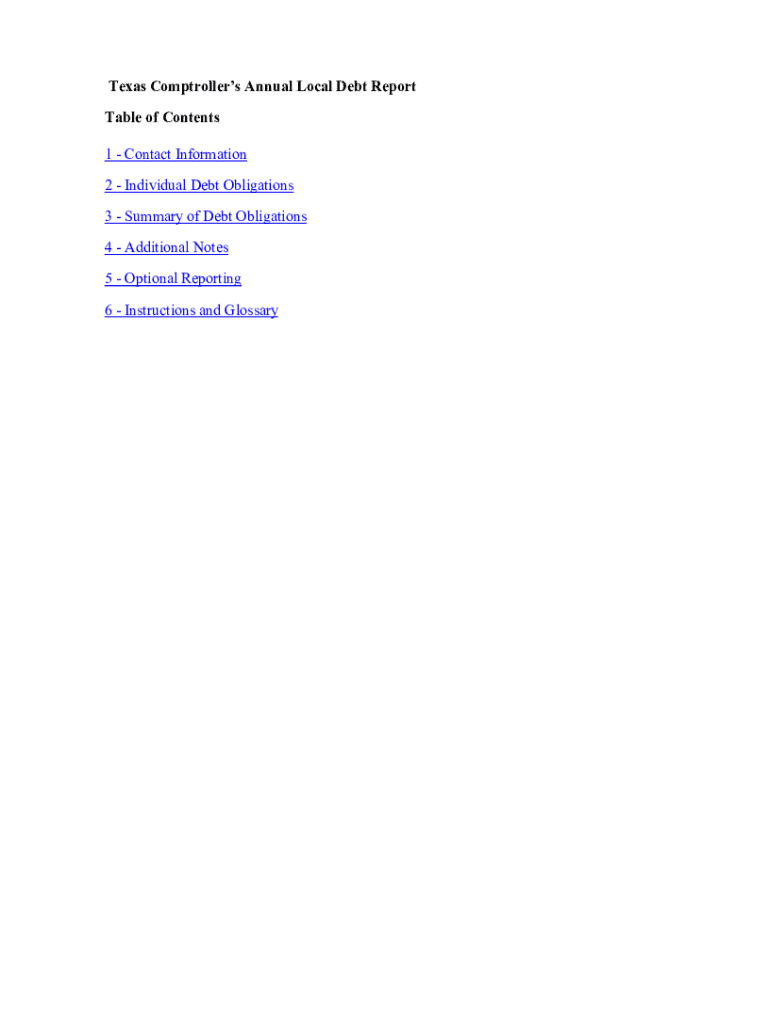

Get the free Revised Debt Report Form

Get, Create, Make and Sign revised debt report form

How to edit revised debt report form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revised debt report form

How to fill out revised debt report form

Who needs revised debt report form?

Comprehensive Guide to the Revised Debt Report Form

Understanding the revised debt report form

The revised debt report form is a critical document designed to provide a clear overview of an entity’s debt obligations. This form is essential for organizations, as it helps in assessing financial health, negotiating terms with creditors, and managing overall financial strategies. By accurately detailing debts, organizations can improve decision-making and enhance financial visibility.

Key components of the revised debt report form typically include basic information about the entity, a summary of outstanding debts, payment history, and projections for future payments. These components serve a dual purpose: they provide financial insights for the entity, and they comply with regulatory standards that govern financial reporting.

Common uses span various industries, including finance, real estate, and manufacturing. For example, a startup may use this form to present its debt structure to potential investors, while established companies often utilize it during loan compliance checks or audits.

Preparing to use the revised debt report form

Preparation for using the revised debt report form begins with identifying the necessary information and data required. Key financial data includes recent loan agreements, interest rates, outstanding balances, and current payment schedules. Gathering detailed documentation is crucial to ensure accuracy and transparency in the report.

Stakeholders involved in the reporting process often include finance managers, accountants, and external auditors. Each party plays a role in ensuring that all relevant financial data is accurately represented. Tips for efficient data collection include leveraging databases like bank statements, loan agreements, and accounting software, which can streamline the process.

Step-by-step guide to completing the revised debt report form

Completing the revised debt report form involves several key sections. The first section generally covers basic information about the entity. Here, you will include the legal name, address, and contact information accurately, as this data is fundamental for identifying the reporting entity.

Moving on to the debt summary, this section requires a comprehensive aggregation of all outstanding debts. Make sure to include details such as the nature of each debt, loan terms, and interest rates. This enables a complete view of the financial obligations and assists in monitoring repayment strategies.

In the payment history section, it’s essential to document payment schedules, highlighting any missed payments. Visual aids, such as graphs or charts, can help clarify trends and foster a better understanding of the debt timeline. Finally, in the future projections section, forecasting potential scenarios for repayments requires an understanding of cash flow and market conditions.

Editing and customizing the revised debt report form

Customizing the revised debt report form can enhance its relevance and impact. Utilizing interactive tools, such as those available on pdfFiller, allows users to adjust the document easily for specific needs. To access these tools, simply upload your form into the platform and start customizing sections as necessary.

Best practices for customization include ensuring the layout is clear and that the information flows logically. Incorporating visual elements like charts and graphs can significantly improve both understanding and presentation. Tutorials available on pdfFiller can guide you through the process of adding these visuals for maximum effect.

Signing and sharing the revised debt report

Once the revised debt report is complete, the next step involves signing the document. eSigning your report has legal validity, provided it complies with jurisdictional requirements. Ensure you understand these legal considerations and follow the steps to securely eSign the report within pdfFiller.

Sharing the report with stakeholders can be accomplished seamlessly through pdfFiller. Users can select specific individuals or groups while setting permissions and privacy settings, ensuring that only authorized personnel have access to sensitive data. This streamlined sharing option integrates well with collaborative efforts.

Managing your debt reports effectively

Effective management of debt reports is crucial for ongoing organizational success. Organizing your document collection begins with best practices such as maintaining a clear filing system and utilizing cloud storage solutions for easy access and retrieval. This prevents data loss and ensures information is readily available when needed.

Collaboration with team members is facilitated through features within pdfFiller, allowing for comments and feedback directly on the document. This collaborative environment enhances engagement and promotes timely updates on debt management, ensuring that all stakeholders remain informed of changes and progression.

Frequently asked questions about the revised debt report form

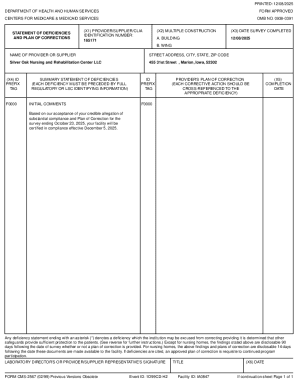

Addressing common queries surrounding the revised debt report form is essential for clarity. Users frequently ask about common mistakes to avoid, such as omitting necessary data or miscalculating debt totals. Understanding the review process and the timelines for approvals is equally crucial; users should anticipate some time for cross-verification by relevant stakeholders.

Moreover, clarifying reporting standards and compliance is vital to adhere to local regulations. Ensuring adherence not only builds trust but also strengthens the organization’s financial reputation.

Leveraging the revised debt report for strategic insights

The revised debt report is more than just a compliance tool; it's an opportunity to derive strategic insights. By analyzing the data presented, organizations can identify debt patterns and trends that inform their financial decision-making. This understanding allows for more informed budgeting and investment strategies.

Future-proofing your debt management strategies requires leveraging these insights effectively. Organizations must remain agile, adapting to shifts in the economic landscape and adjusting their financial tactics accordingly. Data-driven decisions will empower stakeholders to make educated choices regarding future borrowing and financial commitments.

Additional considerations for comprehensive debt reporting

For a well-rounded approach to debt reporting, integrating feedback from past reports is critical. This ensures that lessons learned are accounted for in future assessments, refining the reporting process continuously. Moreover, keeping abreast of regulatory changes is essential; such shifts can impact the requirements and structure of your reports.

In conclusion, remaining current with debt management practices not only enhances efficiency but also prepares organizations for future challenges. By utilizing comprehensive tools like the revised debt report form, entities can ensure accuracy, clarity, and strategic insight regarding their fiscal responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my revised debt report form directly from Gmail?

How do I make edits in revised debt report form without leaving Chrome?

How do I complete revised debt report form on an iOS device?

What is revised debt report form?

Who is required to file revised debt report form?

How to fill out revised debt report form?

What is the purpose of revised debt report form?

What information must be reported on revised debt report form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.