Get the free Opening a BFS Account For Personal Investors

Get, Create, Make and Sign opening a bfs account

Editing opening a bfs account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out opening a bfs account

How to fill out opening a bfs account

Who needs opening a bfs account?

Opening a BFS Account Form: A Comprehensive Guide

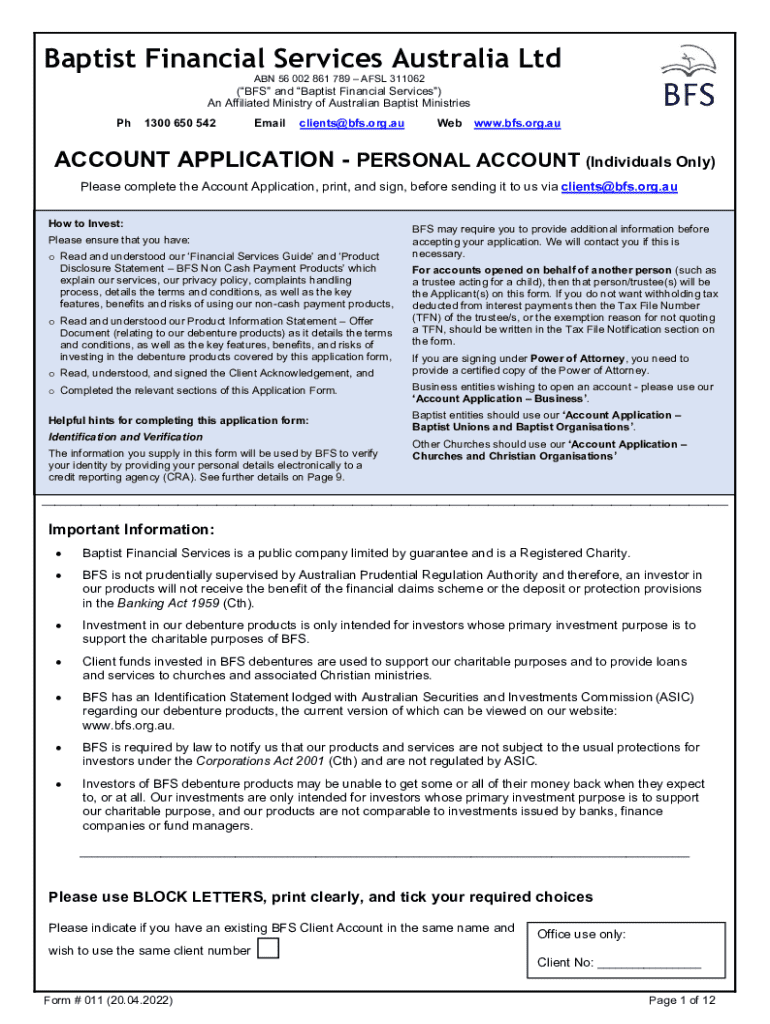

Understanding BFS accounts

A BFS (Banking Financial Services) account serves as a versatile tool for managing personal or business finances. It facilitates transactions while providing access to a wide range of financial services. Opening a BFS account can simplify managing your finances, giving you direct control over your banking operations.

The advantages of setting up a BFS account are plentiful. They encompass smoother funds management, elevated financial control, ease of accessibility, and a plethora of convenience-driven features.

Preparing to open your BFS account

Before you initiate your journey with the BFS account form, it is vital to ascertain your eligibility. Each financial institution has specific criteria, so reviewing these requirements before selecting a provider is essential to streamline the process.

Once eligibility is confirmed, gather the necessary documents. The following documentation is commonly required to complete your account application:

Step-by-step guide to accessing the BFS account form

Accessing your BFS account form online is straightforward. Start by visiting the official banking website or the relevant financial institution. Look for the 'Open an Account' or 'BFS Account Form' link, typically found under the ’Accounts’ or ‘Personal Banking’ tabs.

In addition to the online access, you may want to find a downloadable PDF version of the BFS account form. This can come in handy if you prefer to fill it out manually. Searching phrases like 'BFS Account Form PDF' will usually lead you to the official document.

Finally, ensure that the link you’re using is the official pdfFiller link, which guarantees you a safe and official form to fill out.

Filling out the BFS account form

When it's time to complete the BFS account form, detailed attention to each section is paramount. Each segment requires specific information, from personal identification to employment details. Ensure to fill out the following sections correctly:

To ensure accuracy, avoid common pitfalls such as incomplete fields or incorrect documentation. After filling the form, double-check it before submission.

Editing your BFS account form

Sometimes, mistakes happen during form submission. Thankfully, pdfFiller offers robust editing tools to help you revise the BFS account form efficiently. You can rectify errors, add another signature, or include additional information seamlessly.

Signing the BFS account form

After filling out the account form, it's vital to sign it correctly. There are multiple options available for signing, each with its perks. You can opt for electronic signing, which is quick and secure, or use the traditional method of printing the form, signing it by hand, and scanning it back to an electronic format.

Proper signing is crucial for your submission's legal validity. eSignatures are recognized by law, ensuring that your digital consent meets all required standards.

Submitting the BFS account form

Once the BFS account form is completed and signed, it’s time for submission. For electronic submissions, follow the precise guidelines indicated on the banking website. Most institutions expect forms to be sent via a secure online portal to enhance security.

If you prefer not to submit online, mailing your form generally involves sending it to the bank’s designated mailing address. Ensure that you obtain a receipt or confirmation once your application is sent to track its progress.

Upon submission, you should receive a confirmation email, outlining the next steps, such as when and how to expect a response regarding your application.

Frequently asked questions about BFS accounts

Even with clear guidelines, questions can arise. Here are some frequently asked queries regarding the BFS account form that may help clarify common concerns.

Additional tools and resources

pdfFiller enhances the BFS account form experience by providing various interactive fillable form features. As a user, you benefit from step-by-step guidance to navigate any part of the document creation process.

First-time users can rely on dedicated support resources to help them understand how pdfFiller's functionalities work. Additionally, frequently asked questions directed at pdfFiller services can shed light on specific queries related to navigating the platform effectively.

Managing your BFS account post-opening

Once your BFS account is up and running, maintaining it is essential. pdfFiller allows you to access and update your account information whenever necessary. They offer straightforward navigation for tracking transaction activities and account health.

Beyond tracking your account, pdfFiller positions you to initiate further services, such as investments and loans, reinforcing its role as a comprehensive document management solution.

Common challenges when opening BFS accounts

Opening a BFS account, while straightforward for many, can sometimes encounter bumps. One common obstacle is misunderstandings regarding eligibility requirements. Having the right documents at hand, alongside familiarity with requirements, can prevent potential delays.

Another challenge often encountered is document inconsistencies. Resolving such issues may require contacting customer support for assistance. Using clear records and double-checking all submissions can help mitigate these problems.

Conclusion

Navigating the journey of opening a BFS account form doesn't have to be daunting. With pdfFiller, empowering users to edit, eSign, and seamlessly manage their banking documents is a straightforward and efficient process. Utilizing these features enhances your ability to handle your banking needs skillfully. Take full advantage of what pdfFiller offers for your document management, ensuring a smooth BFS account setup and a path towards achieving your financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit opening a bfs account from Google Drive?

How do I execute opening a bfs account online?

How do I fill out the opening a bfs account form on my smartphone?

What is opening a bfs account?

Who is required to file opening a bfs account?

How to fill out opening a bfs account?

What is the purpose of opening a bfs account?

What information must be reported on opening a bfs account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.