Get the free Budget in Brief: Fiscal Year 201920 - Agencies - Colorado.gov

Get, Create, Make and Sign budget in brief fiscal

How to edit budget in brief fiscal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget in brief fiscal

How to fill out budget in brief fiscal

Who needs budget in brief fiscal?

Budget in Brief Fiscal Form: A Comprehensive Guide

Understanding budget in brief fiscal form

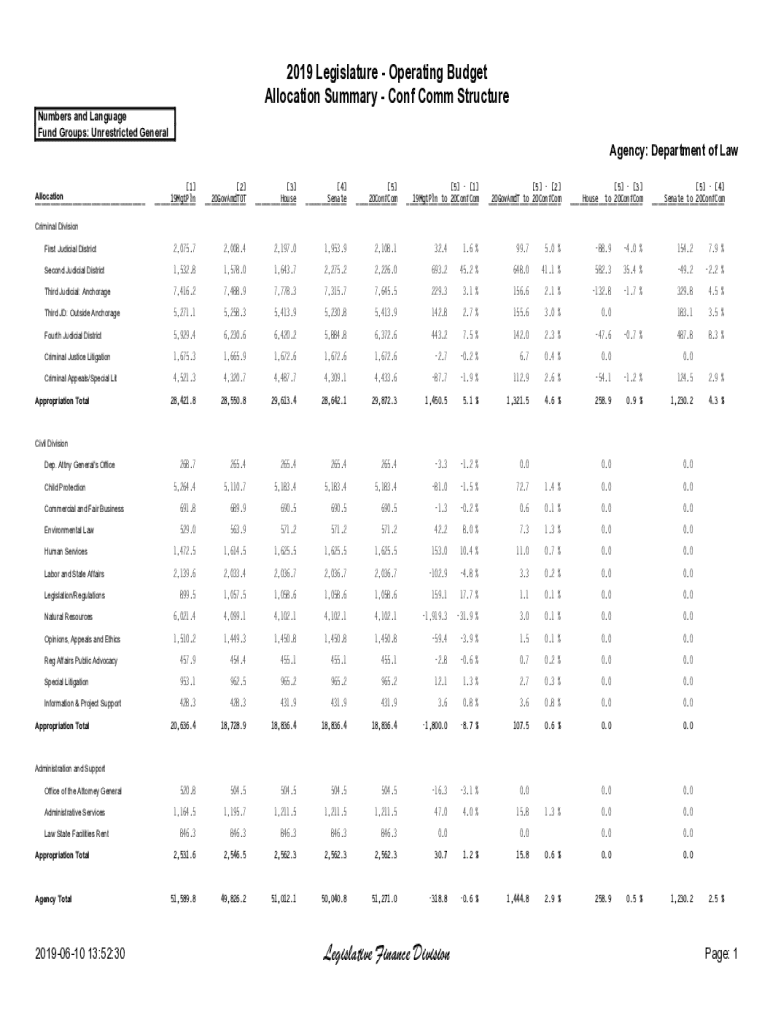

A budget in brief fiscal form is a succinct representation of an organization's projected revenues and expenses over a defined period. It provides a clear overview that facilitates decision-making and resource allocation. Fiscal forms are crucial in maintaining financial discipline, ensuring that individuals and organizations can monitor their financial health effectively. The primary components of a budget in brief include income sources, fixed and variable expenses, and a summary of the net profit or loss expected during the period. These elements establish the financial roadmap necessary for achieving objectives.

Types of budget in brief fiscal forms

Understanding the different types of budgets in brief fiscal forms is essential for effective financial management. Annual budgets cover a full fiscal year, providing a long-term view, whereas quarterly budgets allow for more nimble adjustments every three months. An operating budget details daily operational expenses and revenues, while a capital budget focuses on long-term investments and projects like infrastructure development. Fixed budgets remain unchanged regardless of activity level, while flexible budgets adjust based on actual activity, offering better responsiveness to financial changes.

How to create a budget in brief fiscal form

Creating a budget in brief fiscal form requires a systematic approach. Start by assessing historical financial data to understand spending patterns and income streams. Next, set clear financial goals and objectives that align with your organization’s mission. Estimating revenues involves considering all sources of income, while estimating expenses includes both fixed costs, like salaries, and variable costs, like materials. After gathering this information, allocate resources based on priorities and anticipated needs. Finally, create a draft budget and review it for accuracy, revising as necessary to ensure it reflects realistic financial expectations.

Interactive budgeting tools

As financial management practices evolve, interactive budgeting tools like pdfFiller offer users a dynamic platform for creating and managing budgets. This software simplifies the budgeting process by providing templates that can be easily filled out and modified. Key features to look for in budgeting tools include the ability to track changes, collaborate with team members, and integrate with other financial software. With pdfFiller, users can edit PDFs, eSign documents, and share budgets seamlessly, enhancing collaboration among stakeholders.

Best practices for filling out a budget in brief fiscal form

When filling out a budget in brief fiscal form, accuracy and organization are paramount. Using templates ensures consistency and saves time. Organizing income and expense categories into defined groups helps to streamline the budgeting process and makes for easier tracking. Leveraging eSign features for budget approvals ensures that all necessary stakeholders have validated the budget quickly. Common mistakes to avoid include overlooking minor expenses, failing to review or update the budget regularly, and not involving relevant team members in the budgeting process.

Editing and managing your budget in brief fiscal form

Utilizing editing tools like those offered by pdfFiller can make managing a budget in brief fiscal form much more efficient. Users can make real-time updates to their budgets, ensuring that they always reflect the current financial situation. Collaborative budgeting within teams is made easier when everyone can access the document and make necessary changes. Version control is another significant feature that helps track changes over time, making it simple to review the evolution of the budget and reference earlier drafts.

Using your budget for financial reporting and analysis

Utilizing a budget in brief fiscal form extends beyond its creation; it plays a vital role in financial reporting and analysis. By interpreting budget results, organizations can understand whether they are on track toward their financial goals. Comparing budgeted figures against actual results allows for a thorough analysis of performance, highlighting variances that require attention. This comparison enables data-driven decisions, allowing leaders to adjust strategies and operations based on current financial realities, ultimately enhancing the overall efficiency of the organization.

The importance of regular budget reviews

Establishing a regular budget review schedule is critical for staying aligned with ever-changing financial circumstances. Reviewing the budget periodically ensures that it remains accurate and relevant, particularly in response to new data and unforeseen expenses. Involving stakeholders in the review process not only enhances engagement but also leads to better-informed decisions regarding financial adjustments. By adapting to changes in the financial landscape, organizations can maintain stability and meet their operational goals effectively.

Case studies: Successful budgeting in action

Examining real-life examples of effective budget in brief fiscal implementations reveals valuable lessons and strategies. For instance, a local government successfully implemented a budget in brief fiscal form that allowed for quick adjustments based on shifting economic needs, demonstrating agility in resource allocation. Conversely, organizations that failed to keep detailed records or ignored stakeholder input often faced funding shortages and operational disruptions. Such case studies highlight the importance of structured budgeting and exemplify how proactive financial management can yield positive results.

FAQs about budget in brief fiscal forms

Understanding common questions around budget in brief fiscal forms can demystify the budgeting process for many users. What are the essential components of a budget in brief? Why is it critical to involve stakeholders? How can one effectively revise a budget? These FAQs address typical concerns, providing accessible solutions for individuals and teams. Additionally, numerous resources are available for those looking to deepen their financial knowledge and refine their budgeting processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find budget in brief fiscal?

Can I create an electronic signature for signing my budget in brief fiscal in Gmail?

Can I edit budget in brief fiscal on an iOS device?

What is budget in brief fiscal?

Who is required to file budget in brief fiscal?

How to fill out budget in brief fiscal?

What is the purpose of budget in brief fiscal?

What information must be reported on budget in brief fiscal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.