Get the free Virginia Department of Taxation Form 760-PMT Payment ...

Get, Create, Make and Sign virginia department of taxation

Editing virginia department of taxation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out virginia department of taxation

How to fill out virginia department of taxation

Who needs virginia department of taxation?

Understanding the 2025 Form 760-PMT Payment Form

Breadcrumb Navigation

Home > Payment Forms > Form 760-PMT

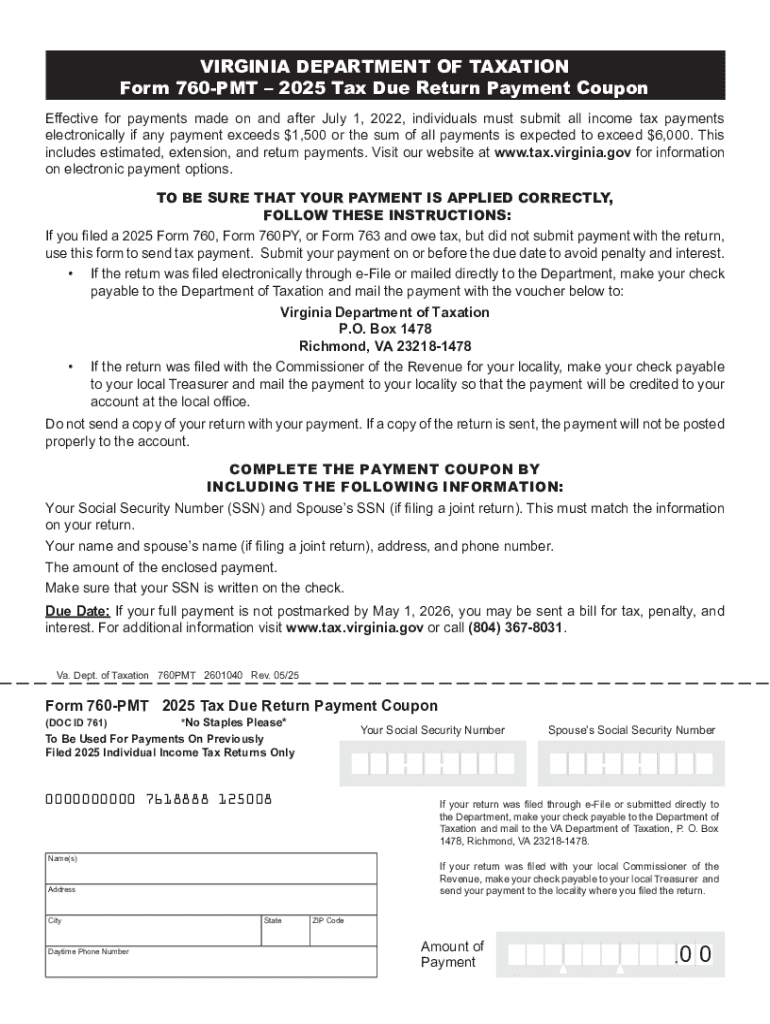

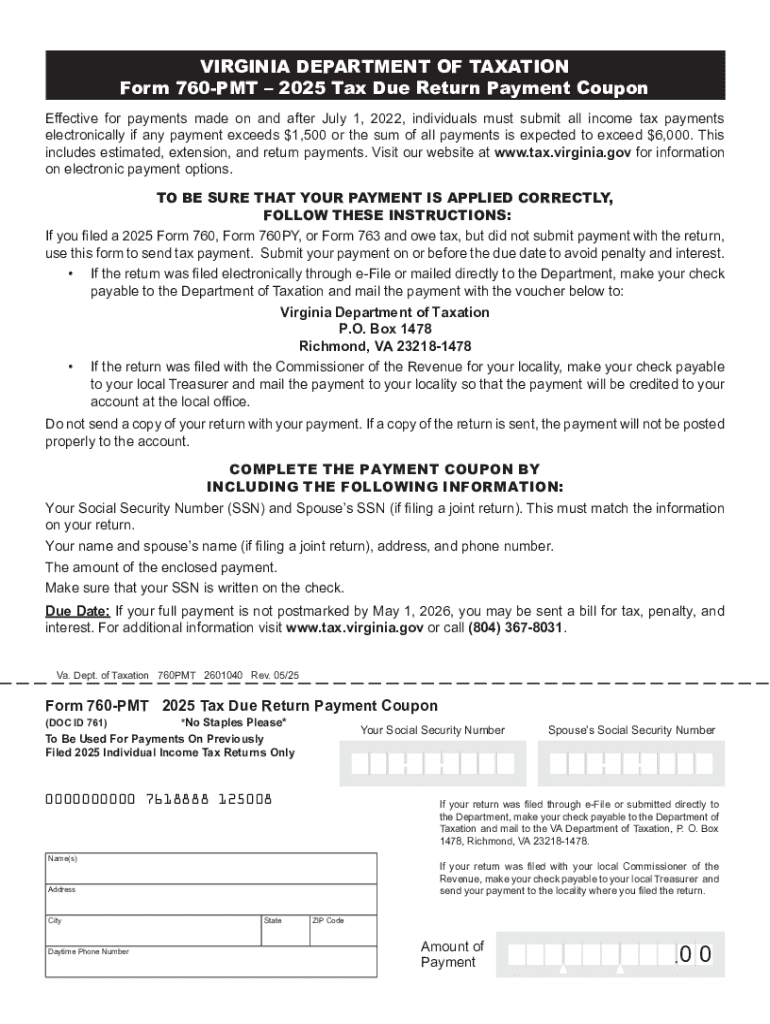

Understanding the 2025 Form 760-PMT

The 2025 Form 760-PMT is essential for taxpayers in Virginia, designed for those who need to submit pre-payments for their state income tax. This form allows taxpayers to report their expected tax liability for the year, ensuring they stay compliant with state tax regulations. Individuals or businesses that anticipate a certain tax liability—in addition to what has been withheld—must utilize this form. The form helps mitigate penalties associated with underpayment.

Timely submission of the Form 760-PMT is crucial, as late payments can result in hefty penalties or interest on outstanding balances. By using this form correctly, taxpayers can benefit from a more manageable tax process, reducing the stress associated with unexpected tax bills during tax season.

Who needs to use Form 760-PMT?

Form 760-PMT is needed by both individuals and teams, especially those whose financial situations might have changed. This could include freelancers, contractors, or businesses with fluctuating incomes. It’s imperative to analyze one’s financial standing to determine whether making estimated tax payments is necessary.

Filing requirements make it evident that without proper usage of Form 760-PMT, taxpayers may face significant tax liabilities at the end of the fiscal year, especially if their earnings increase unexpectedly.

What information do need on Form 760-PMT?

Completing the 2025 Form 760-PMT requires specific personal and financial information to accurately reflect tax obligations. Initially, individuals must provide their full name, address, and taxpayer identification number—commonly known as the Social Security Number.

Furthermore, financial information such as total income, eligible deductions, and any credits must be reported. It’s advised to gather documents such as W-2 forms, 1099 statements, and previous tax returns in advance to streamline the form-filling process.

Step-by-step guide to completing Form 760-PMT

To begin the process of completing the 2025 Form 760-PMT, it's vital first to obtain the form. It can be accessed through the Virginia Department of Taxation’s website, ensuring you are always using the latest version. For an efficient workflow, tools from pdfFiller can facilitate the editing and signing of the form, making the entire process significantly easier.

When filling out the form, each section requires careful attention to detail. Common mistakes include incorrect taxpayer information and miscalculating expected tax payments. Ensure consistency across all financial data, as discrepancies could lead to payment issues.

Using pdfFiller for enhanced editing and signing

pdfFiller provides users with interactive tools to fill out the Form 760-PMT efficiently. Utilizing the eSigning feature allows you to sign documents digitally, reducing the hassle of printing and scanning. This user-friendly interface is designed to cater to busy individuals and teams seeking quick solutions for document management.

After completing the form, remember to double-check all inputted information. Use pdfFiller to save the completed form as a PDF, print a copy for your records, or submit it electronically if applicable.

Managing your 760-PMT payments

After submitting the 2025 Form 760-PMT, it is essential to track payment statuses. pdfFiller offers features that allow for easy tracking of forms submitted, helping you stay organized and up to date about your payment obligations.

If adjustments to your payment plans are necessary, amendments can be made directly through pdfFiller. You can easily access previous submissions, ensuring that you maintain accurate records of your financial transactions. This capability is especially important for individuals with changing financial situations.

FAQs about the 2025 Form 760-PMT

Users often have numerous questions regarding the Form 760-PMT. Common inquiries include guidance on what to do if payments are missed, how to calculate expected tax, and the specific deadlines for submission. Each of these aspects plays a role in ensuring compliance with state regulations.

When problems arise, whether it be with filling the form or unexpected errors, troubleshooting common issues can often resolve most challenges effectively. pdfFiller’s support tools are readily available for users who may encounter difficulties.

Additional tips for using pdfFiller with Form 760-PMT

One significant advantage of using a cloud-based document management solution like pdfFiller is flexibility. Users can access their documents from anywhere, making it easier to fill, edit, and manage forms such as the Form 760-PMT on-the-go.

Additionally, pdfFiller has various support services that can assist users through every step of the process. Whether you're unsure about a specific section of the form or need technical support, their resources are designed to empower users to navigate document management effectively.

Related forms and resources

In addition to the Form 760-PMT, various other tax forms are relevant during filing season. Familiarity with these related forms can help users navigate their obligations better. Key forms include Form 760 and Form 763, which also pertain to Virginia state taxation.

pdfFiller further enhances your experience with a myriad of integrated tools, suitable for document management beyond just the Form 760-PMT. Utilizing the full suite of tools provided ensures a seamless user experience.

Connect with us

If you need personalized assistance or have further questions regarding the 2025 Form 760-PMT, pdfFiller is committed to supporting you. Utilize our contact options for direct communication with our expert team, dedicated to ensuring your tax documentation process is as effortless as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in virginia department of taxation?

Can I create an electronic signature for signing my virginia department of taxation in Gmail?

How can I fill out virginia department of taxation on an iOS device?

What is 2025 form 760-pmt payment?

Who is required to file 2025 form 760-pmt payment?

How to fill out 2025 form 760-pmt payment?

What is the purpose of 2025 form 760-pmt payment?

What information must be reported on 2025 form 760-pmt payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.