Get the free 2024 form mo mo-1065 fill online, printable, fillable, blank ... - dor mo

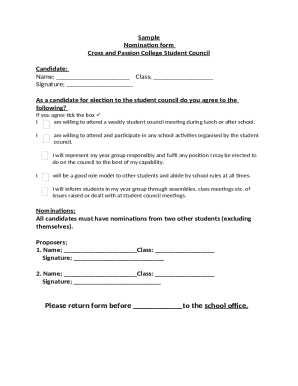

Get, Create, Make and Sign 2024 form mo mo-1065

How to edit 2024 form mo mo-1065 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form mo mo-1065

How to fill out 2024 form mo mo-1065

Who needs 2024 form mo mo-1065?

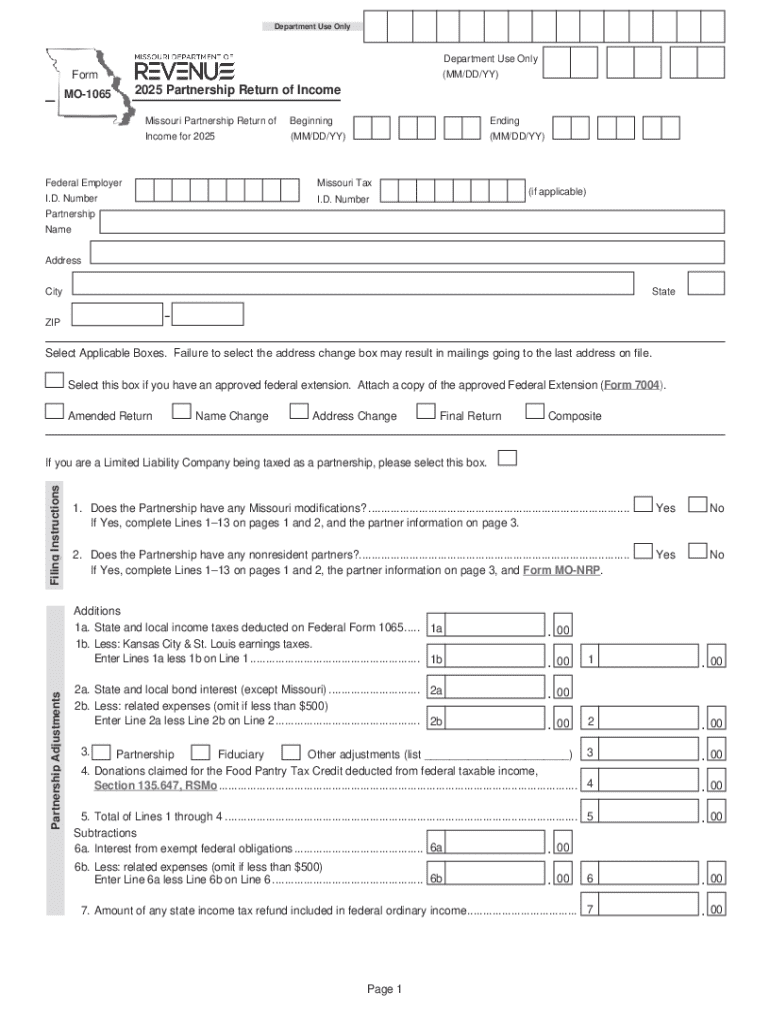

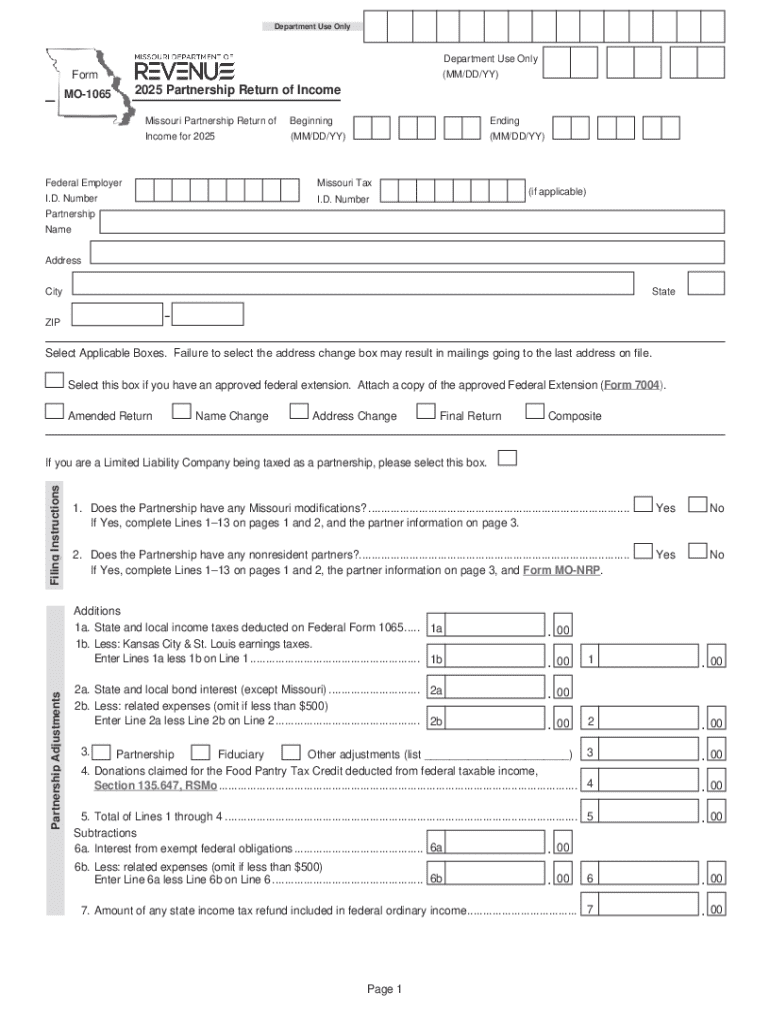

Understanding the 2024 Form MO MO-1065 Form: A Comprehensive Guide

Overview of the 2024 Form MO MO-1065

The 2024 Form MO MO-1065 is a critical document required for partnership entities operating in Missouri. This form facilitates the reporting of income, deductions, credits, and other pertinent tax information inherent to partnerships. By consolidating financial details, the MO MO-1065 serves not just to comply with state tax obligations, but also to guide partners in understanding their individual tax responsibilities.

Partnerships—including limited liability companies (LLCs) treated as partnerships—must file this form annually. Understanding whether you need to use the 2024 MO MO-1065 is essential for maintaining compliance and avoiding penalties. As tax laws evolve, staying informed about updates becomes imperative.

Key Changes in the 2024 Version

The MO MO-1065 has undergone crucial amendments in 2024. New provisions introduced streamline the process of reporting income and deductions and clarify the guidelines for certain credits. These updates are designed to simplify the filing process, enhance accuracy, and reduce the risk of errors for filers.

Key changes also include enhanced instructions that address common filing pitfalls, offering clearer guidance on how to report various income types and deductible expenses, which ultimately impacts partners' tax calculations.

Accessing the 2024 Form MO MO-1065

Accessing the 2024 Form MO MO-1065 is straightforward. The form is available on the official Missouri Department of Revenue website, which is the primary source for all state tax forms. Users can also find downloadable versions of the form online through various platforms, including pdfFiller.

Features of the pdfFiller Platform

pdfFiller enhances your experience with the MO MO-1065 form by offering a comprehensive document management solution. The platform enables users to edit, sign, and store documents securely in the cloud. With its user-friendly interface, team collaboration features, and advanced editing tools, pdfFiller is an outstanding choice for managing tax forms.

Step-by-Step Instructions for Completing the 2024 Form MO MO-1065

Completing the 2024 Form MO MO-1065 may seem daunting, but following a structured approach can ease the burden. This section outlines a section-by-section breakdown to help you navigate the form efficiently.

Personal Information Section

Start by entering your partnership’s name, federal identification number, and address in the Personal Information section. Accuracy is essential to avoid issues with the IRS and state authorities. Ensure that all names are spelled correctly and that the ID matches your internal records.

Common mistakes often include typos in the EIN or incorrect formatting of the partnership address. Such errors can lead to processing delays or potential audits, so double-check this section before moving on.

Income and Deductions Section

In the Income and Deductions section, detailed data regarding your partnership’s revenue and expenses should be reported. This section should include all sources of income—operating income, interest, and other applicable income streams. For deductions, it suggests documenting all operational costs including wages, rent, and utilities.

The challenge lies in ensuring that all data entered reflects accurate financial activity. Misreporting income or overstating deductions can consequently trigger audits.

Credits and Payments Section

This section identifies applicable tax credits your partnership may qualify for. Credits can significantly lower your tax liability, making it imperative to capture them correctly. Ensure to input any estimated taxes already paid to prevent double payments or discrepancies.

Tax credits can dramatically affect your financial outcomes, so exercising caution in this section is crucial.

Tips for Accurate Completion

Adopting best practices greatly enhances the accuracy of your form submission. Start by compiling all necessary documentation before you begin filling out the form. This preparation reduces the likelihood of errors and provides a seamless filling experience.

Editing and customizing the form

Customizing the 2024 Form MO MO-1065 using pdfFiller allows you to tailor the document to your specific needs. After accessing the platform, uploading your form is a straightforward process.

Utilizing pdfFiller's range of editing tools—such as text insertion, formatting options, and signature fields—allows users to personalize documents fully while maintaining compliance with state regulations. With pdfFiller, you can also easily add dates and electronic signatures, making it versatile for any business requirement.

Adding signatures and dates

pdfFiller provides advanced eSignature features, which allow users to sign the document electronically. This is compliant with eSignature laws, ensuring that your submitted documents are legally binding and secure. The process only takes a few clicks, making it convenient to include necessary signatures without the hassle of printing and scanning.

Collaborating on the 2024 Form MO MO-1065

Working as a team to fill out the 2024 Form MO MO-1065 enhances accuracy and accountability. pdfFiller offers collaboration features that allow you to invite team members for a review, enabling seamless teamwork.

Harnessing collaborative tools ensures all necessary stakeholders can provide input while minimizing the potential for discrepancies.

Managing feedback and track changes

With pdfFiller, you can view the comment history and track changes made to the document easily. This feature helps you implement suggestions efficiently and maintain a clear record of who contributed to which information.

Submitting the 2024 Form MO MO-1065

Once you've completed and reviewed the form, the next step is submission. For the 2024 Form MO MO-1065, multiple submission methods are available, allowing flexibility according to your preference.

Staying aware of crucial filing deadlines is integral to filing your tax documents. The 2024 deadline aligns with the annual tax filing period, with additional penalties applicable for late submissions.

Deadlines and important dates

For the 2024 filing season, ensure you file Form MO MO-1065 by the due date to avoid unnecessary penalties. Typically, the deadline for filing is April 15, but it's critical to verify the specific dates as they may vary.

Troubleshooting common issues

Filing tax forms can be complex, leading to potential errors in submissions. Common error messages may include mismatched taxpayer identification numbers or incorrectly completed fields. If you encounter issues, refer to the instructions in the 2024 Form MO MO-1065 carefully.

FAQs regarding the 2024 Form MO MO-1065

Frequently asked questions can shed light on common concerns from users. Questions around filing status, eligibility for credits, and updates in the form are prevalent. Engage with tax professionals or the Department of Revenue's resources for clarity on these matters.

Understanding the impact of the 2024 Form MO MO-1065 on your taxes

The insights gained from completing the 2024 Form MO MO-1065 are crucial for assessing your overall tax liability. This form directly affects your taxable income and resultant tax obligations, influencing future financial planning and decision-making.

Effective tax strategy incorporates an understanding of how Form MO MO-1065 fits into the broader financial narrative of the partnership.

Exploring additional tools and resources on pdfFiller

Beyond the MO MO-1065 form, pdfFiller offers a range of relevant forms and templates to cater to various legal and financial needs. Users can access quickly related documents to ensure they have all the necessary tools for comprehensive tax management.

These resources enhance the broader context of financial administration, making pdfFiller a one-stop-shop for document needs.

User testimonials and success stories

Real-life experiences from individuals and teams underscore the efficiency of using pdfFiller for the MO MO-1065 process. Users frequently report a smoother experience when managing complex documents online, highlighting how the platform has transformed their filing efforts.

Such endorsements indicate widespread satisfaction, positioning pdfFiller as a leader in document management solutions.

Engaging with pdfFiller for more information

For users seeking clarification or further assistance, pdfFiller provides easy access to contact details for support. Additionally, the platform offers interactive tools and resources, including demos and webinars on harnessing the platform effectively to manage forms like the MO MO-1065.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2024 form mo mo-1065 online?

How do I make edits in 2024 form mo mo-1065 without leaving Chrome?

Can I create an eSignature for the 2024 form mo mo-1065 in Gmail?

What is 2024 form mo mo-1065?

Who is required to file 2024 form mo mo-1065?

How to fill out 2024 form mo mo-1065?

What is the purpose of 2024 form mo mo-1065?

What information must be reported on 2024 form mo mo-1065?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.