Get the free Maryland Court Backs Borrower In Case Over Mortgage ' ...

Get, Create, Make and Sign maryland court backs borrower

Editing maryland court backs borrower online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland court backs borrower

How to fill out maryland court backs borrower

Who needs maryland court backs borrower?

Maryland court backs borrower form

Overview of the Maryland court backs borrower form

The Maryland court backs borrower form serves as a crucial document in the lending process, providing transparency and understanding between borrowers and lenders. Its primary purpose is to clearly outline the terms of a loan and establish the rights and responsibilities of the borrower. With the recent judicial support for this form, it has gained importance as a legally enforceable document, ensuring that borrowers are adequately protected in their agreements with lenders.

The legal implications of the borrower form in Maryland mean that both borrowers and lenders are bound by its contents, making it essential for all parties involved to comprehend its stipulations fully. Stakeholders, including individual borrowers and lending institutions, as well as legal representatives tasked with ensuring compliance, all play vital roles in the lifecycle of this document.

Understanding the legal framework

Maryland's legal framework governing borrower forms can be intricate, underpinned by state laws that dictate how lending practices should be conducted. A key aspect is the requirement for clarity in terms, which protects consumers from predatory lending practices. The evolution of regulations surrounding borrower forms reflects a growing awareness of borrowers’ rights and the necessity for greater accountability among lenders.

Recent court rulings have further impacted the landscape of borrower forms in Maryland. These decisions often reinforce a borrower's right to challenge terms or seek remedies if discrepancies arise. For example, courts have upheld that borrowers can contest enforceability based on vague or misleading language in loan documents, highlighting the necessity of precise drafting.

Detailed insights on the borrower form

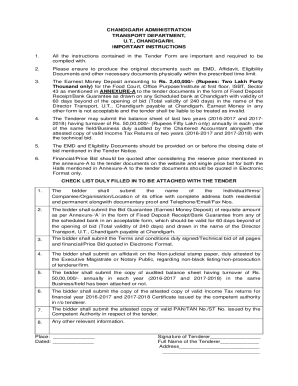

The Maryland borrower form comprises several key components that are essential for documenting the loan agreement. It begins with personal borrower details, including the borrower's name, address, and Social Security number, which are critical for identity verification. Next, the form outlines the loan terms, detailing the amount borrowed, interest rates, repayment schedule, and any fees associated with the loan, ensuring both parties have a clear understanding of expectations.

In addition to these components, the borrower form also specifies the rights and responsibilities of the borrower. This may include the right to receive periodic statements, the obligation to maintain insurance on the collateral, and the consequences of defaulting on the loan. Understanding these terminologies and phrases can empower borrowers to protect their rights effectively. It's also important to note that forms can vary based on loan types, such as personal loans, mortgages, or student loans, reflecting the unique conditions associated with each category.

Filling out the Maryland borrower form

Completing the Maryland borrower form requires careful attention to detail. Begin by gathering the necessary information and documents, including identification, credit history, and income verification. Accurately filling out borrower details is crucial, as any discrepancies can delay loan approval or cause compliance complications.

Next, input the specific loan-related information such as the requested amount and the desired terms. Finally, conduct a thorough review and verification process to ensure that all information is accurate and complete. This step is vital to prevent common mistakes, such as leaving fields blank or miscalculating loan amounts, which could potentially jeopardize the agreement.

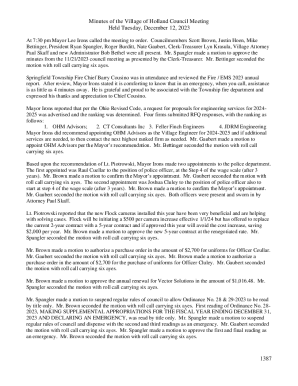

Editing and managing your borrower form

Managing your borrower form effectively ensures that all necessary updates and changes are captured appropriately. With pdfFiller, editing the borrower form is seamless. Users can utilize interactive tools to edit text, add or remove information, and adjust formatting as required. This flexibility is critical, especially when the terms of a loan change or when additional information is needed.

Saving and organizing forms for future reference is also crucial. pdfFiller allows users to store their forms in a cloud-based solution, ensuring that documents are accessible from anywhere at any time. Keeping track of revisions and updates helps maintain an accurate record of all changes made, ensuring both borrowers and lenders remain aligned throughout the loan process.

E-signing and securing your borrower form

E-signatures have become a significant feature in the borrower form process, adding both convenience and security. By leveraging pdfFiller's e-signature capabilities, borrowers can effortlessly sign documents from their devices, ensuring a smooth and expedited approval process. The legal validity of e-signatures is well-established in Maryland, making this approach both reliable and efficient.

Security measures are also in place to protect sensitive information throughout the borrower form's lifecycle. pdfFiller utilizes encryption and secure storage methods, ensuring that personal and financial data remains confidential. Borrowers can feel confident knowing their information is safeguarded while navigating their loan agreements.

Collaborating on the borrower form

Effective collaboration is essential when multiple stakeholders are involved in the borrower form process. pdfFiller facilitates teamwork by allowing individuals to work together seamlessly on the same document. This is particularly beneficial in cases where team members contribute different pieces of information or provide feedback on the borrower form.

The platform's commenting and feedback features allow users to communicate with one another directly within the document. Additionally, there are options for sharing the form with stakeholders, ensuring that everyone has access and stays informed about any updates or revisions. Effective collaboration enhances the quality and accuracy of the borrower's submission.

Frequently asked questions (FAQs)

If issues arise with the borrower form, borrowers should first review the document for errors or omissions. If problems persist, contacting the lender for clarification is advisable. Additionally, legal assistance may be beneficial for navigating more complex issues related to loan agreements.

Borrowers can challenge or appeal loan-related decisions in Maryland by providing documented evidence and presenting their case to the relevant authorities, such as the district court. Legal resources are available for those who need assistance in understanding their rights and the processes involved in appealing decisions related to their loan.

Conclusion: Navigating the Maryland borrower form landscape

Understanding the Maryland borrower form is essential for safeguarding individual rights and ensuring compliance with legal standards. Being well-versed in the content and implications of this form empowers borrowers to navigate the lending landscape more effectively. As changes continue to unfold in lending practices and regulations, borrowers must remain informed about their rights and responsibilities to protect their interests.

Moving forward, the landscape for borrowers in Maryland will continue to evolve, necessitating ongoing education and awareness of legal documents like the borrower form. With the support of platforms like pdfFiller, users can confidently manage their documentation needs in a secure and accessible manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my maryland court backs borrower in Gmail?

How can I fill out maryland court backs borrower on an iOS device?

How do I fill out maryland court backs borrower on an Android device?

What is maryland court backs borrower?

Who is required to file maryland court backs borrower?

How to fill out maryland court backs borrower?

What is the purpose of maryland court backs borrower?

What information must be reported on maryland court backs borrower?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.