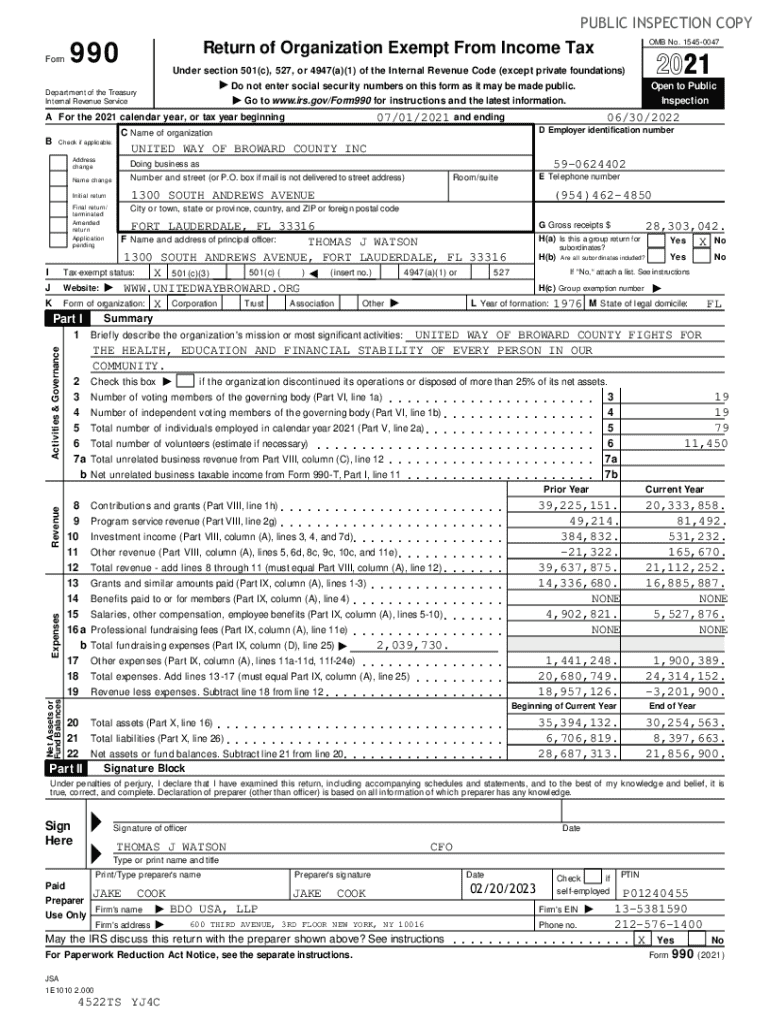

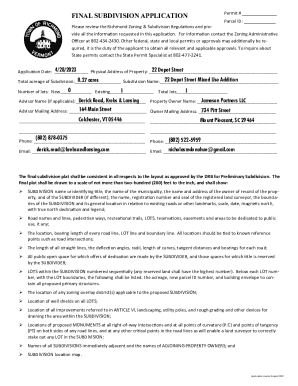

Get the free Return oT Organization Exempt From income Tax A AV 11

Get, Create, Make and Sign return ot organization exempt

How to edit return ot organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return ot organization exempt

How to fill out return ot organization exempt

Who needs return ot organization exempt?

Return of Organization Exempt from Income Tax: Your Comprehensive Guide

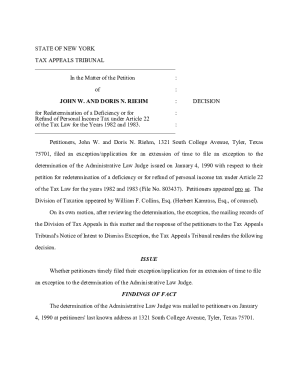

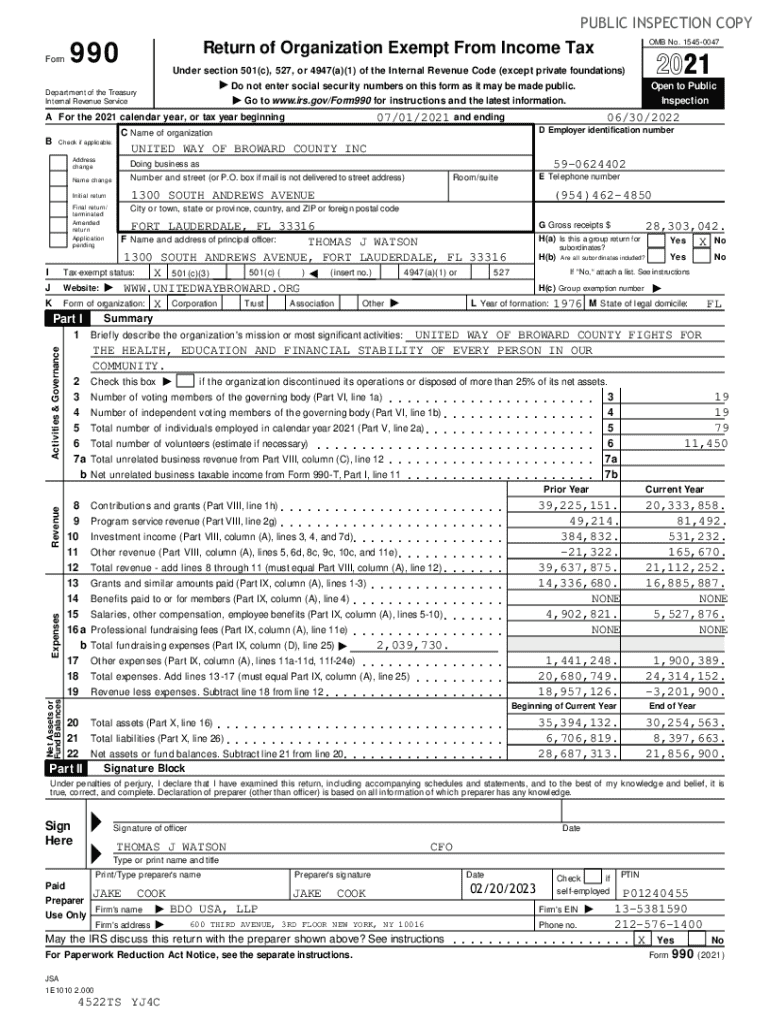

Overview of Form 990

Form 990 is an essential document that non-profit organizations must file annually to maintain their tax-exempt status. More than just a tax return, it provides transparency regarding the organization's financial health and activities, making it important for public accountability and for maintaining donor trust.

All tax-exempt organizations, including charities, foundations, and other non-profits, are required to complete and submit this form. An important distinction exists between Form 990 and other tax forms, such as Form 1040 or Form 1120, which are designed for individuals and corporations, respectively. Form 990 offers a comprehensive look at an organization’s operations and finances over the preceding year.

Comprehensive Guide to Filling Out Form 990

Filling out Form 990 can seem daunting, but breaking it down into manageable sections can simplify the process. Below is a step-by-step guide to efficiently completing the form.

This guide outlines crucial components and common pitfalls, ensuring you can submit a correct and thorough organization exempt form.

Step-by-step breakdown of form sections

Starting with Basic Information, you need to provide your organization’s official name, address, and Employer Identification Number (EIN).

Mission and activities

Crafting a clear mission statement is vital. This section gives you the opportunity to articulate your organization's purpose concisely, along with a detailed description of your goals and activities.

Revenue and expense reporting

Reporting financials effectively involves categorizing different sources of revenue and employing comprehensive strategies for reporting expenses. Transparency is crucial in this section, as it reflects your organization's financial health.

Balance sheet reporting

Accurate balance sheet preparation is essential. Include key components like assets, liabilities, and fund balances, and develop best practices to ensure completeness in your reporting.

Common mistakes to avoid

Even the most diligent organizations can fall victim to common mistakes while completing the return. Inaccurate reporting of revenues and expenses could lead to problematic audits.

Further, failing to disclose information about board members and key employees or not adhering to filing deadlines can jeopardize your non-profit's standing. Be meticulous when filling out Form 990.

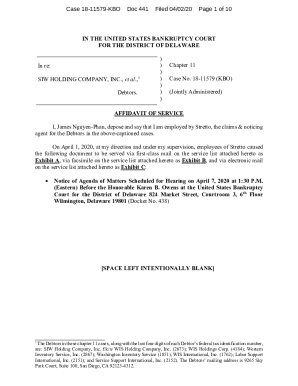

Navigating e-filing for Form 990

E-filing Form 990 offers several advantages that traditional paper filing does not. The ease of electronic submission is enhanced by instant confirmations and reduced processing time, making it a preferred choice for many organizations.

Moreover, e-filing reduces paper waste and is more environmentally friendly, plus many online platforms include built-in checks for common errors to streamline the process.

Advantages of e-filing

Step-by-step e-filing process

To successfully e-file your Form 990, follow a clear process. Begin by selecting the right software tailored for Form 990 that will not only ease your workflow but also comply with the IRS specifications.

Interactive tools for enhancing your e-filing experience

Using tools like pdfFiller can enhance your overall e-filing experience. Template fillers and budgeting calculators are available to simplify document preparation, allowing non-profits to precisely estimate future revenues and expenses.

Template fillers and calculators

Collaboration features

For teams working together to fill out Form 990, pdfFiller offers various collaboration features. Real-time editing and commenting functionalities enable seamless teamwork, which is particularly useful when finalizing details before submission.

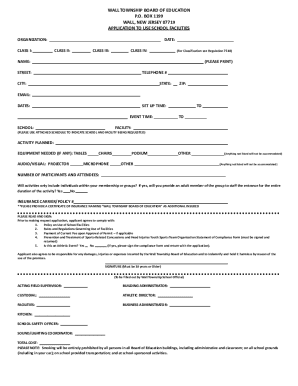

Ensuring compliance and best practices

Understanding both state and federal requirements is crucial for filing Form 990. Different states may impose varied regulations, and an organization must coordinate these filings to remain compliant.

Conducting annual reviews and internal audits are essential best practices that help ensure compliance. Resources for legal advice can also be beneficial, particularly if your organization is navigating complex regulations.

Document management after filing

Once submitted, effective document management is critical. Archiving your Form 990 correctly ensures it is readily available for future reference or audits. Adopting best practices for safe document storage can mitigate risks associated with data loss.

Utilizing document organization and retrieval tools can enhance efficiency in managing your organization’s filings and compliance status. Always stay informed about any changes that may impact compliance using reliable tools like those offered by pdfFiller.

Incorporating pdfFiller’s features

pdfFiller streamlines the entire process of filing Form 990 from start to finish. As an all-in-one solution, it empowers users to edit, e-sign, collaborate, and manage their documents on a cloud-based platform with ease.

Being able to seamlessly navigate through the intricacies of Form 990 provides organizations with confidence in compliance. User testimonials specifically highlight the effectiveness of pdfFiller in managing Form 990 submissions effortlessly.

Frequently asked questions (FAQs)

When it comes to Form 990 and e-filing, questions frequently arise. Many organizations wonder about the specific requirements for filing, troubleshooting issues during the process, and optimal resources available for assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute return ot organization exempt online?

Can I create an eSignature for the return ot organization exempt in Gmail?

How do I edit return ot organization exempt straight from my smartphone?

What is return ot organization exempt?

Who is required to file return ot organization exempt?

How to fill out return ot organization exempt?

What is the purpose of return ot organization exempt?

What information must be reported on return ot organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.