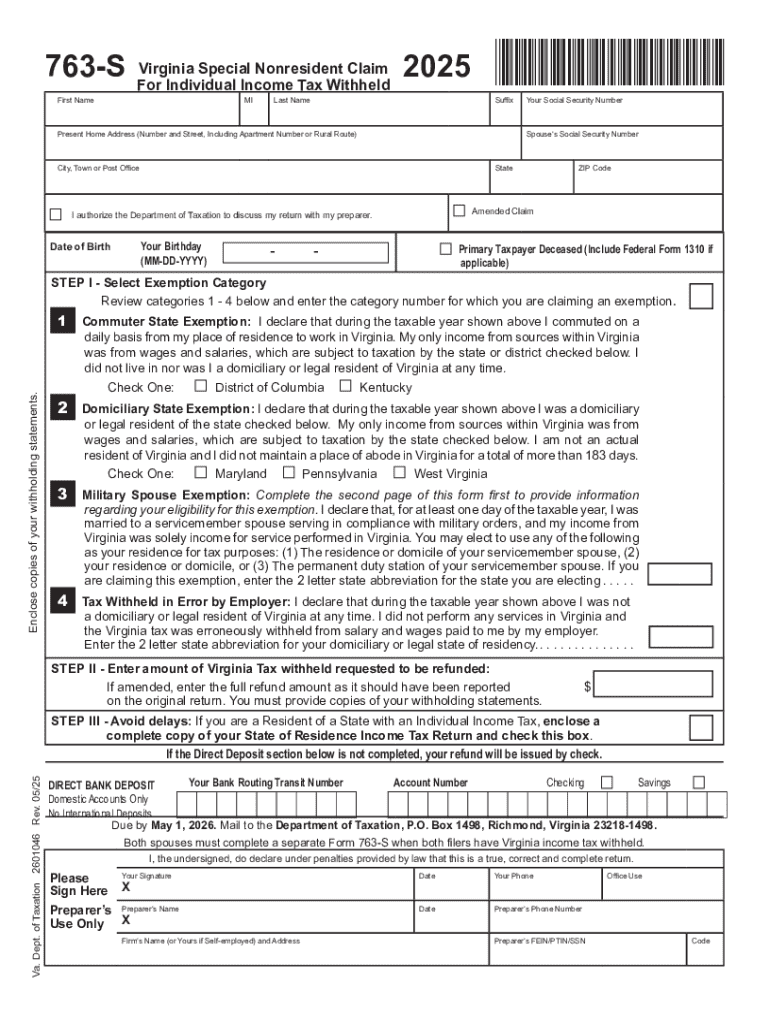

Get the free Desktop: Virginia Form 763-S - Special Nonresident Claim

Get, Create, Make and Sign desktop virginia form 763-s

Editing desktop virginia form 763-s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out desktop virginia form 763-s

How to fill out 2025 form 763-s virginia

Who needs 2025 form 763-s virginia?

Your Complete Guide to the 2025 Form 763-S in Virginia

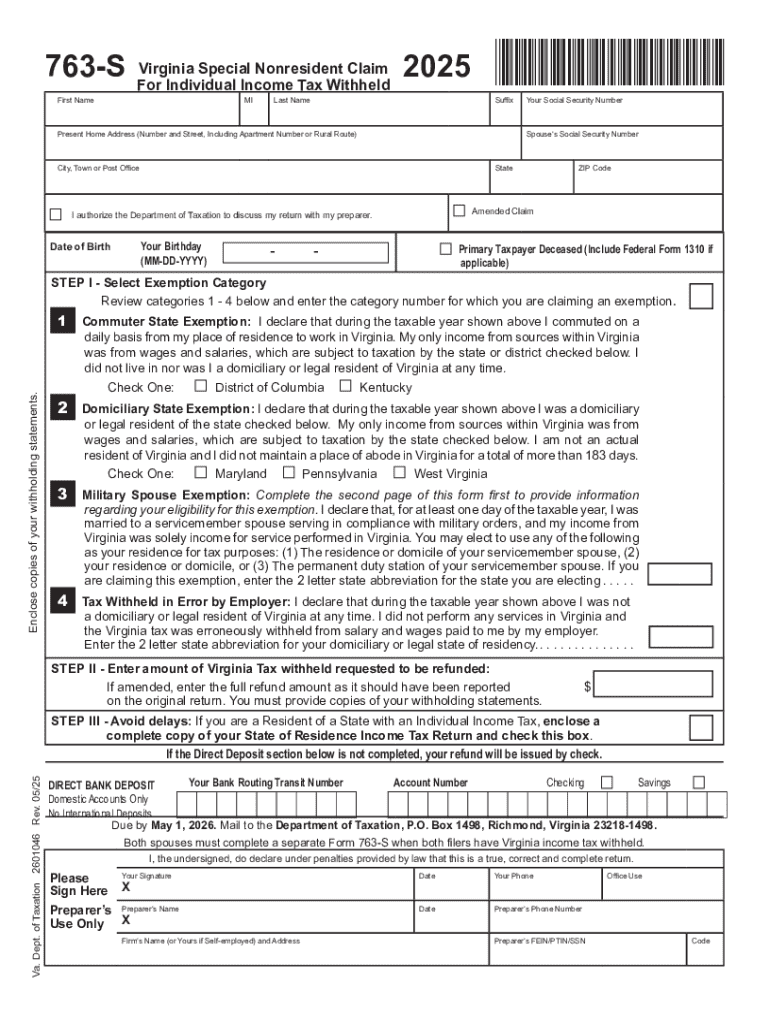

Overview of the 2025 Form 763-S

The 2025 Form 763-S is a key document for individuals and entities filing taxes in the Commonwealth of Virginia. It is designated for Virginia residents who have specific tax obligations based on their income. The primary purpose of this form is to report income for state tax assessments. This form is particularly relevant for those who may not have to file a federal tax return but still hold taxable income based on local requirements.

Who needs to file this form? Generally, any Virginia resident with taxable income, such as wages, interest, or dividends, needs to complete this form. Special filing categories may apply to specific groups, including self-employed individuals, part-time workers, and certain retirees. It’s crucial to understand whether your circumstances necessitate filing the 763-S.

Key changes and updates for the 2025 tax year

The 2025 tax year exhibits several crucial updates to the Form 763-S. These revisions have emerged primarily in response to recent economic trends and legislative changes aimed at simplifying tax compliance for residents. Comparing with previous years, taxpayers will notice adjustments in deduction limits and credits. New credits may be available for certain filers, specifically aimed at low-income households.

These changes could significantly impact tax filings. Taxpayers should be prepared to review the details carefully to ensure they take advantage of available credits and deductions, optimizing their tax outcomes in light of new regulations.

Step-by-step guide to completing the 2025 Form 763-S

Completing the 2025 Form 763-S is straightforward if you follow the steps methodically. Here’s how to ensure your filing is accurate and complete.

Step 1: Gather necessary documents

Before you start filling out the form, collect all relevant financial documents. This includes:

Organizing these documents before starting can enhance the efficiency of the process. Keep everything in one folder or a digital format for quick access.

Step 2: Filling out the form

Begin filling out the 763-S form by entering your personal information accurately. This includes your name, address, and Social Security number. Then, proceed to report your income. This section is vital; be thorough, as inaccuracies can lead to complications later.

For deductions, ensure to refer to the updated guidelines for 2025. Items such as state and local taxes paid or charitable contributions can sometimes reduce your taxable income significantly. Remember to avoid common pitfalls like omitting necessary signatures or failing to double-check inputted data. Errors can lead to delays or miscalculations in your tax obligations.

Step 3: Reviewing your submission

Before submitting, take the time to review your form. Here’s a brief checklist you can follow to ensure everything is in order:

If mistakes are found after submission, you may amend your filing. Contact the Virginia Department of Taxation for guidance on the amendment process.

Interactive tools for managing your Form 763-S

Utilizing digital solutions can enhance your experience completing the 2025 Form 763-S. pdfFiller provides tools tailored to streamline your document management process.

PDF editing features on pdfFiller

With pdfFiller, you can easily upload your Form 763-S as a PDF. The platform allows you to edit, add text, and make annotations directly within the document. You can also digitally sign your form, expediting the filing process while maintaining security.

Furthermore, pdfFiller’s collaboration tools are particularly helpful if you’re working with a team. Multiple users can access the document simultaneously, making it simpler to complete the form accurately together.

Using cloud-based solutions

Filing your Form 763-S through cloud-based solutions has significant advantages. It allows for access from any location, enabling flexibility for users with varied schedules. Ensure your taxes are filed regardless of time constraints—whether during lunch breaks at work or while traveling.

Additionally, the cloud ensures your documents are stored securely, reducing the risk of loss or unauthorized access. Always consider security features when choosing a platform for sensitive tax information.

Filing and submission options

Once your 2025 Form 763-S is accurately completed, it’s time for submission. You have options: electronic and paper filing. Each has its own set of considerations that can impact how quickly the Virginia Department of Taxation processes your returns.

How to file the 2025 Form 763-S

For electronic filing, ensure that you use certified e-filing software to submit your form. This method is the most efficient, typically resulting in faster processing times for refunds and confirmation of submission. Most online platforms, including pdfFiller, can facilitate this process with streamlined features.

If you opt for paper filing, it's essential to mail your completed form to the correct address provided by the Virginia Department of Taxation. A reminder: postmark deadlines can catch many filers off guard. Always ensure your form is postmarked by the filing deadline to avoid penalties.

Where to send your completed form

Ensure your completed paper form is sent to the following mailing address, verified through the Virginia Department of Taxation’s website. If you prefer in-person submission, you can also visit local tax offices, but be mindful of peak hours and wait times.

Frequently asked questions (FAQs) about Form 763-S

Tax filing can generate a multitude of questions, especially concerning eligibility for Form 763-S. Many newer taxpayers, or those who have had changes in their circumstances, often wonder about whether they must file this form. It's important to reach out to the Virginia Department of Taxation or consult financial advisors for personalized advice.

Troubleshooting issues with form submission can also be tricky. If you experience problems during electronic filing, check the compatibility of your software and revisit the submission guidelines provided by the tax authority. Resources for help range from official state tax websites to community forums dedicated to tax-related discussions, providing support for navigating these complex issues.

Understanding taxes in Virginia

Virginia has distinct tax obligations for its residents, separate from federal responsibilities. It's essential to familiarize yourself with how state laws impact your tax filings, particularly if you're using Form 763-S. Virginia residents must be cognizant of state tax rates, which can vary based on income levels and local jurisdictions.

Local tax laws also form an essential part of the equation for filers. The Virginia Department of Taxation offers a wealth of educational resources that help residents navigate their tax obligations. From webinars to step-by-step guides, these tools are invaluable for individuals seeking to understand the nuances of state tax laws.

About Virginia Tax

The Virginia Department of Taxation’s mission is to ensure tax compliance while educating residents regarding their obligations. Understanding the nuances of state taxes can lead to optimal tax outcomes. Engaging residents through workshops and community outreach is part of the agency's dedication to assist taxpayers in satisfying their tax responsibilities accurately and efficiently.

With such support, individuals and families can better navigate their tax responsibilities, minimize potential penalties, and maximize available credits to facilitate their financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send desktop virginia form 763-s to be eSigned by others?

Can I create an electronic signature for the desktop virginia form 763-s in Chrome?

How do I fill out desktop virginia form 763-s using my mobile device?

What is 2025 form 763-s virginia?

Who is required to file 2025 form 763-s virginia?

How to fill out 2025 form 763-s virginia?

What is the purpose of 2025 form 763-s virginia?

What information must be reported on 2025 form 763-s virginia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.