Get the free Remuneration and Expenses for Elected Officials for the Year Ended ...

Get, Create, Make and Sign remuneration and expenses for

Editing remuneration and expenses for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out remuneration and expenses for

How to fill out remuneration and expenses for

Who needs remuneration and expenses for?

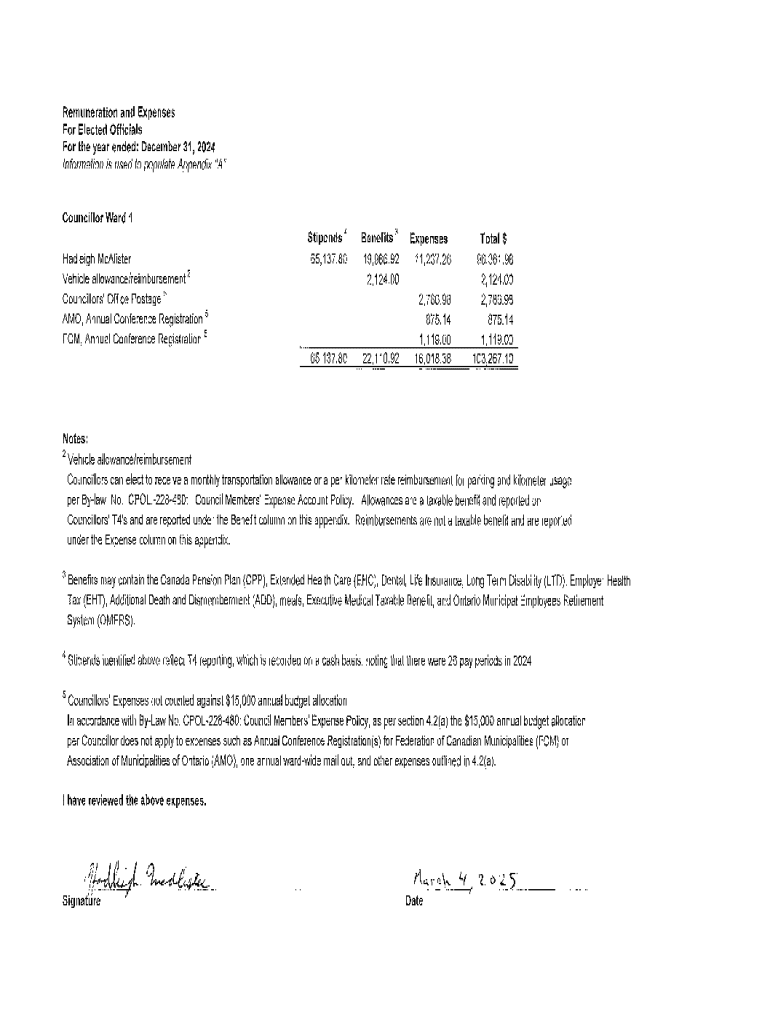

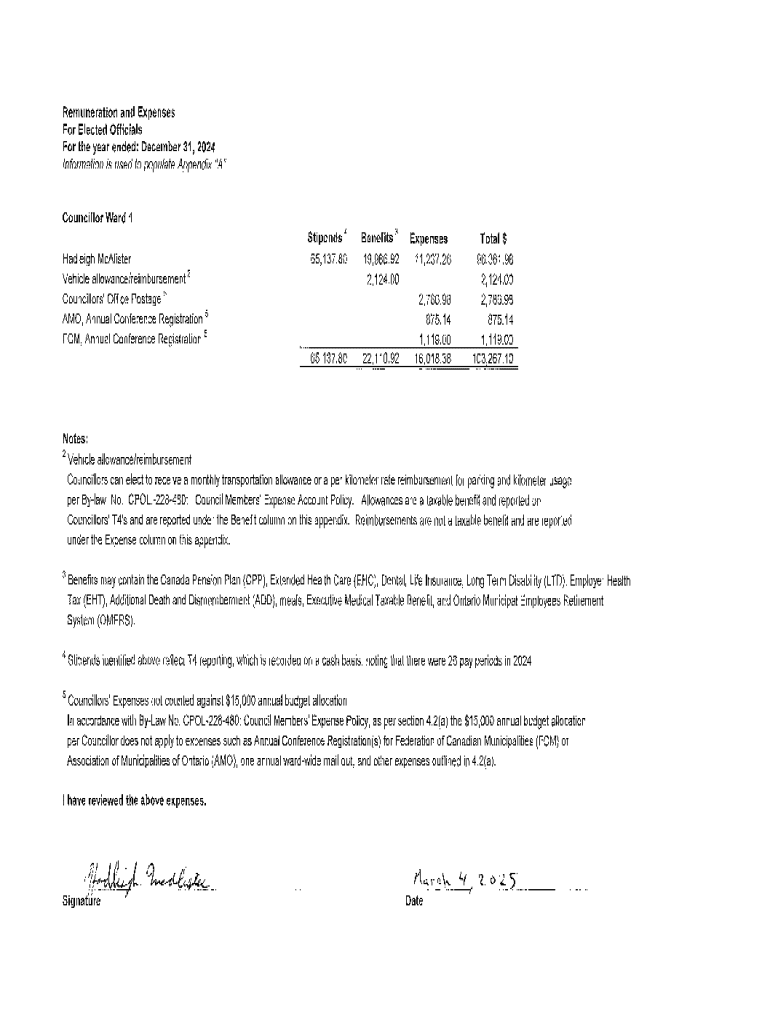

Remuneration and Expenses for Form

Understanding remuneration and expenses related to form

Remuneration refers to the total compensation received by an individual for their employment, and it can come in various forms. It not only includes the fixed salary or wages but also encompasses benefits, bonuses, and other forms of financial rewards that contribute to the overall payment package. Understanding the types of remuneration is crucial, not just for employees, but also for employers, as failure to accurately document this information can lead to issues during income tax return preparation. Proper recording of remuneration strengthens financial documentation and provides a clear picture of company expenses.

Expenses fill another crucial role within the financial structure. These can fall into various categories depending on their nature and purpose. From operational expenses to one-time costs related to specific projects, understanding what constitutes a reportable expense is vital. Many regulations surround these expenses, dictating how they should be reported and what qualifies for deductions, especially when preparing for audits or tax filings.

Navigating the specific form for reporting remuneration and expenses

The requisite form for reporting remuneration and expenses is a critical piece of paperwork, especially within structured environments such as corporate entities or government bodies. Understanding its purpose and the regulations that govern its completion are essential for compliance purposes. This form not only assists in maintaining transparency between employees and employers but also simplifies the task of reporting potentially taxable income and eligible expenses for tax calculations.

Submission of this form is generally dictated by specific criteria set forth by local laws and regulations. For instance, New York State residents must adhere to stringent guidelines regarding when they are required to submit forms related to remuneration and expenses. Typically, these forms are due at the conclusion of a financial period, aligning with filing deadlines for income tax returns.

Detailed instructions for filling out the form

Filling out the remuneration and expenses form correctly is paramount in ensuring accurate reporting. Each section typically requires specific information, starting with personal information, which lays the foundation for the remittance of remuneration and evaluation of expenses. Here, detail is crucial; ensure that your name, contact information, and identification numbers, such as the Social Security Number (SSN) or Employer Identification Number (EIN), are accurate and complete.

As you fill out the form, checklists can be invaluable in avoiding common pitfalls. Often, individuals overlook details such as correctly categorizing expenses or providing legible documentation. Errors in these sections can lead to further scrutiny from tax authorities or an audit, something no one wants to face.

Advanced tips for effective expense tracking

In today's fast-paced work environment, leveraging digital tools can significantly enhance the tracking and reporting of remuneration and expenses. With a myriad of software solutions and applications tailored for expense management, users can streamline their processes and reduce the risk of manual entry errors. Utilizing a cloud-based solution not only offers the flexibility of access across devices but also provides enhanced security for sensitive information.

Establishing best practices for maintaining thorough records also plays a critical role in ensuring compliance and preparedness for audits. Documentation essentials include retaining all receipts, bank statements, and any necessary worksheets that elucidate how certain amounts were calculated. Organizing this paperwork can greatly simplify the process of filling out your remuneration and expenses form.

Case studies: Real-life examples of remuneration and expense reporting

Understanding the intricacies of remuneration and expense reporting can be better illustrated through real-life scenarios. For instance, freelancers and contractors operate within a distinct structure; they not only report their income but must also track and report numerous expenses that relate directly to their services. Unique considerations for self-employed individuals include the deductions they can claim, such as home office expenses or vehicle mileage rates, while preparing their forms.

For small business owners, differentiation between remuneration and business expenses can be challenging. For instance, when paying a spouse or family member for work performed, documentation must be thorough to ensure it meets IRS guidelines. Effective strategies include utilizing a dedicated ledger to track expenses and remuneration while considering the unique regulations that may apply, such as documenting disaster losses or theft that can affect overall profitability.

FAQs about reporting remuneration and expenses

As professionals navigate the transition towards more structured reporting of remuneration and expenses, a few common questions frequently arise. One of the most prevalent inquiries is related to what exactly qualifies as remuneration. Understanding whether specific bonuses, stipends or reimbursements fit into this definition is crucial for compliant reporting.

Beyond basic inquiries, access to government resources and professional consultation can provide guidance on best practices for reporting. Many individuals find comfort in seeking external assistance, particularly when navigating complex regulatory requirements.

Conclusion: The importance of accurate remuneration and expense reporting

Accurate reporting of remuneration and expenses extends far beyond simple compliance; it directly impacts a business's financial health. Maintaining correct documentation illustrates fiscal responsibility and can foster trust between employers and employees, facilitating a smoother process during tax seasons. The stakes become higher as missing documentation or misreported figures can result in audits or financial penalties, hindering business operations.

Proper financial documentation ultimately serves as a backbone for business success. By instituting thorough tracking and reporting methodologies, organizations can position themselves favorably in their respective marketplaces, thereby ensuring long-term sustainability.

Interactive tools for streamlined reporting

Utilizing the right tools can significantly enhance the experience of managing remuneration and expenses. pdfFiller offers interactive PDF templates and fillers that simplify the process of completing necessary forms. These digital solutions not only enhance accuracy but also facilitate easy collaboration, allowing various stakeholders to work on documents effectively.

Additionally, tutorials on how to use pdfFiller for document completion can ease the learning curve. Step-by-step guides provide insights into eSigning, editing, and collaborative features, transforming the way individuals handle their paperwork and enabling a more efficient management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my remuneration and expenses for directly from Gmail?

How do I complete remuneration and expenses for online?

How do I edit remuneration and expenses for on an iOS device?

What is remuneration and expenses for?

Who is required to file remuneration and expenses for?

How to fill out remuneration and expenses for?

What is the purpose of remuneration and expenses for?

What information must be reported on remuneration and expenses for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.