced homeowner, understanding the necessity of the 2025 104ptc Book Property Form is crucial for maximizing your tax benefits.

Who needs this form?

The 2025 104ptc Book Property Form is primarily intended for homeowners and property investors. Specifically, individuals who own a residential property and wish to apply for tax rebates should be utilizing this form. This includes:

Key features of the 2025 104ptc Book Property Form

The 2025 104ptc Book Property Form is structured to facilitate user-friendly completions. Its design integrates a variety of sections to gather comprehensive data efficiently. Each component is tailored to collect vital information needed for accurate tax assessment and rebate eligibility.

The form comprises various fields and instructions that guide the user through its completion. Specific sections include applicant information, property details, and income and deductions. Each segment is intended to be straightforward, minimizing room for error.

Interactive features available via pdfFiller

Using pdfFiller enhances the process of completing the 2025 104ptc Book Property Form. With its interactive capabilities, users can enjoy seamless editing options that allow for the following:

Step-by-step instructions for completing the 2025 104ptc Book Property Form

Completing the 2025 104ptc Book Property Form requires careful preparation and attention to detail. Start by gathering necessary documentation to ensure your submission is accurate. Key items include:

Once you have gathered the required information, proceed to filling out the form. Each section of the form focuses on different aspects:

Finally, be mindful of the common mistakes while filling out the 2025 104ptc Book Property Form. These include:

Editing and adjusting the 2025 104ptc Book Property Form

After form completion, you may find adjustments are needed. pdfFiller offers various easy editing tools, making it simple to adapt your document. Users can modify text, add or delete sections, and adjust formatting to align with their preferences or new information.

Additionally, saving and sharing your completed form via pdfFiller is streamlined. Follow the outlined steps to:

E-signing the 2025 104ptc Book Property Form

Legal validation of the 2025 104ptc Book Property Form is achieved through eSigning. This method guarantees the authenticity and commitment of the signer, aligning with modern digital practices accepted by tax authorities.

To eSign the form using pdfFiller, follow these simple steps:

Submitting the 2025 104ptc Book Property Form

Once completed and signed, the next step is submitting the 2025 104ptc Book Property Form. It can be sent either online or via standard mail, providing flexibility based on user preferences.

Important submission deadlines should be noted to ensure timely processing. Factors to consider include:

Managing your 2025 104ptc Book Property Form with pdfFiller

Effective document management is vital for a smooth experience. pdfFiller facilitates organizing your forms in the cloud, ensuring access and collaboration whenever needed. Users can segregate files into folders, and label them for easy retrieval.

Monitoring the status of your submission is also critical. With pdfFiller, tracking is made simple, allowing users to see updates and confirmation once the form is processed.

Frequently asked questions (FAQs)

As users engage with the 2025 104ptc Book Property Form, common queries often arise regarding the process. Addressing these FAQs can minimize confusion and streamline form submissions.

Some typical questions include:

Additional tools and resources for users

To enhance your experience with the 2025 104ptc Book Property Form, several complementary resources are available. These tools and templates can provide further guidance and context for users unfamiliar with property tax submissions.

In addition, access to customer support is essential should any obstacles arise. With pdfFiller’s customer support team, users can expect prompt assistance tailored to their specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ptc rebate 2025 form online?

Can I create an electronic signature for signing my ptc rebate 2025 form in Gmail?

How do I edit ptc rebate 2025 form on an Android device?

What is 2025 104ptc book property?

Who is required to file 2025 104ptc book property?

How to fill out 2025 104ptc book property?

What is the purpose of 2025 104ptc book property?

What information must be reported on 2025 104ptc book property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.