Get the free Shareholder Article 69(1) or (2) and Article 69a (1) or (3) of the Act on public off...

Get, Create, Make and Sign shareholder article 691 or

How to edit shareholder article 691 or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out shareholder article 691 or

How to fill out shareholder article 691 or

Who needs shareholder article 691 or?

Comprehensive Guide to Shareholder Article 691 or Form

Understanding shareholder article 691

Shareholder Article 691 is a crucial component of corporate governance frameworks that stipulates the rights and responsibilities of shareholders in a company. This article outlines the legal structures that govern shareholder engagement, and its provisions aim to uphold transparency and fairness in corporate operations.

Navigating the complexities of corporate governance is essential for both individual and institutional investors. Article 691 plays a pivotal role in ensuring that shareholders are informed about their statuses, rights, and interests within a corporation. Its relevance is underscored in various jurisdictions, where the legal frameworks dictate different requirements and rights for shareholders.

Key terms and definitions

Understanding shareholder rights is the cornerstone of Article 691. These rights empower shareholders to influence corporate governance through voting on critical issues, participating in shareholder meetings, and receiving timely dividends. Each term within this context sheds light on how shareholders can protect their interests and engage effectively.

The role of articles in a company’s structure extends beyond the abstract; they are foundational documents that dictate how a corporation operates. A thorough grasp of common terminology related to shareholder matters, such as quorum and proxy voting, helps investors navigate their rights and obligations efficiently.

The purpose of shareholder article 691

The fundamental purpose of Article 691 is to enhance transparency in corporate operations. By outlining clear procedures and rights, it ensures that all shareholders are well-informed and can uphold their interests. This transparency is critical for fostering trust and legitimacy in corporate structures.

Facilitating shareholder participation means providing avenues for investors to voice their opinions, propose changes, and challenge decisions that could affect their interests. This is particularly vital for minority shareholders, who often rely on Article 691 to protect against potential conflicts with majority investors or directors.

Detailed analysis of Article 691 provisions

An in-depth analysis of Article 691 reveals several crucial provisions regarding voting rights and procedures. It articulates how shareholders can cast votes, what constitutes a valid vote, and the thresholds required for various decisions. These provisions ensure that all shareholder voices contribute to the decision-making process.

Moreover, the article provides specific rules related to dividend distribution. It clarifies how profits are allocated among shareholders, maintaining transparency and fairness in how returns are managed. Additionally, it sets forth guidelines for shareholder meetings, including the necessary notices and agendas, ensuring all participants are adequately prepared.

The decision-making process outlined in Article 691 requires a quorum that allows for informed and representative decision-making. This mechanism not only engages shareholders but also precludes the potential for director conflict by ensuring that decisions are collectively endorsed rather than unilaterally imposed.

How to fill out the shareholder article 691 form

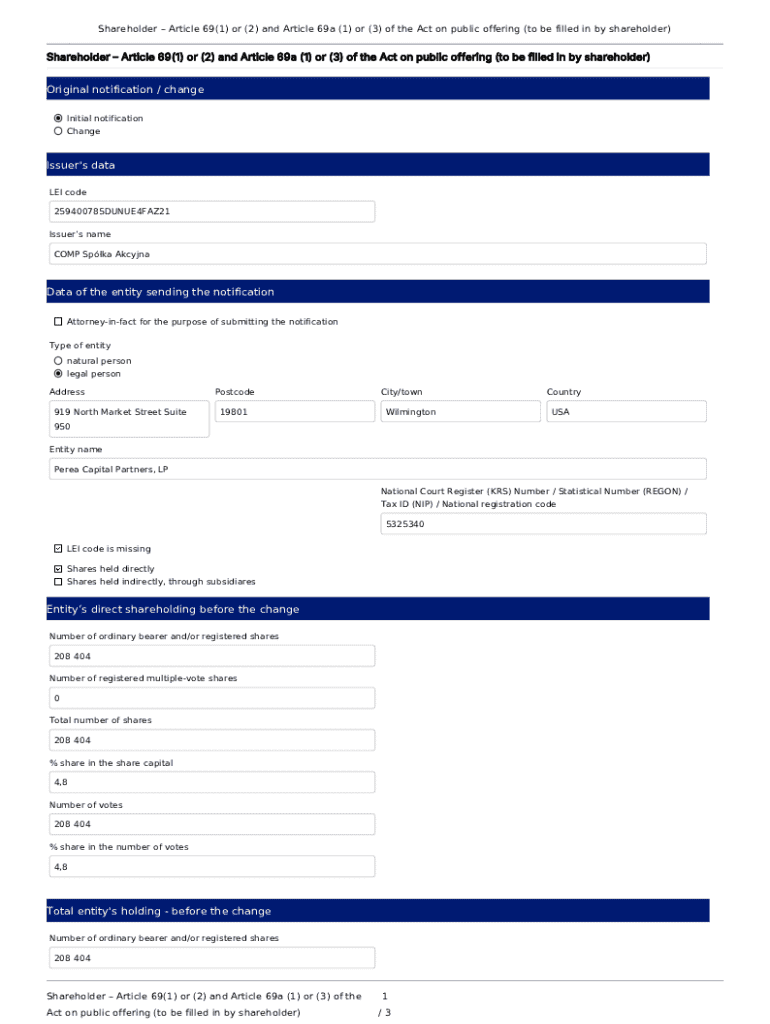

When you're ready to fill out the Shareholder Article 691 form, gathering all necessary information is the first step. This includes your personal details, the company’s information, and specifics regarding your shareholder interests. The clarity and completeness of this data are critical in ensuring that your rights are properly reflected and acknowledged.

Next, follow the step-by-step instructions. Start with completing the basic information section, ensuring that all entries are accurate. As you specify your rights and preferences within the form, be watchful for any requirements concerning shareholder categorization that might apply. After finalizing the document, a thorough review is essential to ensure that all details are correct before submission.

Common mistakes can lead to complications; for instance, incorrect shareholder designations or missing signatures can invalidate the form. Leveraging pdfFiller's tools can greatly enhance the editing experience, allowing for easy corrections and adjustments as needed.

Electronic signatures and the legality of article 691 forms

Understanding electronic signatures is crucial for validating the Article 691 form. eSignatures offer a legally binding solution that meets many jurisdictions’ requirements for signing documents, making the process more streamlined. The benefits of eSigning include speed, convenience, and the ability to execute agreements without the limitations of physical signatures.

Utilizing pdfFiller for secure eSigning can safeguard against unauthorized changes while ensuring that the signed document retains its integrity. Legal validity is one of the most significant advantages of electronically signed documents, which can be critical during disputes or when presenting shareholder agreements.

Collaborating with other shareholders under article 691

Collaboration among shareholders is essential for passing resolutions and advancing corporate agendas. Article 691 provides mechanisms for collaboration that can lead to more unified efforts in advocating for shareholder rights or addressing corporate governance issues. Joint ownership and cooperative movements among shareholders can influence major corporate decisions.

Using pdfFiller to share and manage documents can enhance this collaboration, allowing shareholders to access information easily and engage in meaningful discussions. Best practices such as maintaining open lines of communication and setting regular meetings contribute to effective teamwork among shareholders, ensuring that all voices are heard.

Navigating disputes related to article 691

Disputes among shareholders can arise for various reasons, including disagreements over dividend distribution or voting procedures. Understanding common sources of conflict helps in preventing and resolving them efficiently. Legal recourse can often be pursued under Article 691, providing a structured pathway for addressing grievances.

Alternative dispute resolution methods, such as mediation or arbitration, can also be effective in settling disputes without escalating to litigation. Engaging in dialogue with corporate governance bodies can help facilitate these resolutions, ensuring that the company's operational integrity remains intact.

Updating and modifying article 691

Updating Article 691 is necessary to reflect changes in corporate governance best practices or shifts in legal requirements. Regular reviews and revisions ensure that the article remains relevant and effective for all shareholders. When such changes are warranted, a structured process for amending shareholder articles must be followed.

Using pdfFiller can simplify managing document revisions. Its collaboration tools enable multiple stakeholders to contribute to the amendment process, effectively integrating feedback and ensuring that necessary updates are accurately captured in the new version of the article.

Case studies: application of article 691 in real companies

Real-world applications of Article 691 demonstrate its functionality in protecting shareholder rights and upholding corporate governance. Successful implementation of various shareholder rights has resulted in increased transparency and shareholder satisfaction in numerous corporations. Learning from these cases can provide valuable insights into the strengths and weaknesses of different approaches.

Moreover, challenges faced by companies in adhering to Article 691 can highlight areas for improvements in governance practices. By analyzing these case studies, corporations can adopt best practices that enhance their operations and shareholder relations.

Interactive tools for understanding shareholder rights

pdfFiller offers interactive tools that can significantly aid in understanding and applying shareholder rights under Article 691. Templates are available for various articles of incorporation, customizable to meet specific corporate needs, providing users with a solid foundation for formulating their documents.

Additionally, customization tools enable shareholders to personalize forms according to their unique preferences and requirements. Features for collaborative document management streamline the communication and approval processes among stakeholders, enhancing the overall experience.

Ensuring compliance with article 691

Regularly scheduled compliance checks are essential to identify any gaps in adherence to Article 691. Companies carry legal obligations to ensure that shareholders are protected and that the provisions of the article are being followed rigorously. Engaging pdfFiller for ongoing management and documentation can facilitate meeting these compliance requirements efficiently.

Establishing an ongoing compliance review process can further safeguard against potential conflicts arising from misunderstandings or oversights regarding shareholder rights. This proactive approach promotes a healthy corporate culture that respects and values shareholder participation.

The future of shareholder rights and article 691

Trends in corporate governance forecast an increasingly active role for shareholders in shaping the future of businesses. This evolution signifies that Article 691 must adapt to evolving technologies and modern expectations regarding corporate accountability and transparency. Staying ahead of these trends ensures that companies maintain relevance in the dynamic business landscape.

Embracing new technologies in document management is crucial, as these innovations enhance collaboration and streamline governance practices. The importance of adaptability in corporate structures cannot be overstated, as markets and stakeholder expectations continuously evolve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send shareholder article 691 or to be eSigned by others?

Can I edit shareholder article 691 or on an iOS device?

How do I complete shareholder article 691 or on an iOS device?

What is shareholder article 691 or?

Who is required to file shareholder article 691 or?

How to fill out shareholder article 691 or?

What is the purpose of shareholder article 691 or?

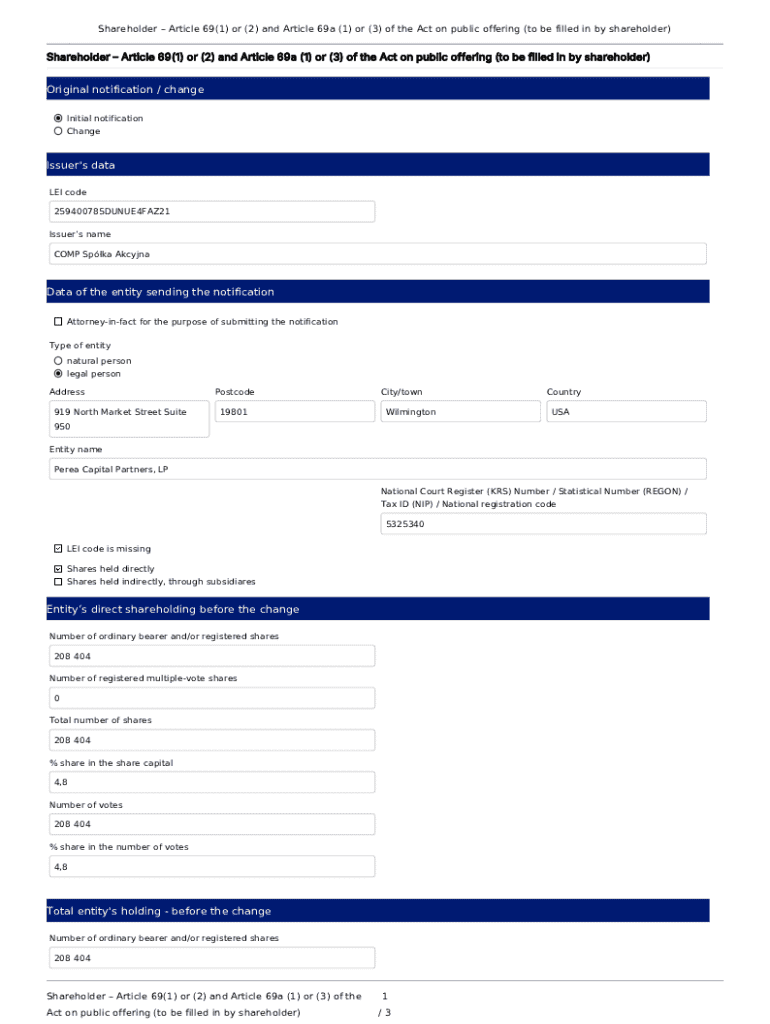

What information must be reported on shareholder article 691 or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.