Get the free Nyc 1127 FormFill Out and Use This PDF

Get, Create, Make and Sign nyc 1127 formfill out

How to edit nyc 1127 formfill out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc 1127 formfill out

How to fill out nyc 1127 formfill out

Who needs nyc 1127 formfill out?

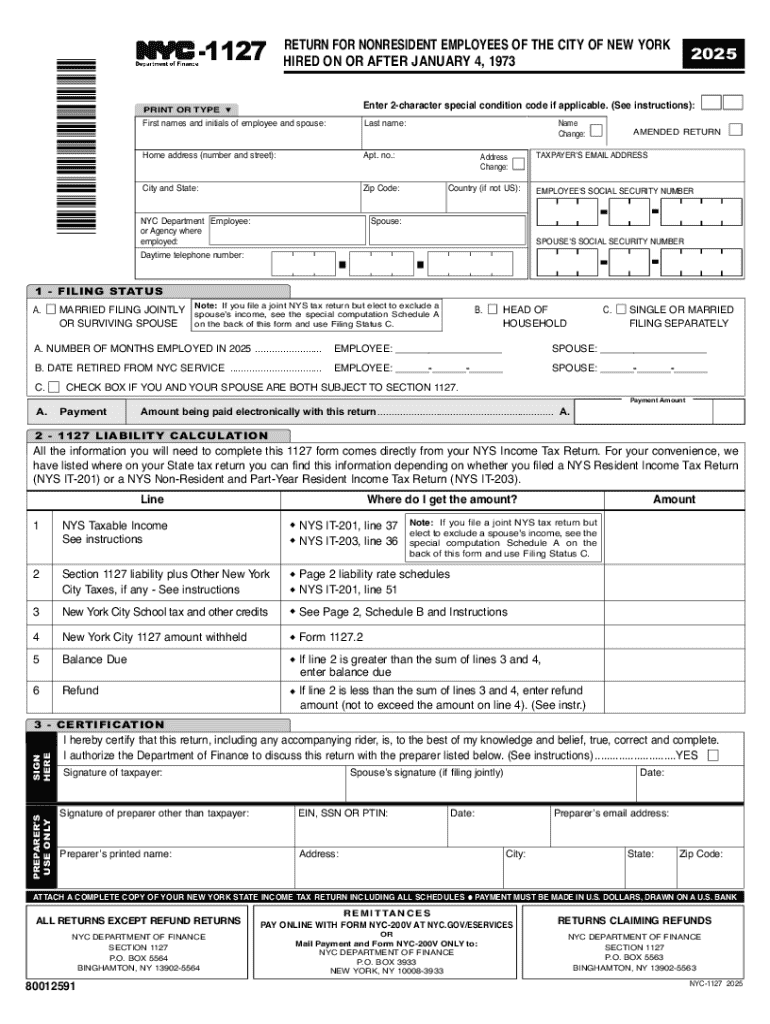

Comprehensive Guide to Filling Out the NYC 1127 Form

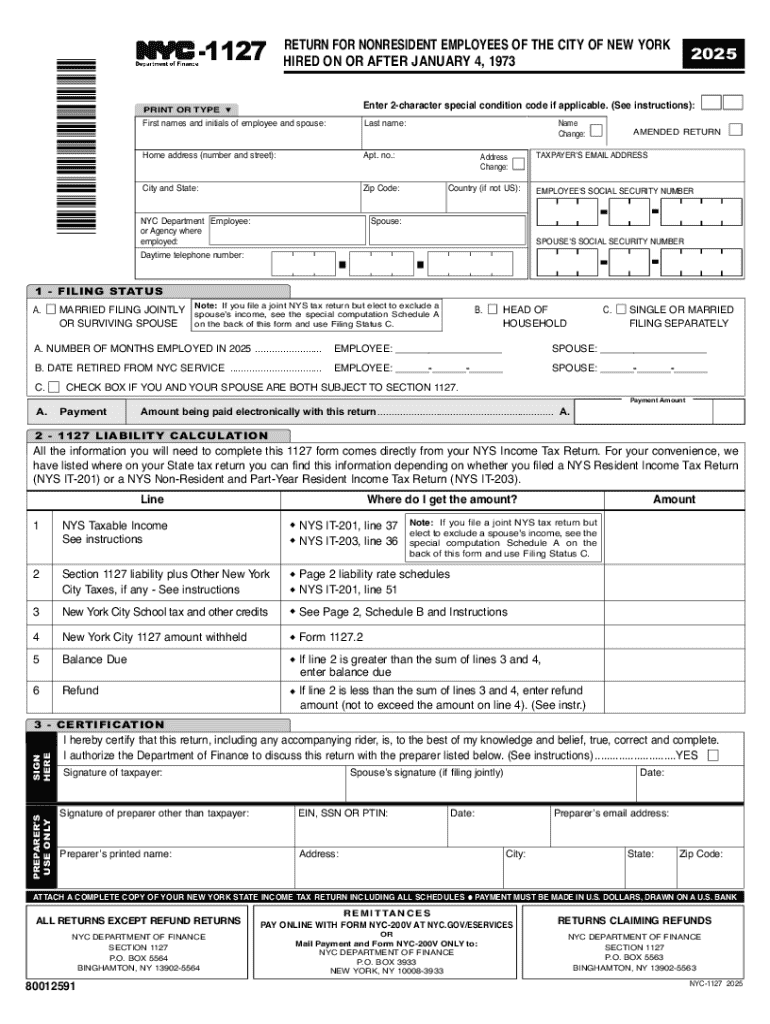

Understanding the NYC 1127 Form

The NYC 1127 Form is essential for non-residents who owe personal income tax to the City of New York. This form serves to inform the Department of Finance about the income you earned in the city, ensuring compliance with local tax obligations. Filling out this form accurately is vital as it assists in determining your tax liability and eligibility for any potential refund.

As non-residents often engage in income-generating activities within New York City, understanding the relevance of the NYC 1127 Form becomes paramount. Whether you're an independent contractor, a freelancer, or working on short-term projects, this form directly impacts your tax responsibilities. Ensuring that your tax documents are correctly filled out can save you from penalties and help you maintain good standing with the city.

Who needs to fill out the NYC 1127 Form?

The primary users of the NYC 1127 Form include non-residents who earn income from sources within New York City. This primarily includes independent contractors, consultants, and freelancers who might work on various projects in the NYC area. It's crucial for these individuals to recognize their tax obligations to ensure they meet the requirements set forth by the city.

Several common scenarios necessitate completing the NYC 1127 Form: individuals who provide professional services to New York-based clients, those who receive royalties from NYC-based intellectual property, and anyone working for a New York company but residing outside the state. Each of these scenarios creates a tax obligation that must be reported accurately to avoid complications or legal issues.

Navigating the NYC 1127 Form: Step-by-Step Instructions

Completing the NYC 1127 Form can seem daunting, but breaking it down into manageable sections simplifies the process. Here’s a detailed overview of each section of the form:

Interactive tools for efficient form completion

Utilizing interactive tools can streamline the form completion process significantly. pdfFiller offers robust PDF editing features that allow users to fill out the NYC 1127 Form online effortlessly. You can edit the document directly in your browser, making it easy to input information without worrying about printing or scanning.

One of the standout features of pdfFiller is the real-time collaboration option. If you’re working as part of a team, you can invite colleagues to assist in filling out the form. This ensures that all necessary inputs are captured and reduces the chances of errors during submission.

Common errors and their solutions

While completing the NYC 1127 Form, many individuals make common mistakes that may lead to delays or denials. It’s crucial to understand these errors and how to avoid them. Some frequent mistakes include incorrect income entries, which can arise from miscalculating totals or misunderstanding what constitutes taxable income.

Additionally, overlooked signatures are a common pitfall. Ensure you check that all required fields are filled out, including signatures, to prevent your form from being returned. If you notice an error post-submission, you can quickly amend and resubmit the form, but it’s best to confirm the accuracy before sending it in.

Additional considerations for non-residents

Non-residents face unique tax implications that can complicate their filing process compared to residents. It's essential to understand these distinctions effectively to avoid potential issues. For instance, tax on income earned while working in New York City is treated differently from income earned elsewhere.

Moreover, non-residents must pay special attention to deadlines. The NYC 1127 Form must be submitted by the designated filing date to avoid penalties. Familiarizing yourself with these deadlines can help prevent any unwanted fees and ensure compliance with tax obligations.

FAQs about the NYC 1127 Form

Individuals often have questions regarding the NYC 1127 Form, especially when navigating tax obligations as non-residents. A frequently asked question involves what to do if you don’t receive your form. It’s recommended to check with the NYC Department of Finance or utilize online resources to determine if your submission went through.

Tracking your submission status is also a common query. Users can often track the progress of their form through online portals or by contacting the tax assistance services, ensuring they're informed about the disposition of their documentation.

Leveraging pdfFiller for document management

Using pdfFiller not only allows for easy completion of the NYC 1127 form but also provides comprehensive document management capabilities. The platform supports seamless editing, filling, and signing of PDFs, ensuring that your tax documents are organized and accessible.

Benefits of utilizing pdfFiller include enhanced document security, easy retrieval of past submissions, and the ability to manage all your forms from one central location. These features collectively create a user-friendly experience for individuals and teams tasked with managing tax documentation.

User testimonials and success stories

Many users have experienced significant improvements in their form submission process thanks to pdfFiller. Testimonials highlight how the platform's interactive features and collaborative options effectively reduced the time spent completing the NYC 1127 Form, making it less intimidating for users unfamiliar with tax documentation.

Statistics show that organizations using pdfFiller have reported higher rates of successful form submissions, translating into fewer errors and less back-and-forth communication with tax authorities. These success stories not only demonstrate the platform's effectiveness but also encourage others to take advantage of such tools.

Next steps after submission

Once you've submitted the NYC 1127 Form, it's essential to understand what to expect in the coming weeks. Your submission will undergo processing, and you may receive a confirmation of receipt from the NYC Department of Finance. Timelines can vary based on the volume of submissions, so patience is key as you await confirmation.

Additionally, it's vital to prepare for future tax filings by keeping organized records of your submissions and any related documentation. Staying abreast of updates to tax regulations and ensuring your documents are current will make filing in subsequent years both efficient and accurate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nyc 1127 formfill out online?

How do I edit nyc 1127 formfill out in Chrome?

How do I fill out the nyc 1127 formfill out form on my smartphone?

What is nyc 1127 formfill out?

Who is required to file nyc 1127 formfill out?

How to fill out nyc 1127 formfill out?

What is the purpose of nyc 1127 formfill out?

What information must be reported on nyc 1127 formfill out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.