Get the free Ohio School District Estimated Income Tax Vouchers

Get, Create, Make and Sign ohio school district estimated

How to edit ohio school district estimated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ohio school district estimated

How to fill out ohio school district estimated

Who needs ohio school district estimated?

A comprehensive guide to the Ohio School District Estimated Form

Understanding the Ohio School District Estimated Form

The Ohio School District Estimated Form is a critical document that allows residents of Ohio to estimate their school district income tax liability. Its primary purpose is to facilitate accurate payment of estimated school taxes, which is essential for funding educational services and programs. This form not only reflects an individual's or business's expected income tax payments based on current and past earnings, but it also helps districts project and manage their resources effectively.

This form is vital for Ohio school districts as it ensures that they have a predictable revenue stream, which is necessary for budgeting and planning educational activities. Additionally, it plays a crucial role for taxpayers, allowing them to avoid underpayment penalties while ensuring they are meeting their tax responsibilities throughout the year.

Eligibility and requirements

Eligibility to file the Ohio School District Estimated Form typically includes individuals who reside in a school district that imposes an income tax. This encompasses both employees earning income and self-employed individuals who need to calculate their estimated payments. Understanding the local school district's tax laws helps determine the exact payment due and any specific requirements that may apply.

Individuals and entities must also provide specific documentation when completing the estimated form. Commonly required documents include previous year’s tax returns, current pay stubs, or earnings statements that provide insight into expected future income. However, many misconceptions arise regarding this form. For instance, some believe that all taxpayers within a district are required to file, but this only applies to those who have taxable income subject to the district's income tax.

How to determine your estimated payments

Determining your estimated payments involves analyzing several key factors. One must consider previous income levels, any anticipated changes in earnings, and applicable tax rates based on the school district. Additionally, it's crucial to review any withholding amounts already deducted from paychecks throughout the year, as these will directly affect total liability.

Calculating estimated payments can be done through a series of straightforward steps. Begin by estimating your expected income for the year, apply the appropriate district tax rate, and subtract any applicable credits or withholdings. Utilizing financial calculators and tools designed for estimating taxes can enhance accuracy and streamline the process.

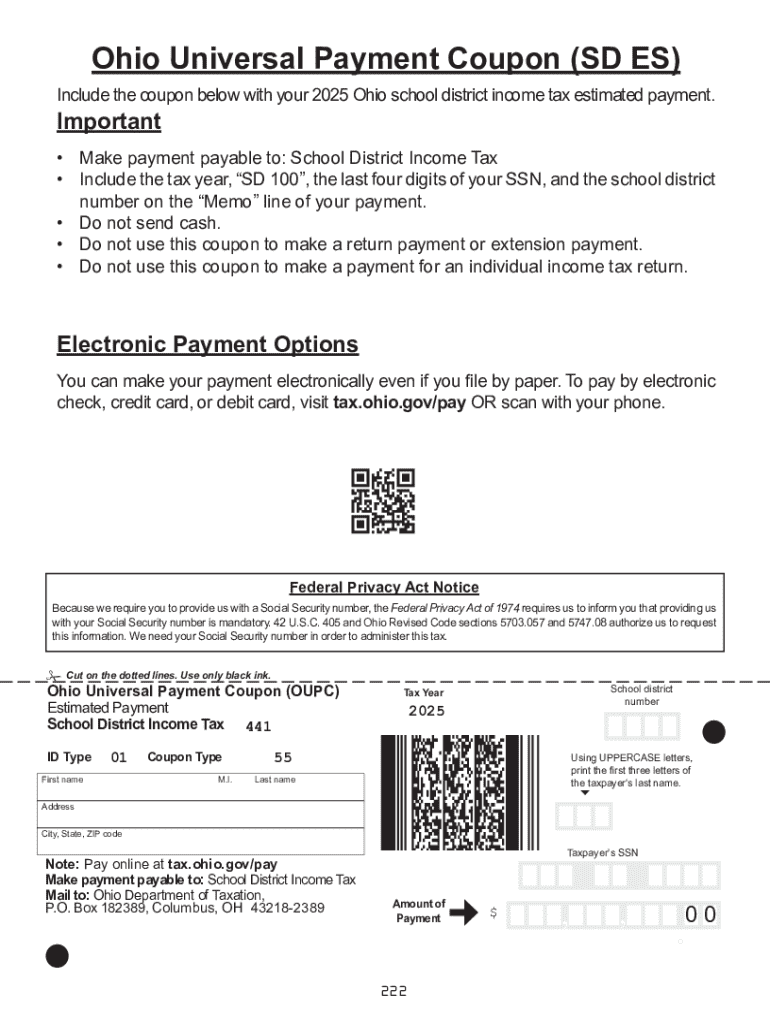

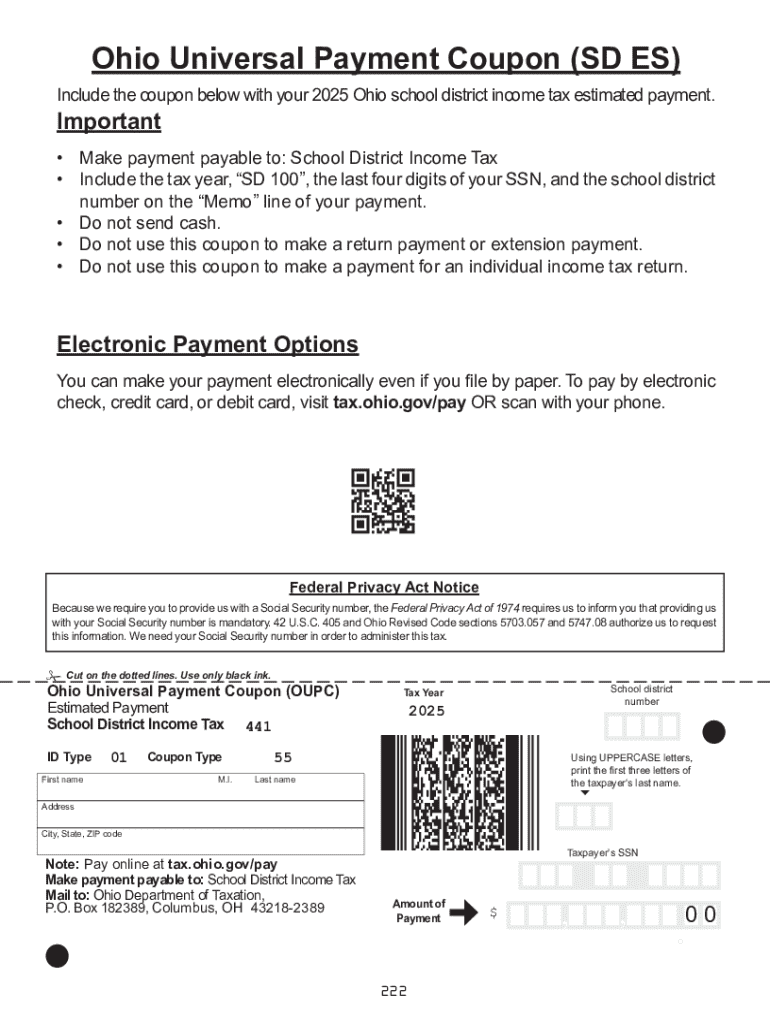

Detailed instructions for filling out the Ohio School District Estimated Form

Filling out the Ohio School District Estimated Form requires meticulous attention. Start by entering your personal details accurately, including your name, address, and social security number. Then, provide your estimated income and calculate your expected school district income tax liability based on the available rates.

The form may include interactive features, especially on platforms like pdfFiller, that enable users to auto-fill sections based on previous data or add necessary calculations automatically. During completion, be mindful of common pitfalls such as miscalculating income or overlooking eligible deductions, which can lead to inaccurate taxes owed.

Submission process

Once the Ohio School District Estimated Form is completed, the next step is understanding the submission process. Typically, these forms can be submitted online through the Ohio Department of Taxation’s website or directly to the local school district’s tax office. It’s crucial to adhere to the deadlines established by state law to avoid incurring penalties for late submissions.

Additionally, tracking the status of your submission can often be done through the online platform, providing peace of mind and ensuring that your estimated payments are recorded correctly. Keeping a copy of the submitted form for your records is highly recommended.

Payment methods available

When it comes to making payments based on the Ohio School District Estimated Form, multiple methods are often available. Taxpayers can typically select from online payment options, traditional mail, or in-person visits at their district's office. Each method has its own process, and understanding them is essential to ensure timely and accurate payments.

For online payments, users usually gain access via their district's tax portal, where they can use credit or debit cards. In-person payments often require filling out an additional form at the office, while mail-in payments should include a copy of the completed estimated form to ensure proper allocation.

Consequences of not making estimated payments

Failing to fulfill your estimated payment obligations can result in serious consequences. Penalties and fines can be imposed, significantly increasing your overall tax burden. Furthermore, delayed payments may adversely affect the budgeting capabilities of your school district, potentially leading to cuts in educational programs and resources that directly impact students.

Long-term implications can include not just financial burdens but also diminished funding for extracurricular activities, facilities, and technology upgrades within the district. It is imperative for residents to recognize the critical role their estimated payments play in maintaining quality education in their area.

FAQs related to the Ohio School District Estimated Form

Frequently asked questions about the Ohio School District Estimated Form often include important considerations. For example, what should you do if you need to amend your estimated payment? In general, taxpayers can adjust their estimated payments by submitting a revised form or through online platforms designated for amendments.

Another concern is whether joint filings are permissible between two districts. This can be complex and generally depends on the specific regulations of each district involved. If your financial situation changes mid-year, it's crucial to reassess and possibly adjust your estimated payments to align with your current income reality, thus avoiding excessive underpayments that could lead to further penalties.

Utilizing pdfFiller’s platform for document management

When it comes to managing your Ohio School District Estimated Form, utilizing pdfFiller’s platform offers numerous benefits. This cloud-based solution allows users to seamlessly edit their forms, eSign where necessary, and collaborate with tax professionals or team members efficiently. Moreover, the ease of accessing documents from any device ensures users can manage their forms on-the-go.

By leveraging pdfFiller, users can eliminate the hassle of paper forms by utilizing features such as real-time edits and version tracking, which are instrumental for maintaining accuracy throughout the filing process. Overall, it stands as an ideal partner for individuals and teams navigating tax-related documentation.

Case studies: Successful form submissions using pdfFiller

Numerous real-life examples demonstrate the effective use of pdfFiller for submitting the Ohio School District Estimated Form. Users have reported smoother submissions and speedier processing times due to the platform's intuitive features, helping them avoid common filing errors associated with traditional paper forms.

This feedback underscores how pdfFiller has empowered individuals and organizations to navigate their filing processes with confidence. Whether users are seeking to minimize errors or maintain a clear record of communication with their school districts, pdfFiller consistently provides a satisfying solution.

Next steps after submission

After submitting your Ohio School District Estimated Form, it’s crucial to stay proactive about your payment status. Raise any concerns or queries with your school district promptly to resolve issues that may arise. Regular follow-up can ensure that all paperwork is in order and your requests or inquiries are handled efficiently.

Preparations for the upcoming year should also begin as you analyze your financial standing and adjust estimates for the next cycle. By maintaining awareness of any changes in district tax rates or your income status, you can set yourself up for future success and mitigate any potential challenges down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ohio school district estimated on an iOS device?

How do I edit ohio school district estimated on an Android device?

How do I complete ohio school district estimated on an Android device?

What is ohio school district estimated?

Who is required to file ohio school district estimated?

How to fill out ohio school district estimated?

What is the purpose of ohio school district estimated?

What information must be reported on ohio school district estimated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.