Get the free Instructions for Form 593-V

Get, Create, Make and Sign instructions for form 593-v

Editing instructions for form 593-v online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 593-v

How to fill out instructions for form 593-v

Who needs instructions for form 593-v?

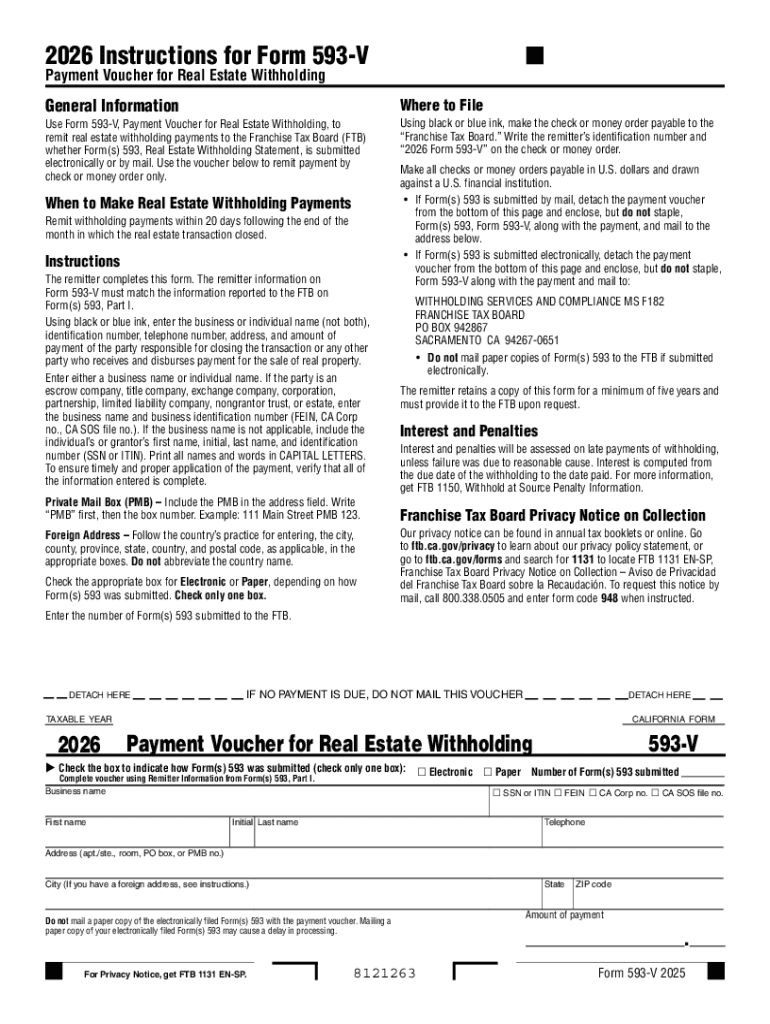

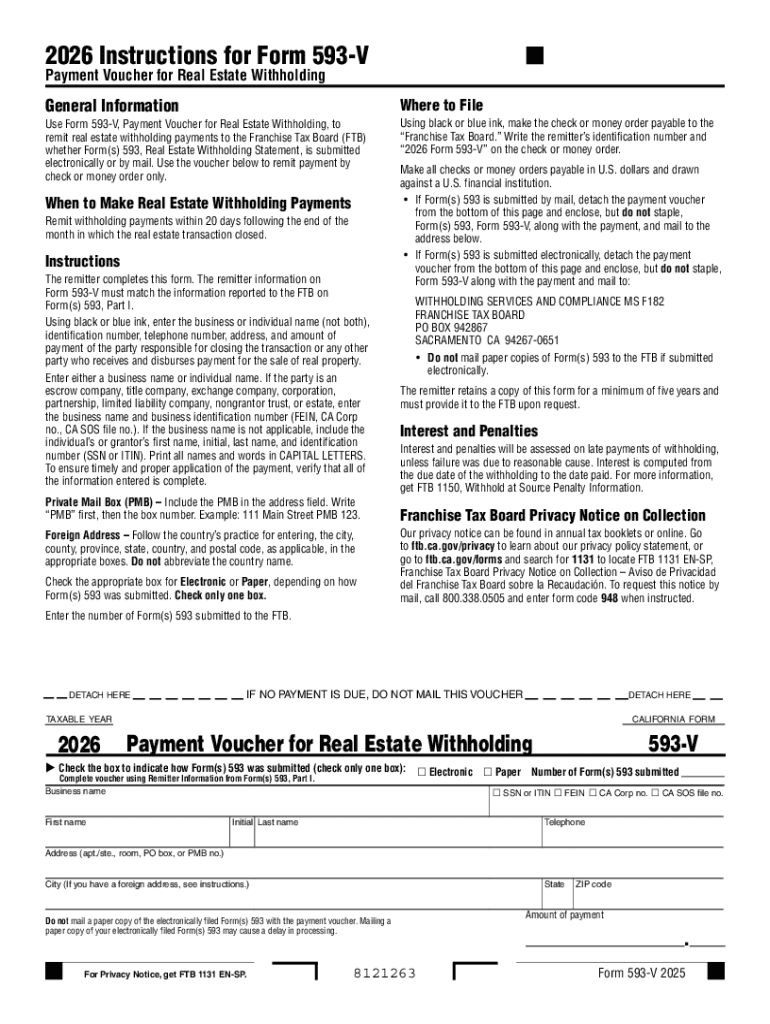

Instructions for Form 593-

Overview of Form 593-

Form 593-V is a California state tax form that facilitates the withholding of taxes on certain real estate transactions. The form is essential for non-resident sellers to notify the Franchise Tax Board (FTB) of potential tax liabilities that arise from the sale of California real estate. By accurately completing Form 593-V, transferors can ensure compliance with state tax regulations, thereby avoiding potential penalties and ensuring proper tax withholding during the transaction process.

Originally designed to safeguard the state’s interests, Form 593-V plays a critical role in real estate transactions, especially for individuals and entities unfamiliar with California tax obligations. The form serves as a compromise between the state's need for revenue and the sellers' interests in concluding transactions swiftly. Thus, understanding the intricacies of this form is crucial for anyone involved in real estate sales in California.

Who should use Form 593-?

Individuals selling real estate properties in California need to use Form 593-V if they qualify as non-residents or if their properties were classified as 'non-residential.' Business entities engaging in property transfers should also consider this form as it applies to any real estate transaction involving a transferor who is not a California resident. Understanding if your transaction requires this form is vital to ensuring compliance and smooth processing of the sale.

This necessity extends to scenarios such as conventional sales, exchanges, or installment sales where the property is sold. Transferees, particularly those acquiring properties from non-residents, should also be aware of the form's requirements as it directly impacts their financial and legal responsibilities in the transaction.

Key components of Form 593-

Form 593-V is typically divided into several sections, each collecting vital pieces of information necessary for processing the withholding tax correctly. The key components consist of sections that require personal and property details, withholding amounts, and allocation of responsibility for payment. Understanding how to navigate through these sections will facilitate the effective completion of the form.

Familiarizing yourself with this structure is essential as it will guide you through the necessary inputs and minimize common errors, ultimately contributing to a smoother filing experience.

Common terminology

Understanding the terminology associated with Form 593-V is crucial for accurately completing the form and understanding your responsibilities during a transaction. Common terms include 'transferor,' referring to the individual or entity selling the property. 'Transferee' denotes the buyer or recipient of the ownership rights from the transferor. The term 'withholding' refers to the amount deducted from the sale proceeds to ensure tax obligations are met, preventing future liabilities for transferors.

Other vital terminologies like 'installment sale' and 'exchange' describe specific methods of selling or transferring property, impacting the calculations on withholding amounts. Recognizing these terms not only aids in filling out Form 593-V accurately but also enhances your understanding of the real estate transaction process in California.

Step-by-step instructions for filling out Form 593-

Before filling out Form 593-V, gather all necessary documentation, including personal identification, property details, and any previous tax filings relevant to the transaction in question. This preparation ensures that you are equipped with all required information, minimizing errors during the completion process.

Preparing to fill out the form

You should have the following documents ready: your Social Security number or tax identification number, the property address, the sale price, and any other pertinent financial information related to the transaction. Having this information on hand will streamline the completion process and ensure you provide accurate figures.

Detailed filling instructions

It's vital to complete each section of Form 593-V carefully:

Common mistakes to avoid

Many filers encounter common pitfalls when completing Form 593-V. One frequent error is incorrectly providing taxpayer identification numbers, which can lead to significant complications. Another is miscalculating the withholding amounts, particularly for 'installment sale' scenarios that may alter tax obligations. A lack of clarity in property details can also complicate the process, resulting in additional fines or penalties by the state.

To ensure accuracy, follow these tips: Double-check all figures and ensure they are backed by proper documentation. Employ the use of validation tools or consulting professionals to review the form before submitting. Taking time to ensure everything is correctly filled out can mitigate risks of audits and additional penalties later.

Using pdfFiller for Form 593-

pdfFiller offers a dynamic platform for accessing and completing Form 593-V conveniently. Start by locating the form in the template library, where it's readily available for download or direct online filling. The user-friendly interface allows for seamless navigation throughout the document completion.

How to access Form 593- on pdfFiller

To begin, simply visit pdfFiller's website and enter 'Form 593-V' in the search bar. You can select the form from the results, allowing for immediate editing. This eliminates the need for manual data entry, enhancing efficiency.

Editing and customizing features

pdfFiller provides an array of editing tools that enable customization of Form 593-V. Users can easily fill in required fields, add notes, and even upload necessary documents. This is especially beneficial in complex transactions where additional information may be necessary. You can ensure that your form not only meets the regulatory requirements but also contains all relevant details to facilitate a smooth transaction.

eSigning and collaboration

Gathering signatures is effortless using pdfFiller’s eSignature functionality. Once the form is complete, you can send it to necessary parties for review and signature directly within the platform. This feature allows for real-time collaboration, ensuring that all stakeholders can engage in the process without requiring in-person meetings or paper exchanges.

Managing your form after submission

Once you have submitted Form 593-V, tracking its status is essential to ensure compliance with California tax obligations. Typically, you should allow several weeks for processing before following up. Many users find that checking the submission confirmation emails helps them stay organized.

Tracking submission status

For a streamlined tracking process, keep records of your submission confirmation, and monitor any communications from the FTB. This will ensure you can address any requests for additional information promptly.

Amending filed forms

If you discover an error in your submission, it’s crucial to amend Form 593-V as soon as possible. The best course of action is to clearly state the corrections and submit an amended form, ensuring that you include marked changes. Maintaining open communication with the FTB can help clarify any issues arising from amendments.

Retaining copies for records

Properly storing a copy of your submitted Form 593-V is vital. Utilizing pdfFiller's cloud storage options can help keep your documents secure and accessible for future reference. This is beneficial during tax audits or in scenarios where up-to-date documentation is necessary.

Frequently asked questions (FAQs)

Many filers have common concerns regarding Form 593-V. Questions often arise regarding deadlines, penalties for non-compliance, and how withholding amounts are determined. Addressing these queries helps demystify the form for new users, allowing for smoother transactions.

Common queries about Form 593-

For example, many sellers want to know the timeline for filing Form 593-V relative to the sale date. Generally, this form should be filed simultaneously with your tax payment, which is typically due on the sale date. Understanding these timelines helps ensure compliance and prevent unnecessary penalties.

Resources for additional support

For further inquiries, users are encouraged to refer to the California Franchise Tax Board's website or customer service for specific guidance related to their transactions. These resources provide invaluable assistance in clarifying any pressing concerns.

Conclusion: Empower your document management with pdfFiller

Utilizing pdfFiller to manage Form 593-V not only simplifies the completion process but also enhances your document management capabilities overall. This comprehensive platform allows you to edit, sign, collaborate, and store important forms, ensuring every transaction runs smoothly.

We encourage all users to explore the full range of functionalities that pdfFiller offers. All of these features work cohesively to improve your real estate transaction experience, ensuring that you remain compliant and organized without additional hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out instructions for form 593-v using my mobile device?

How do I edit instructions for form 593-v on an Android device?

How do I complete instructions for form 593-v on an Android device?

What is instructions for form 593-v?

Who is required to file instructions for form 593-v?

How to fill out instructions for form 593-v?

What is the purpose of instructions for form 593-v?

What information must be reported on instructions for form 593-v?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.