Get the free DOR 2025 Individual Income Tax Forms

Get, Create, Make and Sign dor 2025 individual income

Editing dor 2025 individual income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dor 2025 individual income

How to fill out 2025 i-041 wisconsin form

Who needs 2025 i-041 wisconsin form?

A Comprehensive Guide to the 2025 -041 Wisconsin Form

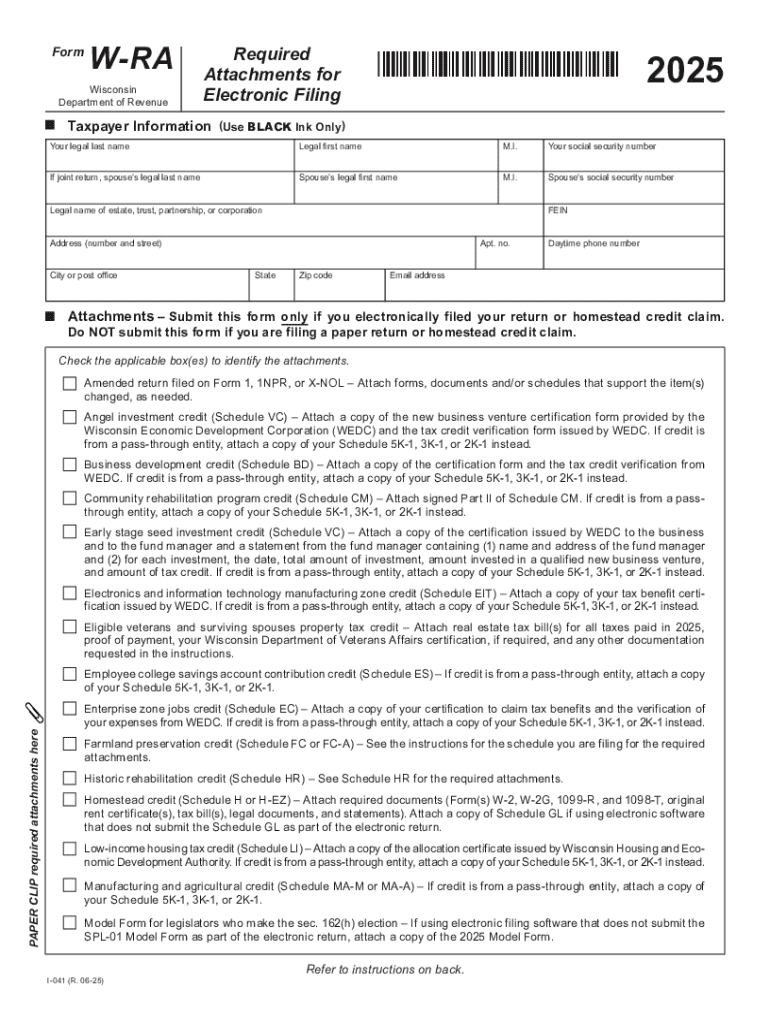

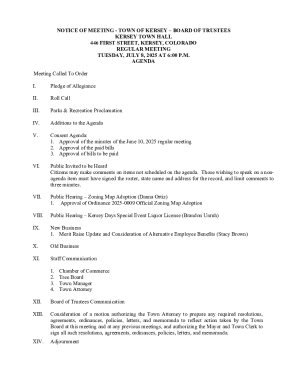

Overview of the 2025 -041 Wisconsin Form

The 2025 i-041 Wisconsin Form is a vital document used for reporting individual income tax obligations in the state of Wisconsin. Designed primarily for residents and non-residents earning income within the state, this form serves to calculate the taxes owed to the state government. Accurate and timely filing of this form is crucial, as it helps ensure compliance with state tax laws and allows taxpayers to take advantage of any deductions or credits for which they may be eligible.

Failure to file the i-041 form on time can result in penalties, interest on unpaid taxes, and complications during any potential state audits. The key deadlines for submission typically fall on April 15 each year, but for special cases, such as extension requests, additional guidelines apply.

Who needs to file the 2025 -041 form?

Understanding who is required to file the 2025 i-041 Wisconsin Form is crucial. Generally, it is necessary for any individual earning income within Wisconsin, including wages from employers, self-employment income, and even certain forms of investment income. Residents of Wisconsin must file the form annually, while non-residents are required to submit it only if they have sourced income from the state.

Specific situations that necessitate filing include receiving W-2s, 1099s, or earning income from freelance work or rental properties. Additionally, individuals who qualify for tax credits or have specific deductions applicable to their circumstances should also file this form to benefit from potential tax relief.

Required attachments for electronic filing

When electronically filing the 2025 i-041 Wisconsin Form, various attachments may be required to support the income and deductions reported. Necessary documents typically include W-2 forms from employers, 1099 forms for any freelance or contract work, as well as records related to business income in the event of self-employment. Furthermore, individuals claiming deductions for expenses or credits must provide documentation to validate these claims.

Gathering these documents in advance ensures a smoother filing process. Start by organizing your financial documents and receipts meticulously, and maintain an electronic or physical binder that can include summaries of your income and expenditures. Tools like pdfFiller can also help streamline this process by allowing for easy document uploads and electronic signatures.

Step-by-step guide to completing the 2025 -041 form

Completing the 2025 i-041 Wisconsin Form may seem daunting, but breaking it down into manageable sections simplifies the process. Below is a structured approach to help you navigate the form:

Utilizing interactive tools, such as checklists for each section, can ensure you don’t miss essential information while filling out the form.

Common errors to avoid when completing the -041 form

It's essential to watch out for common pitfalls that can lead to complications with your 2025 i-041 filing. Many filers make mistakes such as inaccuracies in reported incomes, incorrect calculations of total tax owing, or failing to include necessary attachments. Double-checking the identification fields for errors is also crucial, as these mistakes can delay processing times significantly.

An effective strategy to spot and correct errors includes reviewing the completed form multiple times, ideally after a short break. You may also consider seeking assistance from tax professionals or leveraging resources on pdfFiller to check your document for common mistakes before submission.

What happens after filing the 2025 -041 form?

After successfully filing the 2025 i-041 Wisconsin Form, the Wisconsin Department of Revenue will initiate a review process. This phase typically takes several weeks, during which they verify the accuracy of reported information and supporting documents. Expect to receive a confirmation notice upon successful filing, along with any further instructions if additional documentation is required.

Processing times may vary; however, filers can usually anticipate a turnaround of approximately 4 to 6 weeks. If there are discrepancies or further questions, the Department of Revenue may reach out to you directly to clarify issues, potentially delaying your refund or resolution.

Troubleshooting: Issues with the -041 form submission

Encountering issues during electronic filing is not uncommon. Common problems include issues with uploading documents or technical difficulties with the online platform. In cases where your submission fails to process, it's critical to check for connection issues or document format requirements.

For assistance, potential filers can contact the Wisconsin Department of Revenue’s helpdesk or consult with tax professionals. It’s always useful to have documentation handy when seeking help, as providing specific error messages can expedite the troubleshooting process.

Staying updated on changes in the 2025 -041 form

The 2025 i-041 Wisconsin Form may undergo updates or changes, impacting requirements or procedures. Staying informed is essential for compliance and optimizing your tax benefits. Recent changes could affect income limits for certain deductions or adjustments in tax rates.

The Wisconsin Department of Revenue regularly posts updates regarding any changes to tax forms or filing procedures. By subscribing to official announcements and checking their website, taxpayers can ensure they are up to date with the most accurate information.

Related documents and forms

In addition to the 2025 i-041 Wisconsin Form, various other documents may be necessary for tax filing. These include essential forms such as W-2s and 1099s, which report different sources of income. Each of these forms serves a unique purpose and is critical in ensuring that you report your income accurately.

Accessing and filling out these linked documents is straightforward through the Wisconsin Department of Revenue’s website or using platforms like pdfFiller that supports seamless document management.

Frequently asked questions about the 2025 -041 form

Frequent inquiries about the 2025 i-041 Wisconsin Form typically revolve around eligibility requirements and filing deadlines. Taxpayers often seek clarification on what constitutes taxable income or how deductions can be claimed effectively. Understanding these nuances can significantly influence a taxpayer's liabilities and potential refunds.

Consulting tax professionals or utilizing online resources can help individuals obtain expert answers to these complex topics, enabling confident and informed filing.

Important actions after filing

Once you have filed the 2025 i-041 Wisconsin Form, it's critical to be proactive about tracking your submission status. Keep an eye on any communications from the Wisconsin Department of Revenue, as they may reach out for additional information or clarification. If there are discrepancies or if you believe an error has been made, knowing the appeal process will be beneficial.

Expect to follow up on your submission if you do not receive confirmation within the typical processing period. Understanding your rights and responsibilities regarding your tax assessment can aid in addressing issues quickly and effectively.

Interactive tools and resources

Utilizing platforms such as pdfFiller can drastically simplify the process of filling out, editing, eSigning, and managing the 2025 i-041 Wisconsin Form. The platform’s features allow users to upload documents directly, collaborate with others, and ensure that every part of your tax submission is properly handled from one cloud-based solution.

With robust editing and eSigning capabilities, pdfFiller empowers users to easily navigate tax forms and documents without the hassle of cumbersome paperwork, reducing the chances of errors and enhancing efficiency.

Links to additional templates and resources

To make the filing process even more manageable, accessing other relevant resources can be vital. Links to additional Wisconsin forms and templates are readily available through the Wisconsin Department of Revenue's website. Utilizing pdfFiller can aid you in managing and storing these documents efficiently.

Consider exploring resources available on pdfFiller for enhancing your document management capabilities beyond just tax forms, making your filing process seamless and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find dor 2025 individual income?

How do I execute dor 2025 individual income online?

How do I complete dor 2025 individual income on an Android device?

What is 2025 i-041 wisconsin form?

Who is required to file 2025 i-041 wisconsin form?

How to fill out 2025 i-041 wisconsin form?

What is the purpose of 2025 i-041 wisconsin form?

What information must be reported on 2025 i-041 wisconsin form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.