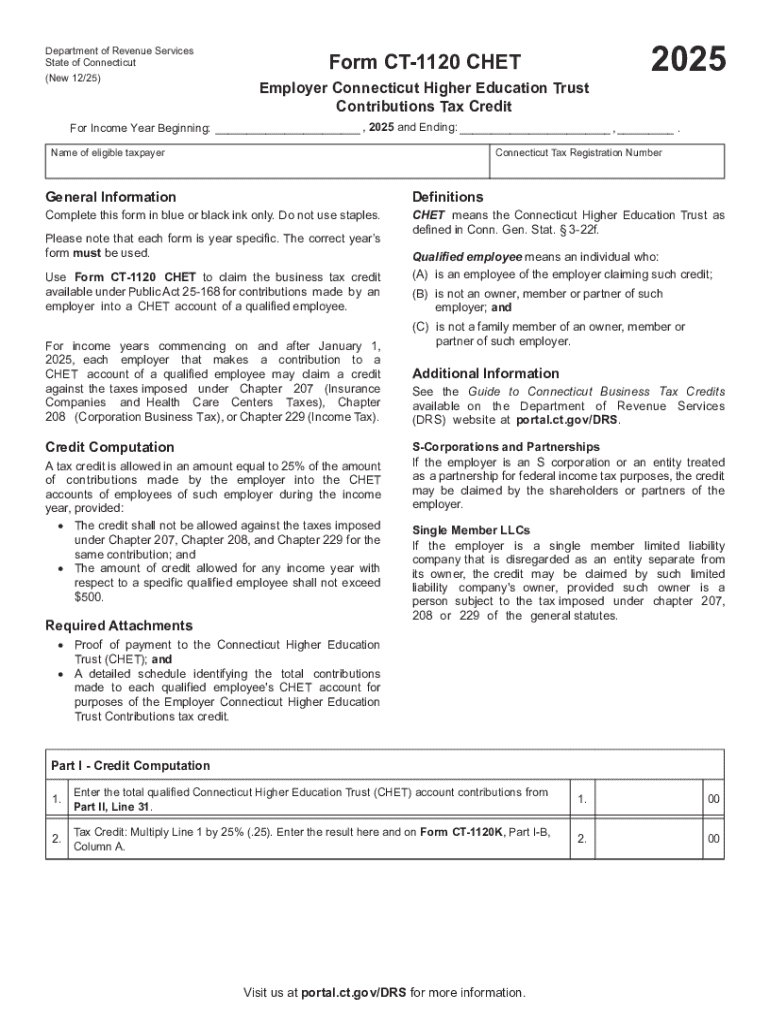

Get the free Form CT-CHET Employer Connecticut Higher Education Trust ...

Get, Create, Make and Sign form ct-chet employer connecticut

How to edit form ct-chet employer connecticut online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-chet employer connecticut

How to fill out form ct-chet employer connecticut

Who needs form ct-chet employer connecticut?

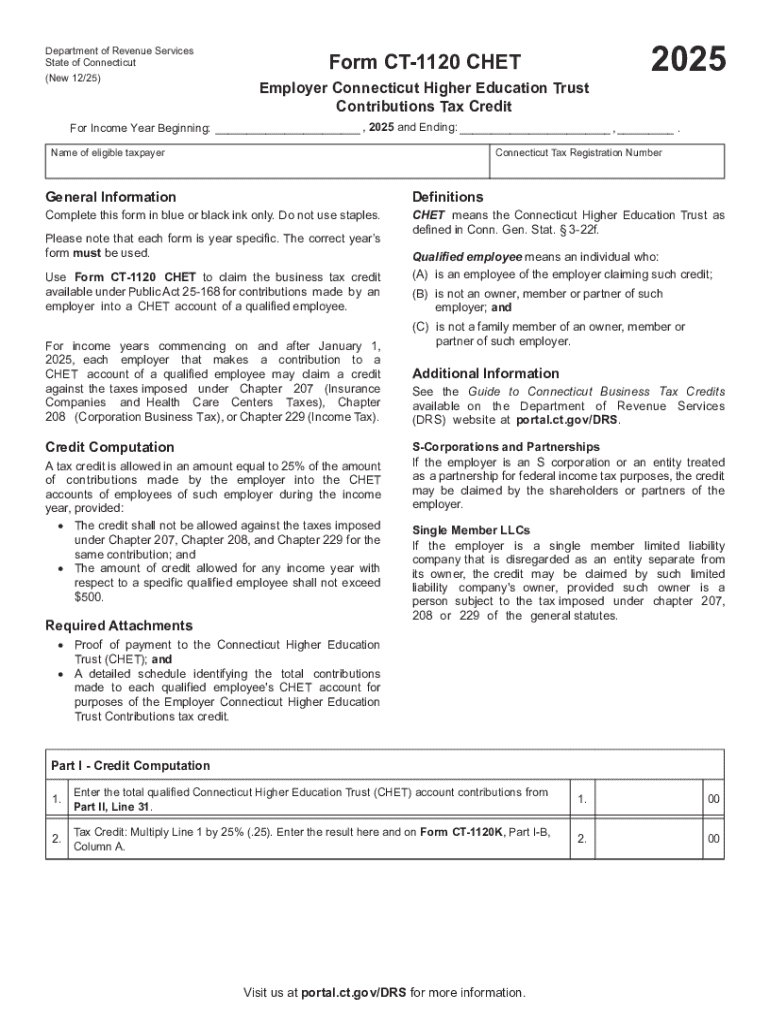

Understanding the CT-CHET Employer Form in Connecticut

Overview of the CT-CHET employer form

The Connecticut Collaborative for Health Equity and Transparency (CT-CHET) program was created to foster financial towards healthcare initiatives. A key document within this program is the CT-CHET Employer Form, which serves as a bridge between employers and the state's health initiatives. This form enables employers to register their participation and provide pertinent employee information crucial for state-wide healthcare accountability.

Step-by-step guide to filling out the CT-CHET employer form

Completing the CT-CHET Employer Form may seem daunting, but breaking it down into manageable steps can simplify the process. The first step is gathering the required information about both the employer and the employees.

Consult the following steps for a clear path towards successful form completion.

Common pitfalls when completing the CT-CHET employer form

Several errors can occur while filling out the CT-CHET Employer Form, which may lead to unnecessary delays. Understanding these common pitfalls can help ensure smooth submission.

Interactive tools for managing the CT-CHET employer form

Utilizing tools like pdfFiller can greatly enhance your workflow regarding the CT-CHET Employer Form. These interactive tools provide an intuitive experience for managing documentation.

Frequently asked questions (FAQs) about the CT-CHET employer form

Employers often have queries regarding the CT-CHET Employer Form submission process. Below are answers to some of the most common questions.

Best practices for employers using the CT-CHET program

Employers can maximize the benefits of the CT-CHET program by adhering to specific best practices that ensure compliance and enhance communication.

Real user experiences: case studies of successful CT-CHET implementation

Several Connecticut employers have successfully implemented the CT-CHET program, providing testimonials about the positive impact on their organizations.

The role of pdfFiller in simplifying CT-CHET form management

pdfFiller plays a pivotal role in transforming how the CT-CHET Employer Form is managed. Its robust cloud-based solutions allow users to efficiently create, edit, and submit necessary documents.

Future of the CT-CHET program

With the continuous evolution of healthcare policies, the CT-CHET program is anticipated to expand and adapt over time. This could involve new requirements and enhancements that will affect how employers interact with forms like the CT-CHET Employer Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form ct-chet employer connecticut from Google Drive?

Where do I find form ct-chet employer connecticut?

How do I edit form ct-chet employer connecticut on an iOS device?

What is form ct-chet employer connecticut?

Who is required to file form ct-chet employer connecticut?

How to fill out form ct-chet employer connecticut?

What is the purpose of form ct-chet employer connecticut?

What information must be reported on form ct-chet employer connecticut?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.