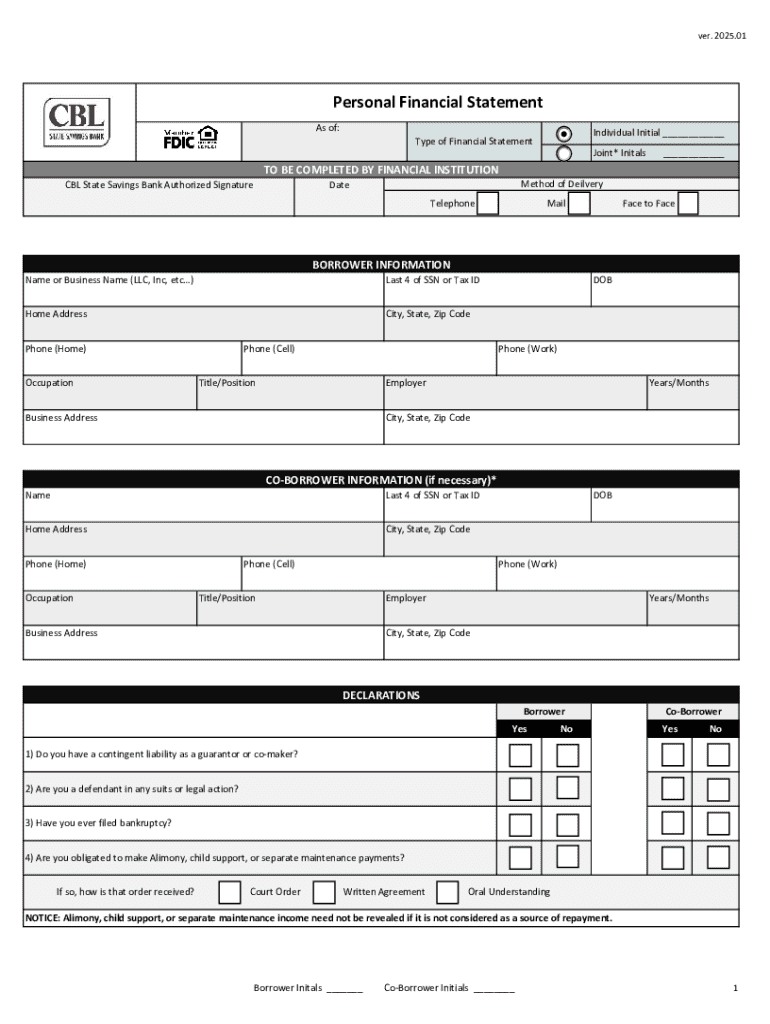

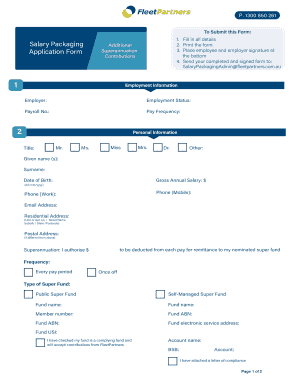

Get the free Type of Financial Statement

Get, Create, Make and Sign type of financial statement

How to edit type of financial statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out type of financial statement

How to fill out type of financial statement

Who needs type of financial statement?

Understanding the Types of Financial Statement Forms

Understanding financial statement forms

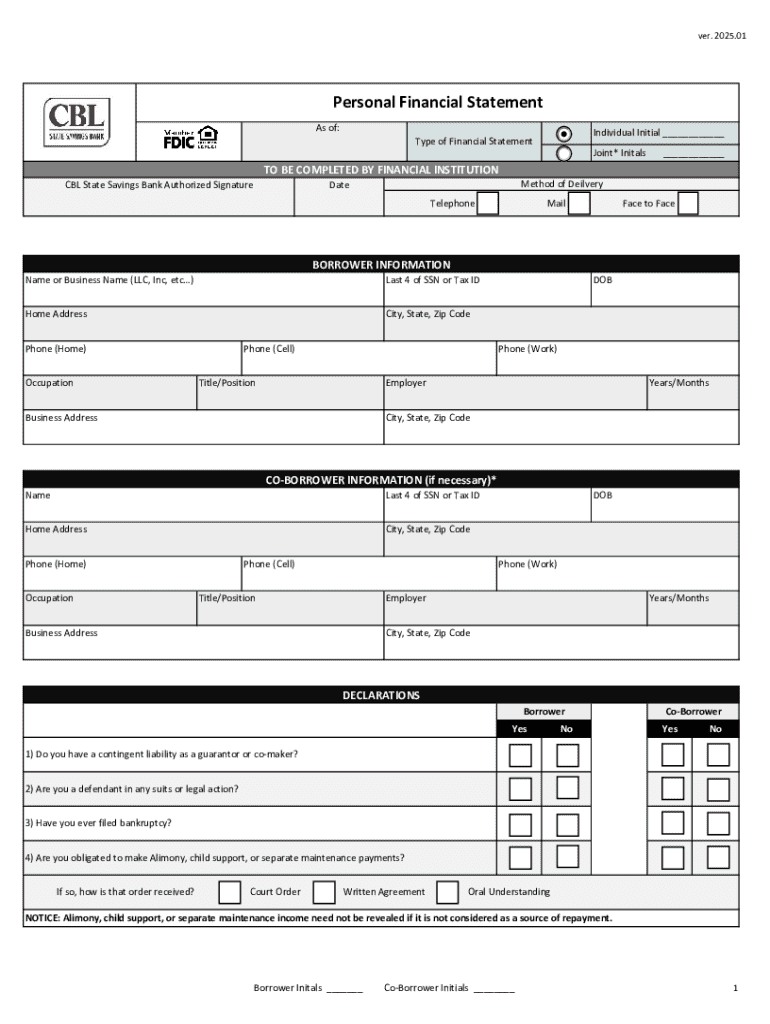

Financial statements offer a formal record of the financial activities and position of a business, person, or entity. They are essential for various stakeholders, including investors, creditors, and internal management, to analyze the financial health of an organization. The importance of financial statements lies in their ability to provide key insights into profitability, liquidity, and solvency.

The different types of financial statement forms serve specific purposes and vary in structure depending on the information they convey. Organizations can utilize these forms for internal reporting purposes or meet regulatory compliance as required by governing financial authorities. It's crucial to understand not just the types but the specific usage of each form to leverage them effectively in business decision-making.

Key components of financial statement forms

Each type of financial statement serves a unique purpose and contains specific components that convey critical business information. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, allowing stakeholders to assess the organization’s financial position. Understanding these components is pivotal for accurately interpreting and preparing financial statements.

The income statement outlines the profitability of a company, summarizing revenue and expenses over a specific period. This statement provides insight into the operational efficiency and financial performance of the organization. The cash flow statement is equally crucial as it offers a view of the inflow and outflow of cash, revealing how well a company manages its cash resources to fund operations and growth.

How to fill out financial statement forms

Completing financial statement forms requires a systematic approach to ensure accuracy and compliance with accounting standards. Begin with the balance sheet, where you will first list your assets, followed by liabilities, and finally equity. Each of these components has specific items that need to be represented, such as cash, accounts receivable, and long-term debt.

The income statement should detail all sources of revenue followed by all expenses incurred within the reporting period to determine net income. The cash flow statement will require you to categorize all cash-related activities into operating, investing, and financing sections. Meanwhile, the statement of shareholders’ equity tracks any changes due to ownership transactions or dividend distributions, providing valuable insights to investors.

Common mistakes include failing to reconcile balances correctly and misclassifying expenses or revenues. Therefore, meticulousness during the completion of these forms is paramount to maintain regulatory compliance and represent a true reflection of the organization's financial status.

Editing and customizing financial statement forms

Editing financial statement forms is made easy with pdfFiller. With a user-friendly interface, you can upload your financial statements and begin customizing them to meet your specific needs quickly. Making changes to text or data fields can be done in just a few clicks. This flexibility allows businesses to stay current with changing financial situations without the hassle of manual updates on paper documents.

Utilizing form templates can also save time when ensuring your financial statement forms comply with standard formats. These templates can be customized to include your logo and other brand-specific elements, allowing for professional-quality documents that reflect your company image. Best practices include reviewing every statement for accuracy even after editing, as financial discrepancies can lead to severe consequences.

eSigning financial statements

The use of electronic signatures in financial statements streamlines the approval process and enhances security. Electronic signatures are legally binding in many jurisdictions, making them a convenient alternative to traditional handwritten signatures. This is particularly advantageous for remote teams or organizations that require quick turnarounds on critical documents, allowing stakeholders to approve changes without delays.

To eSign financial statement forms using pdfFiller, simply select the document, choose the eSign option, and follow the user-friendly prompts. The process includes adding your signature and any required initials, ensuring that all necessary parties can approve the statement without the need for physical presence. Understanding the legal validity of eSignatures is also essential, as they provide a secure framework for transaction records.

Collaborating on financial statements

Collaboration is fundamental when preparing financial statements, especially in larger organizations with multiple stakeholders involved. pdfFiller offers advanced sharing options that allow teams to work together efficiently on financial documents. Real-time collaboration features enable users to see changes as they occur, ensuring everyone is aligned and aware of the latest updates.

Teams can assign roles such as editor or viewer, protecting sensitive data while still allowing necessary contributions. This level of collaboration reduces the chances of miscommunication and enhances overall workflow efficiency. Moreover, version control systems keep track of document history, making it easy to reference past versions if necessary.

Using technology to streamline financial reporting

In an increasingly fast-paced business environment, leveraging technology to automate financial statements has become a prime necessity. pdfFiller provides tools for generating reports that can significantly reduce the time spent on financial reporting. By integrating with accounting software, organizations can sync their financial data and automatically populate necessary fields in their statements, enhancing accuracy and minimizing manual data entry.

Automation in financial reporting not only saves time but also fosters accuracy by reducing the risk of human error. Companies benefit from timely reporting, making it easier to respond to market changes and investor queries promptly. Furthermore, the use of dashboards and analytical tools provides insights based on real-time data, equipping businesses to make informed decisions.

Managing financial statement forms

Effectively managing financial statement forms is vital for maintaining organization and quick access to essential documents. pdfFiller offers robust options for organizing and storing your forms securely in the cloud. This ensures that all team members can access the most up-to-date versions whenever needed, facilitating smoother financial operations.

Version control is another critical aspect of document management. By keeping track of all changes made to financial statements, users can return to previous versions as required, ensuring accountability and accuracy. Securely sharing these documents with stakeholders emphasizes trust and privacy, as sensitive financial information is handled with the utmost care.

Accessing financial statement forms anywhere

Cloud-based document management revolutionizes how teams access financial statement forms. The ability to work on financial statements from different devices and locations enhances flexibility and responsiveness. pdfFiller's platform enables users to access, edit, and share documents without physical limitations, making remote work more manageable and efficient.

This accessibility also ensures that important financial data is at your fingertips whenever you need it, whether in the office or on the go. Increased mobility allows businesses to react promptly to inquiries from investors or regulatory bodies, reinforcing a robust financial strategy and maintaining investor confidence.

Frequently asked questions about financial statement forms

New users often have inquiries regarding the particulars of preparing financial statement forms. One of the most common questions pertains to the distinction between various statement types and their respective functions. Understanding the unique role of each form is necessary for accurate reporting and compliance.

Another frequent inquiry involves best practices for maintaining financial statement accuracy, especially for companies preparing these forms for the first time. A thorough review process is suggested, along with seeking guidance from financial experts if needed, to ensure that all documents reflect the true financial position of the company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify type of financial statement without leaving Google Drive?

How do I execute type of financial statement online?

Can I create an electronic signature for the type of financial statement in Chrome?

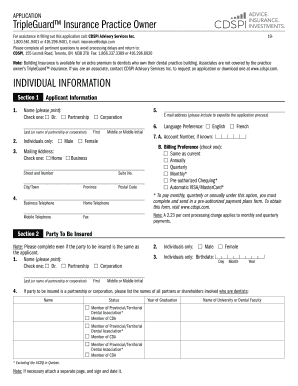

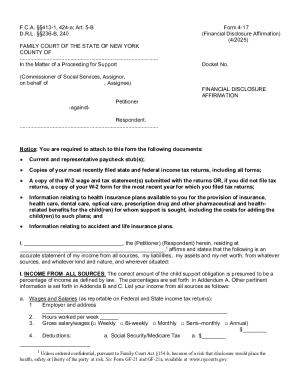

What is type of financial statement?

Who is required to file type of financial statement?

How to fill out type of financial statement?

What is the purpose of type of financial statement?

What information must be reported on type of financial statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.