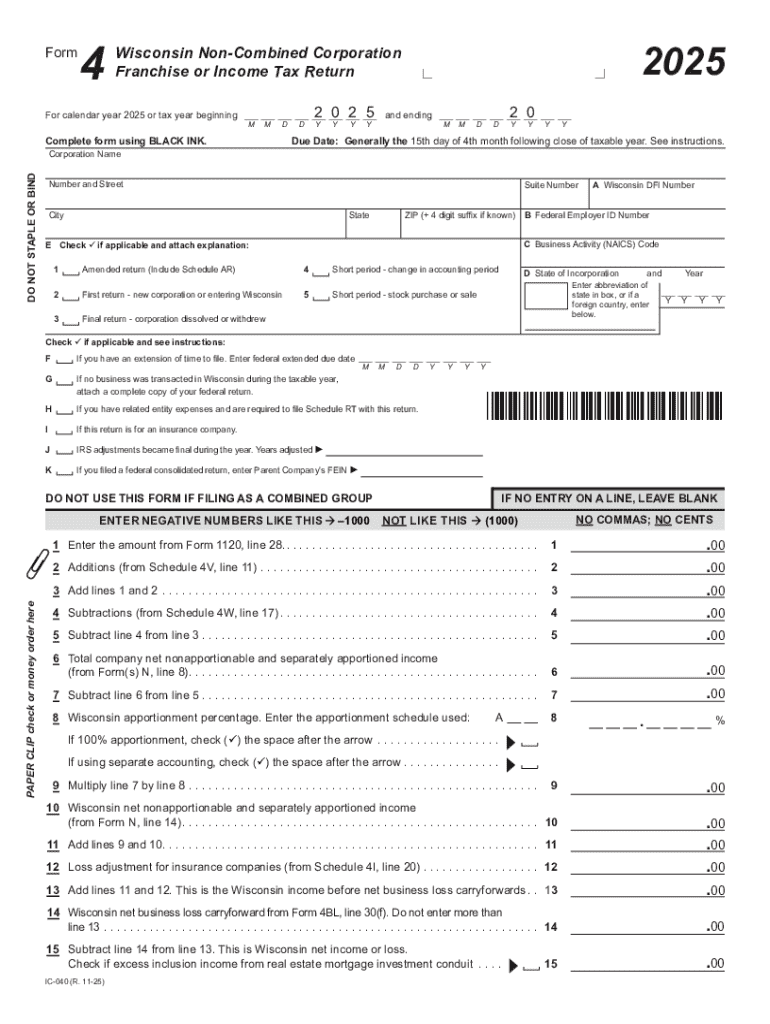

Get the free 2025 IC-040 Form 4 Wisconsin Non-Combined Corporation Franchise or Income Tax Return...

Get, Create, Make and Sign 2025 ic-040 form 4

Editing 2025 ic-040 form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 ic-040 form 4

How to fill out 2025 ic-040 form 4

Who needs 2025 ic-040 form 4?

2025 -040 Form 4: A Comprehensive Guide

Understanding the 2025 -040 Form 4

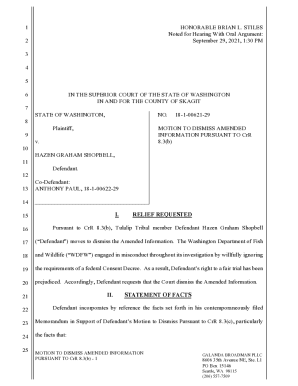

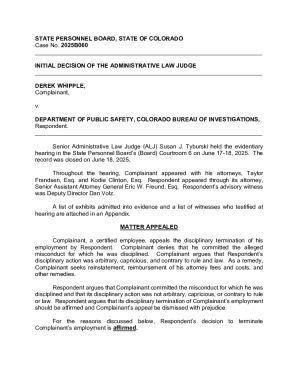

The 2025 IC-040 Form 4 is a critical document used in compliance with regulations set forth for that year. It serves multiple purposes, primarily related to financial and personal disclosures required from individuals and businesses alike. Understanding its nuances is essential for accurate completion and submission. Moreover, the form plays a significant role in document management processes by ensuring consistent data reporting, which is crucial in maintaining regulatory standards.

As a compliance tool, Form 4 reflects the evolving requirements that individuals and organizations must adhere to. By utilizing this form, stakeholders can ensure they meet the legal mandates while providing necessary information to authorities. Given its importance, mastering the intricacies of the 2025 IC-040 Form 4 is essential for those managing their finances or compliance documentation.

Key features of the 2025 -040 Form 4

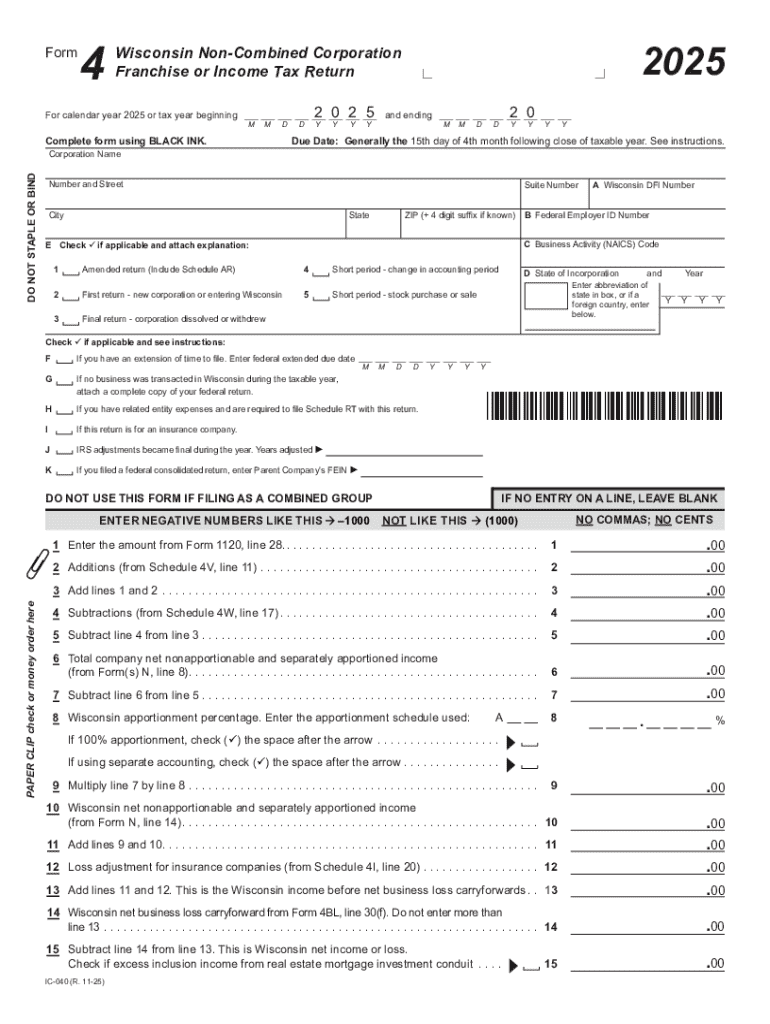

The 2025 IC-040 Form 4 has been enhanced with several key features designed to streamline the process of data entry and improve overall user experience. One of the most notable upgrades is the interactive elements that facilitate easier navigation through the form. This interactive format allows users to click and enter information swiftly, reducing the chances of errors during completion.

Additionally, the data fields within Form 4 have been carefully crafted to ensure that all necessary information can be captured with consistency. Each field serves a specific purpose, often tied to compliance regulations, making it crucial for users to understand their significance. For instance, there are distinct sections that differentiate personal information from financial disclosures, highlighting the importance of accurate segmentation in documentation.

Step-by-step guide to filling out the 2025 -040 Form 4

Filling out the 2025 IC-040 Form 4 requires careful preparation to avoid common pitfalls. It's essential to gather all necessary information before diving into the form. This includes valid identification, financial documents, and any prior submissions that may be relevant to your case. Ensuring you have all your documents at hand will simplify the process and reduce errors.

When you start filling out the form, it’s essential to break it down into its components. Here’s a detailed breakdown of the sections you'll encounter:

When filling out each section, maintain consistency in your entries to prevent discrepancies. Common mistakes include mismatching information with supporting documents, neglecting to sign the form, or failing to review the requirements for each section.

Editing the 2025 -040 Form 4

After filling out the 2025 IC-040 Form 4, you may need to make adjustments or edits. Utilizing tools like pdfFiller enhances the editing experience. With its user-friendly interface, you can make real-time changes efficiently. Whether you need to correct minor errors or make major updates, these tools facilitate easy editing without the hassle of starting from scratch.

Formatting is another critical aspect to consider while making edits. Ensuring your form is clear, concise, and organized helps convey appropriate information effectively. Avoid densely packed text or overly complex layouts that could confuse the reader. Using annotations can also enhance collaboration, allowing others involved to provide input or clarifications directly on the document.

Signing the 2025 -040 Form 4

Once you've ensured your form is complete, it’s time to sign it. The 2025 IC-040 Form 4 can be signed using digital signatures, which is increasingly recognized as a valid method of consent and acknowledgment. Using a platform like pdfFiller for eSigning not only saves time but also aligns with legal standards for digital agreements.

One of the major advantages of eSigning through pdfFiller is the seamless integration into the editing and management process. You can sign the document without needing to print it, maintaining the integrity of the digital format. Furthermore, digital signatures on Form 4 offer the same legal validity as traditional handwritten signatures, making them a reliable option in compliance matters.

Managing the completed 2025 -040 Form 4

After signing, managing your completed 2025 IC-040 Form 4 is crucial. This involves securely saving and storing the document to ensure it can be accessed when needed without compromising sensitive information. Utilizing cloud storage options provided by pdfFiller allows for easy retrieval and long-term preservation. Make sure to implement a systematic approach when naming files to make searching easier.

Collaboration tools also play an important role in document management. If you're working as part of a team, pdfFiller offers various sharing options that facilitate cooperation. Tracking changes and managing version history within the platform ensures that everyone is on the same page, ultimately reducing the probability of errors during updates.

Frequently asked questions about the 2025 -040 Form 4

The 2025 IC-040 Form 4 may raise several questions among users. For instance, what happens if you make a mistake after submitting? Generally, you would need to submit a correction request or a new form to amend any errors. It's important to check with regulatory authorities for precise procedures regarding corrections.

Another common inquiry is how to update information if your circumstances change post-submission. Most jurisdictions allow for updates through a specified process, often involving additional documentation. If you have questions about the form itself, support resources on pdfFiller can provide guidance and assistance from experienced professionals in document management.

Related topics and linked documents

Understanding how the 2025 IC-040 Form 4 relates to other essential tax forms is crucial for comprehensive tax planning. Numerous forms exist that intersect with Form 4, each serving specific regulatory purposes. Resources formed in conjunction with the IC-040 can provide a broader context for users seeking to navigate the complexities of compliance.

By viewing comprehensive resources, users can gain firsthand knowledge of how Form 4 interacts with other regulatory requirements and the implications for their overall compliance strategy. These resources not only enhance understanding but also aid in keeping up-to-date with evolving tax regulations and ensuring readiness for any upcoming changes.

Future revisions and updates to the 2025 -040 Form 4

As the regulatory landscape is ever-evolving, staying ahead of potential changes to the 2025 IC-040 Form 4 is wise. Anticipated revisions for the upcoming year may include adjustments aimed at simplifying the data entry process or changing reporting requirements based on new legislation or data needs. Being proactive about these changes will prepare individuals and organizations to adjust their documentation processes accordingly.

Users should also keep an eye on how platforms like pdfFiller adapt to these changes. Regular updates on software services reflect shifts in compliance needs, ensuring that users have the latest tools for filling out and managing their forms efficiently. Embracing these advancements will not only streamline personal processes but also fortify compliance and accuracy in submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 ic-040 form 4 for eSignature?

Where do I find 2025 ic-040 form 4?

How do I edit 2025 ic-040 form 4 on an iOS device?

What is 2025 ic-040 form 4?

Who is required to file 2025 ic-040 form 4?

How to fill out 2025 ic-040 form 4?

What is the purpose of 2025 ic-040 form 4?

What information must be reported on 2025 ic-040 form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.