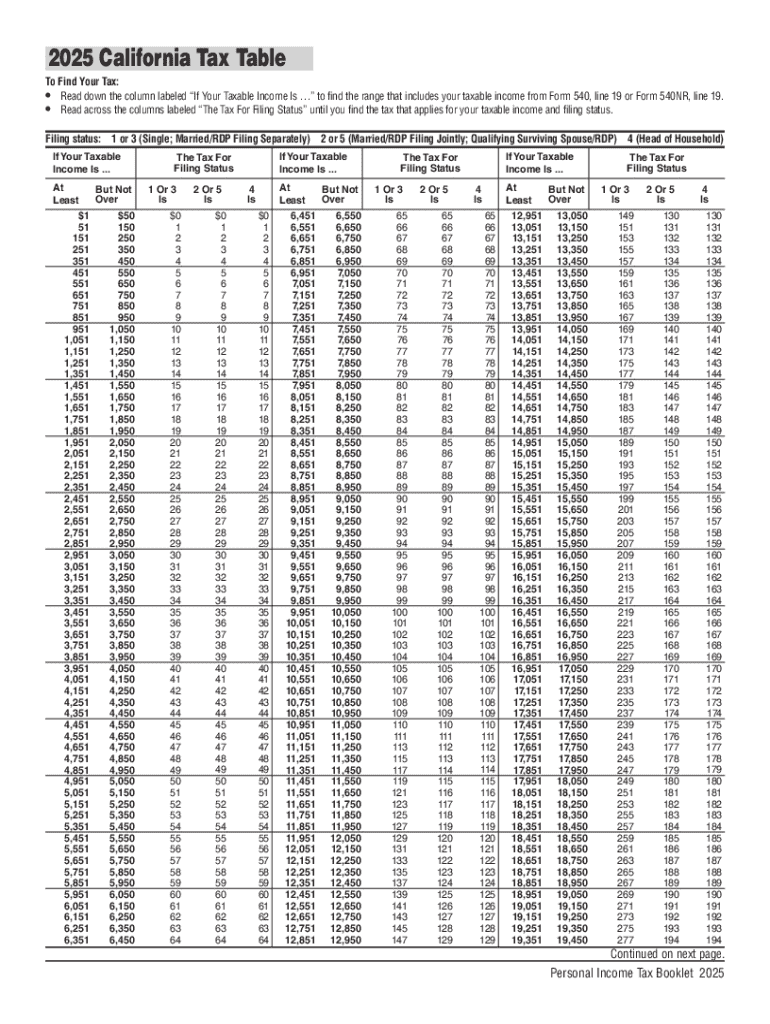

CA FTB Tax Table 2025-2026 free printable template

Get, Create, Make and Sign CA FTB Tax Table

Editing CA FTB Tax Table online

Uncompromising security for your PDF editing and eSignature needs

CA FTB Tax Table Form Versions

How to fill out CA FTB Tax Table

How to fill out 2025 ftb 540 booklet

Who needs 2025 ftb 540 booklet?

Understanding the 2025 FTB 540 Booklet Form: A Complete Guide

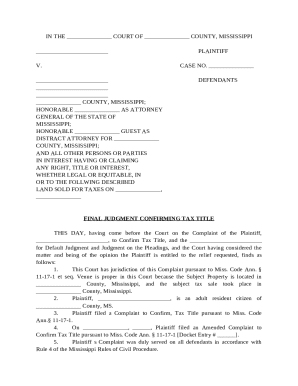

Overview of the 2025 FTB 540 booklet form

The 2025 FTB 540 booklet form is the primary state income tax return form used by residents of California. It serves to report income, claim deductions, and determine tax credits that can significantly impact a taxpayer's financial obligations. This version is crucial as it incorporates the latest tax regulations and guidelines that California residents must adhere to during the tax filing process.

Filing the 2025 FTB 540 enables taxpayers to accurately report their income, apply any applicable credits, and minimize their tax liability. With California's economy being dynamic, the updates in the 2025 version reflect changes in tax law, making it essential for taxpayers to understand its features to ensure compliance and optimize their returns.

Important dates for 2025 tax filings

One of the key components of tax preparation is knowing the crucial deadlines for form submissions. For year 2025, the deadline for submitting the FTB 540 form is April 15, 2026. However, California allows for automatic filing extension requests, moving the deadline to October 15, 2026, if necessary. It’s vital that taxpayers remain aware of these dates to avoid penalties.

In addition to the filing dates, taxpayers should note when estimated tax payments are due. For the 2025 tax year, estimated tax payments are typically due on April 15, June 15, September 15, and January 15 of the subsequent year. Meeting these deadlines helps prevent underpayment penalties that can further complicate tax situations.

The benefits of using the 2025 FTB 540 form

Filing the 2025 FTB 540 form can lead to significant benefits for California residents. First and foremost, correctly completing this form allows taxpayers to maximize their potential refunds. By understanding available deductions and credits, they can significantly reduce their taxable income. For instance, credits for education, earned income, and child care can greatly benefit taxpayer savings.

Moreover, electronic filing, especially via platforms like pdfFiller, offers distinct advantages over traditional paper filing. Electronic submissions are processed faster, reducing the time required to receive refunds. Additionally, taxpayers have access to features that help ensure their submissions are accurate, efficient, and secure.

Common errors and how to prevent them

Historically, taxpayers encounter several common errors when completing their FTB 540 returns. Miscalculations, incorrect social security numbers, and overlooked credits can lead to costly mistakes. Taxpayers often mistakenly utilize outdated forms or forget to sign their returns, leading to delayed processing and repayment.

To prevent such errors, taxpayers are encouraged to double-check their calculations thoroughly and cross-reference the line instructions accurately. Utilizing tools like pdfFiller, which allows for online completion and editing of forms, can streamline the process and reduce human error significantly through guided prompts and template formats.

Do have to file the 2025 FTB 540 form?

The requirement to file the 2025 FTB 540 form primarily depends on a taxpayer's income level and filing status. As a general rule, any California resident earning $18,524 or more must file a return. Special cases may apply for dependents or individuals with specific circumstances; they may also need to file even if their income is below this threshold.

Additionally, there are exemptions and exceptions that could alleviate the need to file. For instance, if a taxpayer’s total income is below the filing requirement but they had tax withheld from their wage, submitting a return may still be beneficial to reclaim withholdings. Understanding one's residency status is also crucial, as non-residents may have differing requirements compared to full-year residents.

Recent updates for 2025: What’s new?

The 2025 FTB 540 form comes with updated provisions reflecting recent changes in tax law. Taxpayers should be aware that new federal and state regulations can affect their deductions and credits. For instance, monetary thresholds for certain credits might have increased, impacting eligibility.

Furthermore, specific new forms and schedules may need to be attached to the FTB 540 this year that weren't required in previous filing cycles. Such changes can have significant implications for how California residents approach their tax filings. Keeping updated about these changes is essential to ensure compliance and leverage tax benefits fully.

Step-by-step instructions for completing the 2025 FTB 540 booklet form

To successfully complete the 2025 FTB 540, taxpayers must follow structured steps to ensure accuracy and compliance.

What to do after filing your 2025 FTB 540 form

After submitting the 2025 FTB 540 form, taxpayers should track the status of their tax return to ensure it processes smoothly. The California Franchise Tax Board offers resources to allow residents to check their return status using their social security number and the expected amount of refund or tax due.

In cases where taxes are owed, taxpayers should prepare for payment options, which include direct debit, credit card payments, or installment agreements. Those expecting refunds can find peace of mind in tracking their funds, ensuring they receive their entitled returns promptly.

Frequently Asked Questions (FAQs) about the 2025 FTB 540 form

Many taxpayers have questions about the FTB 540 form and its requirements. Common queries revolve around filing requirements, important deadlines, and potential pitfalls that might cause delays or rejections.

It is important to clarify that California's FTB requirements differ from federal mandates, and taxpayers should be aware of unique state-specific tax obligations. Platforms like pdfFiller streamline the handling of the FTB 540, providing templates and tools that simplify the filing process.

Interactive tools for the 2025 FTB 540 form

pdfFiller offers multiple interactive tools designed to help users complete the 2025 FTB 540 form seamlessly. Features include real-time editing capabilities and prompts that guide users through the process of filling out required fields.

Moreover, e-signing capabilities allow for secure online signatures, while collaborative tools facilitate teamwork for those managing multiple tax documents. This comprehensive system alleviates the complexities of tax filing, providing a user-friendly experience.

Utilizing pdfFiller for a streamlined tax filing experience

pdfFiller is an essential tool for anyone looking to file their 2025 FTB 540 form efficiently. The advantages of using this platform include straightforward editing options, easy management of tax documents, and secure storage for sensitive data.

User feedback consistently highlights how pdfFiller's functionalities can simplify the tax process, making document preparation quick and hassle-free. By embracing such tools, California residents can navigate their tax obligations more effectively, feeling confident in their submissions.

People Also Ask about

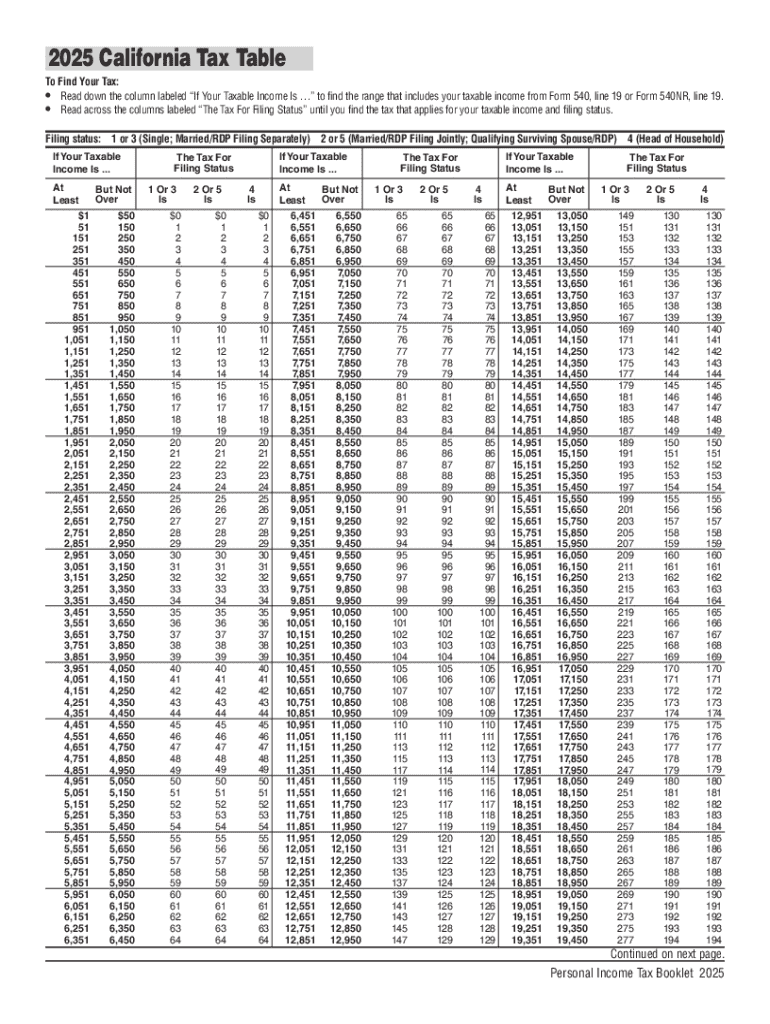

What is the tax table for California?

What form is the tax table?

How do I calculate CA use tax?

What is FTB form 540?

How do I figure out my tax rate?

How do you calculate tax in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA FTB Tax Table?

How can I edit CA FTB Tax Table on a smartphone?

How do I fill out the CA FTB Tax Table form on my smartphone?

What is 2025 ftb 540 booklet?

Who is required to file 2025 ftb 540 booklet?

How to fill out 2025 ftb 540 booklet?

What is the purpose of 2025 ftb 540 booklet?

What information must be reported on 2025 ftb 540 booklet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.