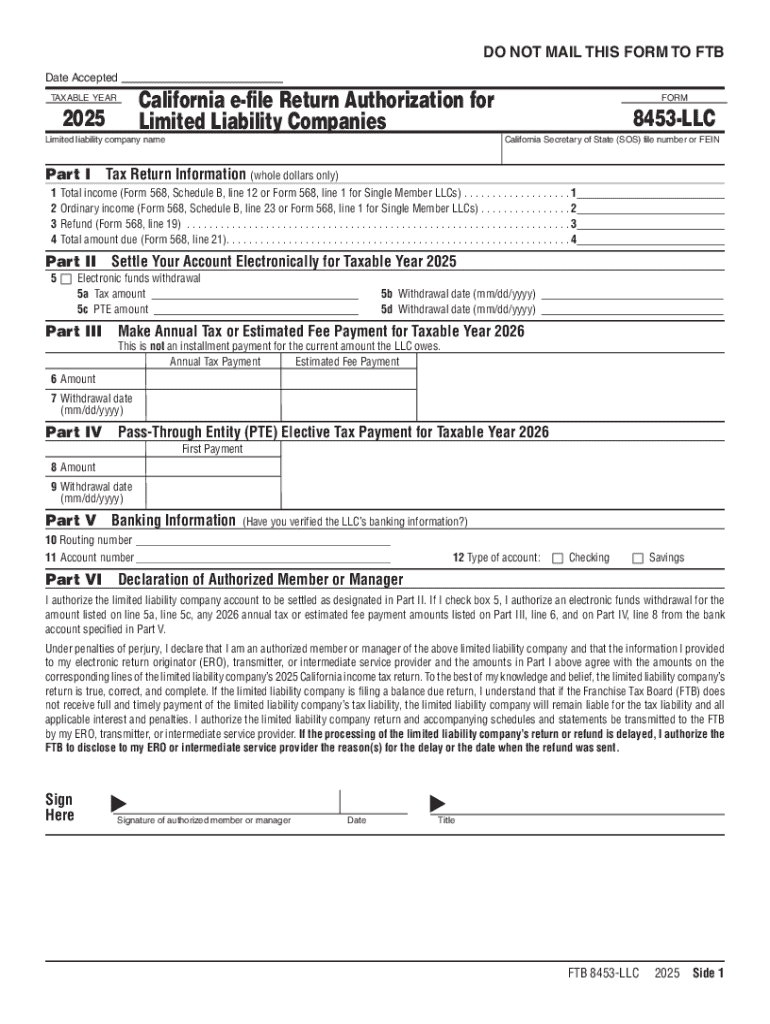

Get the free 2025 Form 8453-LLC California e-file Return Authorization for Limited Liability Comp...

Get, Create, Make and Sign 2025 form 8453-llc california

Editing 2025 form 8453-llc california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 8453-llc california

How to fill out 2025 form 8453-llc california

Who needs 2025 form 8453-llc california?

2025 Form 8453- California Form: A Comprehensive Guide

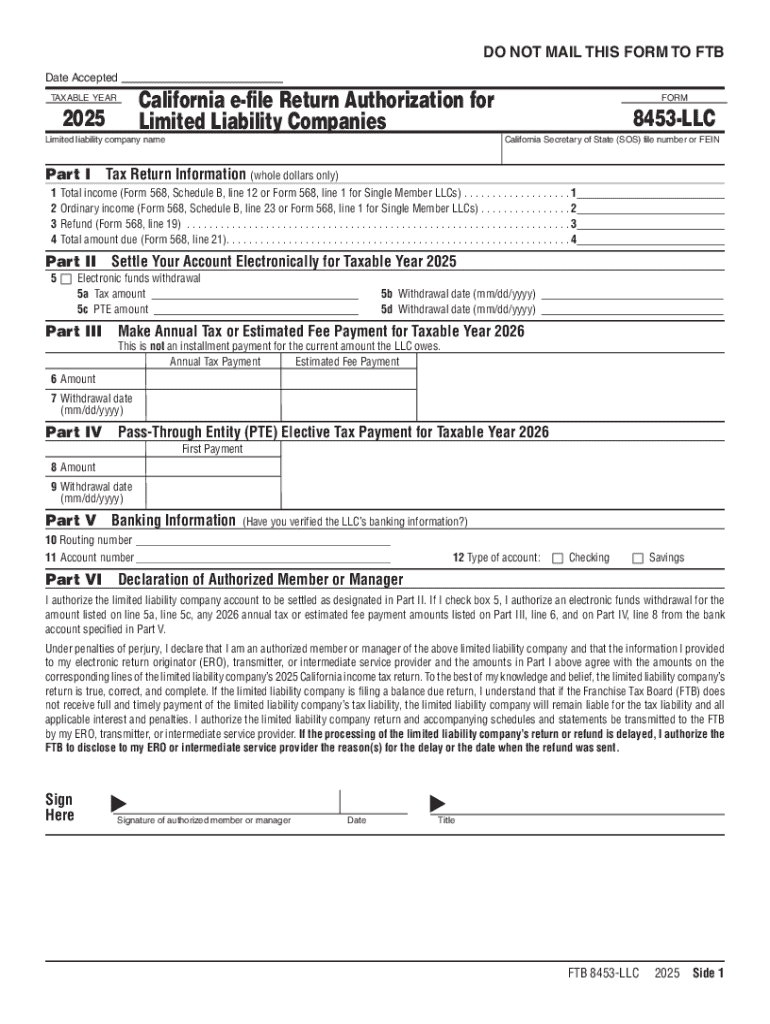

Overview of Form 8453-

Form 8453-LLC serves a vital role in facilitating the electronic filing process for Limited Liability Companies (LLCs) in California. This document is essential for taxpayers who are filing their taxes online and is designed to authenticate and authorize the e-filing of a return. Understanding the necessity of Form 8453-LLC is crucial as it ensures your tax return is properly processed by the California Franchise Tax Board (FTB).

Without this form, the e-filing procedure can face delays or may even be rejected by the tax authorities. Therefore, embracing this form is integral to safeguarding your tax submission and avoiding potential pitfalls.

Who needs to file Form 8453-?

Any LLC in California that is opting for e-filing their tax return must file Form 8453-LLC. This includes single-member LLCs, multi-member LLCs, and those that have chosen to be taxed as S-corporations or C-corporations. Understanding your LLC's classification is part of the criteria that determines your tax obligations, and thus your requirement to file this form.

Detailed instructions for completing Form 8453-

To correctly complete Form 8453-LLC, a clear understanding of its sections is essential.

Part 1: Identification Information

The identification section requires fundamental details, such as the LLC’s name, address, and taxpayer identification number (TIN). Ensuring that accurate information is provided here is crucial as errors can lead to complications during processing. Double-checking your entries against official documents can help avoid common mistakes.

Part 2: Election Information

This section allows you to choose your LLC’s tax classification. Different elections will affect your tax rates and filing requirements. It's important to carefully consider the implications of each option before making a choice. If you’re uncertain, consulting with a tax advisor could be beneficial.

Part 3: Signature and Certification

Lastly, this part of the form entails signatures for certification purposes. An important note here is that digital signatures are accepted, which expedites the process of e-filing. Understanding the verification steps for electronic submissions can further ease your filing experience.

Common mistakes to avoid when filling out Form 8453-

While completing the 2025 Form 8453-LLC, certain sections are frequently overlooked, leading to unnecessary complications.

Avoiding these common pitfalls is crucial as errors could lead to significant delays in processing your submission and even incur tax penalties or audits.

Utilizing pdfFiller for Form 8453-

Using pdfFiller to manage Form 8453-LLC streamlines the process, making it efficient and user-friendly. With pdfFiller's intuitive interface, users can easily edit and prepare their documents for submission.

Benefits of using pdfFiller

The platform simplifies eSigning with straightforward steps to electronically sign your form. Additionally, collaboration tools allow teams to work together seamlessly, ensuring that all input is accurate and timely.

Interactive features

pdfFiller also offers editing capabilities so users can modify PDF content effectively. Whether it’s adding notes or correcting errors, the platform supports a range of functionalities, making teamwork easier through convenient uploading and sharing options.

Filing process for Form 8453-

Filing Form 8453-LLC involves several steps that must be meticulously followed to ensure compliance and efficiency.

Understanding the timelines associated with your filings is essential. Key dates and deadlines for the 2025 tax year should be on your radar to avoid last-minute complications.

Processing times can vary, so it's advised to plan for potential delays and ensure that you have follow-up mechanisms in place.

Frequently asked questions (FAQs)

After submitting Form 8453-LLC, it's natural to wonder what happens next. Typically, you will receive notifications and responses from tax authorities regarding the status of your submission.

Can amend my Form 8453- after filing?

If you need to correct your submission, it is possible to amend Form 8453-LLC. The steps involve submitting a new Form 8453-LLC indicating the corrections and any necessary supplementary documentation.

For further assistance, various resources are available, including the California Franchise Tax Board's website, which provides comprehensive guidance and updates on Form 8453-LLC.

Success stories and testimonials

Numerous individuals and teams have successfully navigated the LLC filing process using Form 8453-LLC. Their testimonials often highlight how intuitive tools on pdfFiller made a significant difference in their experience.

For instance, one user described how the document editing feature allowed them to quickly correct entries, while another appreciated the ease of collaborating on the form with their accountant, showcasing the platform’s effectiveness.

Additional considerations for 2025 filings

As you prepare to file for 2025, keep in mind that key tax changes may impact Form 8453-LLC. Staying current on new laws and amendments relevant to your LLC can provide significant advantages.

Effective tax planning is crucial for minimizing your liabilities, and gathering insights on these tax regulation changes will support your long-term business strategies.

As you navigate the complexities of tax filing, using tools like pdfFiller can empower you to manage your documents efficiently from anywhere, ensuring you remain compliant and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 form 8453-llc california to be eSigned by others?

How do I edit 2025 form 8453-llc california in Chrome?

Can I sign the 2025 form 8453-llc california electronically in Chrome?

What is 2025 form 8453-llc california?

Who is required to file 2025 form 8453-llc california?

How to fill out 2025 form 8453-llc california?

What is the purpose of 2025 form 8453-llc california?

What information must be reported on 2025 form 8453-llc california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.