Get the free 2025 Form 760PY - Virginia Part-Year Resident Income Tax Return

Get, Create, Make and Sign 2025 form 760py

Editing 2025 form 760py online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 760py

How to fill out 2025 form 760py

Who needs 2025 form 760py?

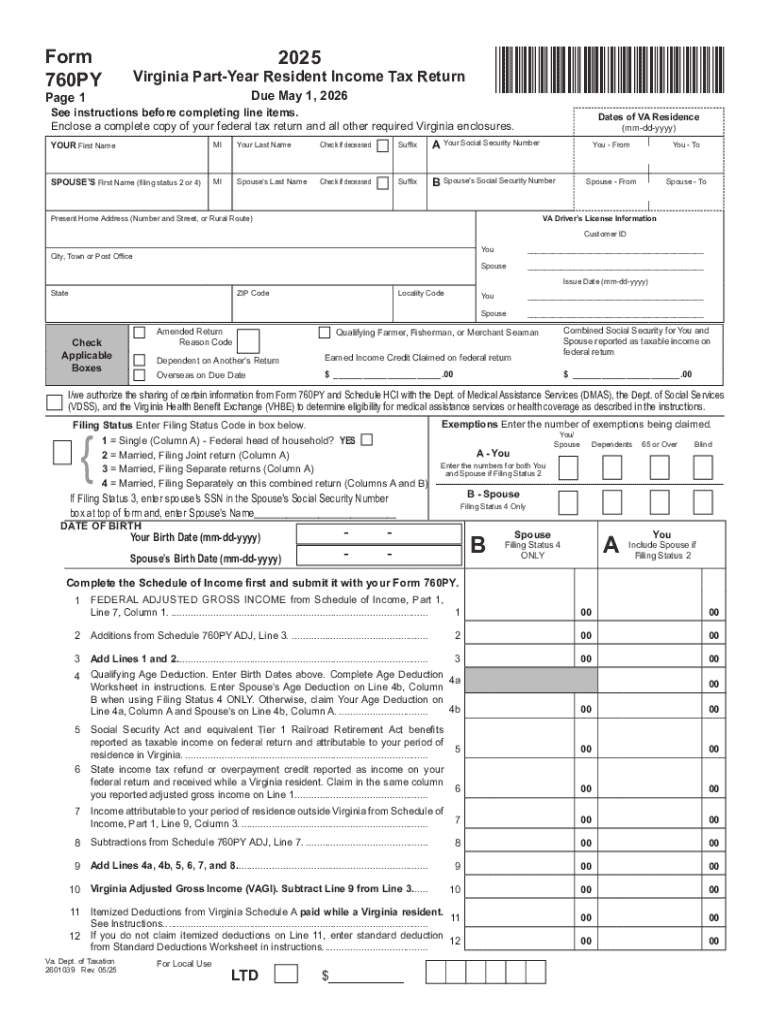

Comprehensive Guide to 2025 Form 760PY for Part-Year Residents in Virginia

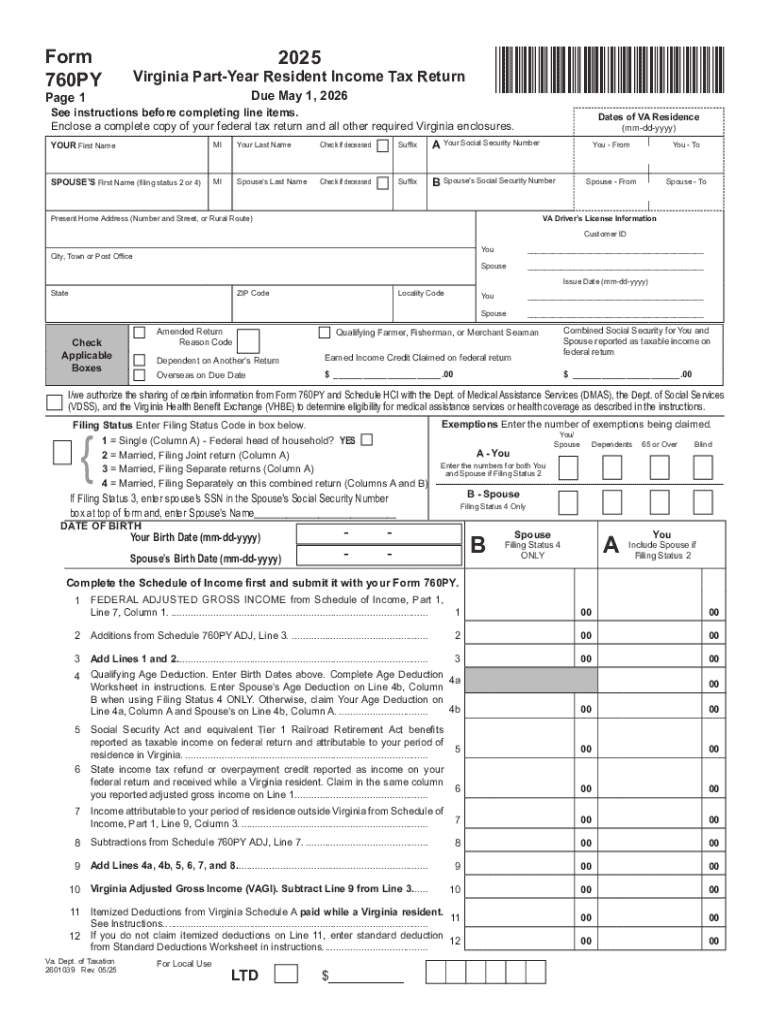

Overview of Form 760PY

The 2025 Form 760PY is a crucial tax form for individuals who have resided in Virginia for only part of the tax year. This form allows part-year residents to accurately report their income and determine their tax liability based on the income earned while residing in Virginia. Since different states have varying tax regulations, understanding how Form 760PY works is vital for compliance and ensuring that you are not overpaying your taxes.

Filing this form correctly is essential not only for tax obligations but also for making sure you receive any potential refunds owed to you based on Virginia income tax regulations.

Who needs to file Form 760PY?

Eligible filers of Form 760PY include anyone who has moved to or from Virginia during the tax year. This includes individuals who may have split their residency or those who took temporary jobs that began or ended within Virginia. Here are key scenarios in which you'd need to consider filing Form 760PY:

Preparing to complete Form 760PY

Completing Form 760PY requires careful preparation to ensure that you have all necessary documents and information. Key documents needed include W-2 forms for wages earned, 1099 forms for other types of income, and any relevant documentation that reflects other earnings during the time you resided in Virginia. Having these documents at hand can streamline the process and minimize errors during filing.

Additionally, familiarize yourself with the important deadlines for filing. For the 2025 tax year, the standard filing deadline for Form 760PY is typically April 15th. However, if you foresee that you're unable to meet this deadline, Virginia allows for extensions. To apply for an extension, you need to submit Form 760PY-E and ensure that it is sent in by the initial due date to avoid penalties.

Required documents and information

Step-by-step guide to filling out Form 760PY

Filling out Form 760PY can be tackled methodically by breaking it down into sections. Start with Section 1, which requires essential personal information, such as your full name, residential address, and Social Security number. Accuracy in these fields is paramount to avoid complications downtime.

Section 1: Personal Information

It’s important to ensure that all names are spelled correctly, that you provide your current address as of December 31 of the tax year, and that your Social Security number matches the IRS records. A mistake here can lead to delays in processing or even potential audits.

Section 2: Part-year resident income

In this section, you'll report income that you earned while a resident of Virginia. Taxable income can include wages, interest from Virginia accounts, and dividends. It's crucial to differentiate income earned inside Virginia from that earned elsewhere.

Section 3: Deductions and credits

Form 760PY allows for certain deductions and credits specific to part-year residents. Understanding which deductions apply is essential, as this can significantly reduce tax liability. Commonly available deductions may include personal exemptions or those related to education.

Section 4: Calculating your tax liability

After detailing your personal information, income, and deductions, you will calculate your tax owed. This involves applying Virginia's tax rates to your net taxable income. Be careful in this step as mistakes can lead to unexpected tax bills or complications with the IRS later.

Interactive tools for completing Form 760PY

Leveraging online calculators and interactive resources can greatly ease the completion of Form 760PY. These tools often provide guided prompts and real-time calculations based on the inputted data, minimizing the possibility of errors.

One trusted platform to use is pdfFiller, which offers features that allow users to fill out, edit and electronically sign documents. The intuitive interface makes it easy to upload your tax forms and receive guidance throughout the preparation and submission process.

FAQs and troubleshooting common issues

Even with preparation, you may come across specific questions while completing your Form 760PY. Here are a few commonly asked questions and their solutions:

Submitting your Form 760PY

Once you've completed Form 760PY, you need to decide whether to file electronically or via paper. Each method has its advantages. E-filing allows for quicker processing and direct confirmation of receipt, while paper filing gives you a physical record of submission.

If you opt for electronic submission, platforms like pdfFiller make it seamless. By following the simple steps, you can upload your completed form, apply an electronic signature, and submit directly to the Virginia Department of Taxation all in one location.

Understanding notification and follow-up

After submission, it’s important to know what to expect. Virginia’s tax department generally processes returns within a few weeks. You can check the status of your return through their online portal if you filed electronically. If you filed by mail, it may take longer, so patience is key.

Managing future filings

As you prepare for future tax seasons, keeping thorough records is essential. Maintaining copies of your W-2s, 1099s, and any other source documents will not only assist you in future filings but also serve as protection in case of an audit. Consider using document management tools available on pdfFiller to organize documents conveniently.

Strategic planning can also help. If you anticipate future changes in residency, keeping a detailed log of income sources and residence duration will aid significantly in your upcoming filings.

Resources for continued support

For ongoing support with Form 760PY and any future tax-related documents, pdfFiller provides customizable templates and guides. Engaging with support community forums can also be a great source for insights into specific filing queries.

Connect with us

Joining discussions within the pdfFiller community can lead to helpful advice and diverse experiences shared by other users. If you have specific questions or need tailored solutions, reaching out through forums can connect you to those who have faced similar situations.

Gathering feedback is crucial for the continuous improvement of resources. Sharing your tax filing experiences and suggestions can help shape future content, making the process easier for others navigating the 2025 Form 760PY.

Pagination

For your convenience, this guide is organized with detailed navigation links available for every section. Easily jump back to frequently accessed topics to enhance your reading experience and ensure that all aspects of your 2025 Form 760PY are easily understandable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2025 form 760py?

How do I make changes in 2025 form 760py?

How do I complete 2025 form 760py on an Android device?

What is 2025 form 760py?

Who is required to file 2025 form 760py?

How to fill out 2025 form 760py?

What is the purpose of 2025 form 760py?

What information must be reported on 2025 form 760py?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.