Get the free Instructions for Virginia Nonresident Tax Form 763

Get, Create, Make and Sign instructions for virginia nonresident

Editing instructions for virginia nonresident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for virginia nonresident

How to fill out 2025 form 763 virginia

Who needs 2025 form 763 virginia?

2025 Form 763 Virginia Form: A Comprehensive Guide

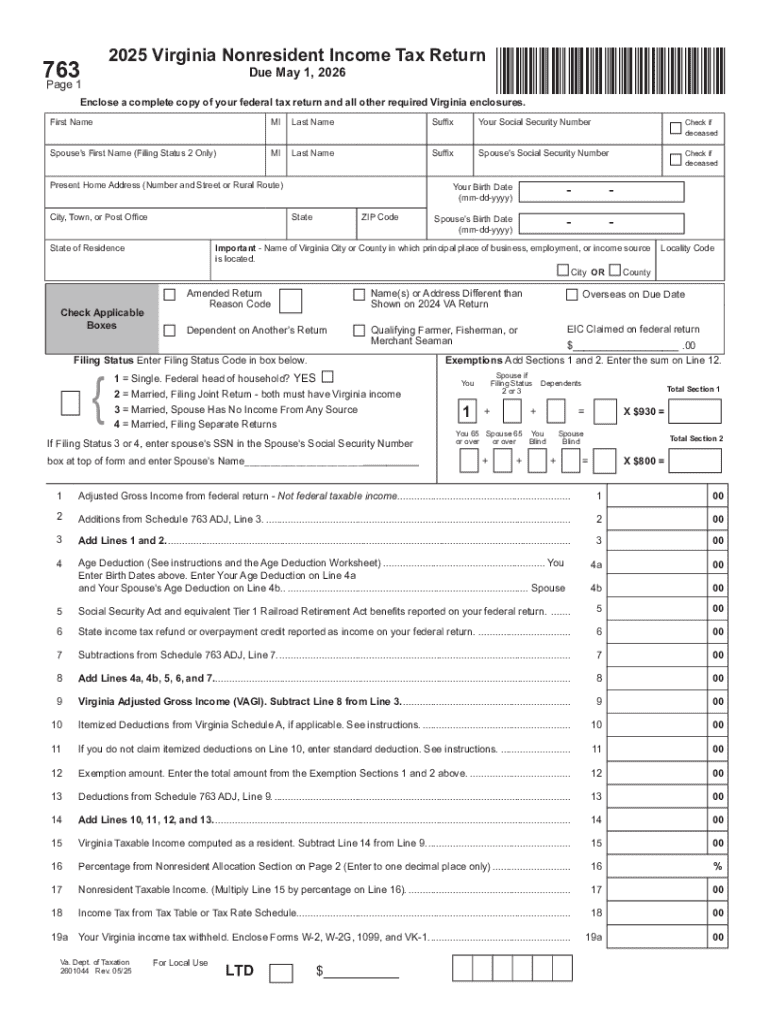

. Understanding Virginia Form 763

Virginia Form 763, also known as the Nonresident Virginia Individual Income Tax Return, is a crucial document for taxpayers who earn income from Virginia sources but do not reside in the state. This form serves to ensure that nonresidents accurately report their Virginia-sourced income and pay the appropriate state taxes. For Virginia taxpayers, understanding and correctly filing Form 763 is vital to avoid penalties and interest due to underreporting or failing to file.

The importance of Form 763 cannot be overstated as it not only simplifies the tax filing process for individuals who work in Virginia but also contributes to the state's tax revenue. Failing to file this form can lead to unexpected tax liabilities and complications with the Virginia Department of Taxation.

Who needs to file Form 763?

Filing Form 763 is generally required for nonresidents who receive income from Virginia sources. This includes individuals who may work temporarily in Virginia, have rental properties, or receive investment income from Virginia-based entities. To be eligible to use Form 763, you should have earned income in Virginia and meet specific thresholds outlined by the state.

Situations necessitating the completion of Form 763 usually include: earning wages in Virginia, receiving income from Virginia-based businesses, or having certain types of investment income sourced to Virginia. Understanding your eligibility for this form is vital to comply with Virginia tax laws.

. Key features of Form 763

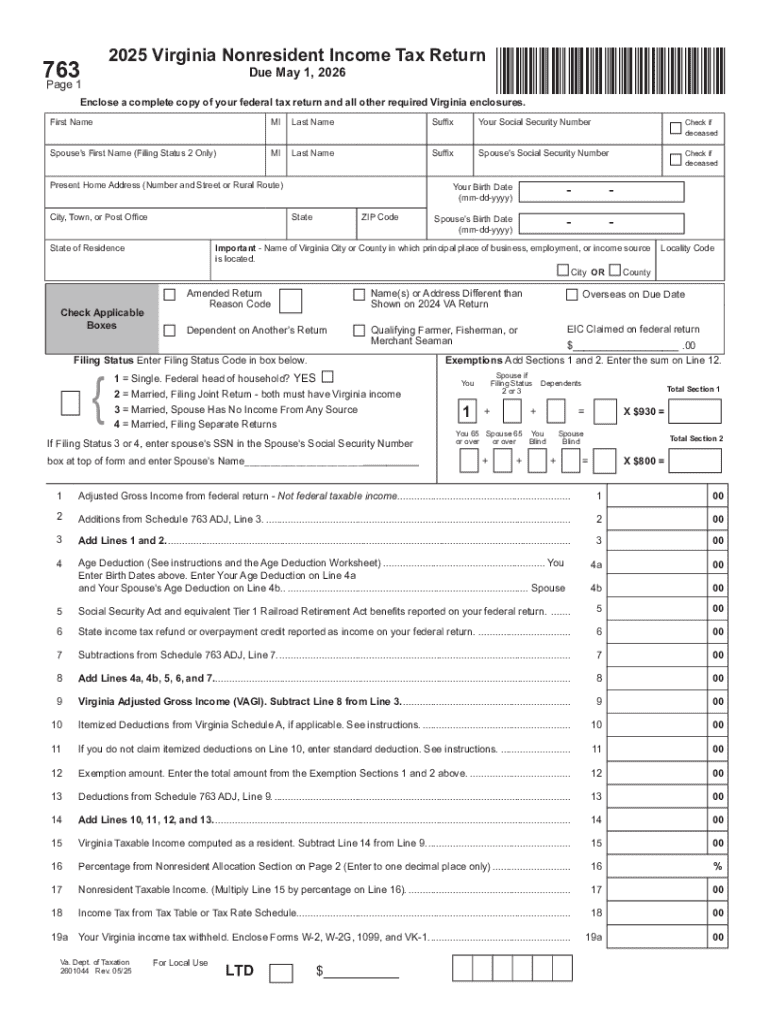

Form 763 is structured to guide taxpayers through the necessary information required to file a nonresident tax return. It encompasses several key sections designed to capture personal information, income details, and applicable deductions and credits. Each section of the form is critical, as they cumulatively determine the tax liability owed to the state.

The breakdown of key sections includes personal information, income reporting, adjustments to income, and tax credits and deductions. Taxpayers need to provide accurate details in each section to validate their income and expenses effectively. Additionally, it's important to note the different filing types available, allowing for both individual and group filings.

Filing types and options

When it comes to filing, options include both individual and joint filing. Individuals who are married may choose to file jointly if both spouses have income sourced from Virginia. Conversely, those who earn income separately have the option to file individually. Special scenarios might necessitate one filing type over the other, depending on individual circumstances such as varying income levels or types of income received.

. Step-by-step guide to completing Form 763

Completing Form 763 accurately requires careful preparation. Before diving into the form itself, taxpayers should gather necessary documents such as W-2 forms, 1099 statements, and any documentation for deductions or credits they plan to claim. Utilizing tools like pdfFiller can simplify this process, helping to streamline documentation and ensure accuracy.

The detailed instructions for each section are as follows:

. Interactive tools for Form 763

Using interactive tools like pdfFiller can greatly enhance the efficiency of completing Form 763. With features designed to streamline the form-filling process, pdfFiller allows users to auto-fill information, check for errors, and ensure compliance with tax regulations effortlessly.

One of the standout features of pdfFiller is its user-friendly interface, which simplifies the process of filling and submitting tax forms. A demonstration video is available on their platform, walking users through the steps of filling out Form 763 online. This tutorial visually guides viewers through each part of the form, illustrating common pitfalls and how to avoid them.

. Common mistakes to avoid

When completing Form 763, taxpayers often encounter various pitfalls that can lead to delays or penalties. Common errors include failing to provide complete information or miscalculations in tax liabilities. Such oversights can result in not only fines but also unnecessary stress.

To avoid these issues, it's imperative to adopt best practices during your review before submission. A thorough checklist can help ensure completeness and accuracy. This checklist may include:

. Filing and submission process

Taxpayers have several options when it comes to submitting Form 763. Choices include electronic submission through platforms like pdfFiller and traditional paper filing by mailing the completed form to the Virginia Department of Taxation. Understanding the deadlines for each submission type is essential to avoid late fees or penalties.

Deadlines for filing Form 763 typically follow the standard timeline set for individual income tax returns. Confirmation of submission is an important step, especially when filing electronically. Tracking your form status after submission can provide peace of mind and help address any potential follow-ups from the Virginia tax authority.

. Additional resources for Virginia tax filers

Taxpayers seeking further guidance on Form 763 and other tax-related inquiries can access a wealth of resources. The Virginia Department of Taxation's official website features detailed instructions, FAQs, and forms, which are incredibly valuable for any taxpayer navigating the tax landscape.

In addition to official resources, participating in community forums or support groups can provide a platform for shared experiences and tips. Many taxpayers benefit from connecting with others who have previously filed Form 763, gaining insights that can inform their own filing process.

. Navigating updates and changes for 2025

As tax laws evolve, understanding anticipated changes for the upcoming tax year is crucial for proper planning. For 2025, some new tax regulations may impact how taxpayers complete Form 763. Staying informed about these updates enables taxpayers to prepare adequately and avoid last-minute hurdles.

To stay updated on future changes, subscribing to Virginia tax newsletters or notifications can be beneficial. This ensures taxpayers receive the latest information directly from state officials, aiding in proper compliance and informed decision-making.

. Connect with pdfFiller community

Engaging with the pdfFiller community can provide additional insights and support for users filing Form 763. Reading user stories and testimonials from other Virginia taxpayers helps illustrate the real-world impact of using pdfFiller's tools, showcasing success in navigating their tax obligations.

Furthermore, providing feedback to the pdfFiller team and participating in webinars about tax filing tools can enhance the overall experience for users. This creates a robust community of informed taxpayers who navigate the complexities of Virginia tax filing collaboratively.

. Breadcrumb navigation

For easy navigation through this comprehensive guide on Form 763, consider outlining quick links to major sections of the page. This feature enhances user experience, enabling readers to jump to the most relevant information swiftly.

. Pagination

When creating detailed content, structured pagination is vital for facilitating user-friendly navigation. This allows readers to browse through sections of the guide with ease, enhancing their overall experience when seeking specific details about 2025 Form 763 Virginia Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in instructions for virginia nonresident?

How do I edit instructions for virginia nonresident on an iOS device?

How do I fill out instructions for virginia nonresident on an Android device?

What is 2025 form 763 virginia?

Who is required to file 2025 form 763 virginia?

How to fill out 2025 form 763 virginia?

What is the purpose of 2025 form 763 virginia?

What information must be reported on 2025 form 763 virginia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.