Get the free instructions for completing form 770 virginia fiduciary ...

Get, Create, Make and Sign instructions for completing form

How to edit instructions for completing form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for completing form

How to fill out instructions for completing form

Who needs instructions for completing form?

2025 Form 770 Virginia Form - How-to Guide

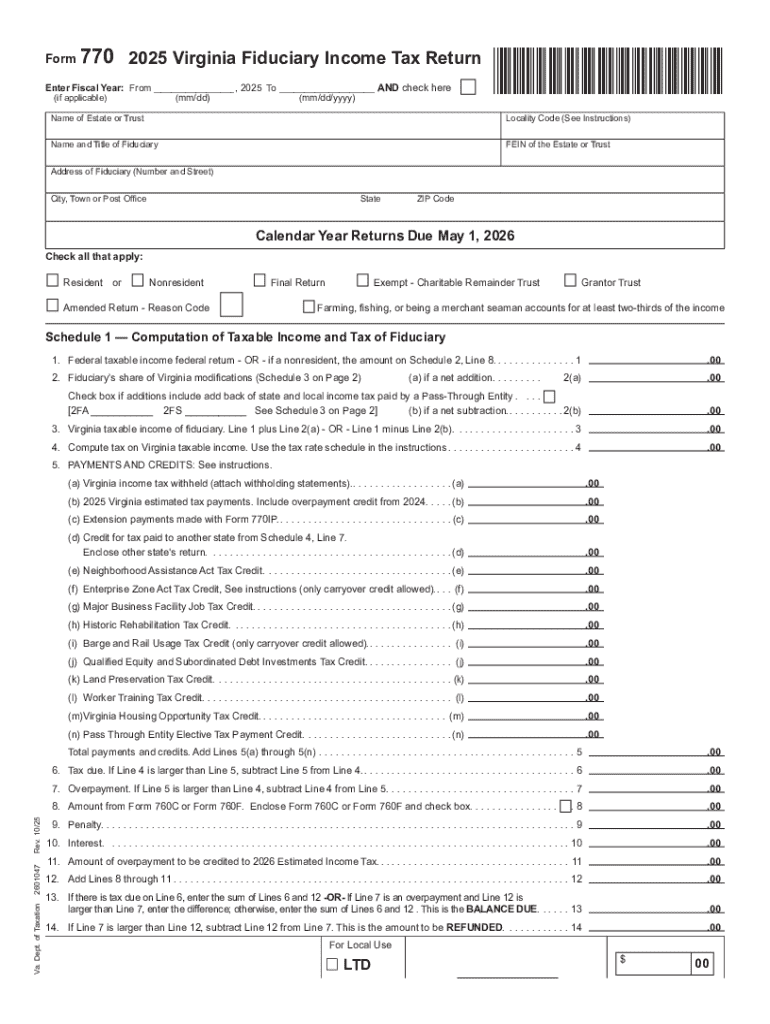

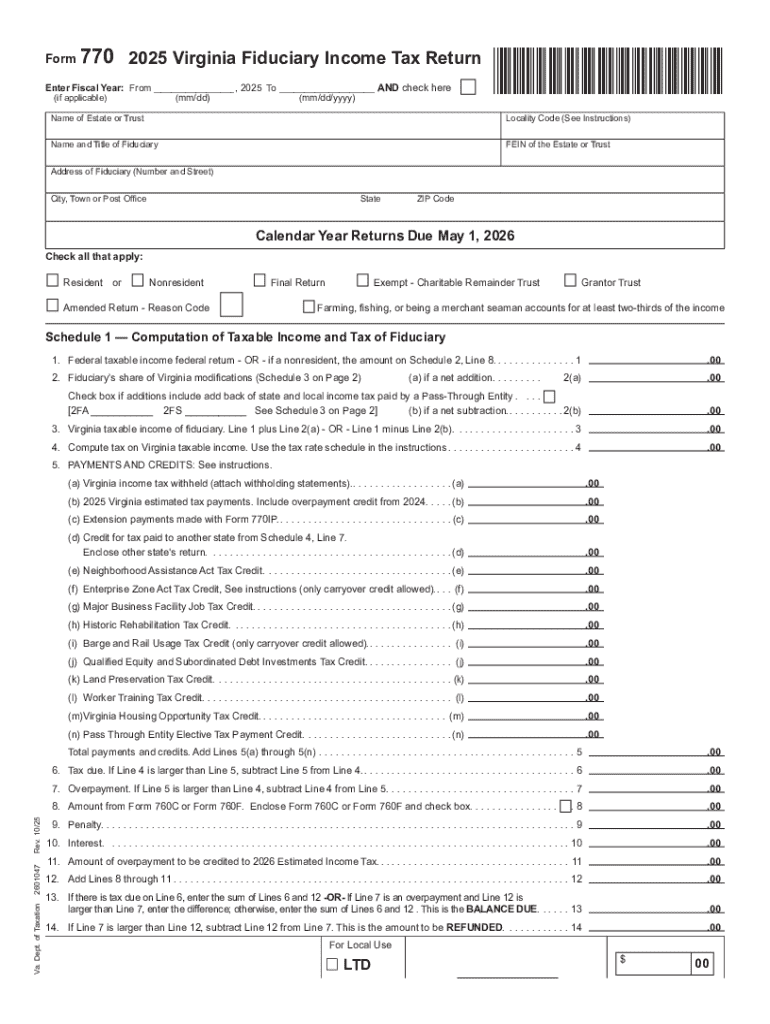

Overview of Form 770

The 2025 Form 770 is the primary individual income tax return for residents of Virginia. It is designed to report personal income, calculate tax liability, and claim any relevant deductions and credits. The purpose of this form is to accurately assess each taxpayer’s financial obligation to the state, ensuring compliance with Virginia tax regulations.

Individuals and certain entities, including partnerships and corporations, are required to file this form if they earn income in Virginia. This includes residents, non-residents with Virginia income, and part-year residents. In addition to fulfilling their legal duties, these taxpayers enjoy various benefits, such as contributing to state services and infrastructure.

Submitting taxes online through the Virginia Department of Taxation's website expedites processing and minimizes errors compared to paper submissions, making it an advisable choice for most filers.

How to access the 2025 Form 770

You can easily access the 2025 Form 770 on the Virginia Department of Taxation's official website. Begin by navigating to , where you can find a dedicated section for forms and publications.

Once in the forms section, look for the individual income tax forms category. Here, the 2025 Form 770 will be listed for download. Click on the appropriate link to not only download but also print your form.

Additionally, if you prefer to fill out the form digitally, platforms like pdfFiller offer access to the 2025 Form 770. Simply search for '2025 Form 770 Virginia form' on pdfFiller, and utilize their tools to seamlessly download and edit the document.

Detailed breakdown of the form sections

The Form 770 consists of several sections starting with the Personal Information Section. It requires your legal name, Social Security number, and filing status. To accurately complete this section, ensure your name matches exactly as it appears on your Social Security card. A common pitfall here is clerical errors in your Social Security number, which can lead to delays or processing issues.

Next, the Income Report Section requires disclosure of various income types, including wages, interest, and dividends. Don’t overlook potential deductions or credits that can lower your taxable income. You should gather all relevant documents, such as W-2s and 1099s, to ensure thorough and accurate reporting.

In the Tax Calculation Section, you will determine your tax bracket based on your income. Virginia employs a progressive tax rate system, meaning higher income earners pay a greater percentage in taxes. Accurately following the step-by-step tax calculation guide provided within the form is essential to determine your total tax liability.

Finally, ensure you complete the Signatures and Submission section. When filing online, electronic signatures are valid and encouraged. pdfFiller allows for easy electronic signing, simplifying this stage of the process.

Interactive tools for form completion

pdfFiller’s comprehensive suite of tools makes filling out the 2025 Form 770 not only straightforward but also efficient. Users can take advantage of user-friendly editing features that allow for quick adjustments to any part of the form. The platform provides drag-and-drop functionality for adding text fields, checkmarks or even notes if clarification is needed.

Filling out and signing forms becomes seamless with pdfFiller. You won't have to worry about missing sections, as the application prompts you to complete any required fields. Save your progress and continue at your convenience. Further, pdfFiller has automation features that allow you to create numerous copies of your completed form with minimal additional effort, making it ideal for teams managing multiple submissions.

Common issues and troubleshooting

When completing the 2025 Form 770, many common mistakes can occur. Typographical errors, misreported income, and neglected deductions frequently lead to complications, delayed filings, or even audits. Ensure to double-check your entries and utilize pdfFiller’s editing options for correction.

FAQs often arise regarding late submissions and penalties. If you file your Form 770 after May 1, Virginia may impose penalties up to 6% of the unpaid tax amount. For those who may require assistance, reach out to the Virginia Tax Support at or find resources on their website.

Web resources for additional insights

For the latest updates on the 2025 Virginia Form 770, visit the official Virginia Department of Taxation website. Here, users can find in-depth tax guidelines and access to updated tax legislation that may affect filings.

Recommended websites, like taxfoundation.org, provide analysis of state-specific tax issues, ensuring taxpayers are well-informed when filing. Additional resources assist individuals and teams in managing their tax information effectively.

Additional form management tips

Staying organized is crucial during tax season, especially when dealing with the 2025 Form 770. It’s beneficial to create a dedicated folder for tax documents, ensuring you have easy access to all relevant paperwork when it comes time to file. Use different subfolders for income documents, receipts for deductions, and prior year returns to maintain order.

Furthermore, tracking your submitted forms and maintaining copies is essential for future reference, particularly for audits or amendments. pdfFiller's collaborative tools allow teams to work together on tax preparation, streamlining the process through shared document management, and ensuring accuracy and completeness.

Pagination & navigation

Navigating the 2025 Form 770 effectively is key to reducing stress during completion. Utilizing pagination tools, such as bookmarks, can guide you directly to major sections or questions, streamlining the filling process. A well-structured table of contents within your document can further aid in quick navigation, especially when working through a long form.

Additionally, electronic platforms like pdfFiller enhance navigation capabilities. Features like hyperlinks between sections or a clear layout prevent confusion while filling in your form, ensuring that you don’t overlook important details.

Connect with us

For any queries regarding document creation using pdfFiller, customer support is readily available to assist you. The user-friendly helpdesk provides timely responses to your requests, ensuring that your experience is smooth and productive.

Engaging with the pdfFiller community can also provide insightful tips and best practices from fellow users. You can share your experiences and learn from others in the community, all while getting updates on new features that enhance document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in instructions for completing form without leaving Chrome?

Can I create an electronic signature for the instructions for completing form in Chrome?

Can I edit instructions for completing form on an iOS device?

What is 2025 form 770 virginia?

Who is required to file 2025 form 770 virginia?

How to fill out 2025 form 770 virginia?

What is the purpose of 2025 form 770 virginia?

What information must be reported on 2025 form 770 virginia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.