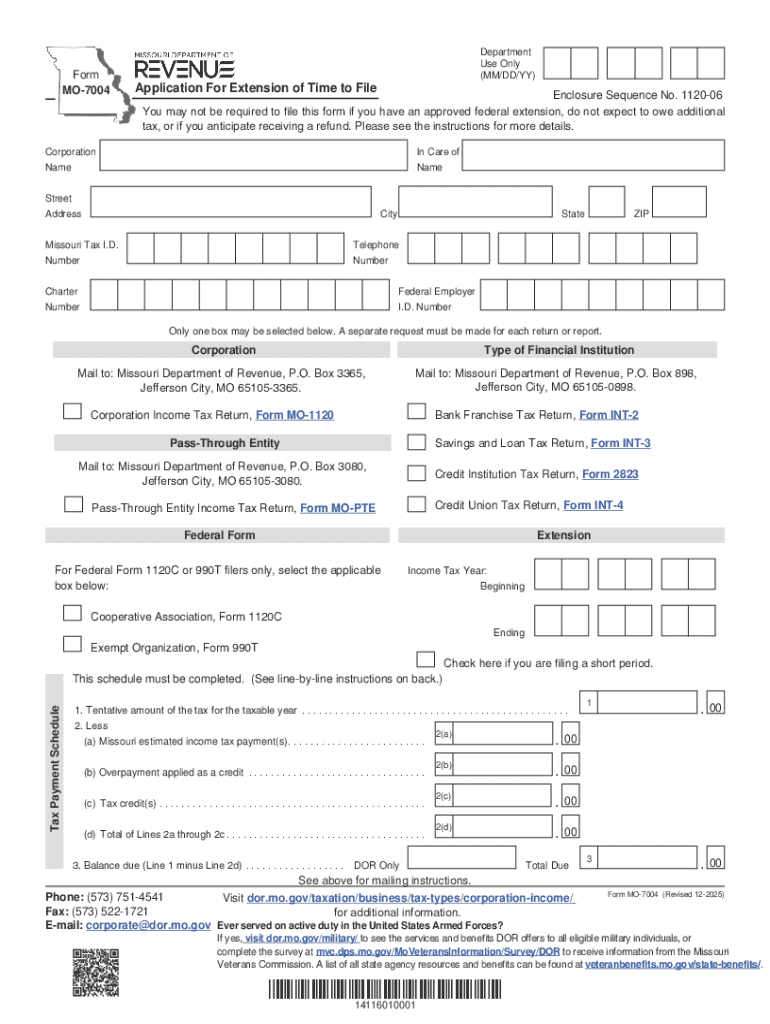

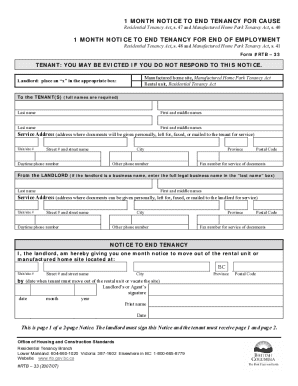

Get the free Form 7004 Entity Extension Errors - dor mo

Get, Create, Make and Sign form 7004 entity extension

Editing form 7004 entity extension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 7004 entity extension

How to fill out form 7004 entity extension

Who needs form 7004 entity extension?

Form 7004 Entity Extension Form: A Comprehensive How-to Guide

Overview of IRS Form 7004

IRS Form 7004 is a crucial document that allows eligible entities to apply for an automatic extension of time to file their income tax returns. This form is specifically designed for corporations, partnerships, and multi-member LLCs, offering a vital lifeline when extra time is necessary to prepare their tax filings. With tax deadlines looming, many entities find themselves overwhelmed by the amount of information and documentation required for accurate submissions. Form 7004 grants this extension, helping to alleviate stress while ensuring compliance with IRS regulations.

Filing for an extension is not merely a convenience; it serves as a necessary step in mitigating potential penalties for late submissions. By utilizing Form 7004, entities can prepare more thoroughly, ensuring their tax returns reflect accurate business income tax and compliance requirements.

Understanding the need for a filing extension

Filing extensions are invaluable in several scenarios. One primary reason for applying for an extension through Form 7004 is the additional time to prepare accurate and thorough tax filings. Businesses operate in dynamic environments, and sometimes documentation isn’t finalized by the original deadline, resulting in the need for extra time to compile financial data.

Avoiding penalties and interest is another compelling reason to file for an extension. Late filing can incur severe financial repercussions for businesses, negatively impacting cash flow and ultimately hurting their bottom line. By extending the filing date, entities can sidestep excessive fees while maintaining compliance with IRS regulations, which is crucial for their ongoing operations.

Failure to file the appropriate forms, such as Form 7004, can lead to significant consequences. Not only does this include possible late fees, but it can also set off an audit by the IRS, causing more stress and complications for a business owner or entity.

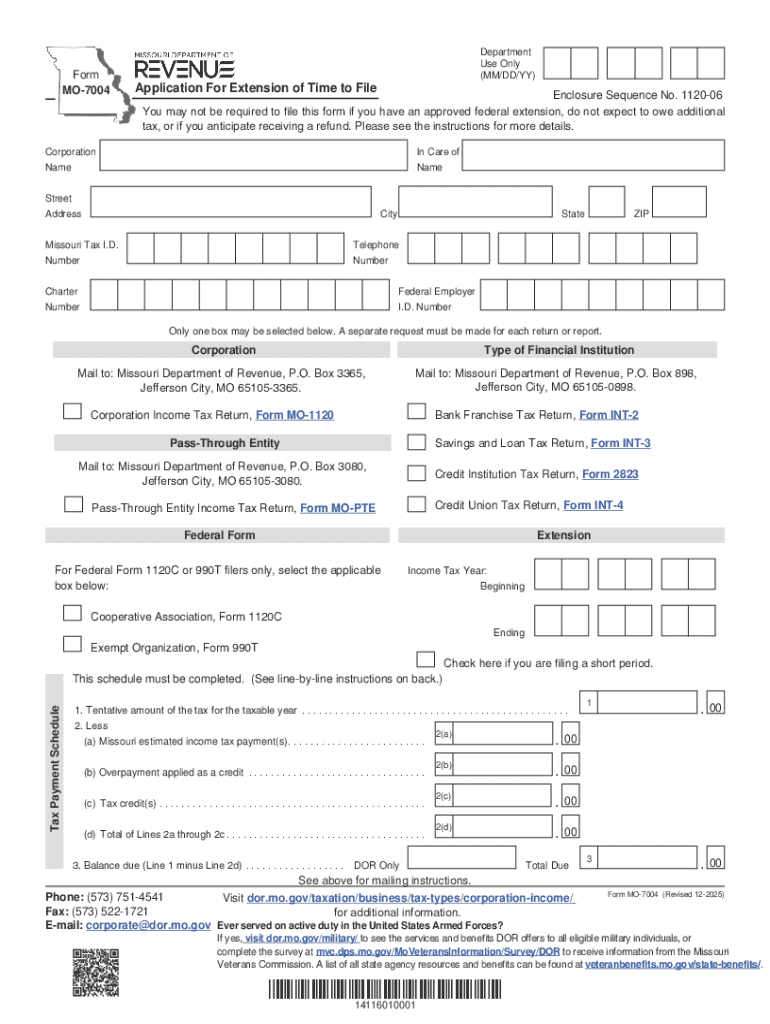

Preparing to fill out Form 7004

Before diving into filling out Form 7004, it's essential to gather and organize the necessary information. This includes critical identifying details about the entity, such as the name, address, and Employer Identification Number (EIN). Additionally, understanding the tax year and confirming the type of entity seeking an extension is vital for accurate submission.

Reviewing all relevant financial documents is a step that cannot be overlooked. Having your business income tax records, profit and loss statements, and balance sheets readily available ensures a smoother completion process. Properly organizing these documents will save time and prevent errors that could delay the filing process.

Utilizing recommended tools, such as pdfFiller, can help manage your document workflow, providing an easy avenue for editing and reviewing essential tax forms, including Form 7004.

Step-by-step instructions for completing Form 7004

Once your documents are in order, you can start filling out Form 7004. The form comprises two main parts: Part I for identification of the entity and Part II for the application for extension. In Part I, you’ll specify your entity's name, address, and EIN, ensuring all entries are accurate. This section provides the IRS with essential information to process your request.

In Part II, you will formally request your extension, specifying the tax year to which the extension applies. Be mindful of the details supplied here, as they influence the final decision made by the IRS regarding your request.

Common mistakes can be easily avoided if you take the time to double-check your entries. Misstating the EIN or failing to select the correct tax year can result in processing delays. Take advantage of resources and templates, like those available on pdfFiller, to simplify this process.

How to file Form 7004

After completing Form 7004, the next step involves submission. There are two primary filing options: e-filing and paper filing. E-filing is highly recommended due to its speed and ease of tracking the submission status. However, if preferred, you can print, sign, and mail your completed form to the designated address provided by the IRS, which can be found in the instructions section of the form.

Be mindful of the submission deadline, which typically aligns with the original due date of the tax return. For instance, corporations that initially must file by March 15 would need to submit Form 7004 by this date to get an extension. Additionally, if estimated taxes are owed, those payments must also be remitted by the deadline to avoid penalties.

You can expect confirmation of your filing whether you e-file or mail your form. Tracking the status online or receiving acknowledgment from the IRS provides peace of mind as you navigate through tax season.

Duration and limitations of an extension

Filing Form 7004 secures a six-month extension for most entities, allowing until September 15 for C Corporations, and until September 15 for S Corporations. However, this extension applies only to the filing date - any tax payments due must still be submitted by the original deadline to avoid interest and late fees.

Once the six-month extension expires, businesses must submit their tax returns or face potential penalties. Moreover, the extension does not postpone the due date for any estimated taxes owed, making it vital for entities to plan their cash flow appropriately. This could impact subsequent tax filings and projections moving forward.

FAQs about Form 7004

Understanding the nuances of Form 7004 is paramount for effective tax management. This brings us to frequently asked questions that can help clarify its usage. One common query is about the types of extensions that Form 7004 applies to - specifically, it is designed for income tax returns, which covers federal and most state requirements for eligible entities.

Another question often raised relates to the ability to file Form 7004 if taxes are owed. The answer is yes; applying for an extension is still permissible even if payment is due, but it's important to pay any owed taxes by the original deadline to prevent incurring further penalties. For those needing an extension for different tax forms, another specific form must be utilized; Form 7004 is solely for business income tax returns.

Withdrawing an extension request is also a consideration for some entities; however, it is important to notify the IRS accordingly to clarify your filing intentions.

Navigating common challenges

Filing Form 7004 is not always a straightforward process; complications may arise that can hinder timely submission. For instance, issues relating to documentation or uncertainties surrounding entity classification can cause confusion. Proper preparation is critical in overcoming these challenges. Utilize support and resources from tax professionals or reliable platforms like pdfFiller for assistance to streamline the process.

Additionally, it is vital to be prepared to handle IRS correspondence should any inquiries arise. An evidence-based approach with organized records and documentation will facilitate rapid resolutions. In scenarios where complexities surpass your expertise, it’s prudent to seek professional assistance. Consulting a tax professional will ensure compliance and safeguard against potential issues.

Comparisons with other extension forms

Understanding how Form 7004 compares with other IRS forms is essential for making informed decisions. Unlike individual forms, which use different processes for filing extensions, Form 7004 caters specifically to certain business types, hence presenting unique requirements. For instance, individual taxpayers utilizing Form 4868 have a different workflow and requirements that do not overlap with those for businesses.

When determining which form to use, consider the specific needs of your entity. If you’re filing as a business or a pass-through entity, Form 7004 is where you should be directing your efforts. On the other hand, individuals needing added time for their personal tax returns will use Form 4868 to apply for their extensions.

Leverage pdfFiller for your Form 7004 needs

For those seeking a seamless solution to filling out Form 7004, pdfFiller emerges as a powerful ally. This cloud-based platform offers users the ability to edit documents effortlessly, from fillable PDF forms to fully customized templates. Users appreciate the convenience of managing various tax forms, particularly Form 7004, in a collaborative digital space, making the often tedious process of tax filings more manageable.

One standout feature is the eSignature capability, allowing for expedient approvals from partners and stakeholders with minimal hassle. This, coupled with easy document customization, has made pdfFiller a preferred choice among many users and businesses alike.

Testimonials and user experiences reveal a high satisfaction rate among those who utilize pdfFiller for their IRS form needs, particularly when it comes to the potential complications surrounding Form 7004.

Recent articles and updates related to IRS Form 7004

The landscape of tax regulations continues to evolve, affecting how entities navigate their obligations. Recent updates to Form 7004 and changes in laws can significantly impact businesses, detailing the ability to secure appropriate extensions. Staying informed through recent articles not only assists in understanding these regulations but serves as a guide for best practices.

Case studies showcasing successful filing extensions indicate the benefits of utilizing Form 7004 proficiently. These demonstrate how businesses that achieve compliance through proper extensions bolster their operational efficiency and financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 7004 entity extension without leaving Google Drive?

How can I edit form 7004 entity extension on a smartphone?

How do I fill out the form 7004 entity extension form on my smartphone?

What is form 7004 entity extension?

Who is required to file form 7004 entity extension?

How to fill out form 7004 entity extension?

What is the purpose of form 7004 entity extension?

What information must be reported on form 7004 entity extension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.