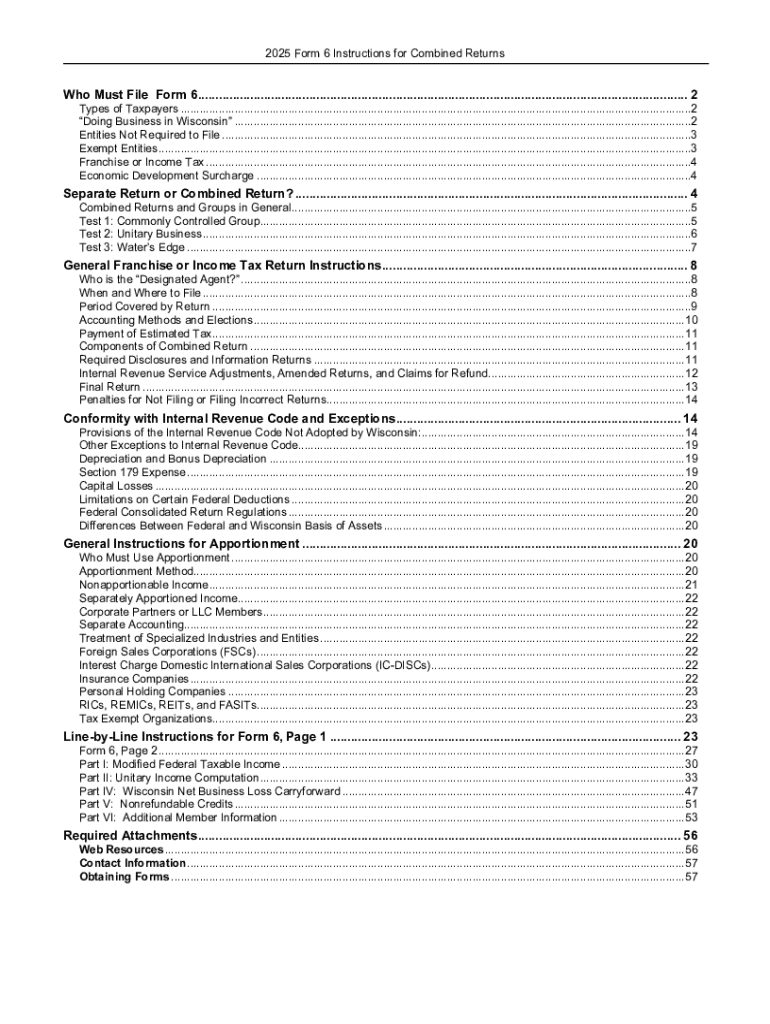

Get the free What are the Wisconsin State Filing Requirements?

Get, Create, Make and Sign what are form wisconsin

Editing what are form wisconsin online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what are form wisconsin

How to fill out what are form wisconsin

Who needs what are form wisconsin?

What are forms Wisconsin form: A Comprehensive Guide

Understanding Wisconsin forms

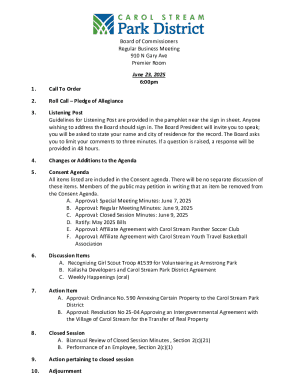

Forms in Wisconsin serve as essential documents that facilitate a variety of processes across government, education, and healthcare. These forms are often required for compliance with state regulations and for accessing services. Understanding their purpose and how to navigate them is crucial for individuals and businesses alike.

Categories of Wisconsin forms

Navigating forms in Wisconsin can be simplified by categorizing them based on their purpose. Understanding these categories can streamline the process for individuals seeking to fill out necessary documents.

In terms of income tax, individuals need to familiarize themselves with critical forms that dictate their tax obligations, which have specific filing deadlines and maneuvering instructions.

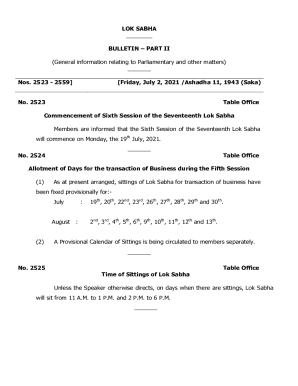

Navigating the Wisconsin forms landscape

Finding the correct forms is critical in ensuring compliance with Wisconsin regulations. The official sources for these forms can often eliminate confusion and help streamline the filing process.

These resources not only provide access to forms but also related instructions and help for various programs.

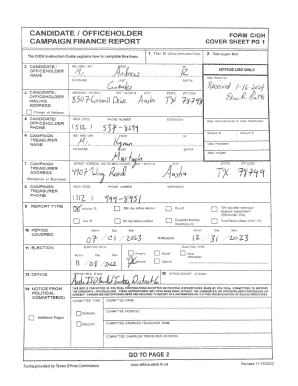

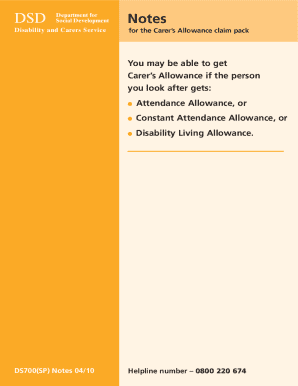

Filling out Wisconsin forms

Accuracy is paramount when filling out forms in Wisconsin. Each form has specific requirements that must be adhered to, ensuring information is correct to avoid delays.

For instance, when completing the Wisconsin Income Tax Form, it helps to break down the sections: personal information, income earned, and deductions claimed.

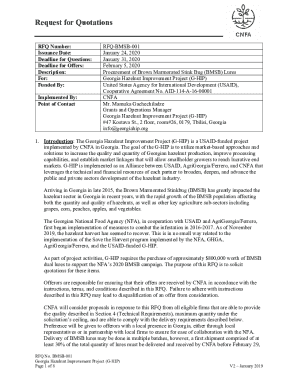

Editing, signing, and submitting Wisconsin forms

Once forms are filled out, the next critical steps involve editing, signing, and choosing a submission method. Using digital editing tools can simplify the process.

Tracking submissions is equally important; many local agencies provide confirmation options to ensure that your forms have been received.

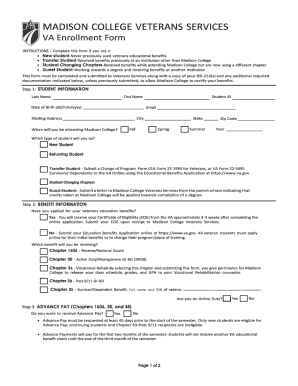

Managing and organizing forms

Proper management of forms is crucial for compliance and efficient retrieval. With the increasing reliance on digital documentation, securing sensitive information is more important than ever.

The use of platforms like pdfFiller can enhance organization and accessibility, making it easier to review and update forms as necessary.

Tips for avoiding common pitfalls

Staying informed about Wisconsin’s specific regulations around forms will help ensure that individuals and businesses do not fall into common traps that may lead to penalties or delays.

Many of these pitfalls can be avoided through diligent preparation and understanding of processes.

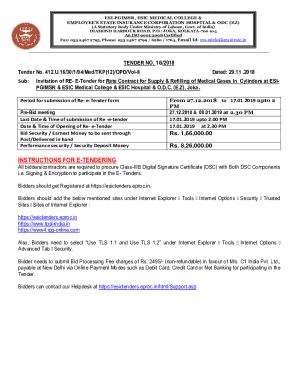

Leveraging technology for form management

The evolution of cloud-based document management solutions is transforming how individuals and businesses handle forms. By integrating powerful tools, managing and completing forms has never been easier.

Embracing these technologies can lead to more efficient document handling and a better overall filing process in Wisconsin.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in what are form wisconsin?

How do I edit what are form wisconsin on an iOS device?

How do I complete what are form wisconsin on an Android device?

What is what are form wisconsin?

Who is required to file what are form wisconsin?

How to fill out what are form wisconsin?

What is the purpose of what are form wisconsin?

What information must be reported on what are form wisconsin?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.