Get the free DCFSA Claims & Reimbursement Process

Get, Create, Make and Sign dcfsa claims amp reimbursement

Editing dcfsa claims amp reimbursement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dcfsa claims amp reimbursement

How to fill out dcfsa claims amp reimbursement

Who needs dcfsa claims amp reimbursement?

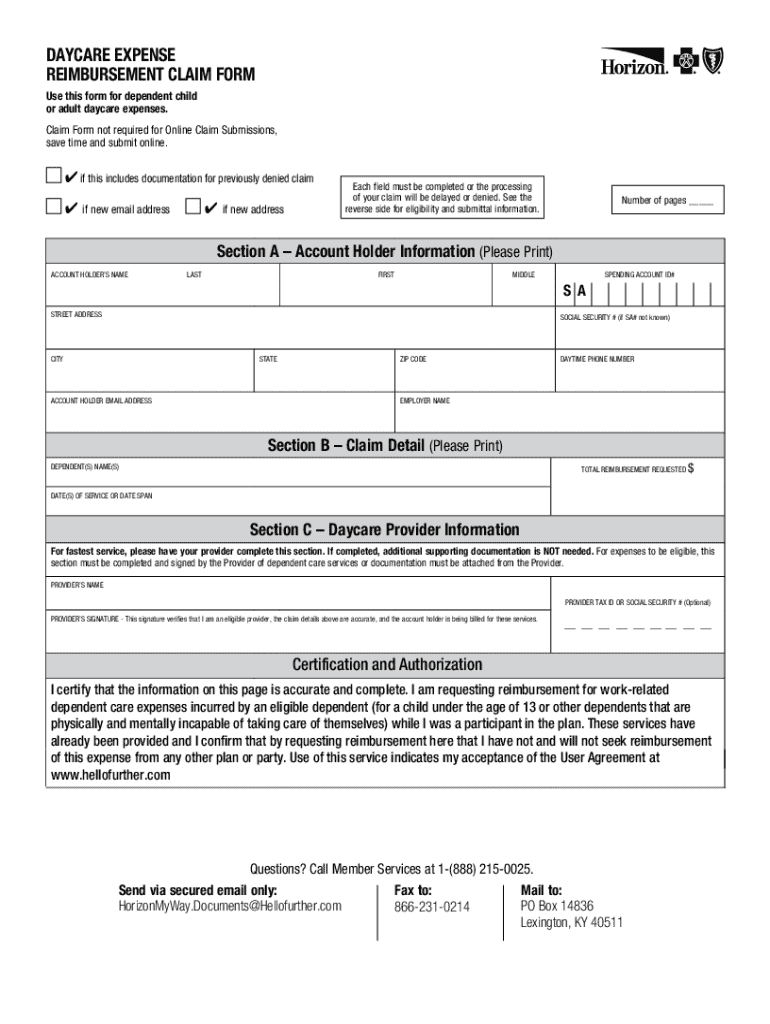

Understanding the DCFSA Claims and Reimbursement Form

Understanding dependent care FSAs

A Dependent Care Flexible Spending Account (DCFSA) allows employees to set aside pre-tax dollars from their salary to cover eligible dependent care expenses, such as childcare for children under age 13 or care for dependents with disabilities. This financial tool not only eases the burden of the costs associated with dependent care but also provides a tax advantage, reducing the taxable income for earners.

Utilizing a Dependent Care FSA offers numerous benefits for families seeking to balance work and personal commitments. By contributing to a DCFSA, employees can save on taxes while managing childcare costs effectively. Furthermore, an FSA brings flexibility to manage these expenses, making it easier for families to maintain their careers without sacrificing quality care for their dependents.

Eligibility for participants typically includes being a full-time or part-time employee whose employer offers a DCFSA. However, it's crucial to understand any limitations that may apply, including the maximum contribution limits and specific qualifying expenses for dependents.

The importance of the DCFSA claims and reimbursement form

The DCFSA claims form is essential for ensuring that families can access the financial benefits provided through their dependent care accounts. This form serves as a gateway for employees to submit their eligible expenses for reimbursement, allowing for a straightforward process to recuperate costs associated with care services.

Covered expenses typically range from childcare services, after-school programs, to summer day camps. Being aware of what qualifies can streamline the reimbursement process and enable families to maximize their benefits.

Accurate claims submission has a significant impact on timely reimbursements. Failing to provide necessary information can lead to denials or delays, emphasizing the importance of thorough preparation when submitting claims.

Step-by-step guide to completing the DCFSA claims form

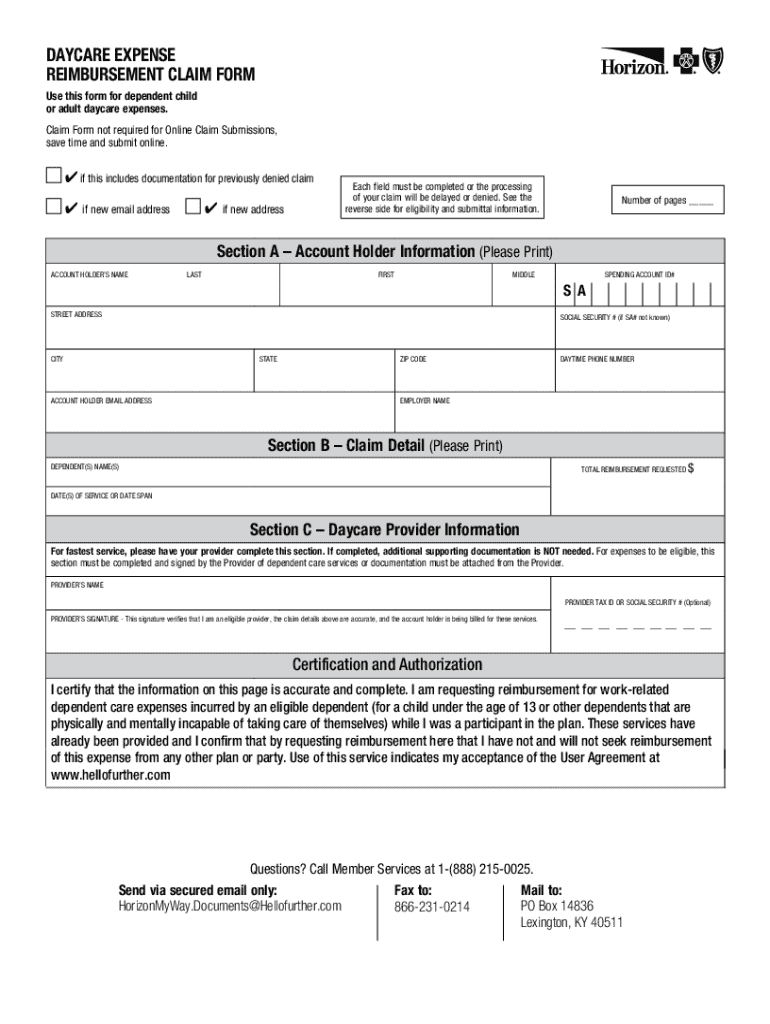

Completing the DCFSA claims form requires some preparation to ensure that all necessary documents are assembled before beginning the form-filling process. Start by gathering receipts, invoices, and any other relevant documentation that outlines the expenses incurred for your dependents.

Next, fill out the DCFSA claims form methodically. Pay attention to each section, especially the personal information section, which requires your contact details, and the dependent information section, where you will enter details about the dependents for whom you are claiming expenses.

Common mistakes to avoid include inaccuracies in dependent information, failing to attach supporting documentation, and submitting claims beyond the allowable timeframe. Careful attention to detail will ensure a smooth claims process.

Reimbursement process: what to expect

Once the DCFSA claims form is submitted, many users wonder how long the reimbursement process takes. Generally, processing claims can take anywhere from a few days to a couple of weeks, depending on your employer's internal processes and the volume of claims submitted.

Reimbursement can occur through various methods. Most employers offer direct deposit options, allowing funds to be transferred directly to your bank account, providing a swift resolution to reimbursements. Alternatively, check payments may be issued, but this could lengthen the time to receive your funds.

To track your claim, many employers provide tools or digital platforms where employees can monitor the status of their submissions. Keeping organized records of your claims can assist in addressing any issues that might arise.

FAQs surrounding DCFSA claims and reimbursements

Navigating the world of DCFSA claims and reimbursements often raises several questions. For instance, can claims be retroactively submitted? The answer typically relies on employer policy; some allow retroactive claims within the plan year but others may have strict cut-off dates.

Handling denied claims is another common concern. If a claim is denied, the reason should be articulated clearly on the claim documentation. Understanding these reasons can help inform whether to submit an appeal or correct and resubmit the claim.

Expenses can change mid-year due to different circumstances, such as job changes or life events. It's critical to stay updated on your DCFSA plan provisions concerning contributions and claims to adapt to these changes seamlessly.

Advanced tips for maximizing your DCFSA benefits

To ensure you’re making the most of your DCFSA, employers often offer resources to educate employees on how to optimize their accounts. Engaging with your HR department or benefits coordinator can provide insight on how to best utilize contributions.

Additionally, digital tools are available to assist in claims management. Leveraging such platforms, like pdfFiller, seamlessly integrate the workflows for creating, filling out, and submitting claims can simplify the process and ensure no document is overlooked.

Planning ahead is crucial for budgeting for dependent care costs. Understanding the annual maximum contributions and estimating the likely expenses during the year can prevent unexpected shortfalls and ensure you leverage the full benefits.

Beyond the DCFSA: other considerations

While the DCFSA is an excellent option for managing childcare and dependent care expenses, it’s also important to explore alternative avenues. For instance, tax credits for child and dependent care can offer substantial financial relief, depending on your specific situation and qualifications.

Exploring Flexible Spending Accounts (FSAs) can also cater to other expenses beyond dependent care. However, it’s vital to realize that while maximizing your DCFSA benefits is important, there may be scenarios where it may not be the optimal choice, such as when your childcare expenses are lower than the benefit threshold.

Analyzing individual circumstances can help determine which plan or combination of benefits works best for managing the costs of care, ensuring families are not leaving money on the table.

Conclusion: making the most of your DCFSA experience

To ensure you leverage the advantages of your DCFSA effectively, it's essential to establish best practices for claims submission. This includes accuracy in completing the DCFSA claims and reimbursement form, keeping organized records, and being proactive in understanding what expenses are eligible.

The impact of a well-managed DCFSA on family financial planning can be quite significant. By maximizing tax benefits and receiving timely reimbursements, families can ensure that their childcare expenses do not negatively affect their overall financial health. Commit to staying informed and organized to fully optimize your DCFSA experience and contribute positively to your family’s financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my dcfsa claims amp reimbursement in Gmail?

Can I edit dcfsa claims amp reimbursement on an iOS device?

Can I edit dcfsa claims amp reimbursement on an Android device?

What is dcfsa claims amp reimbursement?

Who is required to file dcfsa claims amp reimbursement?

How to fill out dcfsa claims amp reimbursement?

What is the purpose of dcfsa claims amp reimbursement?

What information must be reported on dcfsa claims amp reimbursement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.