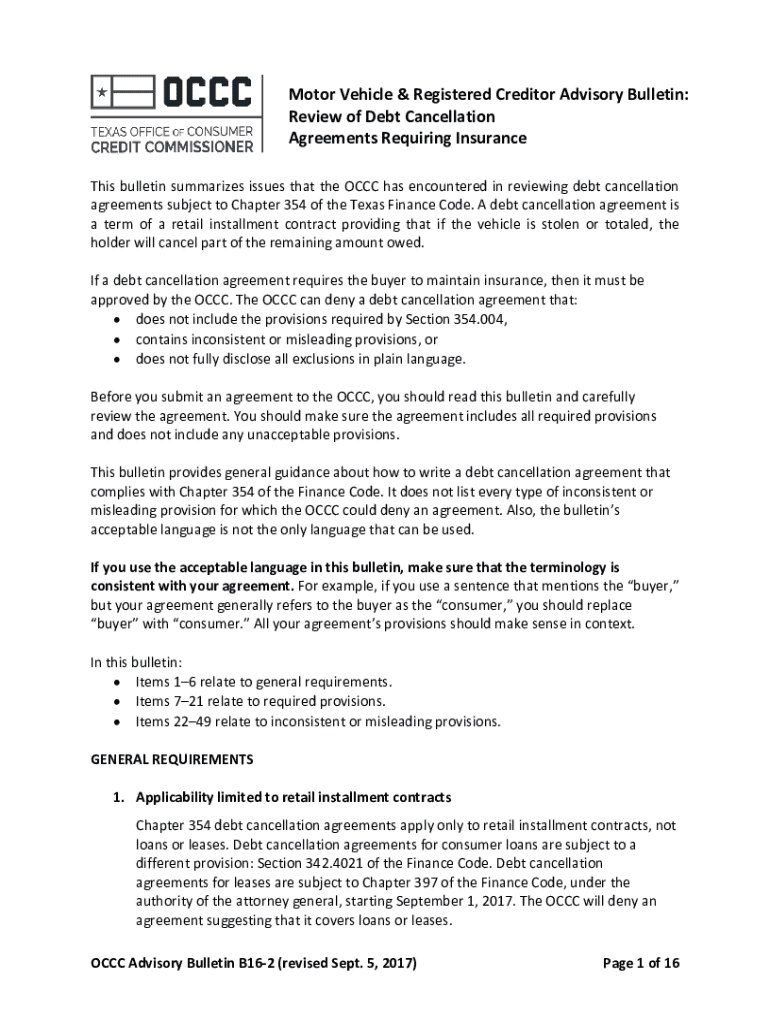

Get the free Review of Debt Cancellation Agreements Requiring Insurance

Get, Create, Make and Sign review of debt cancellation

Editing review of debt cancellation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out review of debt cancellation

How to fill out review of debt cancellation

Who needs review of debt cancellation?

Review of Debt Cancellation Form

Understanding debt cancellation

Debt cancellation refers to the process where a creditor releases a borrower from the obligation to repay a debt. This can carry significant implications, providing relief for individuals facing financial difficulties and fostering a fresh financial start. Common reasons for debt cancellation include insolvency, financial hardship, and negotiated settlements between creditors and debtors.

Various types of debt are subject to cancellation, including student loans, credit card debt, and mortgages. Each category may be governed by specific laws and regulations that dictate the criteria for qualifying for debt cancellation. Understanding these distinctions helps consumers navigate their financial options effectively.

The debt cancellation form: An overview

The primary purpose of the debt cancellation form is to formally initiate the request for the cancellation of debt. For consumers, this is an essential tool for securing financial relief, while for businesses, it offers a mechanism to manage accounts receivable and mitigate losses. Completing this form correctly is vital for the efficient processing of applications.

Key components of the debt cancellation form typically include fields for personal identification, details regarding the debt being canceled, and declarations confirming the application’s accuracy. Various types of forms may exist, depending on the debt type, such as retail installment contracts or insurance-related debts.

Getting started with the debt cancellation form

To access the debt cancellation form, online portals for financial institutions or regulatory agencies are often the best starting points. These forms can usually be filled out electronically, making them compatible with PDF editors and online tools like pdfFiller. This platform enhances the filing experience, allowing users to edit, sign, and submit the form seamlessly.

Before filling out the form, it's crucial to gather necessary documents, including account statements, identification, and proof of financial hardship. Understanding the terms and conditions associated with the cancellation ensures that you approach the process with clarity about your obligations and rights.

Completing the debt cancellation form

Completing the debt cancellation form requires attention to detail. The personal information section must include your full name, contact details, and any pertinent account numbers. Missing or incorrect data can lead to processing delays or outright rejection of your application.

Next, detail the specific debts you intend to cancel. This should encompass the type of debt, such as a vehicle loan or credit card, alongside the respective amounts owed and the dates relevant to the debt transactions. Lastly, the acknowledgments and signatures section must be completed, highlighting the importance of confirming the accuracy of the information and facilitating the electronic signature process.

Submitting the debt cancellation form

After completing the form, the next step is submission. For many users, online submission is the most convenient option, often available through the creditor’s portal or a relevant agency's website. Alternatively, those who prefer non-digital methods can submit a physical copy by mailing it to the designated offset address.

What can you expect after submission? Typically, processing times will vary by institution, but you should be prepared for a wait period ranging from a few days to several weeks. Following up on the status of your submission can often be done through the institution’s customer service channels.

Managing debt cancellation after submission

Keeping thorough records post-submission is essential. It's advisable to track your submission confirmation and store all related documents securely. Utilizing cloud storage solutions can provide an organized and easily accessible way to keep important documents at hand.

Upon approval of debt cancellation, understanding the implications is crucial. This includes acknowledging any potential tax liabilities associated with the canceled amount, such as when the debt cancellation agreement results in a Form 1099-C being issued for tax reporting.

Insights and tools for using debt cancellation

pdfFiller offers numerous features that can maximize the efficiency of form handling. Users can easily edit forms, eSign, and collaborate with others on submissions, which streamlines the paperwork involved in debt cancellation. Utilizing templates for future submissions can further minimize repetitive work and improve accuracy.

In addition, interactive tools are available for users wanting to manage their debt more effectively. Whether it’s calculators that help assess the overall impacts of debt or links to legal resources, these tools can provide valuable insights that help users navigate the complicated terrain of debt management.

Frequently asked questions (FAQs) about the debt cancellation form

Common queries surrounding the debt cancellation form often include questions about eligibility. Many consumers wonder about requirements that dictate who qualifies for debt cancellation, particularly with student loans or significant credit card debt. Additionally, it's essential to understand what happens if the form is filled out incorrectly, as this can lead to processing delays or denials of the application.

It's also important to clarify the cancellation process timeline. Applicants should be mindful that the timeframe from submission to approval can vary widely and factor in personal circumstances. If your application is denied, knowing the next steps — such as the option to appeal or resubmit — can help navigate this often-complex landscape.

Real-life testimonials and case studies

Gleaning insights from users who have successfully navigated the debt cancellation form process can provide reassurance for others. Success stories often highlight how using the form has led to substantial debt relief and improved financial circumstances, making it a key tool for those in financial distress.

However, it’s also beneficial to learn from those who faced challenges during the process. Testimonials can reveal common mistakes, such as the importance of providing all necessary documentation upfront or the impact of deadlines on approval. These lessons can serve as valuable guidance for others embarking on their debt cancellation journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get review of debt cancellation?

How do I fill out the review of debt cancellation form on my smartphone?

How do I edit review of debt cancellation on an iOS device?

What is review of debt cancellation?

Who is required to file review of debt cancellation?

How to fill out review of debt cancellation?

What is the purpose of review of debt cancellation?

What information must be reported on review of debt cancellation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.