Get the free Form MO-2210 - 2025 Underpayment of Estimated Tax By Individuals - dor mo

Get, Create, Make and Sign form mo-2210 - 2025

Editing form mo-2210 - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form mo-2210 - 2025

How to fill out form mo-2210 - 2025

Who needs form mo-2210 - 2025?

Form MO-2210 - 2025 Form: A Comprehensive Guide

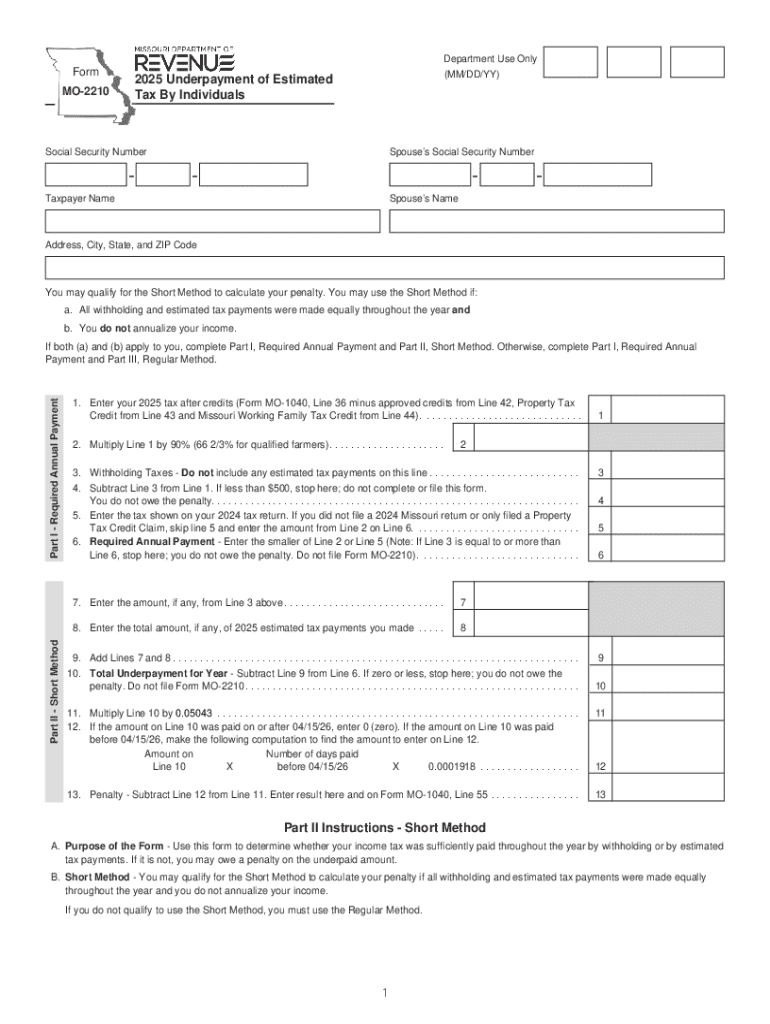

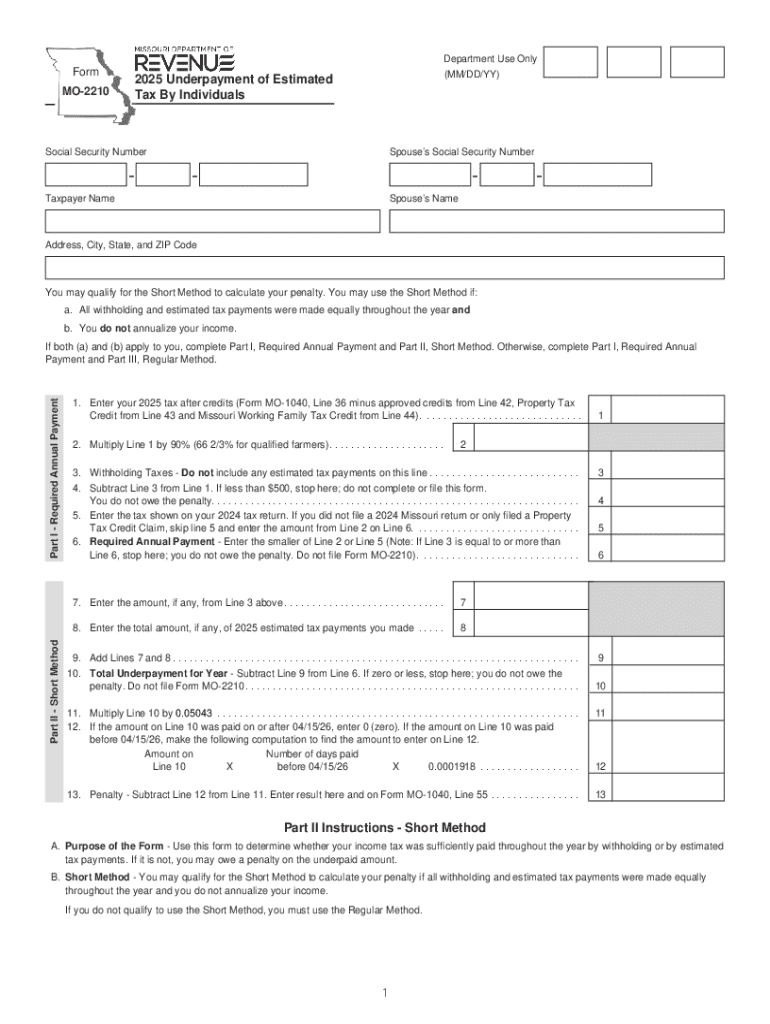

Understanding Form MO-2210

Form MO-2210 is a crucial tax document used by residents of Missouri to determine whether they owe an underpayment penalty on their state income tax. This form is primarily utilized when taxpayers have not made sufficient payments throughout the year, leading to a potential shortfall in their tax obligations. The importance of Form MO-2210 extends beyond mere compliance; it provides a structured method for calculating and addressing any penalties, thereby ensuring accurate dealings with the Missouri Department of Revenue.

For many taxpayers, understanding the intricacies of Form MO-2210 can simplify a potentially stressful tax filing process. Failing to use the form when necessary could result in significant penalties and interest on unpaid taxes, making it essential for individuals and businesses alike to grasp its necessity and implications during tax season.

Who needs to use Form MO-2210?

Any Missouri taxpayer who has underpaid their taxes during the year may need to utilize Form MO-2210. Specifically, individuals who did not pay at least 90% of their current year tax or 100% of the previous year's tax may find themselves required to file this form. Furthermore, self-employed individuals and businesses that experience fluctuating incomes throughout the year are particularly susceptible to underpayment scenarios.

Situations that necessitate the completion of Form MO-2210 include changes in income due to job changes or unexpected financial hardships, coupled with insufficient tax withholding from paychecks. Understanding when this form is applicable can help taxpayers avoid costly mistakes and navigate the complexities of Missouri state taxation.

Navigating the 2025 Form MO-2210

Accessing the latest version of Form MO-2210 for 2025 is straightforward through pdfFiller. Simply visit the official pdfFiller website, where you can find the form available for download in PDF format. This platform also offers additional tools to facilitate the completion of the form, ensuring a user-friendly experience for both beginners and seasoned taxpayers.

The layout of Form MO-2210 is designed for efficiency and clarity. It is divided into distinct parts: Part A gathers general information about the taxpayer, Part B focuses on underpayment details, Part C outlines payment options, and finally, Part D requires the taxpayer's signature and date. Understanding this organization will make it easier to accurately complete the form and avoid unnecessary errors.

Step-by-step instructions for filling out Form MO-2210

Before diving into Form MO-2210, it is crucial to have all necessary documentation on hand. Required information typically includes your Social Security number, income statements, and details regarding any estimated tax payments made throughout the year. This preparation will not only streamline the process but also help ensure all financial data is accurately reflected on the form.

To begin filling out the form, start with Part A, where you will provide your general information such as name, address, and Social Security number. Ensure that all personal details are accurate to prevent any complications during submission. Moving to Part B, focus on underpayment calculations—here, you will detail the amounts owed and any penalties incurred due to underpayment. In Part C, indicate your preferred payment methods, which can include options like electronic funds transfer or credit card payments. Lastly, don't forget Part D, where signing and dating the form is essential to validate your submission.

Tips for successfully completing Form MO-2210

Common mistakes while filling out Form MO-2210 can lead to unnecessary complications. One major error is failing to accurately calculate the amounts due, either from misreading instructions or neglecting to double-check provided data. To avoid these pitfalls, always take the time to review each section thoroughly before finalizing your form. This simple precaution can prevent potential penalties and help ensure compliance with state tax requirements.

Utilizing pdfFiller's features can greatly enhance your accuracy in completing Form MO-2210. The platform provides advanced editing tools that allow you to fill out the form electronically, thus reducing the likelihood of typographical errors. Additionally, take advantage of features such as e-signatures for quick approval from partners or advisors while collaborating efficiently through the platform's shared functionalities. This approach not only streamlines the process but fosters transparency among involved parties.

Submitting your Form MO-2210

Once Form MO-2210 is completed, the next step is submission. There are various methods available, including traditional mailing and digital submission via pdfFiller. Submitting electronically offers the advantage of immediate processing, significantly reducing the time before you receive confirmation of your submission.

Tracking the status of your submission is critical, especially if you submit via mail. Utilizing pdfFiller allows you to monitor the status of your form through the platform, providing peace of mind. It is also advisable to keep records, including copy confirmations and tracking numbers for any mailed documents. This practice ensures you have all necessary documentation should any issues arise later on.

Frequently asked questions about Form MO-2210

One common concern among taxpayers is what to do if they realize they've completed their Form MO-2210 incorrectly. If errors are found after submission, do not panic. Missouri taxpayers can typically file an amended return to correct the oversight. It’s vital to act promptly to minimize any penalties or interest that may accrue due to delayed payments.

Another frequently asked question addresses how Form MO-2210 impacts overall tax filing obligations. This form, while specific to underpayment penalties, directly influences the total amount owed when filing your state taxes. Failure to address any underpayment could lead to additional penalties during the overall filing process, underscoring its importance as a component of responsible tax management.

Taxpayers should also be aware of the potential penalties for not filing Form MO-2210 when required. Failing to submit the form on time can lead to not only additional penalties but also interest charges on any outstanding tax balance, compounding the original payment obligation. Therefore, awareness and timely action are crucial in navigating Missouri's tax landscape.

Additional resources and tools

Utilizing interactive calculators and templates can significantly ease the burden of preparing taxes. Online tools can help estimate potential tax liabilities and assess payments owed, providing insightful guidance to assist in completing Form MO-2210 accurately. Many trustworthy tax websites offer these tools free of charge, allowing users to compile their data effectively.

Moreover, understanding related forms and documentation is crucial to efficient tax filing. Taxpayers should familiarize themselves with documents like the Missouri Income Tax Return and the Form MO-2, which could complement the information required for Form MO-2210. Being well-informed about surrounding documentation helps to create a comprehensive view of tax obligations and ensures a smoother filing process.

Engaging with the pdfFiller community

Real-life experiences from users highlight how pdfFiller has simplified tax document management for many. Users frequently report that the platform's editing and collaborative features allow for streamlined communication and efficiency, particularly during tax season. This aspect fosters better documentation practices, ultimately contributing to accurate and timely submissions.

We encourage readers to connect with others navigating similar tax challenges. Engaging with the pdfFiller community can provide additional insights, support, and shared experiences, which can be invaluable for both novice and experienced taxpayers. Discussing strategies and solutions collaboratively enhances learning and forms a supportive environment that fosters success in managing tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form mo-2210 - 2025 on an iOS device?

How do I edit form mo-2210 - 2025 on an Android device?

How do I complete form mo-2210 - 2025 on an Android device?

What is form mo-2210 - 2025?

Who is required to file form mo-2210 - 2025?

How to fill out form mo-2210 - 2025?

What is the purpose of form mo-2210 - 2025?

What information must be reported on form mo-2210 - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.