Get the free Apply for Retirement

Get, Create, Make and Sign apply for retirement

Editing apply for retirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out apply for retirement

How to fill out apply for retirement

Who needs apply for retirement?

How to Apply for Retirement Form: A Comprehensive Guide

Understanding the retirement application process

Planning for retirement is an essential step for financial security during one's golden years. It requires a thorough understanding of various retirement benefits that may be available, such as pension benefits and Social Security benefits. The process begins with filling out the apply for retirement form, which is crucial for accessing these benefits.

Before diving into the application form, it's vital to gather all key documents required for a successful submission. These typically include identification documents, employment records, and financial statements which will substantiate your application. The ability to present accurate and comprehensive documentation can significantly impact the speed and success rate of your application.

Preparing to apply for retirement

Assessing your eligibility for retirement benefits is crucial before you apply. This evaluation usually considers age requirements, which typically range from 62 to 67 years for Social Security benefits, as well as service periods that may vary based on your employment history and specific retirement plans.

In addition to understanding age-related criteria, it's essential to collect personal data and financial information that will be needed for the apply for retirement form. This includes details like your Social Security number, tax identification numbers, and estimates of your financial needs during retirement. Awareness of these factors helps ensure that your application process is smooth and efficient.

Types of retirement benefits available

Retirement benefits can take several forms, primarily including pension plans and Social Security benefits. When applying, it’s essential to explore each type, as they determine how your retirement income is structured. Pension plans, usually provided by employers, can offer a steady income, while Social Security benefits are federally managed and require eligibility as determined by your work history.

When considering your options, think about how these benefits can be customized according to your personal circumstances. For example, some plans may provide joint and surviving spouse options which are beneficial for couples. Understanding these choices empowers you to create a retirement plan that meets your financial needs and lifestyle preferences.

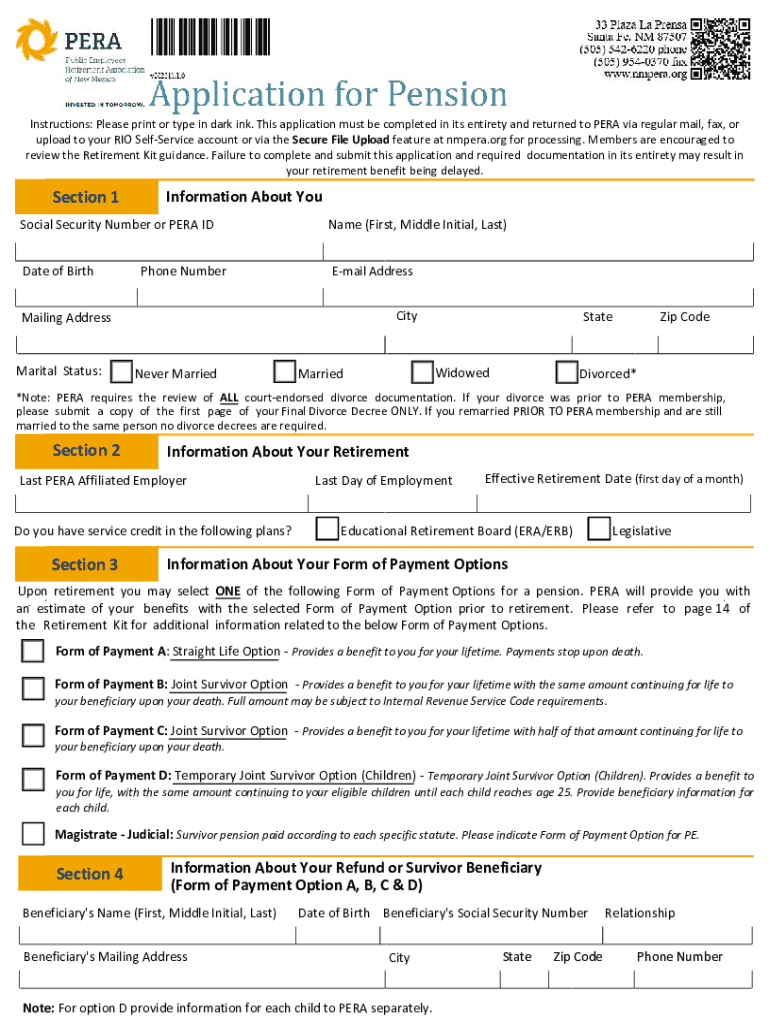

Detailed insights into the apply for retirement form

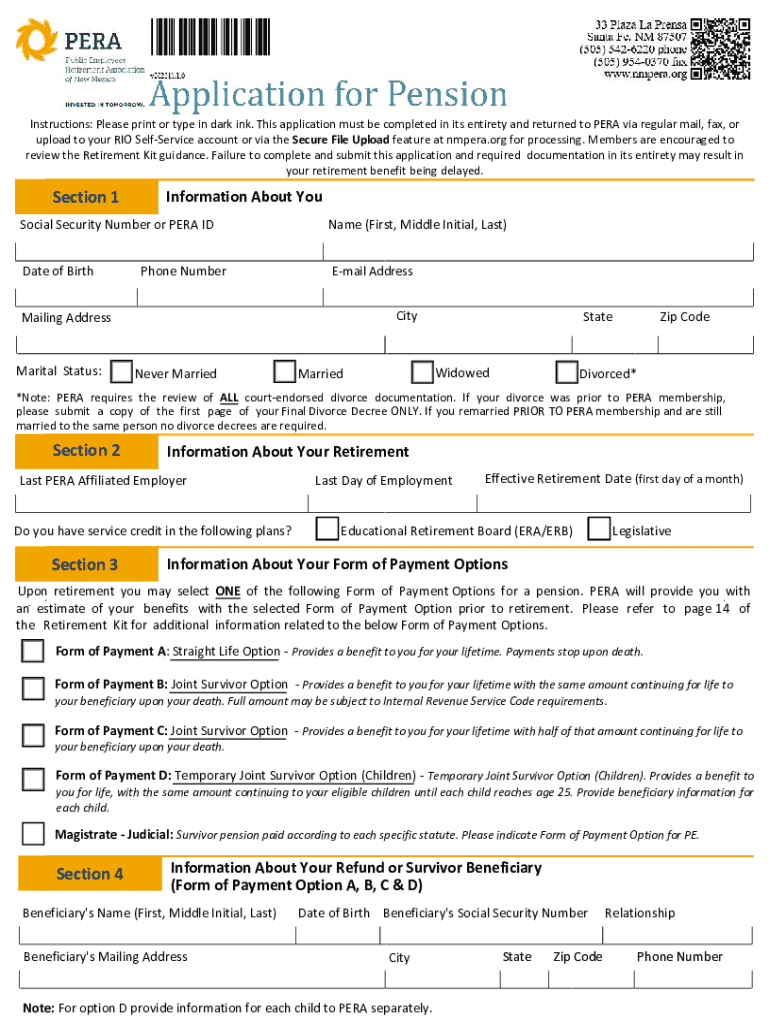

The apply for retirement form consists of several sections that need careful attention. The personal information section collects essential details like your name, address, and Social Security number. This forms the basis of your application, linking you directly with the benefits you're seeking.

Following the personal data, an employment history section captures your work experiences and earnings, which are pivotal for calculating your benefits. Lastly, the benefits selection section allows you to decide on your preferred payment options and any joint or survivor benefits. Understanding how to navigate these sections ensures a thorough and accurate submission.

Step-by-step instructions for completing the apply for retirement form

Navigating the form fields is straightforward but requires attention to detail. Begin by filling in your personal details accurately, ensuring that all information matches the supporting documents you are submitting. Following this, you'll input aspects of your employment history including job titles, length of service, and salary details.

Common mistakes to avoid include leaving required fields blank or providing inconsistent information across different sections of the form. Double-check your entries and consider having a second pair of eyes review your application to ensure completeness and accuracy.

Electronic submission of the apply for retirement form

Many people are opting for electronic submissions due to their efficiency. Using interactive tools like those available at pdfFiller enables you to eSign documents seamlessly. When submitting digitally, be sure to familiarize yourself with the eSignature process, which is usually straightforward and can save time.

The benefits of electronic submission are manifold, including faster processing times and ease of tracking your application status. Post-submission, it’s essential to manage documentation securely, ensuring you keep copies of all submitted forms for your records.

Follow-up steps after applying for retirement benefits

After you submit your apply for retirement form, it’s crucial to know what to expect next. Processing times can vary depending on your location and the type of benefits you're applying for. Stay proactive by checking your application status through the provided online tracking tools.

If you need to make changes to your application, instructions for amendments are typically outlined in your confirmation email or receipt. Contacting support is also an option if you face any issues or have questions regarding your application status.

Frequently asked questions (FAQs)

Many individuals have queries about the application process for retirement benefits. Commonly asked questions often revolve around eligibility criteria, processing times, and support for troubleshooting application hurdles. If you encounter any difficulties or have specific concerns, reaching out to customer support can provide further assistance.

In this evolving field, acquiring responses to these FAQs equips applicants with the necessary knowledge to navigate the retirement application process more effectively.

Finalizing your retirement plan

Once your application is processed and approved, understanding your benefit payment options becomes critical. Many retirees can choose between monthly income payments or lump-sum distributions. Evaluating these options against your financial needs can significantly affect your quality of life in retirement.

Moreover, transitioning to life after work requires adjustments not only financially but socially as well. Planning for social activities and lifestyle changes is imperative for a fulfilling retirement. Ensuring that you have a robust retirement plan in place lets you enjoy this new chapter of life with peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my apply for retirement in Gmail?

How do I complete apply for retirement online?

Can I edit apply for retirement on an iOS device?

What is apply for retirement?

Who is required to file apply for retirement?

How to fill out apply for retirement?

What is the purpose of apply for retirement?

What information must be reported on apply for retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.