Get the free January 2024 S-240 Wisconsin Temporary Event Report (Modified Vendor Version)

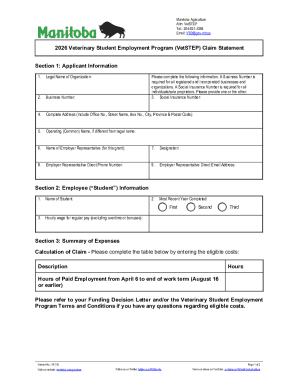

Get, Create, Make and Sign january 2024 s-240 wisconsin

Editing january 2024 s-240 wisconsin online

Uncompromising security for your PDF editing and eSignature needs

How to fill out january 2024 s-240 wisconsin

How to fill out january 2024 s-240 wisconsin

Who needs january 2024 s-240 wisconsin?

January 2024 S-240 Wisconsin Form: A Comprehensive Guide

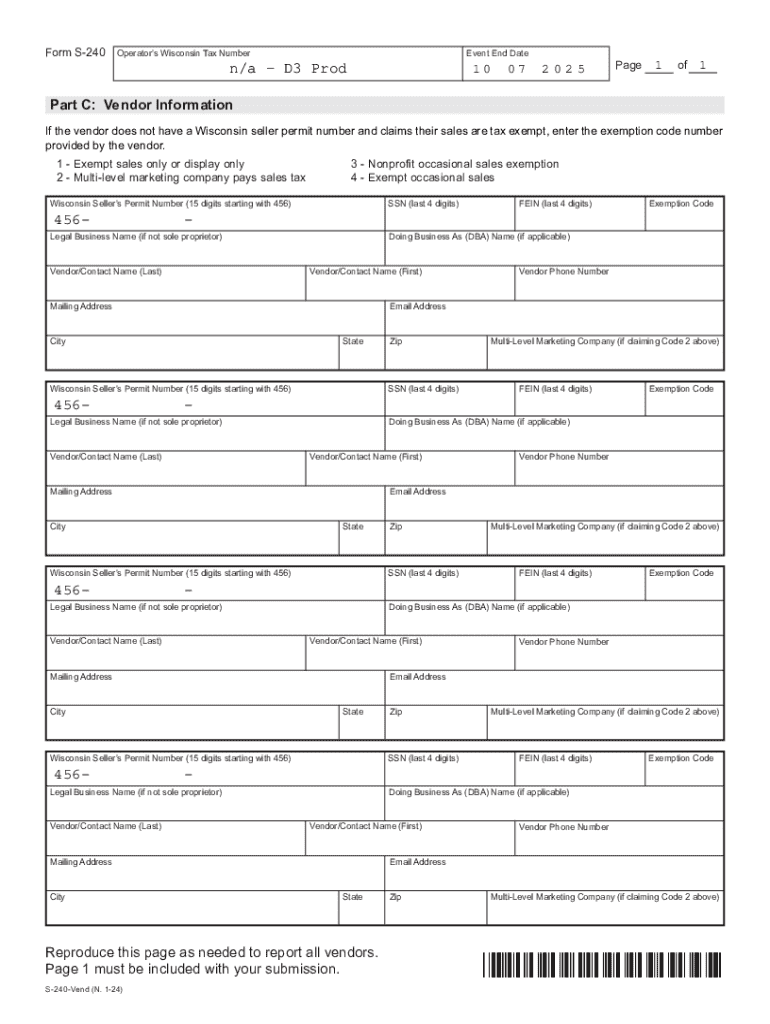

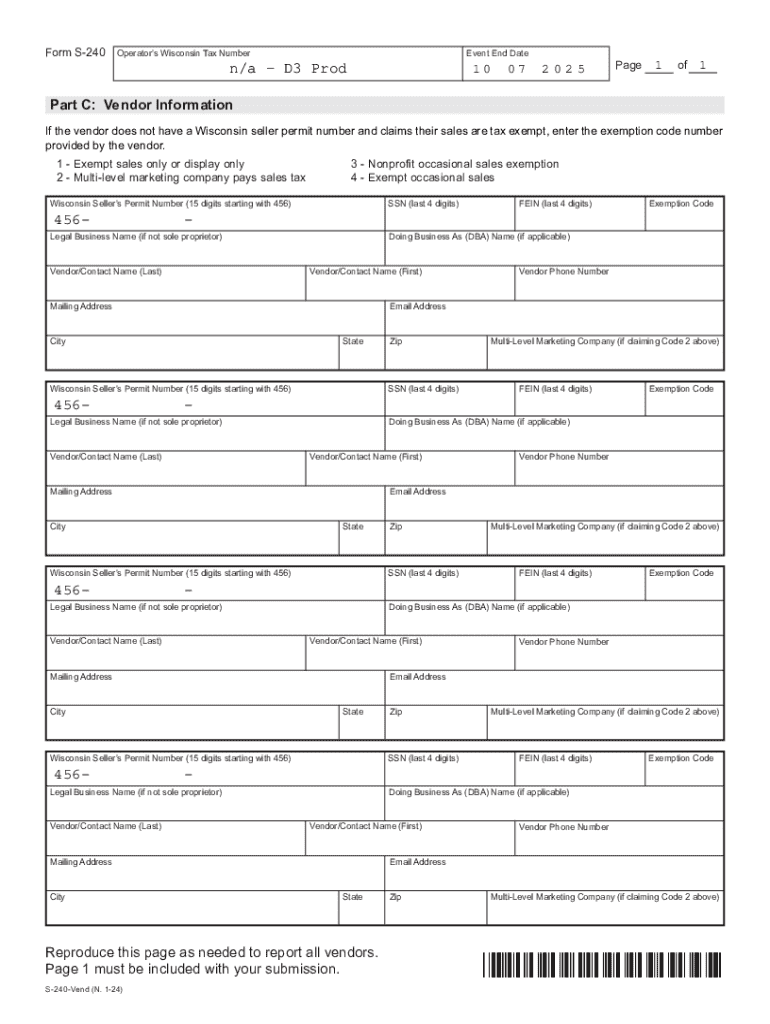

Overview of the S-240 Form

The S-240 form, officially known as the 'Wisconsin Nonresidential Income and Franchise Tax Return,' plays a pivotal role in the tax compliance landscape for Wisconsin businesses. This form is essential for entities that earn nonresidential income and are subject to franchise tax obligations within the state.

Completing the S-240 form accurately ensures that businesses are compliant with state tax regulations and helps avoid penalties or interest from the Wisconsin Department of Revenue. The January 2024 version incorporates critical updates that users must understand to file correctly.

Typically, all corporations, partnerships, and LLCs engaging in business activities generating income within Wisconsin will need to fill out the S-240. Understanding its nuances is vital for anyone involved in these entities for the upcoming filing period.

Key changes for January 2024

The January 2024 S-240 form introduces several key changes aimed at simplifying the filing process and reflecting state tax code updates. These changes include modifications to tax calculation methods, new reporting requirements, and adjustments in filing deadlines.

These updates are significant as they may alter how businesses approach tax planning for the year. For instance, alterations in deductions may directly impact a company's taxable income, potentially resulting in increased taxes owed or refunds.

Comparing this version to previous iterations illustrates a trend towards more user-friendly interfaces, with clearer instructions and streamlined sections.

Step-by-step guide to completing the S-240 form

Completing the S-240 form can be straightforward if approached systematically. This guide outlines each essential step to ensure accuracy in submissions.

### Step 1: Gathering Necessary Information The first step involves collecting all required documentation and information, including financial statements, previous tax returns, and information regarding income sources. Ensure you have accurate data to prevent delays or rejections.

### Step 2: Filling Out the Form Begin by entering your personal information, followed by financial sections. Pay particular attention to: - **Personal Information Section**: Ensure your name, address, and tax ID are correctly entered. - **Financial Information Section**: Input your total income, deductions, and calculate your tax based on the newly updated rates. - **Signature Section**: Don’t forget to sign and date the form, as unsigned forms will be deemed incomplete. Beware of common pitfalls, such as miscalculated figures and overlooking required signatures, which could lead to unnecessary delays.

### Step 3: Reviewing Your Information Before submitting, carefully review your information. Use this checklist: - Confirm your total income calculations. - Ensure all deductions claimed are adequately documented. - Verify your input matches the relevant source documents. Double-checking details can mean the difference between a smooth submission and a rejected form.

Editing the S-240 form with pdfFiller

pdfFiller provides an efficient platform to access and edit the S-240 form for January 2024. To get started, you simply need to navigate to pdfFiller’s website and search for the S-240 form.

Once accessed, the interactive tools allow for easy editing. Users can type directly into the form fields, ensuring all information is correctly formatted and legible. This feature significantly reduces the chances of errors that could lead to filing issues.

Utilizing pdfFiller for modifying forms comes with numerous benefits: - Real-time collaboration features to work with team members effectively. - Cloud storage capability to manage documents securely and access them from anywhere. - Template management options, allowing for quick retrieval of frequently used forms.

Electronic signing of the S-240 form

eSignatures offer a convenient and efficient method for signing the S-240 form electronically. The benefits include faster processing times and reduced reliance on physical paperwork, which is especially advantageous in the fast-paced business environment.

To eSign the S-240 using pdfFiller, follow these steps: 1. Open the S-240 form in pdfFiller. 2. Navigate to the signature section and opt for the eSignature option. 3. Follow prompts to create or insert your electronic signature. 4. Save the signed document. It's essential to note that electronic signatures have legal validity in Wisconsin, making them a reliable option for document completion.

Submitting the S-240 form

Once the S-240 form is completed and signed, you have two options for submission: electronic submission through the Wisconsin Department of Revenue website or traditional paper submission via mail.

If opting for electronic submission, ensure you receive a confirmation to track your submission status easily. For mailed forms, consider using tracking services to confirm receipt. Here are some important deadlines for January 2024 filings: - **Electronic Submission**: January 31, 2024 - **Paper Submission**: February 15, 2024

Troubleshooting common issues

As with any form submission, issues can arise. Here are some frequently asked questions regarding the S-240 form: - **What should I do if my S-240 form is rejected?** Review the rejection notice for specific errors and rectify them before resubmitting. - **How can I ensure my submission is received on time?** Use electronic methods or track your paper submission to confirm timely processing.

For assistance, the Wisconsin Department of Revenue offers a customer service line that can help with specific inquiries regarding forms and procedures. Keeping their contact information handy can save you time and frustration.

Additional tools and features from pdfFiller

Beyond just filling out forms, pdfFiller enhances the document management experience with additional features. Users can collaborate in real time, share forms easily amongst team members, and utilize cloud storage solutions for all your forms.

Moreover, pdfFiller supports saving drafts for later review, ensuring that your information is never lost before submission. Explore other forms and templates tailored for Wisconsin tax compliance available on pdfFiller to streamline your processes further.

Conclusion: maximizing your experience with the S-240 form

Through effective utilization of the January 2024 S-240 Wisconsin form, businesses can ensure a smooth tax-filing experience. pdfFiller serves as a powerful ally, empowering users to edit, eSign, and manage documents seamlessly from a cloud-based platform.

Encouraging the use of digital solutions like pdfFiller not only enhances document management efficiency but also promotes timely compliance with state regulations, ensuring that users maximize their experience and stay on top of their obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send january 2024 s-240 wisconsin for eSignature?

How do I edit january 2024 s-240 wisconsin in Chrome?

How do I complete january 2024 s-240 wisconsin on an Android device?

What is january 2024 s-240 wisconsin?

Who is required to file january 2024 s-240 wisconsin?

How to fill out january 2024 s-240 wisconsin?

What is the purpose of january 2024 s-240 wisconsin?

What information must be reported on january 2024 s-240 wisconsin?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.