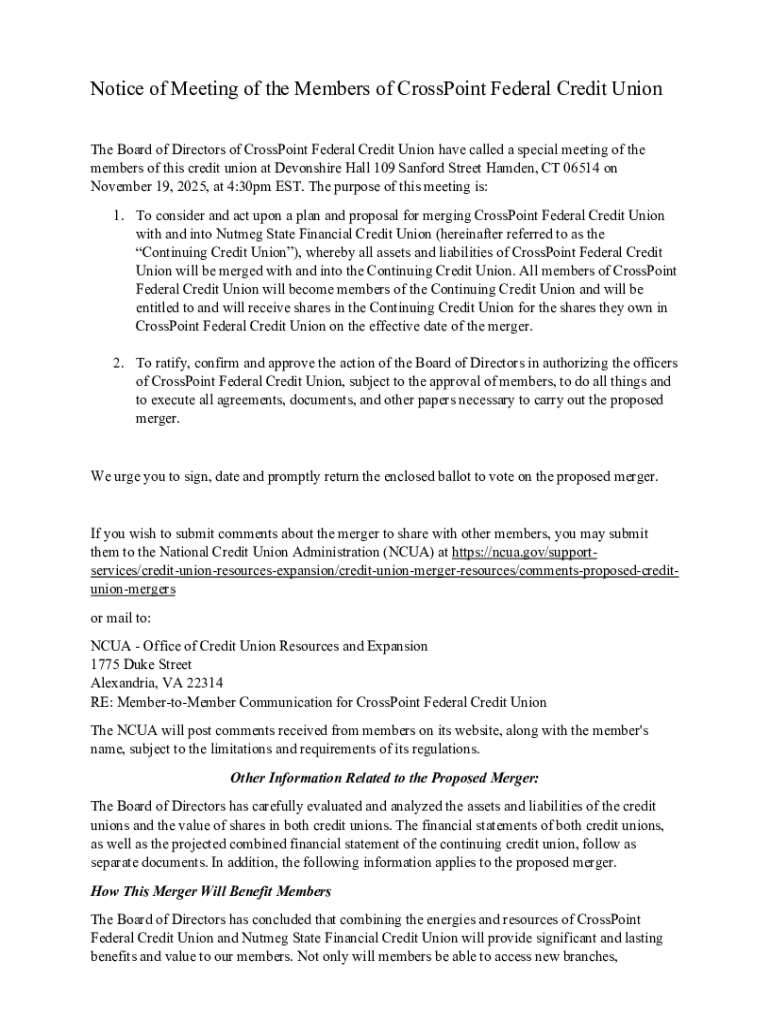

Get the free Comments on Proposed Credit Union Mergers

Get, Create, Make and Sign comments on proposed credit

Editing comments on proposed credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comments on proposed credit

How to fill out comments on proposed credit

Who needs comments on proposed credit?

Comments on Proposed Credit Form: A Comprehensive Guide

Overview of the proposed credit form

The proposed credit form is a critical tool designed to facilitate the assessment of credit applications in a transparent and efficient manner. With an emphasis on user experience and regulatory compliance, this form aims to streamline processes for both applicants and institutions. The significance of gathering comments on this proposed credit form cannot be understated, as it directly influences the refinement of the tool to better meet the needs of its users.

Key features of the proposed version include simplified sections that enhance clarity while maintaining compliance with relevant rules. By soliciting feedback, users are empowered to contribute to the evolution of this document, fostering a collaborative approach that can lead to better-designed forms in the future. Engaging users in this way is essential for continuous improvement and adaptability.

Understanding the proposed changes

The proposed changes to the credit form focus on improving user accessibility and ensuring efficient data collection. Key revisions include the introduction of new fields intended to capture data more accurately as well as the restructuring of existing fields to minimize redundancy. This rationalization aims to make the submission process less cumbersome, ultimately enhancing the user experience.

Comparing the proposed version to the previous one reveals significant enhancements, specifically in the areas of data organization and interactive features. The implications of these changes are far-reaching, potentially reducing the time required for credit assessments, thus improving turnaround times for all parties involved. It’s essential for users to grasp these changes to fully leverage the advantages they present.

Step-by-step guide to reviewing the proposed credit form

To efficiently provide comments on the proposed credit form, follow these steps:

Tips for providing effective feedback

Constructive comments are pivotal in shaping the proposed credit form into a resource that best serves its users. Here are some guidelines for effective feedback:

Addressing common concerns and questions

Frequently asked questions surrounding the proposed credit form often revolve around how changes will impact previous submissions and what to expect after feedback is submitted. It’s important to clarify that changes made will take effect only for future submissions and that users will be notified regarding the status of their feedback following the review process.

For any inquiries that go beyond the FAQs, users can easily reach out to the support team through the contact information provided on the pdfFiller website. Quick access to essential support can assist users in navigating any uncertainties.

Resources for maximizing your use of the proposed credit form

Maximizing the usefulness of the proposed credit form requires taking advantage of additional resources available through pdfFiller. These include interactive tools that enhance user experience, such as real-time data validation features and embedded tutorials.

Moreover, stakeholders should familiarize themselves with the underlying credit regulations and forms applicable in their jurisdiction. Engaging with community forums and user groups can provide valuable insights and shared experiences that contribute to refining the use of the credit form and its functionalities.

Case studies: how feedback has shaped previous versions

Examining case studies can provide powerful insights into the impact of user feedback on form revisions. For instance, previous iterations of the credit form underwent significant transformation after users reported difficulties in comprehension, which led to a redesign focused on clarity and straightforwardness. Analyzing successful adjustments showcases how vital user commentary is in molding effective and efficient documents.

By reviewing past proposals, users can learn valuable lessons about how their input can drive positive changes in processes and systems used across different sectors, reinforcing the importance of continuous engagement.

Next steps: engaging with future changes

Staying informed about updates and modifications to credit forms is critical for ongoing participation in system improvements. Users are encouraged to subscribe to newsletters, attend webinars, and participate in workshops hosted by pdfFiller that focus on credit form usage and regulations.

Encouraging active involvement in feedback beyond the current proposal can help build a robust foundation for future iterations, ensuring that the credit form evolves to meet ever-changing needs.

Conclusion: the impact of your comments

The participation of users and stakeholders in providing insightful comments on the proposed credit form is invaluable. The feedback gathered will significantly shape how the credit assessment process is handled, enhancing the fabric of compliance, efficiency, and user-friendliness within the credit system.

Encouraging continuous dialogue fosters an environment where users can feel empowered to contribute, shaping a form that is not only functional but also responsive to the needs of all stakeholders involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete comments on proposed credit online?

How do I make edits in comments on proposed credit without leaving Chrome?

Can I create an eSignature for the comments on proposed credit in Gmail?

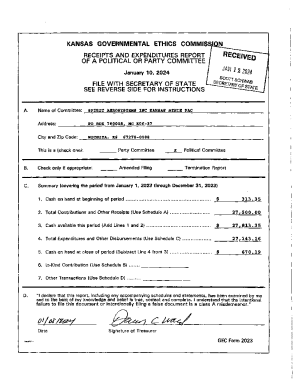

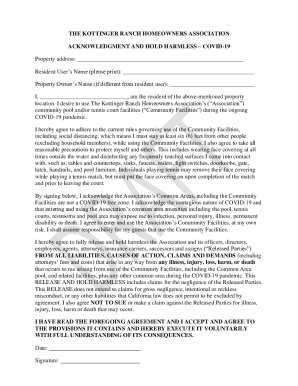

What is comments on proposed credit?

Who is required to file comments on proposed credit?

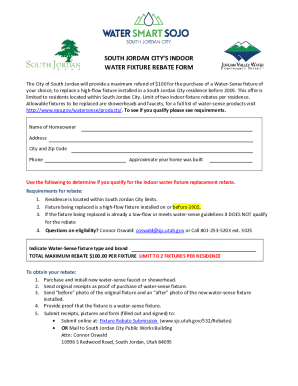

How to fill out comments on proposed credit?

What is the purpose of comments on proposed credit?

What information must be reported on comments on proposed credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.