Get the free Missouri Department of Revenue, Taxation Division 1040A ... - dor mo

Get, Create, Make and Sign missouri department of revenue

How to edit missouri department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out missouri department of revenue

How to fill out missouri department of revenue

Who needs missouri department of revenue?

Missouri Department of Revenue Form - How-to Guide

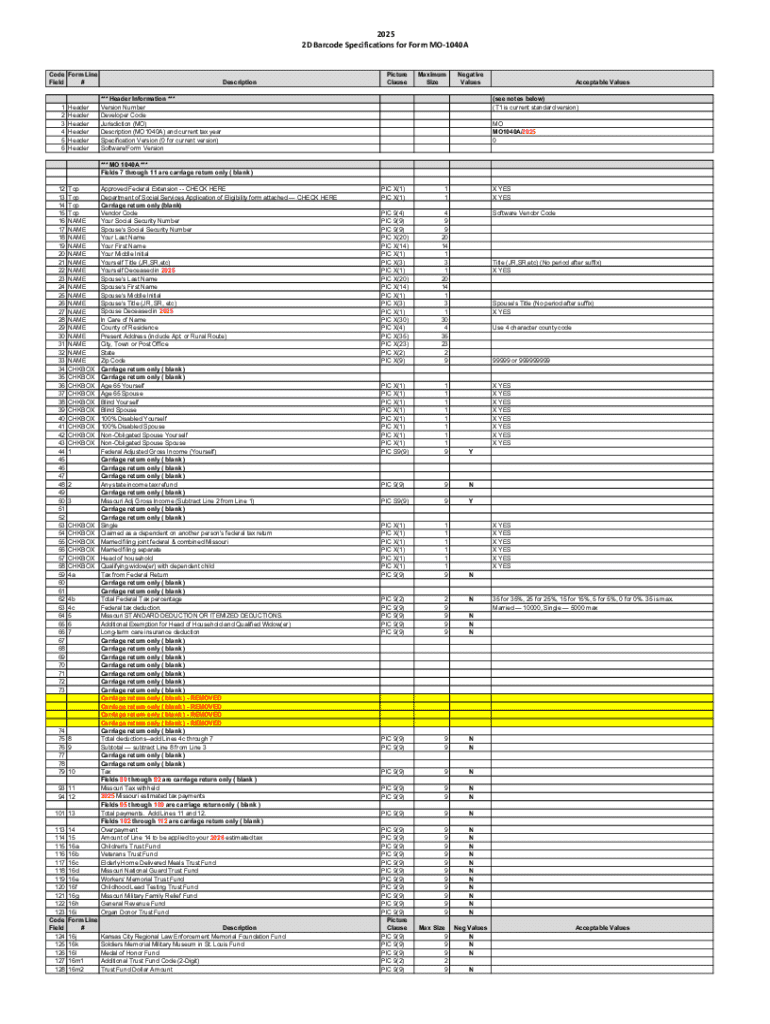

Overview of the Missouri Department of Revenue Forms

The Missouri Department of Revenue (DOR) plays an essential role in managing the state’s collection of taxes, vehicle registration, and more. To facilitate these functions, it provides a variety of forms that individuals, businesses, and non-profits can use. The importance of these specific forms cannot be overstated, as they ensure compliance with local laws and help in the proper allocation of resources within the state.

Historically, the Missouri DOR has evolved significantly, adapting to changes in tax law, technology, and public needs. From its inception, the DOR has aimed to create an efficient process for submitting tax information, vehicle registrations, and other necessary documentation. Understanding the history gives context to the development of necessary forms and how they have become streamlined for user convenience.

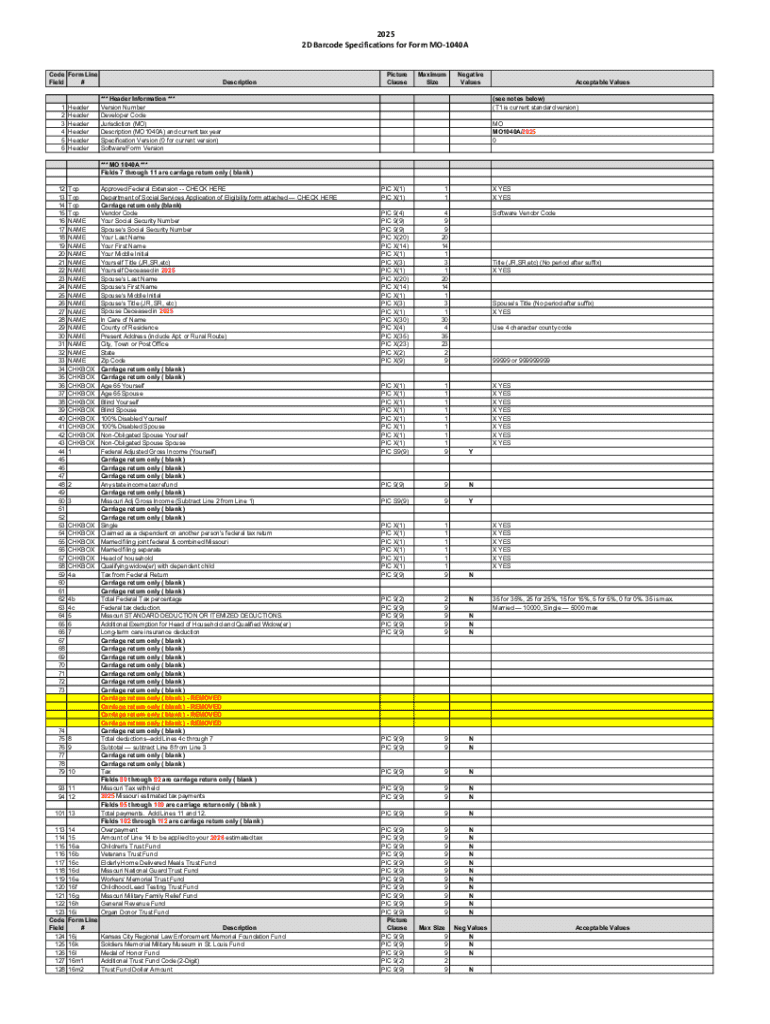

Types of forms offered by the Missouri Department of Revenue

The Missouri Department of Revenue offers a plethora of forms categorized by purpose. Here's a look at the different types:

Getting started with Missouri Department of Revenue forms

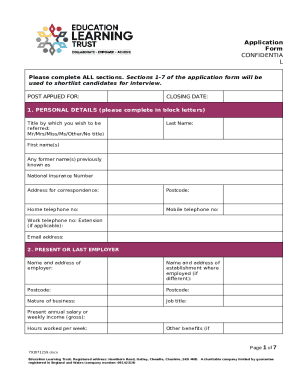

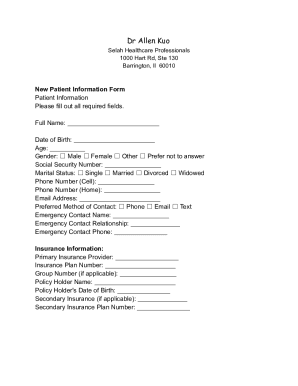

Choosing the correct form from the Missouri Department of Revenue can feel overwhelming, especially with the variety of options available. The first step in your journey is thoroughly understanding your needs and identifying the specific form required for your situation.

Key information requirements can include documentation such as identification, prior tax returns, and proof of residency, depending on the type of form you are filling out. Additionally, each form may have its unique deadlines and submission requirements that must be adhered to ensure compliance with state laws.

Step-by-step guide to completing Missouri Department of Revenue forms

Completing the forms correctly is crucial for avoiding delays and complications. Begin by gathering all necessary information, and familiarize yourself with the definitions and sections of your chosen form.

Here’s a breakdown of completing key forms:

To ensure successful submission, avoid common mistakes such as incomplete forms or miscalculations. Double-check your entries and ensure all required documentation is attached.

Using pdfFiller for Missouri Department of Revenue forms

pdfFiller presents a streamlined solution for managing any type of Missouri Department of Revenue form. With its powerful features, you can edit PDFs effortlessly, eSign documents securely, and even collaborate with your team in real time.

To effectively use pdfFiller, follow these easy steps:

With pdfFiller, managing your documents becomes a hassle-free experience, allowing you to focus on accuracy and compliance.

Ensuring compliance and keeping track of submissions

Compliance with the submission requirements can be a complex task. Familiarizing yourself with the format and necessary data is paramount. Maintaining copies of your submitted documents is not just a good practice; it’s essential for tracking purposes.

To keep everything organized: make note of submission dates, and use tracking options available through the Missouri Department of Revenue to monitor your form submissions. Regularly check if there are any issues with your forms post-submission.

Addressing common FAQs about Missouri Department of Revenue forms

Navigating through the Missouri Department of Revenue forms can induce many questions. Common inquiries include how to correct mistakes after submission, what to do if deadlines are missed, and where to find assistance for complex scenarios.

For immediate assistance, contacting the Missouri DOR can clarify intricate questions. Utilizing the FAQs section on their website can also serve as a helpful resource for general concerns.

Conclusion

Filling out and submitting Missouri Department of Revenue forms accurately and on time is vital for compliance with state law. Utilizing tools like pdfFiller can significantly simplify the entire process, making it easier for individuals and businesses alike to manage their documentation needs.

By leveraging the powerful features of pdfFiller, you can ensure that your form management is seamless and efficient, allowing you to submit accurate and timely forms to the Missouri Department of Revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my missouri department of revenue in Gmail?

How do I execute missouri department of revenue online?

How do I edit missouri department of revenue on an Android device?

What is Missouri Department of Revenue?

Who is required to file Missouri Department of Revenue?

How to fill out Missouri Department of Revenue?

What is the purpose of Missouri Department of Revenue?

What information must be reported on Missouri Department of Revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.