Get the free Instructions for Preparing - 2025 FORM 500 - Virginia Tax

Get, Create, Make and Sign instructions for preparing

Editing instructions for preparing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for preparing

How to fill out 2025 schedule 500fed

Who needs 2025 schedule 500fed?

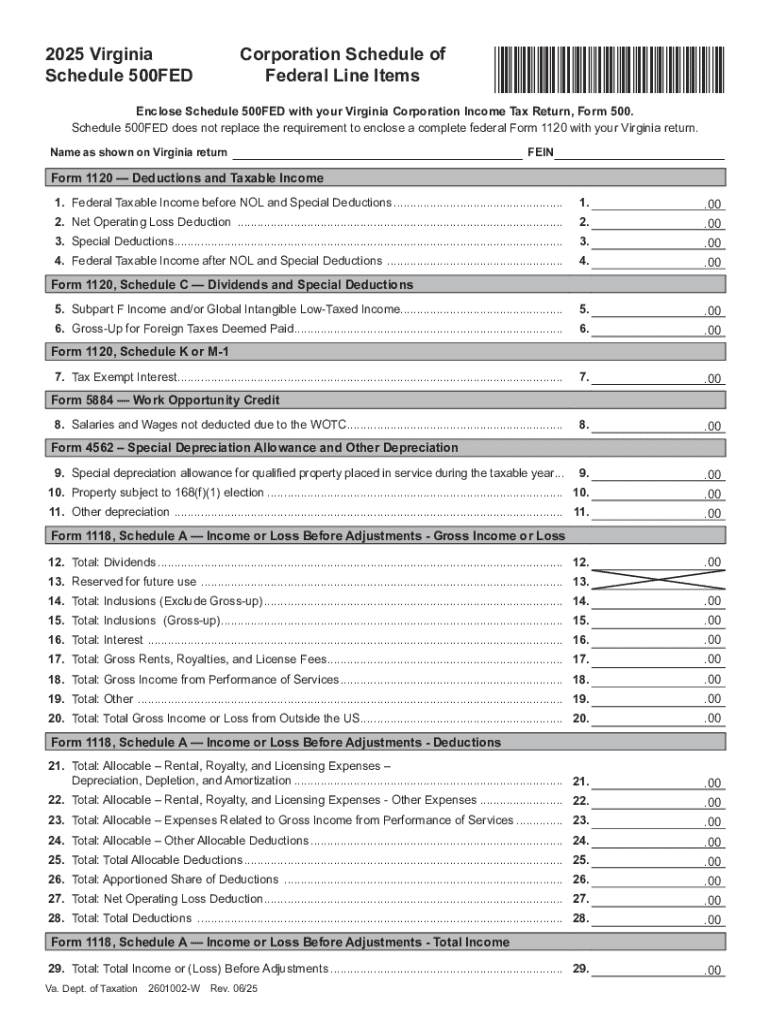

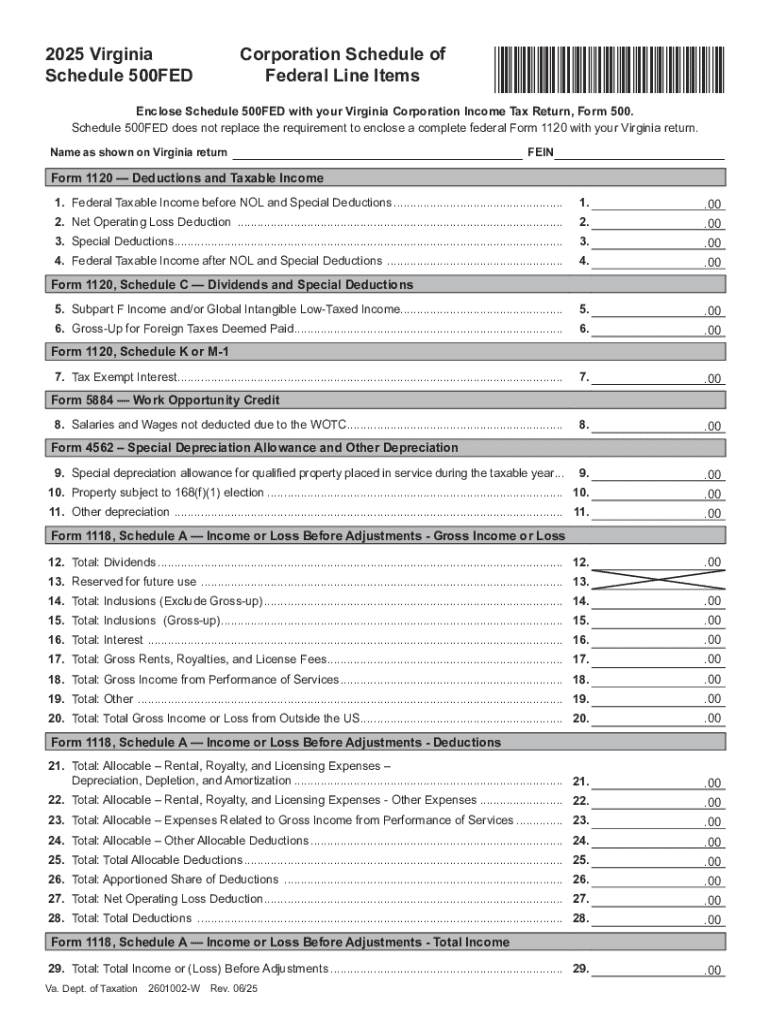

A comprehensive guide to the 2025 Schedule 500FED Form

Understanding the 2025 Schedule 500FED Form

The 2025 Schedule 500FED Form is a crucial document for various individuals and entities tasked with tax reporting. Designed to transparently disclose income and expenses, this form is integral in ensuring compliance with federal and state tax regulations. By providing accurate information, filers can avert audits and potential penalties, making the Schedule 500FED an essential component of responsible tax management.

Its importance spans across different sectors, impacting not just personal finances but also the operational capabilities of businesses. Filing this form accurately ensures that stakeholders are aware of their tax obligations, promoting financial transparency and integrity within the tax system.

Who needs to file the 500FED?

Eligibility to file the 500FED Form typically includes individuals or organizations who derive income that must be reported to the IRS. This encompasses self-employed individuals, partnerships, and corporations that are subject to federal taxation. Understanding these criteria is vital for proper compliance.

Common scenarios for filing include freelancers reporting self-employment income, corporations maintaining transparency regarding earnings, and even small businesses aiming to show their operational profit and loss. Each scenario carries unique requirements, but the overarching theme is transparency and compliance with tax regulations.

Key features of the 2025 Schedule 500FED Form

The 2025 Schedule 500FED Form has several essential components, each designed to capture specific financial information vital for tax calculation. The form typically includes sections for personal information, financial details like income and expenses, and a series of tax calculation fields.

Among the key features, the breakdown of line items allows filers to specify different sources of income and applicable deductions meticulously, ensuring a comprehensive view of their tax situation. This detailed layout is beneficial when completed correctly, providing clear insights into an individual's or business's financial standing.

Updates and changes in 2025

For 2025, significant updates include adjustments to income thresholds, deductibles, and additional documentation requirements aimed at reducing fraudulent filings. These changes can impact how filers prepare their tax documents and the auxiliary information they need to gather.

Comparing with previous years, these updates seek to address evolving financial landscapes and enhance the accuracy of reported data. Consequently, understanding these modifications can simplify the filing process and reduce errors.

Step-by-step guide to completing the Schedule 500FED Form

Before diving into filling out the Schedule 500FED Form, preparation is key. Gather all necessary documents, including prior tax returns, income statements, and any financial records pertinent to your filing. Knowing deadlines is equally crucial to avoid late penalties.

Once prepared, follow these steps:

While filling out the form, be cautious of common mistakes that could lead to rejection. These errors may include incomplete or illegible information, numerical discrepancies, or mismatched data that does not align with IRS records.

Utilizing pdfFiller for seamless completion

Choosing pdfFiller for completing the 2025 Schedule 500FED Form offers numerous advantages. This platform provides users with easy access to templates tailored explicitly for this form, resulting in an efficient and intuitive filling process. Additionally, pdfFiller’s cloud-based document management ensures that you can access and work on your forms from anywhere, fostering convenience and flexibility.

With interactive tools, users can fill, edit, and sign the form online with ease. The platform allows for real-time collaboration, enabling teams to work together seamlessly on the document, optimizing the filing process.

Advanced tips and tricks for successful filing

Maximizing the capabilities of pdfFiller involves utilizing its collaborative features effectively. By inviting team members to join in the filing process, you can ensure accuracy through multiple sets of eyes. Real-time collaboration allows for adjustments and feedback on the go, leading to a polished final form.

Managing multiple filings can be cumbersome, but utilizing pdfFiller’s organizational tools can streamline this process. Users can categorize and track their forms easily, ensuring that each submission is timely and organized for future reference.

Helpful resources and tools

To aid in your completion of the Schedule 500FED Form, a range of web resources offers valuable guidance. The IRS provides comprehensive information related to the form, while several blogs and forums present additional insights shared by tax professionals and other filers.

Within pdfFiller, users can access extensive FAQs and customer support options. Engaging with the community can also lead to enriching discussions and shared experiences that provide a deeper understanding of the process.

Connecting with us

Engaging with pdfFiller’s community can enhance your overall experience. Join forums and discussions to share your experiences and troubleshoot any issues you encounter during the filing process.

Stay updated on the latest document management trends through newsletters, blogs, and webinars. These resources can enrich your knowledge and keep you informed about new features that could benefit your filing experience.

Pagination and additional insights

Navigating the Schedule 500FED Form is streamlined within pdfFiller, enabling users to scroll and locate specific sections quickly. Utilizing the search functionality can dramatically reduce the time spent hunting for critical fields or instructions.

For personalized queries or direct assistance, the support team at pdfFiller is readily available. Their expertise can provide tailored guidance to ensure your experience with the 2025 Schedule 500FED Form is smooth and efficient.

Next steps after filing your Schedule 500FED

Once you have successfully submitted the Schedule 500FED Form, confirmation processes begin. You should expect to receive confirmation from the IRS regarding the acceptance of your submission. Monitoring your submission status can provide peace of mind as tax processing timelines are known to vary.

If your form encounters any issues resulting in rejection or queries, it’s vital to follow up promptly. Best practices include carefully reviewing the communication from the IRS and addressing any outlined concerns swiftly to mitigate potential penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send instructions for preparing to be eSigned by others?

How do I execute instructions for preparing online?

How can I fill out instructions for preparing on an iOS device?

What is 2025 schedule 500fed?

Who is required to file 2025 schedule 500fed?

How to fill out 2025 schedule 500fed?

What is the purpose of 2025 schedule 500fed?

What information must be reported on 2025 schedule 500fed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.