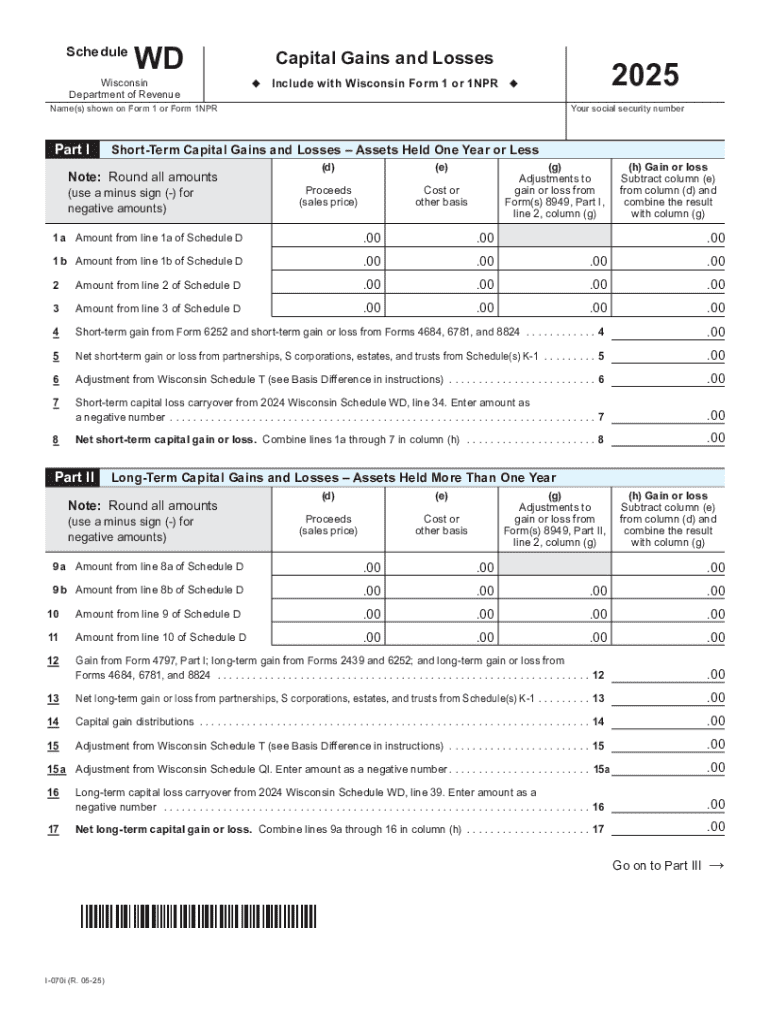

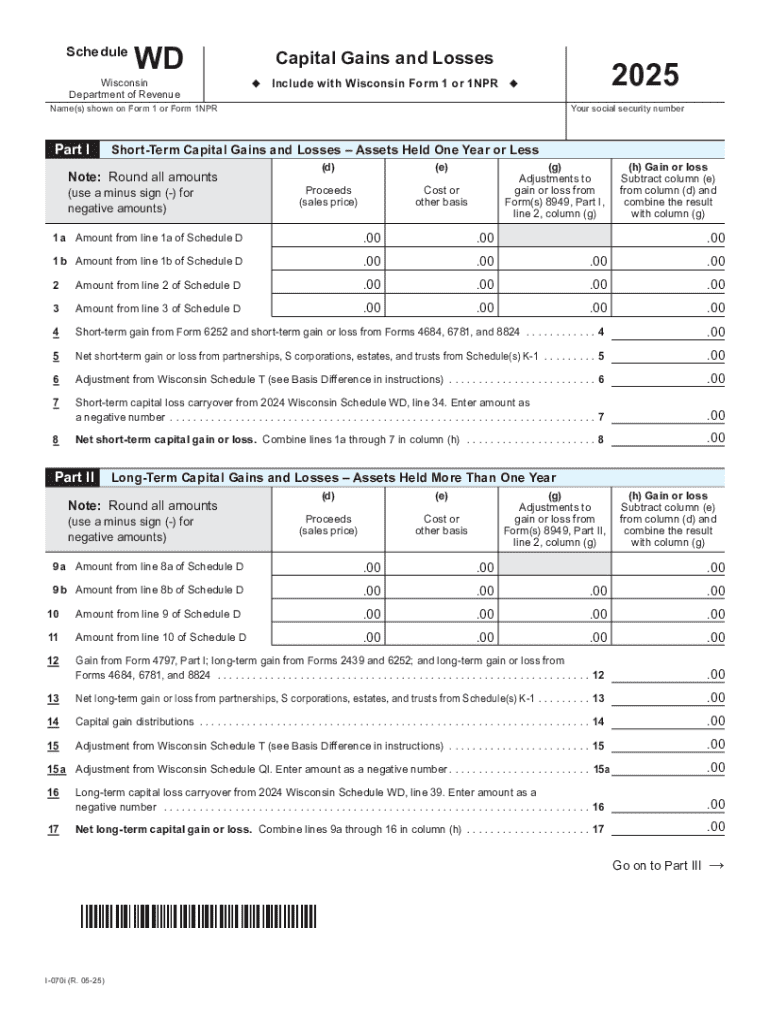

Get the free 2025 I-070 Wisconsin Schedule WD, Capital Gains and Losses (fillable). Wisconsin Sch...

Get, Create, Make and Sign 2025 i-070 wisconsin schedule

Editing 2025 i-070 wisconsin schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 i-070 wisconsin schedule

How to fill out 2025 i-070 wisconsin schedule

Who needs 2025 i-070 wisconsin schedule?

Complete Guide to the 2025 -070 Wisconsin Schedule Form

Overview of the 2025 -070 Wisconsin Schedule Form

The 2025 i-070 Wisconsin Schedule Form serves as a crucial document for residents of Wisconsin who are filing their state income taxes. This form is designed to determine the total taxable income and provide a breakdown of any deductions and credits applicable, ensuring that taxpayers report their financial situations accurately.

Individuals and entities who earn income within Wisconsin or who are residents of the state must complete the i-070 form. More specifically, this includes wage earners, retirees, and anyone else whose income is subject to state taxes. Understanding and filling out the form correctly is essential to avoid penalties or missing out on valuable tax benefits.

Detailed Breakdown of the -070 Wisconsin Schedule Form

Understanding each section of the form

The i-070 form is divided into several key sections, each addressing different aspects of the filing process. Accuracy is paramount throughout, as errors can lead to complications with tax liability or even audits.

Identifying Information

In this section, you will be required to provide personal details such as your name, Social Security number, and address. Ensuring these details are correct is vital, as discrepancies can create problems with your tax record.

Income Reporting

This section covers all types of income, including wages, dividends, and self-employment earnings. You'll need documentation such as W-2 forms or 1099 statements to report your earnings accurately.

Deductions and Credits

Wisconsin residents can take advantage of various deductions and credits, which can significantly reduce taxable income. Be sure to review all available options, such as standard deductions or credits for education expenses.

Calculating your tax liability

Calculating your tax liability can seem daunting, but it can be broken down into systematic steps. Start with your total income, subtract any deductions, and apply the relevant tax rates. Here’s a simplified example:

Interactive tools for completing the -070 form

PDF editing features on pdfFiller

With pdfFiller, editing the i-070 form becomes a breeze. Utilize their intuitive tools that allow you to fill in your details seamlessly, using crafted templates that maintain compliance with state requirements.

eSigning and collaboration features

One of the standout features of pdfFiller is its ability to facilitate digital signatures. You can sign the i-070 form electronically, which saves time and enhances convenience, especially when coordinating with multiple parties for document inspections or submissions.

Tips for a smooth filing process

Common mistakes to avoid

Even minor errors can lead to significant delays or financial penalties. To streamline your filing experience, consider avoiding these common pitfalls:

Best practices for document management

Keeping a well-organized filing system not only aids in the current tax year but also prepares you for future filings. Here’s how you can manage your documents effectively:

FAQs on the 2025 -070 Wisconsin Schedule Form

What if make changes after submitting the form?

If you need to make changes after submission, it’s important to file an amendment. Instructions for amending your tax return are included on the Wisconsin Department of Revenue website. Be sure to include explanations for the changes made.

How to handle errors on the form?

Mistakes happen. If you realize you've made an error, take action as soon as possible. Depending on the nature of the error, you may need to file an amendment or simply correct the figures if the errors are minimal.

Resources for additional help

Utilizing resources can help clarify the intricacies of filing. Check out Wisconsin's Department of Revenue website or consider consulting a tax professional for personalized advice.

The benefits of using pdfFiller for your 2025 -070 form

Anytime, anywhere access to your forms

One of the most significant advantages of pdfFiller is its cloud-based platform. This means you can access your i-070 form from anywhere, on any device, making tax time more manageable, whether you’re at home or traveling.

Enhanced security features

Security is a top priority when it comes to sensitive tax information. pdfFiller employs robust cybersecurity measures, ensuring that your personal data remains protected. Understanding data compliance and security protocols is essential in today’s digital age.

Next steps after form submission

Monitoring your refund status

After submission, tracking the progress of your refund can provide peace of mind. Wisconsin’s Department of Revenue allows taxpayers to check the status of their refunds online, ensuring you’re always in the know.

Preparing for future tax years

Keeping thorough records can ease the filing process for future tax years. Organize financial documents consistently and utilize templates available through pdfFiller to streamline future submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2025 i-070 wisconsin schedule online?

How do I edit 2025 i-070 wisconsin schedule on an iOS device?

How do I complete 2025 i-070 wisconsin schedule on an Android device?

What is 2025 i-070 wisconsin schedule?

Who is required to file 2025 i-070 wisconsin schedule?

How to fill out 2025 i-070 wisconsin schedule?

What is the purpose of 2025 i-070 wisconsin schedule?

What information must be reported on 2025 i-070 wisconsin schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.