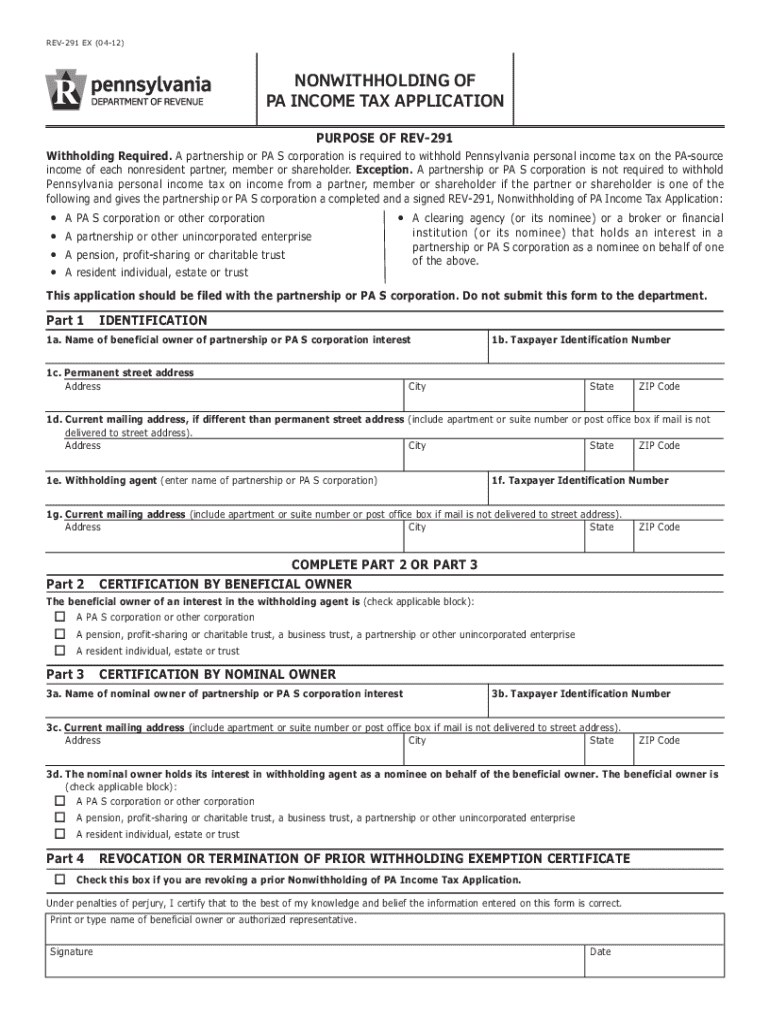

Get the free nonwithholding of pa income tax application

Get, Create, Make and Sign nonwithholding of pa income

How to edit nonwithholding of pa income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonwithholding of pa income

How to fill out nonwithholding of pa income

Who needs nonwithholding of pa income?

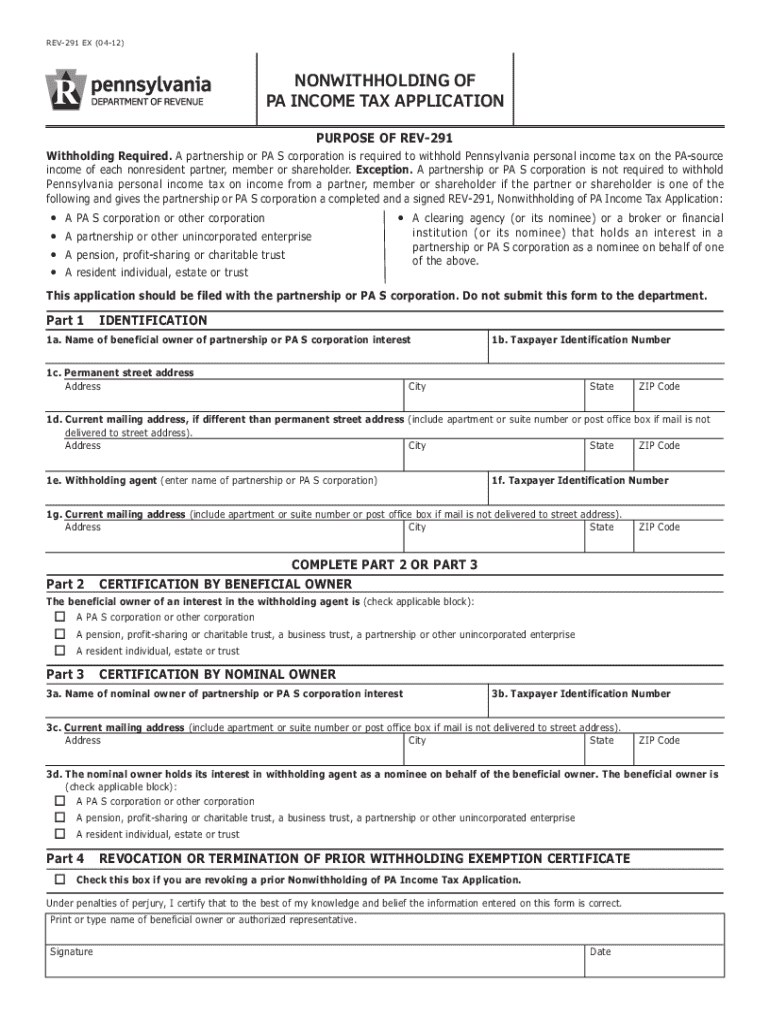

Nonwithholding of PA Income Form: A How-to Guide

Understanding the Nonwithholding of PA Income Tax

Nonwithholding refers to the scenario where an individual does not have Pennsylvania state income tax automatically deducted from their income by an employer or payer. This definition illustrates significant implications for both employees and taxpayers, particularly in the context of tax liabilities. Withholding involves the automatic deduction of a portion of an employee's earnings to pay federal, state, and local taxes upfront, whereas nonwithholding allows individuals more control over their tax payments but requires them to manage their tax obligations actively.

Understanding the distinction between these two concepts is crucial. While withholding is common for salaried positions, self-employed individuals or those with unconventional income sources, such as investments, might opt for nonwithholding. The key benefit of nonwithholding is financial flexibility, allowing taxpayers to manage their funds without early deductions. However, this comes with considerations; individuals opting for nonwithholding must ensure they are paying sufficient taxes throughout the year to avoid underpayment penalties.

Key Requirements for Nonwithholding in Pennsylvania

To qualify for nonwithholding of PA income tax, individuals must meet specific eligibility criteria. Generally, this status is designated for self-employed individuals, independent contractors, or others whose income is not subject to traditional withholding. Importantly, understanding income thresholds is vital; if a taxpayer's income is below a certain level, they may qualify for exemption from withholding altogether. Specific exemptions also apply to various categories of income, such as disability payments or certain retirement benefits.

When pursuing nonwithholding status, specific forms and documentation must be submitted. The essential form for declaring nonwithholding is the 'PA-W4.' This form not only declares your intention to opt-out of withholding but may also require supporting documentation that proves your eligibility for the status. Such documentation can include, but is not limited to, pay stubs showing previous withholding or a letter stating your expected income for the year. Ensuring all required forms are accurately filled and submitted is critical to obtaining approval for nonwithholding status.

Step-by-step guide to completing the nonwithholding PA income form

Successfully filling out the nonwithholding PA income form requires careful attention to detail and proper organization of information. First, gather necessary personal and financial information, including your full name, address, Social Security Number (SSN), and income data. These details will be integral in ensuring your form is accurately processed without delays.

Here’s a detailed breakdown of the PA income nonwithholding form sections:

Editing and managing your nonwithholding PA income form

After filling out the nonwithholding PA income form, it may require revisions or updates. This is where pdfFiller's editing tools come into play. With pdfFiller, users can easily edit their completed documents. You can upload your form, making necessary adjustments to personal or financial information using a suite of intuitive editing tools.

To edit your form in pdfFiller, follow these steps: First, log into your pdfFiller account, then upload the completed PA nonwithholding form from your computer. Utilize available tools such as text box, highlight, or strikethrough functions to clarify any information. Importantly, you may also collaborate with teammates, allowing them to provide insights or corrections. pdfFiller's collaborative features enable real-time editing, ensuring form accuracy before submission.

Signing the nonwithholding PA income form

Once your nonwithholding PA income form is accurately completed and previously edited, the next step is to sign it. pdfFiller offers various options for signing, including traditional paper signatures, faxed documents, and electronic signatures (eSign), each with its benefits. eSignatures provide a quick, secure way to sign documents without the need for physical appointments or mailing, often expediting the overall process.

In Pennsylvania, the legality of eSignatures is robust, meaning they hold the same legal weight as traditional signatures, as long as the signer consents and there’s intent to sign. To initiate the eSign using pdfFiller, simply select the eSign option, choose your signature style, and apply it to your document. Remember, the final signature must comply with identification and authorization requirements to be valid.

Submitting your nonwithholding PA income form

Completing and signing the nonwithholding PA income form is just the start; timely submission is essential. Mail your completed form to the provided Pennsylvania Department of Revenue address, ensuring to use a reliable mailing method such as certified mail to confirm delivery. If applicable, check for any electronic submission options that the department may provide to facilitate a more streamlined process.

Moreover, tracking the status of your submission can help you stay organized. You can verify receipt and status of your form by contacting the Pennsylvania Department of Revenue directly or utilizing any available online tracking services if the form was submitted electronically. If an issue arises, promptly address it by reaching out to the department's customer service for assistance.

Managing future nonwithholding status

Continuing with nonwithholding status may require future amendments or updates if your circumstances change. It's crucial to understand the procedures for adjusting your nonwithholding status throughout a tax year. For alterations, you typically need to complete a new version of the PA income form, noting changes in your financial situation that necessitate a status update. Staying compliant with Pennsylvania tax regulations is non-negotiable, so any status changes should be noted and processed promptly.

To ensure compliance, keep abreast of changes in Pennsylvania tax regulations, as these may impact your nonwithholding status. Utilize resources from the Pennsylvania Department of Revenue, tax workshops, and guidance from tax professionals to stay well-informed and actively compliant with regulations.

Common questions and troubleshooting

Questions frequently arise concerning the nonwithholding of the PA income form. Individuals often wonder about common scenarios, such as what to do if the form is rejected or the implications of missing a payment. Clarifying these points can save time and eliminate confusion. Questions regarding eligibility or documentation requirements can often be resolved by consulting FAQs often provided by the Pennsylvania Department of Revenue or professional tax services.

In the event of a rejection, it’s advisable to review any feedback provided with the rejection notice. If a problem persists, reach out to the tax office directly or seek professional assistance. Knowing where to find help can make the process smoother and alleviate potential stress.

Interactive tools and resources

pdfFiller offers interactive tools that are beneficial for individuals and teams working with the nonwithholding of PA income form. Users can utilize built-in calculators for tax prediction, helping them estimate tax obligations throughout the year, ensuring they adequately plan for payments. Additionally, sample forms and templates can offer visual assistance during the filling process.

The accessibility of pdfFiller from anywhere allows users to manage their documents without concern for location. With the mobile app, users can access their forms and documents anytime, expediting the process of filling out, signing, and submitting necessary tax forms, ensuring all actions comply with the specific needs of Pennsylvania regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nonwithholding of pa income for eSignature?

Can I create an eSignature for the nonwithholding of pa income in Gmail?

How do I complete nonwithholding of pa income on an iOS device?

What is nonwithholding of pa income?

Who is required to file nonwithholding of pa income?

How to fill out nonwithholding of pa income?

What is the purpose of nonwithholding of pa income?

What information must be reported on nonwithholding of pa income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.