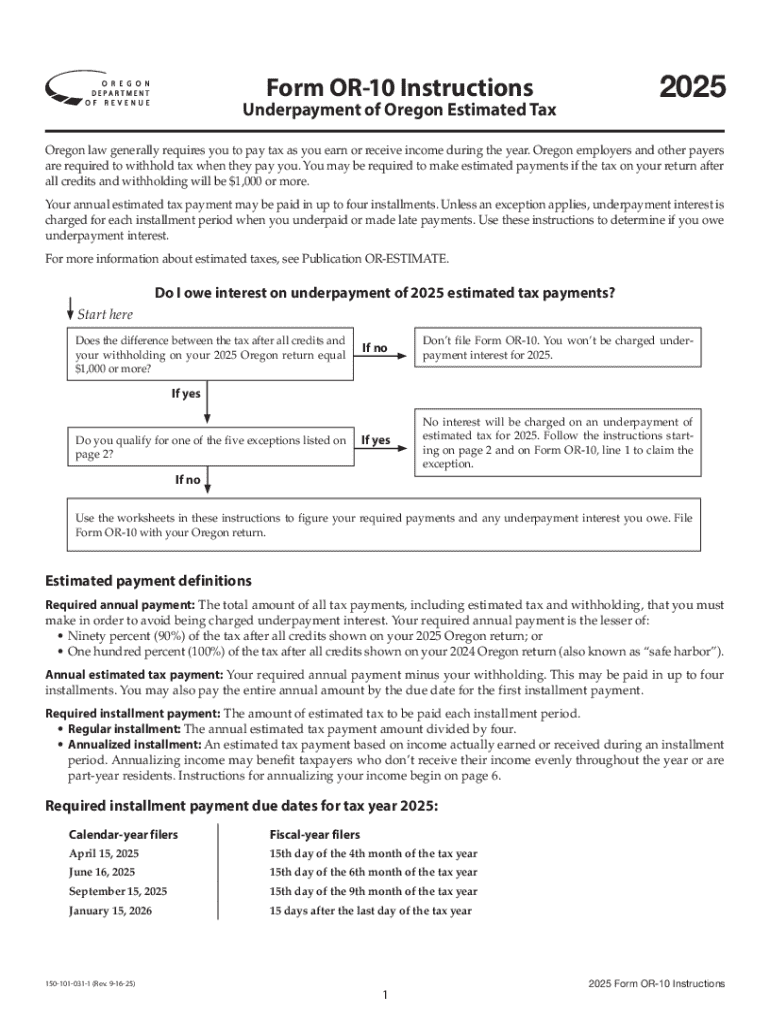

Get the free 2025 Form OR-10 Instructions, Underpayment of Oregon Estimated Tax, 150-101-031-1

Get, Create, Make and Sign 2025 form or-10 instructions

Editing 2025 form or-10 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form or-10 instructions

How to fill out 2025 form or-10 instructions

Who needs 2025 form or-10 instructions?

2025 Form OR-10 Instructions Form: A Complete Guide

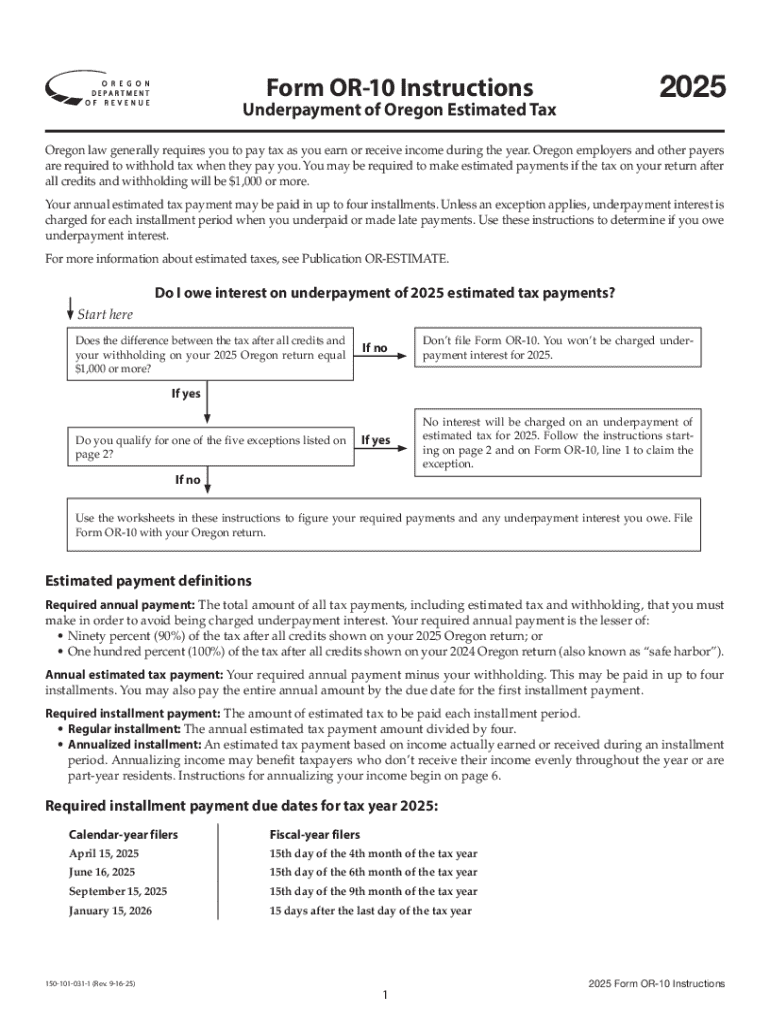

Overview of the 2025 Form OR-10

The 2025 Form OR-10 is a critical document used for reporting personal income and tax obligations to the Oregon Department of Revenue. This form is specifically designed for individual taxpayers who must declare their income and claim deductions accurately to meet state tax requirements.

Accurate completion of the 2025 Form OR-10 is essential, not only for ensuring compliance with state tax laws but also for maximizing potential refunds or minimizing tax liabilities. Any errors or omissions could lead to complications, including penalties or delayed refunds.

Individuals who earn income within Oregon, including residents and some non-residents, are required to file this form. Understanding when and how to file is crucial for maintaining good standing with the state tax authority.

Key features of the 2025 Form OR-10

The 2025 Form OR-10 consists of several sections that outline different aspects of income and deductions. Each section is tailored to capture specific information necessary for accurate tax assessment. Familiarity with these sections can significantly ease the process of form completion.

One of the main highlights of the 2025 version is the updated deduction limits, which reflect recent changes in state tax policies. Taxpayers should also take note of the modifications in reporting requirements that have been implemented for increased clarity.

Preparing to fill out the 2025 Form OR-10

Before tackling the 2025 Form OR-10, gathering the necessary documentation is crucial. This ensures that all reported information is accurate and verifiable, helping to streamline the filing process.

Key documents you’ll need may include personal identification details, such as your Social Security Number, along with various income statements, including W-2s and 1099s. It’s also advisable to have last year’s tax return at hand to reference previous deductions and credits.

Choosing your filing method is also important. You can opt for online submission or traditional paper filing. Utilizing tools such as pdfFiller allows for seamless completion and management of your forms, elevating the filing experience.

Step-by-step instructions for completing the 2025 Form OR-10

Completing the 2025 Form OR-10 involves several distinct sections, each requiring specific information. Understanding each section will help ensure that all necessary information is captured correctly.

Section 1: Personal Information

Begin by entering your personal details, including your name, residential address, and current contact information. Accuracy at this stage is essential, as any mistakes could lead to delays or miscommunication.

Section 2: Income and deductions

This section focuses on reporting your total income from various sources. Include salaried income, self-employment income, and other miscellaneous earnings. It’s equally important to review applicable deductions that might be claimed, such as retirement contributions and education credits.

Section 3: Calculation of tax liability

To calculate your tax liability, take your reported income and apply state tax rates. This section also includes opportunities to apply available credits and adjustments to reduce your overall tax owing.

Section 4: Additional information

In some cases, you may need to report special circumstances, such as business income or dependents. Having comprehensive records on these matters will simplify the submission process.

Section 5: Signature and declaration

Finally, do not forget to sign and date your form. An unsigned form is considered incomplete and could lead to significant issues. Explore e-sign options available through pdfFiller for an efficient and secure signing experience.

Common mistakes to avoid when completing the 2025 Form OR-10

Several common pitfalls can occur during the completion of the 2025 Form OR-10. Identifying these mistakes ahead of time can save you from potential hassles down the line.

Editing and managing your completed 2025 Form OR-10

Once your 2025 Form OR-10 is completed, editing and managing your document effectively can make a significant difference. Utilizing tools like pdfFiller allows easy access to your forms, enabling quick adjustments as needed.

Editing with pdfFiller is straightforward. Users can modify any section of the form directly from their cloud account, ensuring that all changes are up-to-date before submission. Moreover, having the option to save and retrieve your form at any time adds comfort.

Submitting the 2025 Form OR-10

Submitting the 2025 Form OR-10 involves understanding the various submission options available. Each method has its distinct pros and cons, but all aim to ensure successful delivery to the Oregon Department of Revenue.

Submission options overview

You can choose to mail your completed form their designated office or submit it electronically through platforms like pdfFiller. Paper submissions generally require more time and effort, whereas online submissions provide instant confirmation.

Once you submit the form, tracking the status of your submission can help confirm receipt and manage any follow-up communications required.

Frequently asked questions about the 2025 Form OR-10

As with any tax-related document, questions are common. Here, we’ll clarify some frequently asked questions to provide additional insights.

Tools and resources for efficient form management

Leveraging the right tools can significantly improve your experience while managing the 2025 Form OR-10. pdfFiller offers a variety of interactive tools to assist users in various stages of the form lifecycle.

Testimonials and user experiences

Users often share positive experiences when using pdfFiller for completing their 2025 Form OR-10. Many have noted the ease of editing, sharing, and e-signing as essential features that streamline their tax filing process.

Feedback reveals that the platform is user-friendly and that the customer service team is responsive to inquiries, making it a reliable choice for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 form or-10 instructions from Google Drive?

How do I edit 2025 form or-10 instructions on an iOS device?

How can I fill out 2025 form or-10 instructions on an iOS device?

What is 2025 form or-10 instructions?

Who is required to file 2025 form or-10 instructions?

How to fill out 2025 form or-10 instructions?

What is the purpose of 2025 form or-10 instructions?

What information must be reported on 2025 form or-10 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.