Get the free DOR 2025 Corporation Tax Forms

Get, Create, Make and Sign dor 2025 corporation tax

How to edit dor 2025 corporation tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dor 2025 corporation tax

How to fill out dor 2025 corporation tax

Who needs dor 2025 corporation tax?

Comprehensive Guide to DOR 2025 Corporation Tax Form

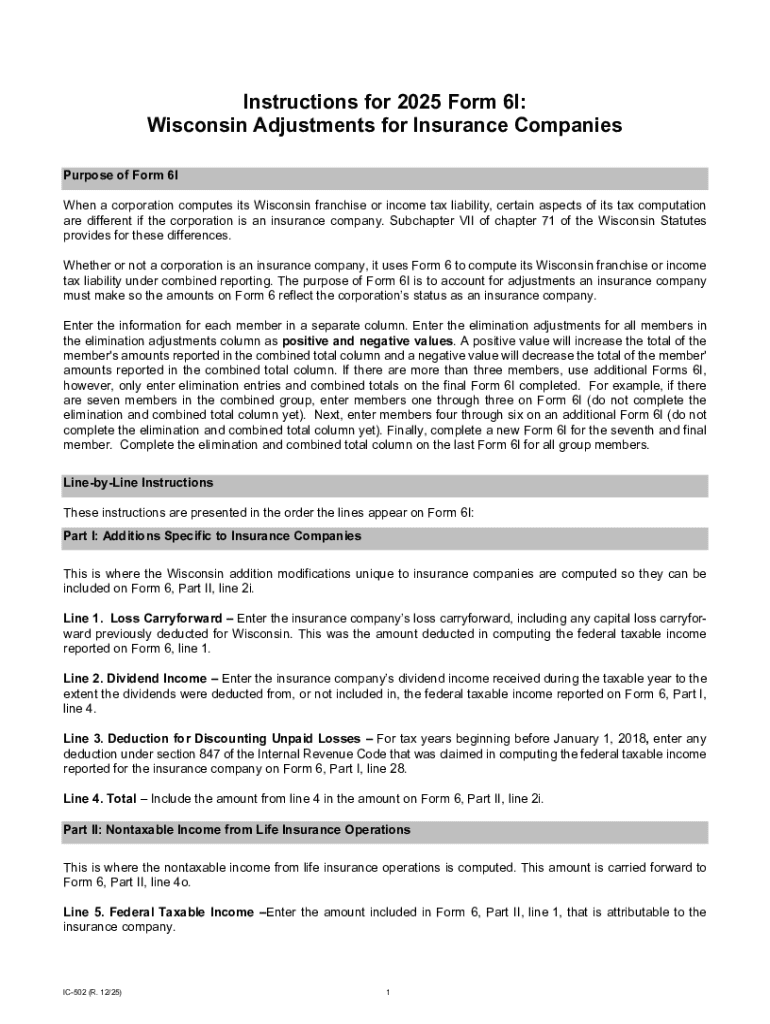

Understanding the DOR 2025 Corporation Tax Form

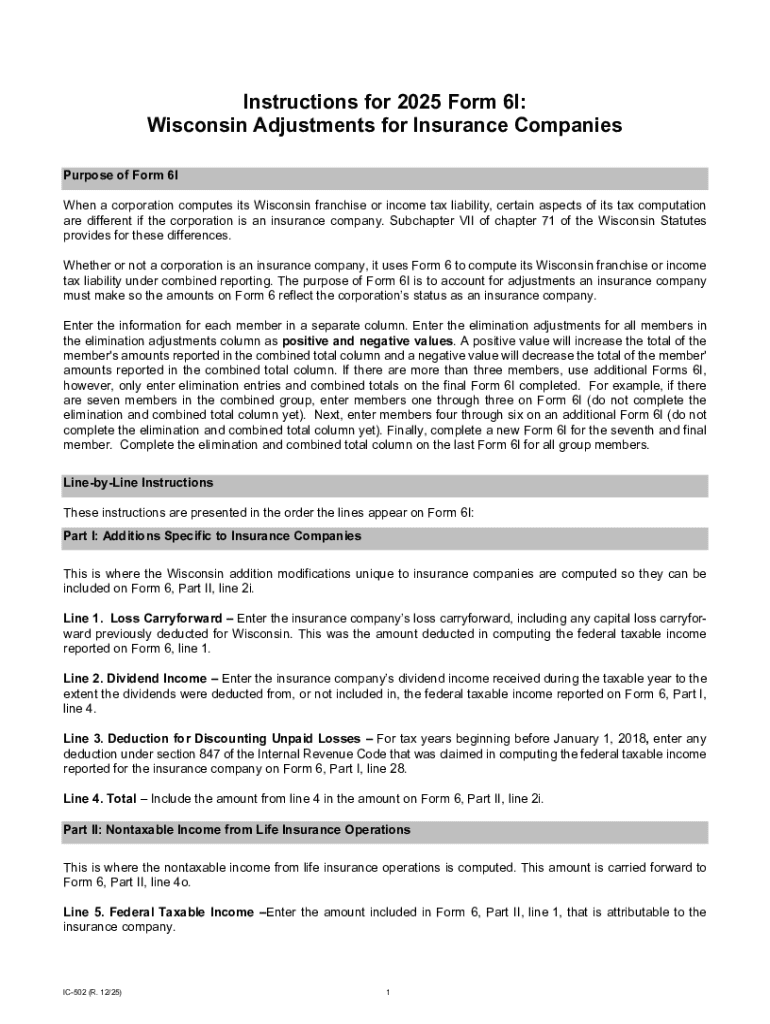

The DOR 2025 Corporation Tax Form is a crucial document that corporations must complete to report their income and liability to the state Department of Revenue (DOR). This form captures a corporation's financial activities, from revenues generated to expenses incurred, and ultimately determines the tax owed. Proper completion of this form is essential not only for compliance with state tax laws but also for avoiding penalties and ensuring that businesses fulfill their obligations.

For the 2025 tax year, there are significant updates, particularly related to deductions and credits, that taxpayers should be aware of. Keeping abreast of these changes can result in notable tax saving opportunities. Thus, understanding the DOR 2025 Corporation Tax Form is fundamental for any corporation wishing to maintain financial health and compliance.

Who needs to file the DOR 2025 Corporation Tax Form?

Various types of entities are required to file the DOR 2025 Corporation Tax Form, primarily focusing on corporations. The main types include:

Additionally, corporations with specific income thresholds and those not qualifying for exemptions need to file this tax form in compliance with the state's taxation laws.

Key sections of the DOR 2025 Corporation Tax Form

The DOR 2025 Corporation Tax Form contains various essential sections that guide users in reporting their financial data accurately. A comprehensive look at its major fields includes:

Users can benefit from interactive tools that clarify these sections and dispel any common misconceptions regarding them. Understanding these elements is vital to minimizing errors and maximizing potential refunds.

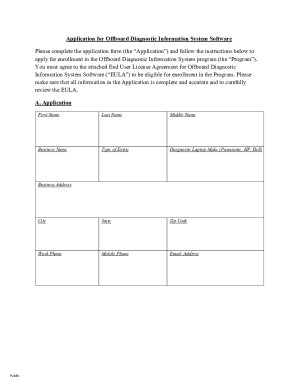

Step-by-step instructions for completing the form

Completing the DOR 2025 Corporation Tax Form can seem daunting, but a structured approach makes it manageable. Follow these detailed steps:

By adhering to these steps diligently, corporations can facilitate the completion process while ensuring accuracy.

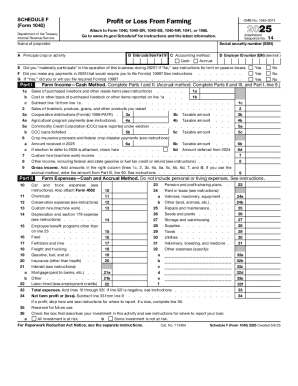

Filing options and deadlines for the DOR 2025 Corporation Tax Form

Filing the DOR 2025 Corporation Tax Form can be done through various methods, each with its own considerations. Corporations have the option to e-file or submit a paper form, with e-filing often being the preferred choice due to its efficiency and quick processing times. Key deadlines to remember include:

Understanding these filing options and adhering to deadlines is crucial for maintaining compliance and avoiding unnecessary penalties.

Managing your DOR 2025 Corporation Tax Form post-filing

Once the DOR 2025 Corporation Tax Form is submitted, the focus should shift to maintaining excellent record keeping. It’s essential to retain copies of filed forms and all related documentation for at least three years in case of audits. Responding promptly to any follow-up inquiries from the tax authorities can also prevent complications down the road.

Utilizing tools like pdfFiller can enhance your document management capabilities, allowing for easy storage, access, and organization of your tax documents online. This not only simplifies retrieval but also ensures that your critical documents are safe and accessible whenever you need them.

Frequently asked questions about the DOR 2025 Corporation Tax Form

Many corporations have queries regarding the DOR 2025 Corporation Tax Form. Some common inquiries include issues related to filing status, due dates, and allowable deductions. For troubleshooting, consider reaching out to tax professionals or utilize online resources to navigate various challenges.

This section aims to clarify uncertainties and offer guiding resources for ongoing education about corporation tax responsibilities.

Conclusion and encouragement for users

Proper filing of the DOR 2025 Corporation Tax Form plays a pivotal role in safeguarding your business's financial stability. By adhering to regulations and understanding allowable deductions, you can optimize your tax liability wisely. Utilize tools like pdfFiller to streamline document management and filing processes, reducing stress and enhancing organizational efficiency.

As you navigate the complexities of corporate tax filing in 2025, remember that comprehensive knowledge and preparing ahead are your allies. Embrace available resources and tools to empower your corporation and ensure a successful filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get dor 2025 corporation tax?

How do I complete dor 2025 corporation tax online?

How do I fill out dor 2025 corporation tax on an Android device?

What is dor 2025 corporation tax?

Who is required to file dor 2025 corporation tax?

How to fill out dor 2025 corporation tax?

What is the purpose of dor 2025 corporation tax?

What information must be reported on dor 2025 corporation tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.