Get the free COMMON AREA TAX-an all-volunteer community

Get, Create, Make and Sign common area tax-an all-volunteer

How to edit common area tax-an all-volunteer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out common area tax-an all-volunteer

How to fill out common area tax-an all-volunteer

Who needs common area tax-an all-volunteer?

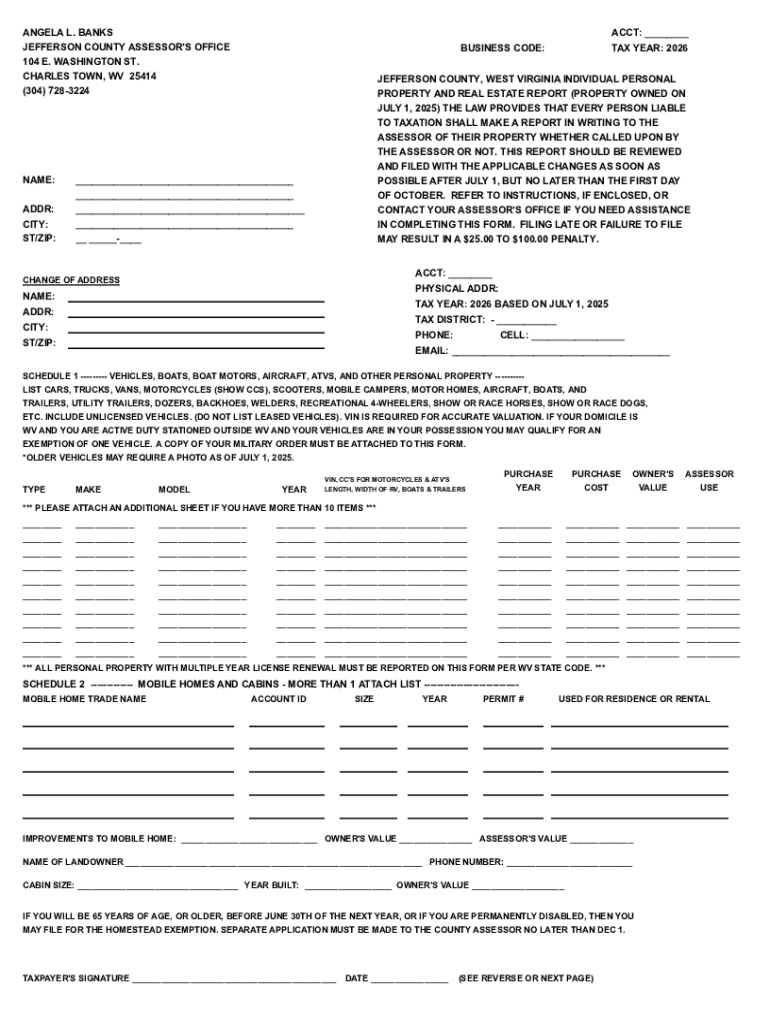

Common Area Tax - An All-Volunteer Form

Understanding common area tax

Common area tax is a unique tax structure that is applied to shared community spaces. These areas may include parks, recreational facilities, and other communal resources that serve a group or neighborhood. Understanding this tax is vital not only for compliance with local laws but also for the efficient management of community resources.

Filing the common area tax ensures that these community assets are funded and maintained adequately. It allows for the repair and upkeep of parks and other facilities that enhance the quality of life within the community. Anyone who is responsible for property or community assets may be required to file this tax.

Volunteer assistance comes into play significantly during the tax filing process. Many community organizations work with local volunteer income tax assistance programs, which utilize trained volunteers to help file taxes efficiently and accurately.

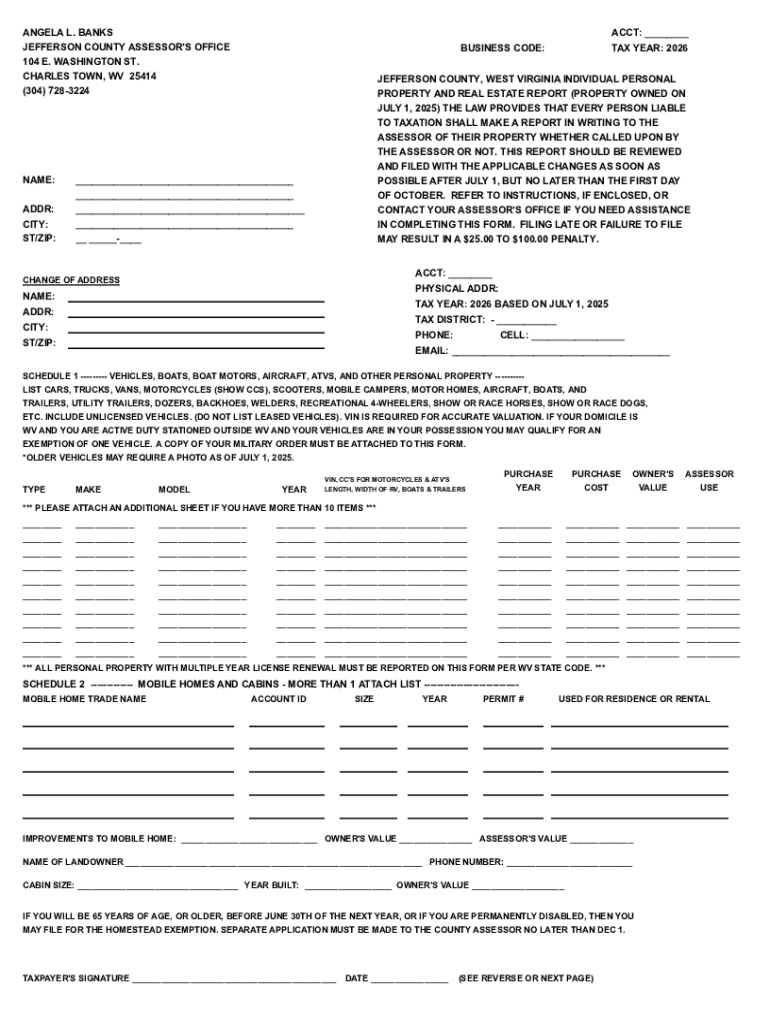

Key features of the common area tax form

The common area tax form is designed to collect essential information pertaining to shared community spaces. Proper structuring of this form ensures that all necessary details are captured for accurate tax assessment and compliance.

Required information typically includes property identification details, the nature of the common area, and estimated expenditures for maintenance or improvements. It’s essential to note sections that require declarations about the use of funds from the common area tax.

Common mistakes can include missing sections or misreporting expenditures. It's crucial to remain diligent during this process to avoid any tax penalties or issues with the Internal Revenue Service.

Accessing the common area tax form

Finding the common area tax form can easily be accomplished through various online resources. Most local government websites provide downloadable versions of the form you need, helping streamline the filing process.

Direct downloads from the tax office's website are convenient and ensure you have the latest version. Utilize search terms like 'common area tax form [your area]' to access specific documents relevant to your locality.

Filling out the common area tax form

Filling out the common area tax form requires careful attention to detail. Start by gathering necessary documents like prior tax returns, identification numbers, and any financial reports outlining community expenditures.

As you complete each section of the form, ensure you provide specific explanations of expenditures. This transparency helps in the accurate processing of your tax returns and aids any volunteers assisting you in understanding the financial layout of your community.

Interactive tools like pdfFiller allow for added convenience. Volunteers can collaborate in real time, making adjustments and comments, ensuring that the filing process is communal and efficient.

Editing and managing your completed form

Once your form is filled out, pdfFiller offers editing capabilities that let you make changes effortlessly. This means if any information requires updates, you can edit the document without needing to start over.

Collaborating with other volunteers is also streamlined with cloud-based document management. This allows multiple users to view and edit the tax form, thus encouraging community involvement and accountability.

Signing and submitting the common area tax form

Submitting your completed form is the final step in the tax filing process. Understanding eSignature requirements is essential, as today’s digital solutions allow for secure and swift signing capabilities.

With pdfFiller, signing your document can be done electronically, ensuring compliance without the hassle of physical paperwork. Follow these steps: use the eSignature tool to place your signature, ensure all needed information is included, and confirm your submission process.

Important considerations post-submission

Tracking your submission is crucial after the filing process. Most local tax offices will provide a tracking number for verification. This allows you to ensure that your common area tax has been processed correctly.

Expect correspondence from the tax office post-filing, which may include confirmation or requests for additional information. Be prepared to address any follow-up questions promptly to avoid complications.

Additional support for volunteers

Volunteers assisting with common area tax filing have access to numerous resources. Training materials often provided by local volunteer income tax assistance programs can significantly enhance understanding and capabilities.

Additionally, community partnerships and support groups can offer practical advice and shared experiences, enriching the volunteer experience and leading to more effective tax filing.

Leveraging technology for efficient tax filing

Utilizing cloud-based platforms like pdfFiller can enhance the efficiency of tax filing. These platforms offer tools that allow stakeholders to manage documents seamlessly and collaborate in real-time, providing a robust solution for tax preparation.

The benefits of using pdfFiller extend beyond ease of use. Users gain access to editing, signing, and storage capabilities, ensuring that everything is within reach from anywhere with an internet connection.

Case studies: Successful common area tax filings

Learning from real-life examples can provide significant insights into successful common area tax filings. Case studies from communities that have efficiently managed their common area tax demonstrate the benefits of organized volunteer efforts.

For instance, a community in [local area] overcame filing challenges by utilizing a unified approach where volunteers were trained collectively, resulting in accurate filings and positive feedback from community partners. This collaborative effort showcased the impact volunteers can have on community resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the common area tax-an all-volunteer in Gmail?

Can I edit common area tax-an all-volunteer on an iOS device?

Can I edit common area tax-an all-volunteer on an Android device?

What is common area tax-an all-volunteer?

Who is required to file common area tax-an all-volunteer?

How to fill out common area tax-an all-volunteer?

What is the purpose of common area tax-an all-volunteer?

What information must be reported on common area tax-an all-volunteer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.