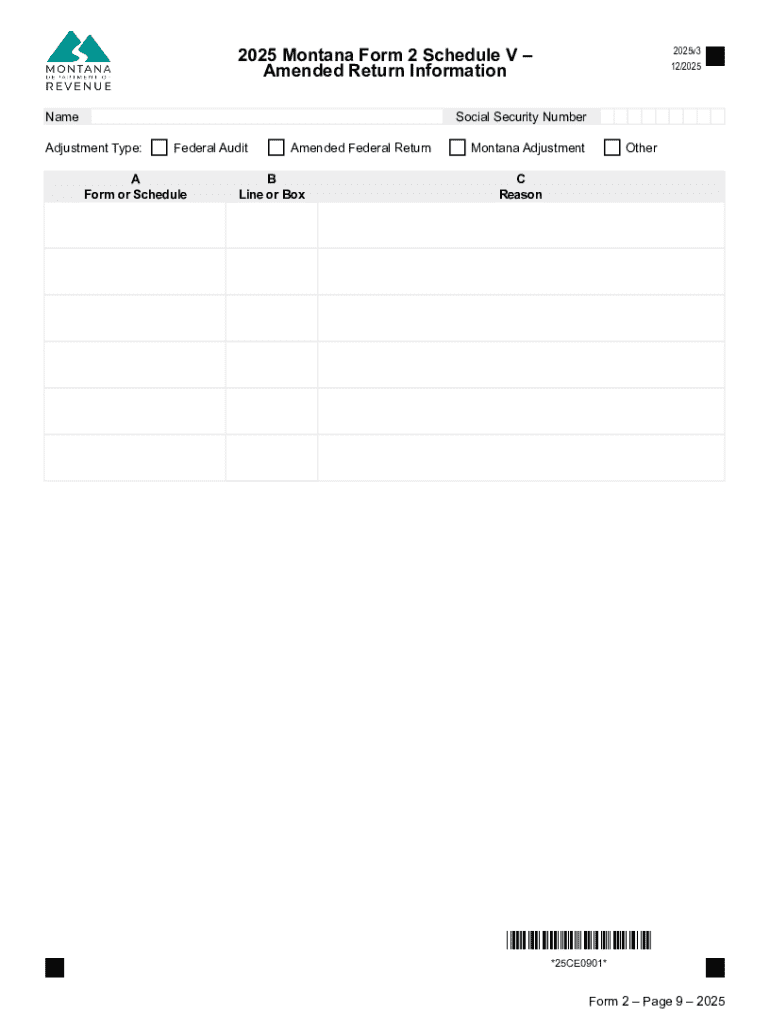

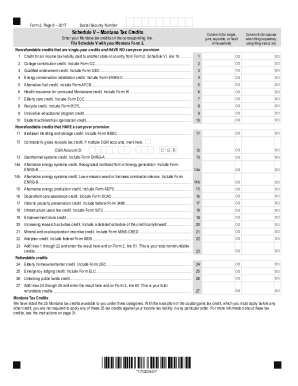

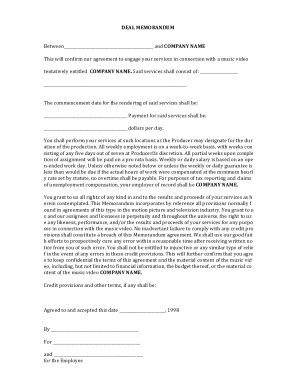

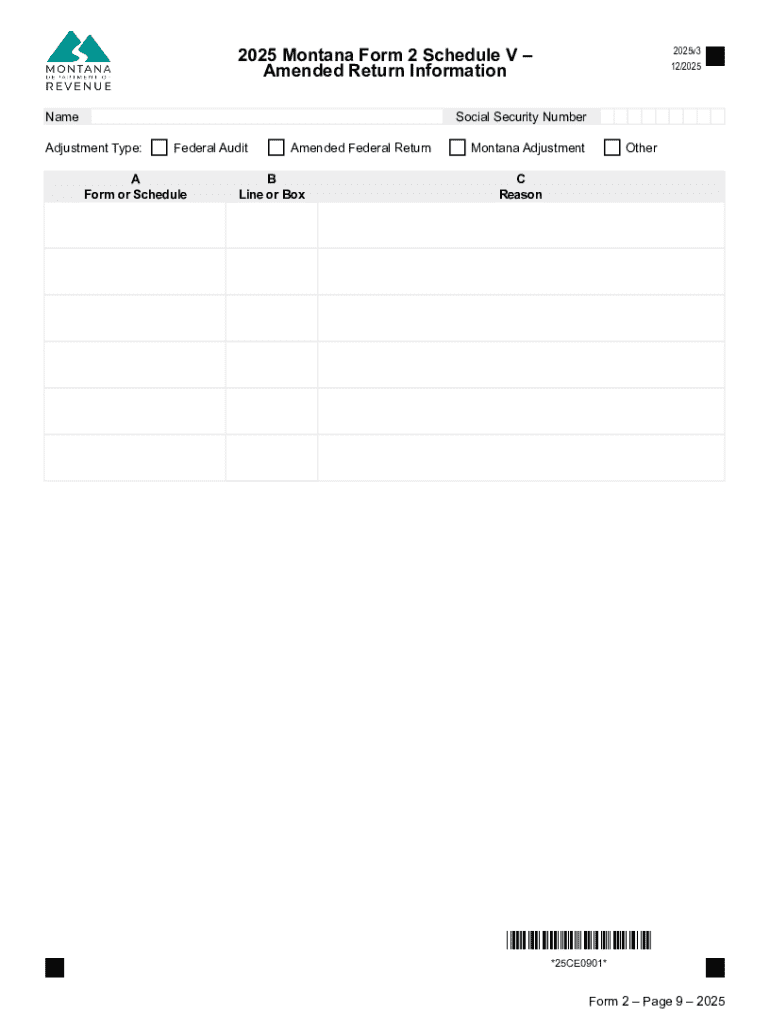

MT Form 2 - Schedule V 2025-2026 free printable template

Get, Create, Make and Sign MT Form 2 - Schedule V

Editing MT Form 2 - Schedule V online

Uncompromising security for your PDF editing and eSignature needs

MT Form 2 - Schedule V Form Versions

How to fill out MT Form 2 - Schedule V

How to fill out 2025 montana individual income

Who needs 2025 montana individual income?

2025 Montana Individual Income Form: A Comprehensive Guide

Understanding Montana's individual income tax

Montana's individual income tax system operates under a progressive tax structure, meaning that your tax rate increases as your taxable income rises. For the 2025 tax year, you’ll need to be aware of the specific tax brackets, which can affect how much you owe or what refund you may receive. Familiarizing yourself with the existing tax laws and recent adjustments in rates and deductions is crucial for an accurate filing.

Important dates and deadlines for your Montana tax return include April 15, 2026, when individual tax returns must be filed for the 2025 tax year. Make sure to mark your calendar for these key dates to avoid penalties and interest on unpaid taxes.

Who needs to file a Montana individual income tax return?

Filing requirements for Montana’s individual income tax depend on your income level, residency status, and specific financial circumstances. To determine whether you need to file, consider the following income thresholds from the Montana Department of Revenue:

Self-employed individuals and those with specific income sources, such as rental properties or investments, should be wary; you may still need to file a return even if your income is below these thresholds. Residency status also plays a crucial role, as part-time residents might face different requirements.

Key changes in the 2025 form

Tax laws are continually evolving, and the 2025 Montana Individual Income Form reflects several key changes aimed at increasing fairness and transparency. Significant tax reforms that impact the 2025 form include adjustments to personal exemptions and increases in standard deduction amounts. For instance, the personal exemption amount has been raised, potentially reducing overall taxable income and improving taxpayer outcomes.

Every taxpayer should review relevant legislation to understand how changes to the form might impact their specific situation. This is crucial not just for comprehension but for optimal financial planning when filing your taxes.

Locating the 2025 Montana individual income form

The 2025 Montana Individual Income Form is readily accessible online via the Montana Department of Revenue’s website. In person, you can obtain a paper version at local tax offices or authorized financial institutions. If you prefer a digital route, downloading the PDF version is straightforward; just visit the state’s official revenue site, navigate to the forms section, and select the 2025 individual form.

Using pdfFiller makes the process even easier. It allows for quick access, editing, and management of tax forms in a user-friendly environment that is cloud-based. This ensures you have access to your documents from anywhere you need to, enhancing your overall filing experience.

Step-by-step instructions for filling out the form

Completing the 2025 Montana Individual Income Form can seem daunting, but breaking it down into manageable sections will simplify the process. Here’s how to navigate the form:

Common pitfalls to avoid include overlooking income sources, failing to claim eligible deductions, or neglecting to check for updates in tax laws. Double-checking your entries and keeping copies of submitted forms will also make the process smoother.

How to edit and eSign the 2025 Montana income tax form with pdfFiller

pdfFiller streamlines the editing process for the 2025 Montana Income Tax Form. Once you've accessed the document, editing is simple; you can fill in the required sections, adjust information, and make necessary corrections without needing to print a hard copy. This versatility saves time and ensures that you are working with the most current version of your form.

Electronic signatures add another layer of convenience. With pdfFiller, you can sign the document digitally, which is secure and compliant with legal standards. Completing this step eliminates delays associated with mailing physical forms and facilitates faster processing.

Moreover, collaborating with tax professionals or team members on the same document is uncomplicated; pdfFiller supports real-time collaboration and sharing, making it a valuable tool during tax season.

Submitting your 2025 Montana individual income tax return

Once your 2025 Montana Individual Income Tax Form is completed, you have multiple submission methods. E-filing is the preferred option due to its speed; you can submit your return online through a recognized service. Alternatively, you can opt for paper filing, which requires sending the completed form to the appropriate Montana Department of Revenue address.

Key considerations before submission include verifying that you've included all necessary documentation. It’s also advisable to keep copies of your submission for your records. Tracking your return post-submission can be done online via the state's revenue website, which will help you ensure that your return is processed efficiently.

Post-filing considerations

After you file your tax return, stay vigilant for any communications from the Montana Department of Revenue, particularly notices or audit requests. If you receive an inquiry, respond promptly and provide requested documentation. Maintaining organized records throughout the year simplifies this process considerably.

Utilizing pdfFiller to manage your tax documentation can provide a clear overview of your forms and supporting documents, making it easy to retrieve what you need in case of inquiries from tax agencies.

FAQs about the 2025 Montana individual income form

As with any tax-related process, questions often arise. Commonly asked queries regarding the 2025 Montana Individual Income Form include inquiries about eligibility for credits and deductions, filing status changes, and deadlines for paper submissions versus e-filing. Resources such as the Montana Department of Revenue's website and local tax clinics can offer helpful guidance tailored to unique situations.

Having a solid understanding of the form through FAQs and dedicated resources available online can clarify any uncertainties and empower you to handle your taxes independently.

Leveraging pdfFiller for ongoing document management

pdfFiller not only facilitates the efficient completion and submission of the 2025 Montana Individual Income Form but also enhances overall document management. Beyond tax workflows, the platform can help individuals and teams manage a broad range of documents, from contracts to corporate bylaws, in an organized manner.

With features supporting collaboration, secure storage, and easy sharing, pdfFiller becomes integral to effective document management. Utilizing its capabilities allows for a more cohesive strategic plan for handling various forms and ensuring all members of a team are aligned and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MT Form 2 - Schedule V directly from Gmail?

How can I send MT Form 2 - Schedule V to be eSigned by others?

How do I edit MT Form 2 - Schedule V on an Android device?

What is 2025 montana individual income?

Who is required to file 2025 montana individual income?

How to fill out 2025 montana individual income?

What is the purpose of 2025 montana individual income?

What information must be reported on 2025 montana individual income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.