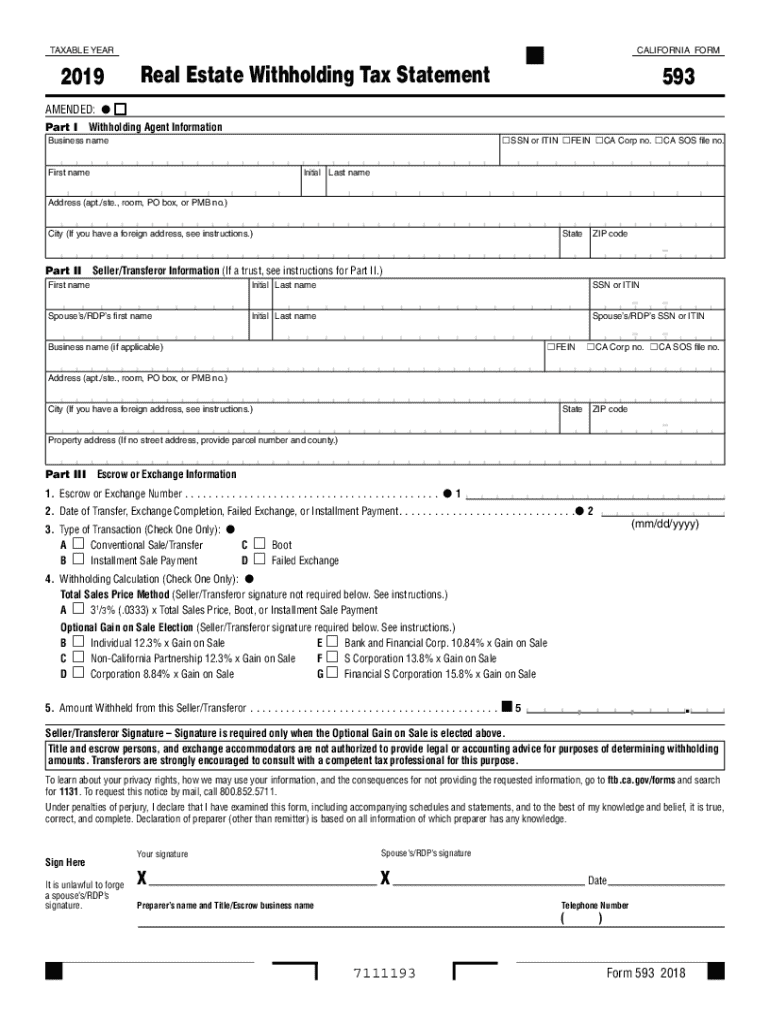

Get the free 2019 Form 593 Real Estate Withholding Tax Statement. 2019 Form 593 Real Estate Withh...

Get, Create, Make and Sign 2019 form 593 real

Editing 2019 form 593 real online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2019 form 593 real

How to fill out 2019 form 593 real

Who needs 2019 form 593 real?

A Complete Guide to the 2019 Form 593 Real Form

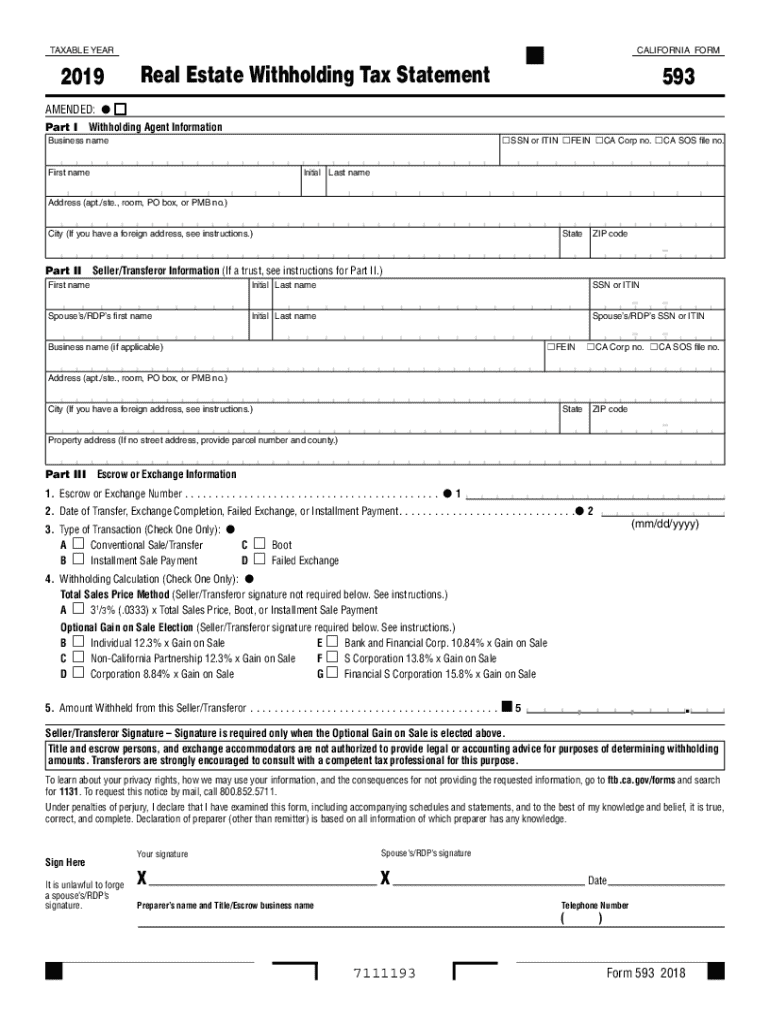

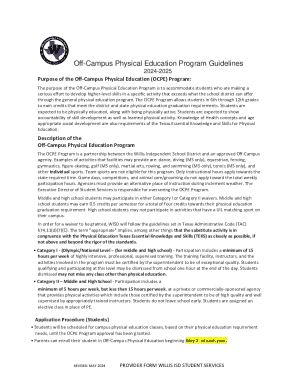

Overview of Form 593

Form 593 is a crucial document in the California real estate landscape. This form captures the withholdings from the sale of California real property, helping ensure compliance with state tax laws. Its primary role is to report the withholding tax amount deducted during real estate transactions involving California properties, which directly affects both the real estate seller and the buyer.

Understanding its implications is essential because failure to comply can lead to penalties and unwanted tax consequences. The withholding is initially set at a percentage of the sale price, supported by specific tax laws contained in the California Revenue and Taxation Code (R&TC). This compliance not only protects all parties involved but also upholds California's revenue system.

Key features of Form 593

The 2019 Form 593 consists of several sections that must be completed accurately for valid tax reporting and compliance. Each part of the form requires specific data, and any inaccuracies can result in issues during tax evaluations.

Mandatory fields include identification details of the buyer and seller, sale price, and the withholding amounts chosen. Accurate completion is not just a formality; it's key in ensuring the correct taxation process is followed. Here’s a breakdown of the main sections of the form:

Step-by-step instructions for completing Form 593

Accurate completion of Form 593 begins with gathering all necessary data from both real estate seller and buyer. Correct financial data and supporting documents are crucial for seamless form submission. An organized approach ensures nothing is overlooked, which could complicate transaction processes.

Here’s a clear guide to navigate through the form:

Common mistakes to avoid

While completing Form 593, it's easy to make errors that could lead to serious complications. One of the most common mistakes is inaccuracies in identification. Incomplete or erroneous information about the buyer or seller can delay processing.

Another frequent issue relates to miscalculating withholding amounts. Relying on outdated calculations or assumptions without verification can lead to under or over-withholding. Ensuring that these values are reconfirmed and compared against the latest tax rates or guidelines is crucial to avoid any compliance issues.

Additional insights on real estate withholding

Real estate transactions can sometimes involve complexities around installment payments made after escrow. Form 593 also plays a role in reporting withholdings related to these payments. Once payments are deferred over time, understanding how withholding applies becomes critical.

Moreover, there are exceptions wherein withholding may not be necessary. For instance, certain sales below the minimum threshold or those qualifying under specific exemptions outlined by the Internal Revenue Code can avoid this obligation. Buyers and sellers need to be aware of these exemptions to ensure efficient tax management.

Filing and submission process

Once Form 593 is completed, timely submission to the California tax authorities is essential. The form can be submitted directly to the Franchise Tax Board or through designated intermediaries and escrows, as prescribed by California regulations.

Key deadlines are established when it comes to submitting this form to avoid potential penalties. It’s crucial to confirm the latest submission dates in the tax year, as they can vary depending on transaction timing and volume.

Interactive tools for form completion

In an age where efficiency is paramount, utilizing tools that streamline forms like the 2019 Form 593 can save significant time. pdfFiller offers functionalities such as online editing and electronic signatures, allowing for remote collaboration on documentation.

These features enable teams to work efficiently even from different locations. The ability to share the document in real time for review and feedback means fewer delays and a smoother submission process.

Frequently asked questions (FAQ)

As with any form, questions arise, especially regarding compliance. Users frequently inquire about the implications of failing to submit Form 593. Typically, failing to submit can lead to significant penalties, including a potential loss of funds withheld.

Another common question pertains to how to amend a submitted Form 593. Amendments can often be performed by following specific guidelines set forth by the California tax authorities, and it’s critical to address mistakes proactively.

Additionally, individuals who conduct multiple property sales in a year ask about reporting requirements. Each sale generally requires a separate form, ensuring comprehensive tax reporting for each transaction.

Resources and support for Form 593 users

For those engaging in real estate transactions and navigating the complexities of Form 593, accessing California tax information is vital. Official California resources provide comprehensive guidelines regarding tax obligations, filing processes, and relevant deadlines.

Moreover, leveraging platforms like pdfFiller can enhance your overall document management strategies far beyond just Form 593. Their cloud-based solutions facilitate ongoing compliance, enabling effective handling of all types of document needs in a streamlined manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2019 form 593 real?

How can I fill out 2019 form 593 real on an iOS device?

Can I edit 2019 form 593 real on an Android device?

What is 2019 form 593 real?

Who is required to file 2019 form 593 real?

How to fill out 2019 form 593 real?

What is the purpose of 2019 form 593 real?

What information must be reported on 2019 form 593 real?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.