Get the free General Fund checks at TOG - doa guam

Get, Create, Make and Sign general fund checks at

How to edit general fund checks at online

Uncompromising security for your PDF editing and eSignature needs

How to fill out general fund checks at

How to fill out general fund checks at

Who needs general fund checks at?

General fund checks at form: A comprehensive guide

Understanding general fund checks

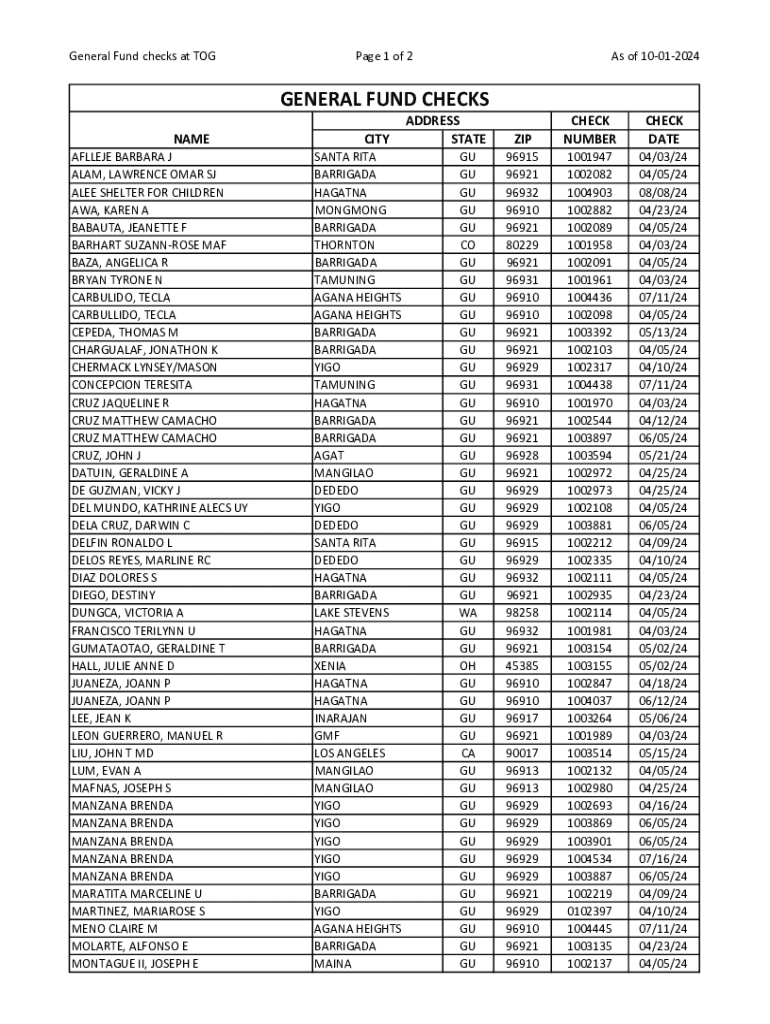

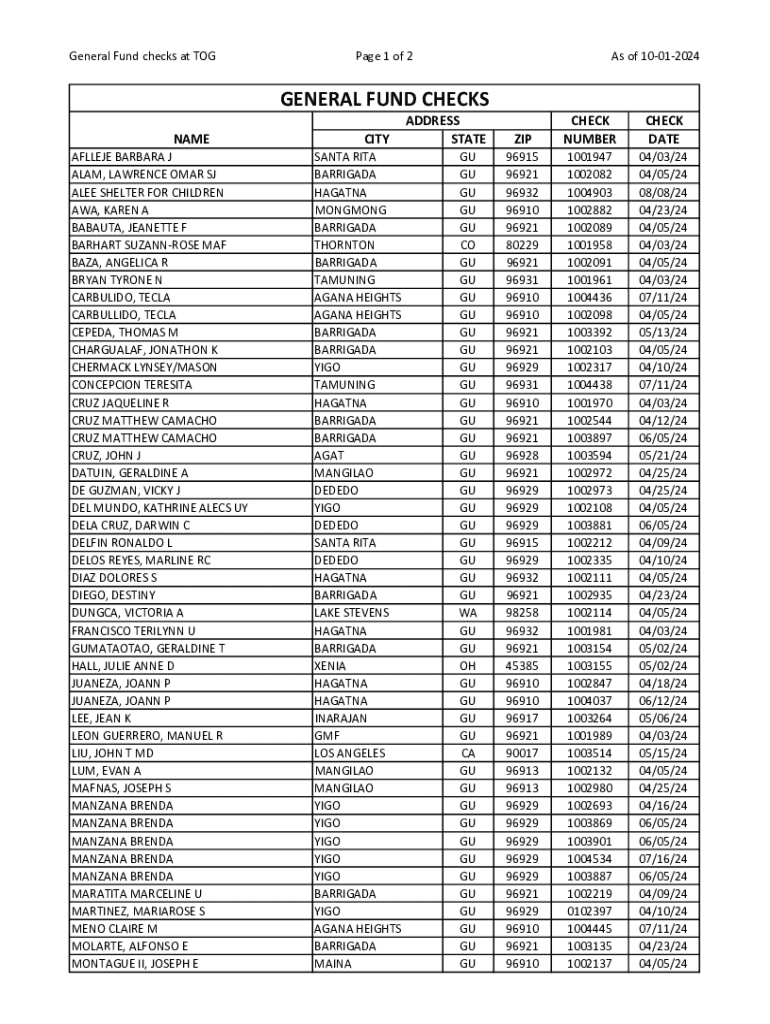

General fund checks are essential tools in the framework of government financial management, designed to facilitate the payment of various operational and capital expenditures. Essentially, a general fund check represents a direct payment made from a government entity's general fund, which is primarily used to support day-to-day operations, programs, and services essential for community functioning. As such, understanding the purpose and significance of these checks is crucial for any individual or team engaged in financial oversight or management.

The general fund plays a pivotal role within governmental accounting, serving as the primary source for funding a wide array of public services including education, public safety, and infrastructure. General fund checks, therefore, are integral to the fiscal services that ensure these programs operate smoothly. They are classified into two primary types of checks: operational checks, which cover regular, recurring expenses such as salaries and utilities, and checks earmarked for capital projects, which might include funding for significant infrastructure investments or improvements.

Essential components of a general fund check

Successfully filling out a general fund check form requires attention to detail, as accuracy is key in ensuring proper payment processing. Each check must contain specific information, such as the details of the payee, which includes the name and address of the recipient. Additionally, it should clearly state the amount to be paid, the date of issuance, and the check number for tracking purposes.

Moreover, the signature is a critical component—this validates the check and confirms that the funds allocated have been authorized for disbursement. The typical layout of a general fund check adheres to standardized format guidelines, ensuring uniformity and clarity across financial documentation. Maintaining consistency in the check's format not only reinforces trust but also aids in the expedient processing of payments.

Filling out the general fund check form

Completing a general fund check form accurately is a straightforward process when approached with a structured method. Here’s how to do it effectively:

Common mistakes include leaving sections incomplete or making errors in amounts and dates. Vigilance during this step not only facilitates a smoother process but also underscores the importance of accuracy in financial documentation.

Editing and modifying general fund checks

Once a general fund check is filled out, circumstances may arise that require modifications. Using pdfFiller, users can easily edit existing checks without starting from scratch. The editing process is straightforward and user-friendly.

Additionally, collaboration features allow teams to work together in creating and refining documents. This is particularly useful when multiple stakeholders are involved in a project's financial management or when approvals from various departments are needed. The ability to collaborate on edits ensures transparency and accountability in financial operations.

Signing and finalizing your general fund check

With the check filled out and edited, the next crucial step is signing. For many organizations, electronic signatures have become the norm, providing a quick and legally binding method to authorize payments. pdfFiller supports various electronic signature solutions, ensuring that users can sign securely and efficiently.

Before the submission of the check, conduct a final review to ensure all elements are accurate. A checklist can be beneficial here, confirming that the payee information, amount, signature, and date are all correct. This preventative measure saves time and potential issues post-issuance.

Managing and storing general fund checks

Effective management of general fund checks extends beyond just issuing them. Utilizing a cloud-based document management solution like pdfFiller offers significant advantages. By storing checks online, users can access them from anywhere, reducing the risk of loss and improving organization.

Organizing and retrieving past checks becomes streamlined with digital storage solutions. Best practices include categorizing checks by date, payee, or purpose, which facilitates tracking and historical analysis of expenditures, essential for fiscal accountability.

Troubleshooting common issues

Common errors encountered when managing general fund checks include wrong amounts, missing signatures, or misfiled documentation. Identifying and addressing these issues quickly is paramount to maintaining an efficient financial workflow.

Quick fixes typically involve reviewing the forms created and using the editing features available in pdfFiller. If a check is incorrect upon reviewing, rectifying the issue can often be done in a matter of clicks, minimizing disruption to your financial operations.

Advanced features of managing general fund checks with pdfFiller

To truly enhance the management of general fund checks, integrating with other financial management tools can be beneficial. Utilizing pdfFiller's capabilities allows users to sync data with accounting software, automating much of the financial tracking process and improving overall efficiency.

Additionally, pdfFiller enables users to access reporting and analytics tools, allowing for a detailed overview of expenses related to general fund checks. This feature aids in tracking spending patterns, making it easier to generate financial reports and provide insights into fiscal health, thus enhancing informed decision-making.

Key insights on compliance and regulations

Navigating compliance and regulatory requirements surrounding general fund checks is critical for any financial manager. Understanding the relevant legislation ensures that all checks issued are in accordance with local, state, and federal laws governing public funds.

Accurate record-keeping becomes paramount, not just for compliance but also for internal accountability. Establishing regular audits of general fund checks helps maintain transparency in financial operations and assures stakeholders that all expenditures are accounted for responsibly.

Frequently asked questions about general fund checks

Addressing common queries related to general fund checks can assist users in effectively managing their financial responsibilities. Here are a few key questions that often arise:

Resources for further learning

To deepen your understanding of general fund checks and related forms, exploring additional guides available on pdfFiller's site can be invaluable. Whether you're seeking to master document management or looking for specific instructions tailored to your unique financial needs, leveraging these resources enhances your ability to navigate the complexities of financial management effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit general fund checks at in Chrome?

How do I fill out the general fund checks at form on my smartphone?

Can I edit general fund checks at on an iOS device?

What is general fund checks at?

Who is required to file general fund checks at?

How to fill out general fund checks at?

What is the purpose of general fund checks at?

What information must be reported on general fund checks at?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.