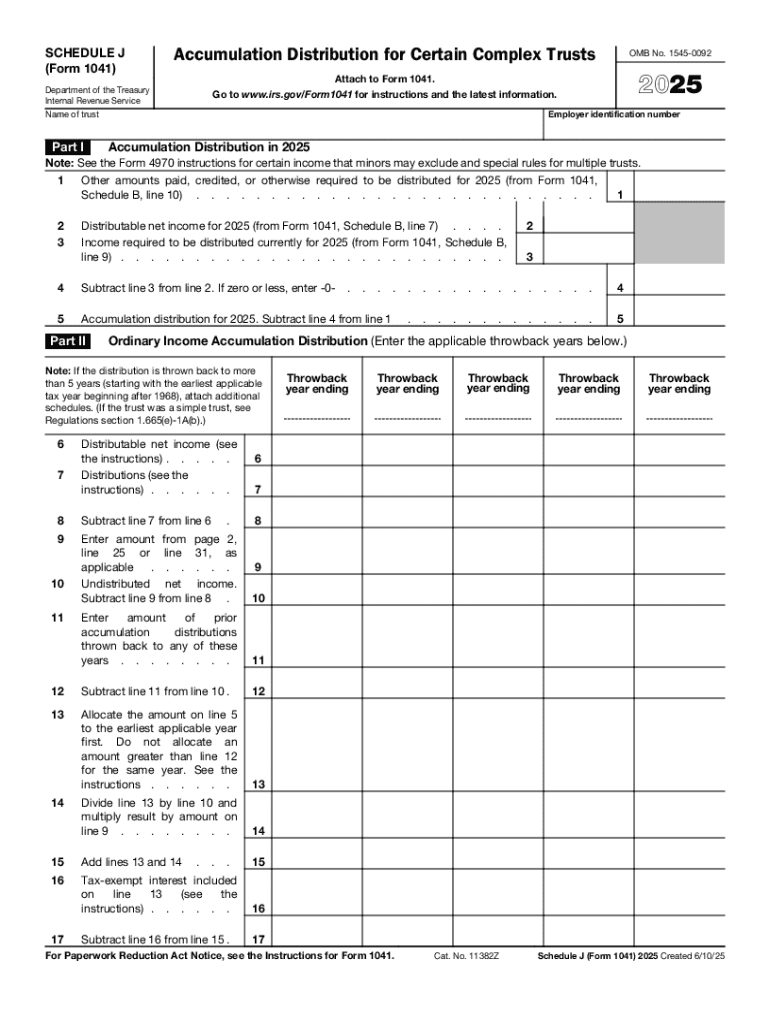

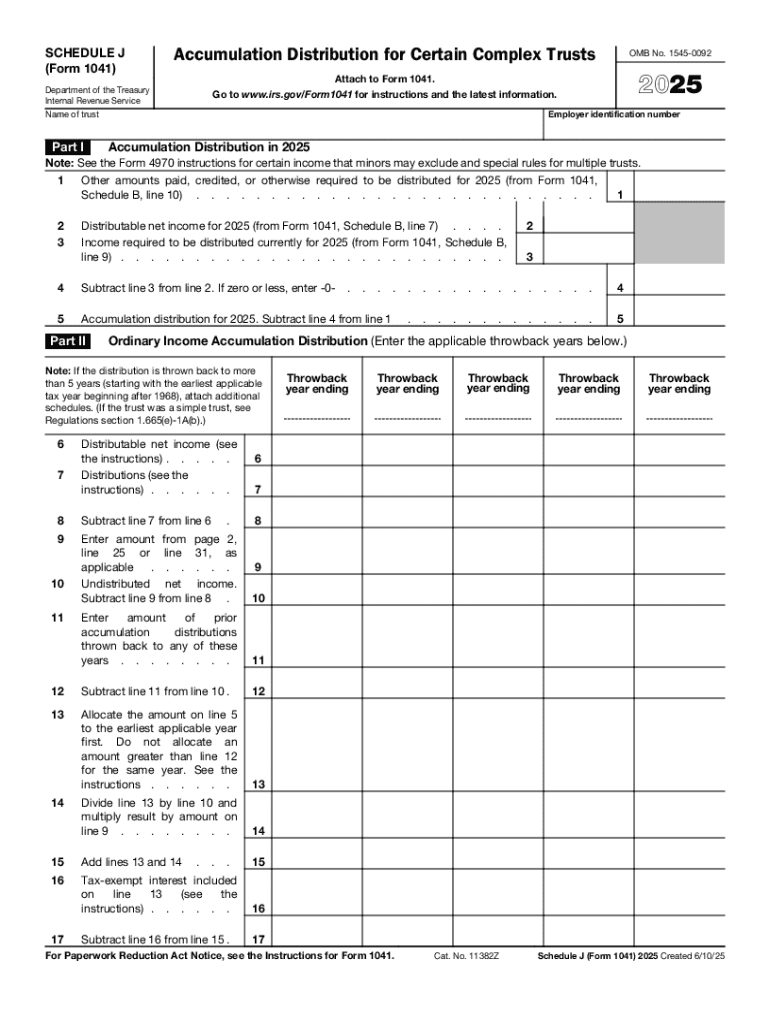

IRS 1041 Schedule J 2025-2026 free printable template

Get, Create, Make and Sign IRS 1041 Schedule J

How to edit IRS 1041 Schedule J online

Uncompromising security for your PDF editing and eSignature needs

IRS 1041 Schedule J Form Versions

How to fill out IRS 1041 Schedule J

How to fill out 2025 schedule j form

Who needs 2025 schedule j form?

Comprehensive Guide to the 2025 Schedule J Form

Understanding the 2025 Schedule J Form

The 2025 Schedule J Form is a crucial document designed for reporting income and determining the tax implications for taxpayers who earn income from multiple business ventures. This form serves a significant purpose in providing the Internal Revenue Service (IRS) with detailed insights into various income streams, ensuring accurate tax computation. Taxpayers utilizing Schedule J can effectively allocate their gross income from different sources, especially beneficial for those in farming and entrepreneurial activities.

The relevance of the Schedule J Form extends beyond mere compliance; it directly influences how taxpayers can maximize their available tax credits and deductions. For individuals managing diverse income, this form acts as a central report that consolidates earnings across ventures, potentially mitigating the overall tax burden.

Key objectives of using the 2025 Schedule J Form

Filing the 2025 Schedule J Form brings several key benefits that streamline the tax preparation process. One of the primary objectives is to facilitate the smooth reporting of multi-source income. Taxpayers can provide a comprehensive landscape of their earnings from different business activities, including farming, thereby simplifying the complexities involved in income reporting.

Furthermore, the Schedule J Form ensures that taxpayers are eligible for substantial deductions related to their farming and business activities. For example, farmers can report their income accurately to qualify for specific deductions associated with agricultural operations. In addition, it simplifies the tracking of various income sources, allowing taxpayers to focus on compliance without getting lost in paperwork.

Who should file the 2025 Schedule J Form?

Identifying eligibility for filing the 2025 Schedule J Form is vital to ensure compliance with tax regulations. Generally, both individual taxpayers and business entities can benefit from this form. Individuals who derive income from multiple streams, such as self-employed individuals or farmers, should consider filing to account for various sources of income properly.

The types of income that necessitate filing Schedule J include earnings from self-employment, various agricultural activities, and income generation from multiple business operations. Specifically, farmers and small business owners must report their gross income through this form to remain compliant with IRS tax requirements.

How to obtain the 2025 Schedule J Form

Accessing the 2025 Schedule J Form is straightforward, with multiple avenues for taxpayers eager to begin their filing process. The official form can be obtained directly from government websites such as the IRS, which maintains the most up-to-date versions of all tax forms. Minimizing the possibility of using outdated documents is crucial for accurate reporting.

Additionally, pdfFiller offers valuable tools for accessing and filling out the form easily. With features that allow users to search for forms and templates, pdfFiller stands out as an accessible resource for obtaining the necessary documentation—ensuring you can manage your forms with convenience and efficiency.

Step-by-step instructions to complete the 2025 Schedule J Form

Completing the 2025 Schedule J Form requires thorough preparation and organization. To start, gather all necessary financial documents, including previous tax returns, income statements, and any relevant financial records that detail your diverse streams of income.

Next, take a step-by-step approach to filling out the form. Breaking down the sections, you must follow the instructions for each line carefully. Find line-by-line guidance by using resources available through pdfFiller, which provides detailed explanations for each section of the form.

Common mistakes often include incorrect reporting of figures or failing to account for specific business deductions. Being methodical can help prevent errors, alleviating future complications with the IRS.

Electronically filing the 2025 Schedule J Form

Utilizing pdfFiller’s capabilities allows you to electronically file the 2025 Schedule J Form efficiently. Online platforms are increasingly favored for their user-friendly interfaces, which streamline the process to meet IRS submission standards. With pdfFiller’s cloud-based tools, you can fill out the form at your convenience without the hassle of paperwork.

To electronically submit your Schedule J, first, ensure all information is correct before finalizing. Use pdfFiller to create an account, complete the form, and take advantage of features for review and editing. Once you have finalized your submission, pdfFiller simplifies the e-filing process, ensuring compliance with IRS standards.

Filing timeline and deadlines for the 2025 Schedule J Form

Adhering to the filing timeline and deadlines for the 2025 Schedule J Form is essential to avoid penalties and complications with your tax return. Generally, the key date to file your form falls within the tax season, coinciding with the overarching tax return submission deadline. For most taxpayers, this date is typically around April 15.

Taxpayers should remain aware of the penalties for late submissions. Filing the Schedule J late can incur financial penalties, interest on unpaid taxes, and increased scrutiny from the IRS. To stay compliant, be proactive about your filing dates, and remember that while annual filing is standard, some filers may have quarterly reporting obligations which must be adhered to as well.

Consequences of incorrect or late submission of the 2025 Schedule J Form

Filing the 2025 Schedule J Form incorrectly or past the due date can lead to several negative repercussions for taxpayers. Financial penalties imposed for late submissions can add up quickly, creating unnecessary strain. Delayed or erroneous filings can trigger additional interest on unpaid taxes, making it even more crucial to file accurately and on time.

Moreover, incorrect submissions heighten the risk of being audited by the IRS, leading to further financial scrutiny and stress. In situations where errors are discovered post-filing, it is possible to amend a filed Schedule J Form; taxpayers should follow the proper procedures outlined by the IRS to rectify any mistakes.

Utilizing pdfFiller tools for managing the 2025 Schedule J Form

pdfFiller offers an array of digital tools specifically designed to enhance the process of managing the 2025 Schedule J Form. The platform includes robust editing features that allow users to modify content directly within their PDFs, enabling tax preparation software capabilities without the need for cumbersome printing and manual entry.

Additionally, collaboration tools on pdfFiller enable efficient teamwork and reviews of documents among various stakeholders. Users can share forms seamlessly, allowing input from colleagues or tax professionals for an optimized filing experience. The accessible, cloud-based platform ensures that you’re equipped with the necessary tools to manage your tax documents effectively.

Common FAQs about the 2025 Schedule J Form

FAQs surrounding the 2025 Schedule J Form typically revolve around common tax concerns. A frequent question entails understanding specific deductions applicable for farmers or those with unique income situations. Taxpayers are encouraged to thoroughly research or consult with tax professionals to clarify these points and ensure they are taking full advantage of available deductions.

Moreover, accessing additional resources online can help manage more complex scenarios, such as dealing with multi-income sources. Overall, diligent research paired with the resources available on platforms like pdfFiller can significantly aid individuals in navigating the tax system effectively.

Conclusion on navigating the 2025 Schedule J Form

Navigating the 2025 Schedule J Form is not merely about compliance but maximizing tax benefits and ensuring accurate reporting of diverse income streams. As a vital tool for taxpayers, the proper use and completion of this form can lead to increased eligibility for deductions and reduced tax burden.

Embracing platforms like pdfFiller empowers users to streamline their filing experience, providing both the tools needed for efficient form management and a user-friendly interface that supports collaboration and review. Adapting to these modern solutions helps ensure that all aspects of your tax preparation, including the Schedule J Form, are handled with diligence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 1041 Schedule J directly from Gmail?

How do I make changes in IRS 1041 Schedule J?

How do I fill out the IRS 1041 Schedule J form on my smartphone?

What is 2025 schedule j form?

Who is required to file 2025 schedule j form?

How to fill out 2025 schedule j form?

What is the purpose of 2025 schedule j form?

What information must be reported on 2025 schedule j form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.