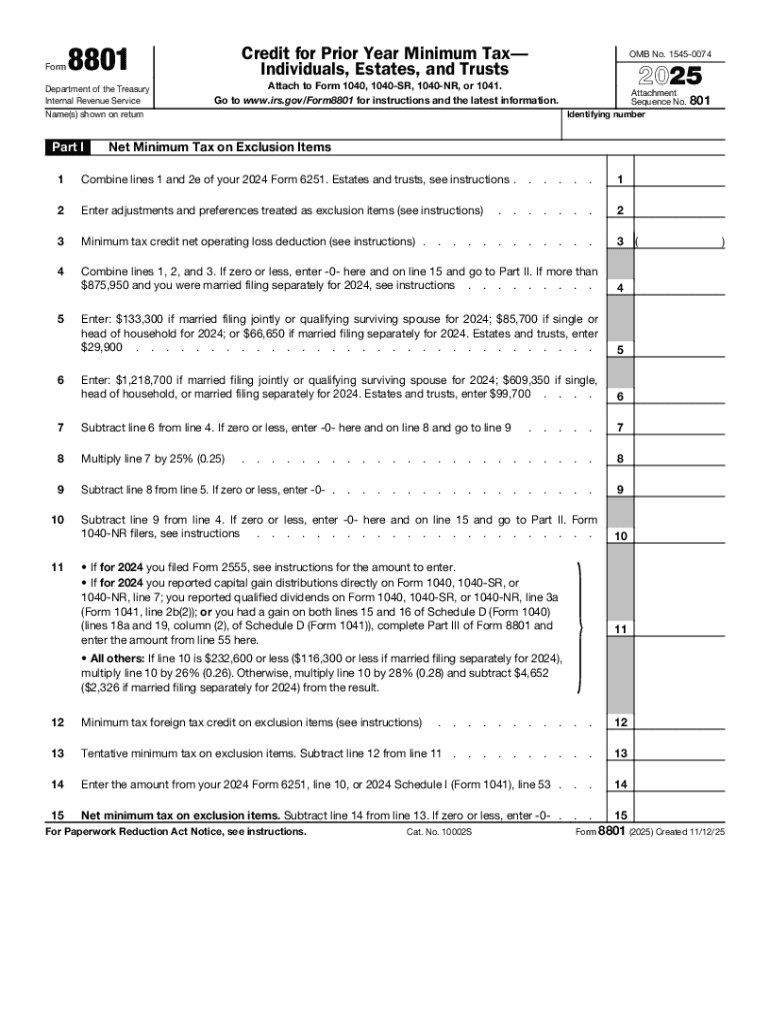

IRS 8801 2025-2026 free printable template

Get, Create, Make and Sign IRS 8801

How to edit IRS 8801 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8801 Form Versions

How to fill out IRS 8801

How to fill out 2025 form 8801

Who needs 2025 form 8801?

2025 Form 8801: A Comprehensive Guide for Taxpayers

Understanding Form 8801

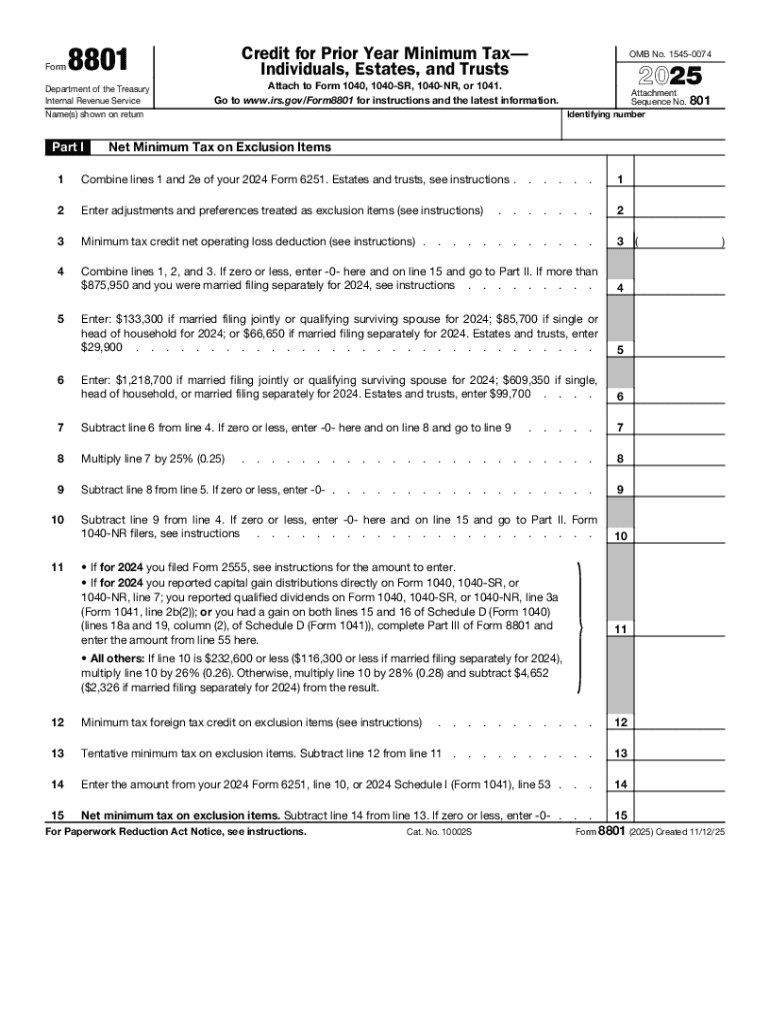

Form 8801 is a critical document for taxpayers wishing to claim the prior year minimum tax credit in conjunction with current-year credits. Its primary purpose is to allow individuals to determine their eligibility and calculate any credits carried forward from prior years. This form is especially significant for taxpayers who have previously paid alternative minimum tax (AMT) and are now eligible to reclaim some of these amounts through tax credits.

Those who may consider filing Form 8801 typically include taxpayers who have faced AMT in recent years and are transitioning back to the standard tax system. If you have unpaid minimum tax amounts from past taxes, this form can be a lifeline to recover some of that lost credit. It's crucial in keeping your tax obligations manageable while maximizing your credits.

The 2025 version of Form 8801 sees some updates aimed at improving clarity and usability. Notably, there may be changes in the calculation methods or documentation requirements intended to streamline the filing process.

Preparing to complete Form 8801

Preparation is key when tackling Form 8801. First, gather all relevant documentation, which might include your previous year's tax returns, any paperwork related to AMT calculations, and records of paid taxes. Accurate preparation can save you from complications later in the process.

Next, examine your eligibility for claiming credits. The criteria often include having paid AMT in previous years without fully benefiting from credits during those tax periods. However, certain situations might disqualify you, such as a significant change in income levels since you last filed AMT.

Step-by-step guide to filling out Form 8801

Completing Form 8801 can feel daunting, but breaking it down into parts makes it manageable. Start with Part I, which addresses the current year credit. Here, you'll calculate how much credit you can claim based on your qualifying expenses and past tax liability.

Next, proceed to Part II, focused on prior year minimum tax credit. This part requires collecting information related to any credits you applied in previous years. Accuracy is paramount here; failing to include prior year credits can diminish your overall tax benefits. Lastly, Part III involves understanding and calculating credit limitations, ensuring you're within the allowable limits based on your income and tax situations.

Insight into filing and submitting Form 8801

Timing is crucial when filing Form 8801. Familiarize yourself with important dates for the 2025 filing season to avoid penalties. Typically, tax forms are due by mid-April, but knowing the exact dates is vital as they can change slightly each year. Be vigilant about these deadlines, as they impact the processing of your credits.

When it comes to submission, taxpayers have two primary options: electronic filing or paper submission. Electronic filing is often the recommended route due to its efficiency and the ability to track the status of your submission. Many tax software solutions, including platforms like pdfFiller, facilitate easy electronic submissions that are secure and fast.

Tracking your submission is essential. Expect a notification from the IRS regarding your filing status within a few weeks, either affirmatively stating your credits or requesting further information. Make sure to retain copies of your Form 8801 and any correspondence received from the IRS.

Common mistakes and how to avoid them

Avoiding mistakes on Form 8801 can save you time and money. One of the most common errors is the miscalculation of credit amounts, particularly due to oversight when transferring figures from previous returns. Ensure that you meticulously verify each calculation, as this can significantly impact your tax liability and refunds.

A successful submission is a careful submission. If possible, ask a partner or a tax professional to review your completed form before filing. Expert guidance can help to catch errors you might overlook.

FAQs about Form 8801

To enhance understanding, let’s address some frequently asked questions regarding Form 8801. What happens if I miss the filing deadline? If you fail to file by the due date, you may not be eligible to claim your credits for that tax year; thus, prompt submission is crucial.

Can I amend my form after submission? Yes, taxpayers can amend their forms if they realize an error. The process involves submitting Form 1040-X, alongside correct information from Form 8801.

Lastly, if you need help, don't hesitate to consult with a tax professional or utilize the resources available through pdfFiller for assistance in navigating the complexities surrounding tax forms.

Enhancing your Form 8801 experience with pdfFiller

pdfFiller adds significant ease to managing Form 8801 and other documentation. The platform helps you edit, eSign, and collaborate seamlessly. With its cloud-based capabilities, you can access your documents from any device, simplifying the process of consistent updates and submissions.

Notably, pdfFiller provides interactive tools specifically designed for tax form completion. You can utilize automated fill options to quickly complete Form 8801, ensuring that you have accurate information entered consistently without the hassle of manual entry.

Real-time collaboration is another key feature, offering teams an efficient way to work together on documents. Whether you're a business or an individual, pdfFiller empowers you to manage your documents smoothly while ensuring accuracy and compliance.

Case studies and examples

Understanding Form 8801 can be enhanced through real-life scenarios. For instance, consider a taxpayer who diligently tracked their AMT payments over the years. When filing for the 2025 year, they meticulously completed Form 8801, properly claiming their prior year minimum tax credits, resulting in a refund that significantly impacted their financial health.

Conversely, a case exists where a taxpayer mistakenly failed to file because they underestimated their eligibility. They missed out on valuable credits that could have offset their tax obligations for that entire year. This highlights the importance of due diligence and understanding the intricacies of the tax codes surrounding Form 8801.

Next steps after filing Form 8801

Once you’ve submitted Form 8801, monitoring your credit application status is your next step. The IRS usually provides updates within a few weeks, confirming credit eligibility or requesting more details, if needed.

Additionally, preparation for future tax filings can become simpler with the tools offered by pdfFiller. Organize records for upcoming years, making sure to incorporate any relevant notes from your previous Form 8801 experiences to guide your future claims.

Consider consistently using pdfFiller's various document management tools to streamline this process, optimizing your efficiency as you move forward in managing your tax documents.

People Also Ask about

How do I claim my AMT credit refund?

What is the purpose of IRS form 8801?

What is line 1 of form 8801?

What is the credit for prior year minimum tax form 8801?

How do I redeem my AMT credit?

How do I get my AMT tax credit back?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 8801 without leaving Google Drive?

How do I edit IRS 8801 straight from my smartphone?

How do I fill out IRS 8801 on an Android device?

What is 2025 form 8801?

Who is required to file 2025 form 8801?

How to fill out 2025 form 8801?

What is the purpose of 2025 form 8801?

What information must be reported on 2025 form 8801?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.