Get the free Form 4466W Corporation or Pass-Through Entity Application ...

Get, Create, Make and Sign form 4466w corporation or

How to edit form 4466w corporation or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4466w corporation or

How to fill out 2025 ic-831 form 4466w

Who needs 2025 ic-831 form 4466w?

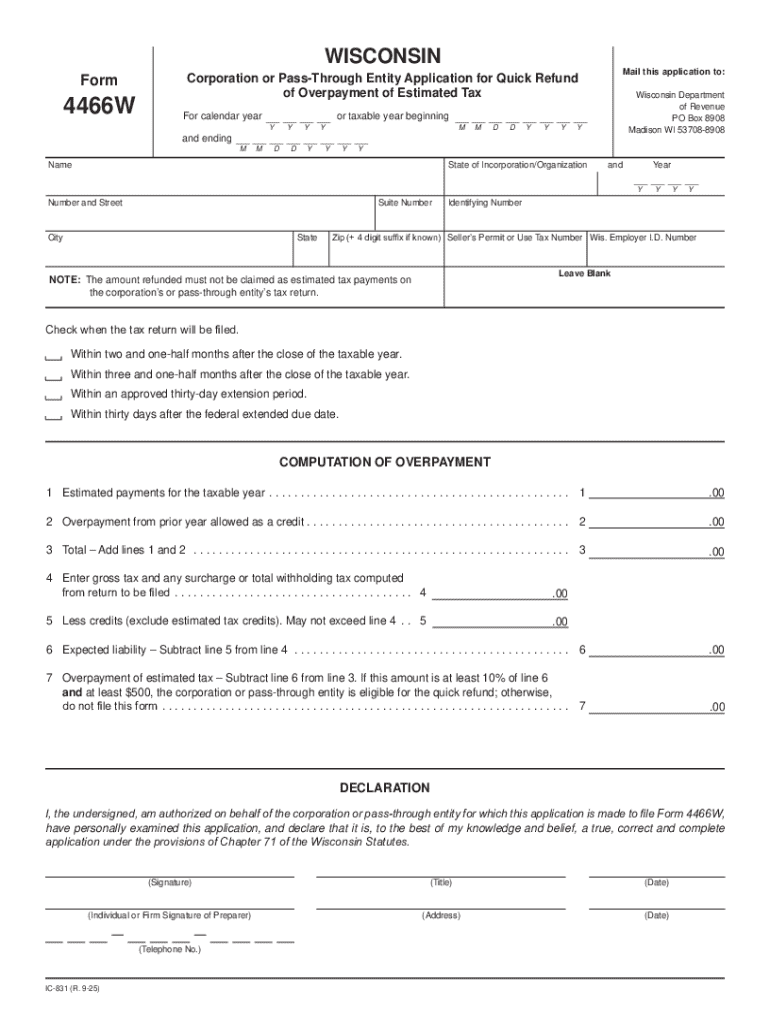

Understanding the 2025 -831 Form 4466W

Understanding Form 4466W: Quick overview

The 2025 IC-831 Form 4466W is a crucial document for taxpayers looking to request a fast refund for overpayments on their estimated tax. This form serves to expedite the refund process, allowing eligible taxpayers to reclaim excess payments more efficiently. It's specifically designed to cater to individuals and small businesses that have made estimated tax payments exceeding their actual tax liability.

Unlike other tax forms, such as Form 1040 or Form 4466, Form 4466W emphasizes the urgency of processing refunds for overpayments. This focus sets it apart by enabling a more expedited response as it caters specifically to immediate refund needs, enhancing cash flow for individuals and businesses alike.

Who should file Form 4466W?

Eligibility for filing the 2025 IC-831 Form 4466W primarily includes individuals and businesses who have overpaid their estimated tax payments for the current tax year. If you qualify as a taxpayer who made higher estimated payments than your tax liability, you should consider this form. Filing can be particularly beneficial for freelancers, independent contractors, and small business owners who often face variable income and tax situations.

Common scenarios prompting a refund request include unexpected financial losses that lower your tax obligation, substantial one-time income events where you overestimated tax liabilities, or simply a general overpayment made throughout the tax year. By filing Form 4466W, taxpayers can conveniently recover their funds and use that capital for other essential expenditures, thereby enhancing their cash flow.

Key components of Form 4466W

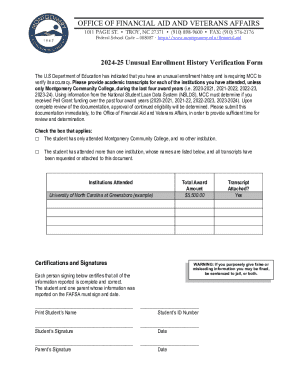

The 2025 IC-831 Form 4466W is divided into three primary sections, each vital for correctly submitting your overpayment request. First, the 'Identification Information' portion collects essential personal details, including your name, address, and taxpayer identification number. Accuracy in this section ensures that your request is properly matched to your tax profile.

In Part 2, you will report the 'Overpayment of Estimated Tax'. This section requires you to detail the amounts paid and the periods associated with each payment. It's crucial to retain documentation supporting your claims to prevent delays in processing. Lastly, Part 3 concerns the specific 'Refund Request Details'. Here, you will outline the refund amount you are claiming, providing additional information that confirms the legitimacy of your request.

Common mistakes to avoid include incorrectly reporting your identification details, miscalculating the tax amounts due, or overlooking supporting documentation. Ensuring meticulous attention to detail can significantly smoothen your refund process.

Step-by-step instructions for filling out Form 4466W

Completing the 2025 IC-831 Form 4466W requires careful preparation. The first step is to gather all necessary documentation, including prior tax returns and statements of estimated payments. Having these documents on hand will make filling out the form much more manageable and accurate.

Next, proceed to complete the form. Take your time to input the required information, ensuring accuracy, especially in the identification section. Filling out the 'Overpayment of Estimated Tax' section requires precise figures, as errors here could delay processing times. Lastly, when detailing your refund request, clearly state the amount you expect based on accurate calculations.

Before you submit your form, take a moment to review the entire document. Verify that all information is complete and accurate. Establish a checklist to confirm all necessary parts are filled out and that documents supporting your claims are attached firmly. This step significantly reduces the chances of rejection or delays.

Submitting Form 4466W: options and best practices

Once your 2025 IC-831 Form 4466W is complete, you have several options for submission. Generally, you can file the form by mail, sending it directly to the IRS service center specified in the form’s instructions. Alternatively, electronic filing may be available depending on your situation, which can expedite the processing time.

You should also track your submission status. If you opted for mailed submission, consider using certified mail or a similar service that provides a tracking number. This can offer peace of mind and provide proof of submission should any issues arise.

If there are problems with your submission, the IRS will typically notify you via mail. It’s essential to address any issues promptly to avoid extended delays on your refund. Keeping accurate records of your communications and submissions can significantly aid in resolving any discrepancies that arise.

Managing your refund: what to expect after submission

After submitting your 2025 IC-831 Form 4466W, expect typical processing times ranging from a few weeks to several months, depending on the IRS's backlog and the complexity of your case. It’s crucial to keep a record of the submission date and any communication pertaining to your refund for future inquiries.

Understanding how your refund is calculated involves a deep dive into your estimated payments versus actual liabilities. If the IRS discovers discrepancies during processing, they will reach out for clarification, which could delay your refund further.

In the event your refund is delayed or found to be incorrect, initiate contact with the IRS as soon as you notice the issue. Providing them with all relevant documentation can help expedite the resolution process. Staying proactive and informed is critical to ensure smooth management of your refund.

Common questions about Form 4466W

Several common concerns arise when filling out the 2025 IC-831 Form 4466W. Frequently asked questions include inquiries about eligibility, processing time, and procedures for correcting errors. Clarifying terminology surrounding the form is essential for ensuring that first-time filers are comfortable and confident in their submissions.

For instance, many question how to determine the overpayment amount accurately. Consulting with tax professionals or using IRS guidelines can offer clarity. Experiences shared by users have highlighted the importance of thorough documentation and correct form completion strategies to avoid delays.

Related forms and resources

When considering the 2025 IC-831 Form 4466W, it’s also important to be aware of other relevant forms, such as the standard Form 4466 and Form 1040, which serves different purposes. Understanding these forms and how they relate can give you a broader context for your tax situation, particularly if you are managing a business or multiple income sources.

Always stay updated with filing dates and deadlines for related forms to ensure compliance. Utilizing government websites can be beneficial for finding the latest information regarding tax forms, including revisions or additional requirements that may affect your filing.

Interactive tools for document management

pdfFiller offers valuable tools for managing the 2025 IC-831 Form 4466W effectively. With the capability to create, edit, and submit your tax forms in a cloud-based environment, you can ensure your documents are accessible from anywhere. This platform simplifies form completion with user-friendly interfaces and templates tailored to your needs.

Using pdfFiller's eSignature capability allows you to sign Form 4466W electronically, enhancing the submission process, as it formalizes your request without delays commonly associated with mailing physical documents. Tutorials provided on the platform are beneficial for new users, offering walkthroughs on how to maximize the tool’s features for efficient document management.

User insights: experiences with Form 4466W

User experiences with the 2025 IC-831 Form 4466W have revealed both successes and challenges that can significantly inform future filers. Many individuals emphasize the necessity of double-checking calculations prior to submission, as errors can lead to frustrating delays in receiving refunds. First-time filers often share tips about seeking professional assistance or utilizing platforms like pdfFiller for straightforward completion and submission.

Moreover, collaboration features in pdfFiller allow multiple team members to actively engage in the form-filling process. This capability can lead to improved accuracy, ensure all necessary steps are completed, and streamline submissions when multiple parties are involved. Collecting collective experiences can illuminate best practices in navigating the complexities of tax refund requests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 4466w corporation or for eSignature?

How do I edit form 4466w corporation or on an Android device?

How do I fill out form 4466w corporation or on an Android device?

What is 2025 ic-831 form 4466w?

Who is required to file 2025 ic-831 form 4466w?

How to fill out 2025 ic-831 form 4466w?

What is the purpose of 2025 ic-831 form 4466w?

What information must be reported on 2025 ic-831 form 4466w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.