Get the free 11420 W

Get, Create, Make and Sign 11420 w

How to edit 11420 w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 11420 w

How to fill out 11420 w

Who needs 11420 w?

11420 W Form: A Comprehensive Guide for Efficient Document Processing

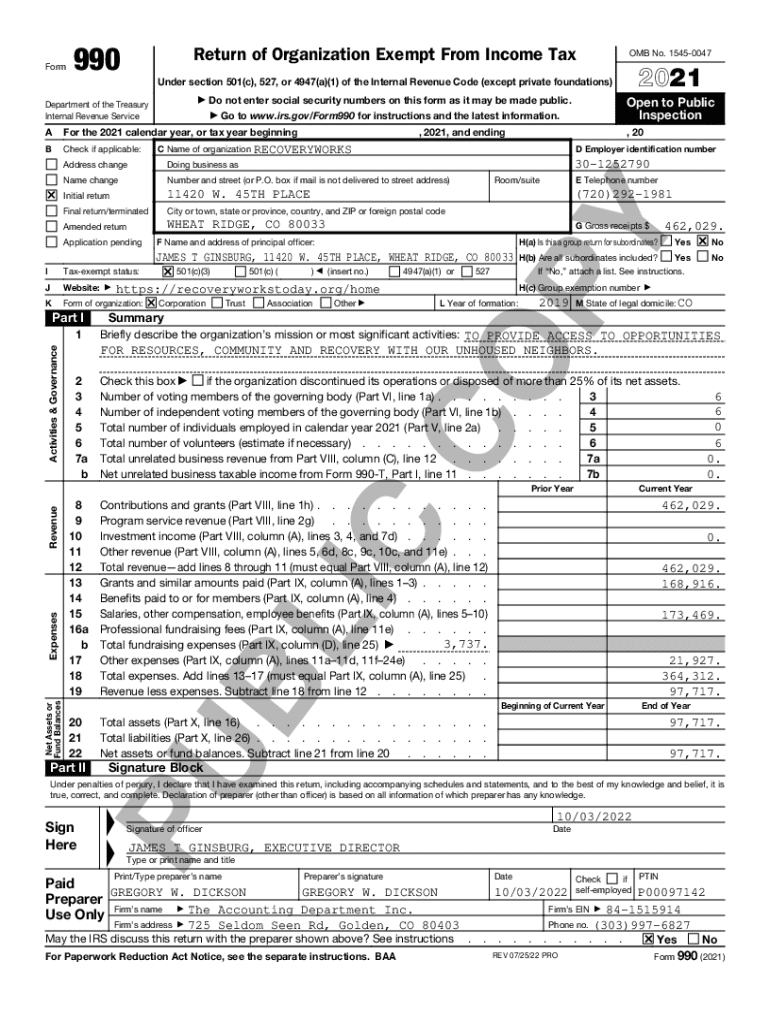

Understanding the 11420 W Form

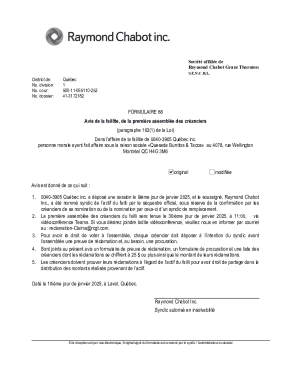

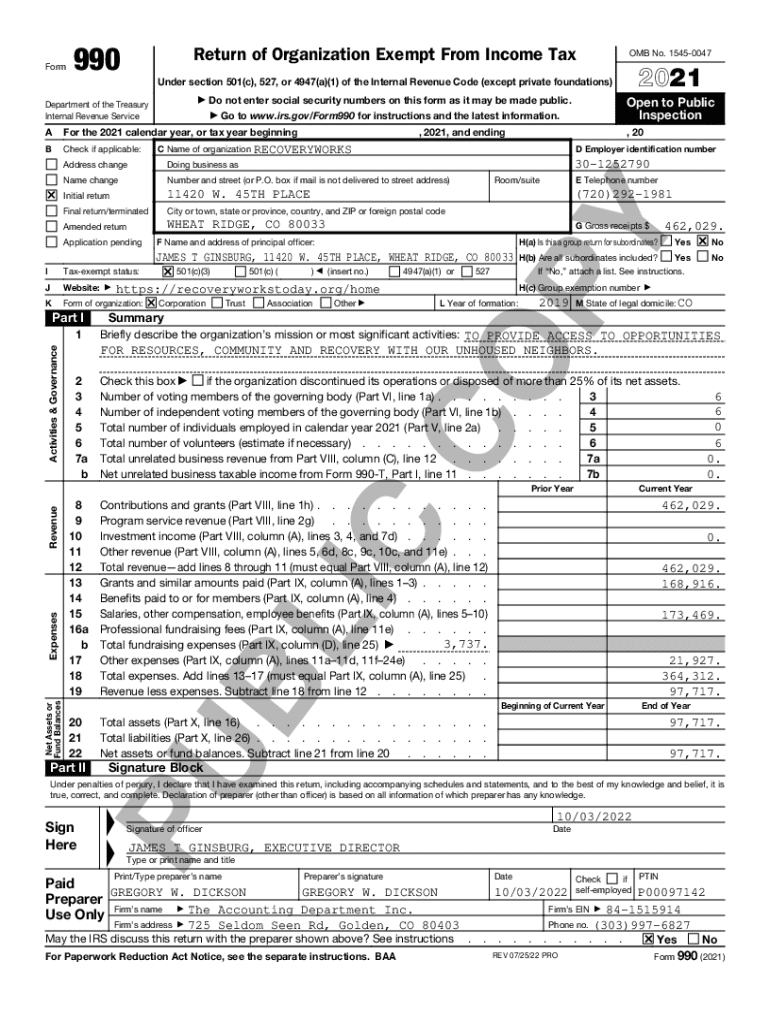

The 11420 W Form is integral in specific financial and administrative processes within various organizations. This form serves as a request for a waiver on certain taxes or obligations, making it crucial for individuals and businesses to understand its significance. Particularly, it's used when filing certain types of federal forms, primarily focusing on tax considerations that impact both residents and non-residents engaging with the U.S. financial system.

Several transactions demand the usage of the 11420 W Form, whether for income documentation, tax treaty benefits, or exemptions. Without the proper submission of this form, individuals may face unnecessary taxation and compliance issues. Thus, its role cannot be overstated in efficient document processing.

Who should use the 11420 W Form?

Several stakeholders should take advantage of the 11420 W Form, making it relevant for diverse target audiences. Individuals with income sources in the U.S. who reside abroad, professionals dealing with clients on a global stage, and teams managing international transactions often benefit from understanding and utilizing this form. Whether you're a freelancer providing services to U.S. clients or a corporate entity navigating foreign investments, the 11420 W Form becomes a necessary tool in your documentation arsenal.

Moreover, tax professionals and accountants play a pivotal role. Their in-depth knowledge ensures compliance with U.S. tax laws for expatriates and non-residents. By familiarizing themselves with this form, clients receive tailored advice that prevents penalties and optimizes tax obligations, reflecting the importance of this form across various sectors and professions.

Key features of the 11420 W Form

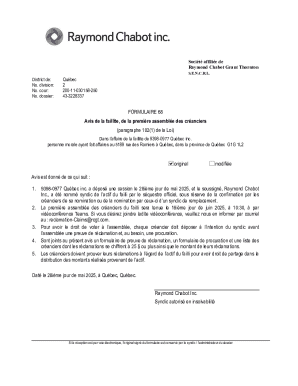

The 11420 W Form's structure is designed for clarity and functionality. Key attributes include various sections that request specific information, thus simplifying the form-filling process. Notably, common mistakes include omitting required details or misinterpreting tax obligations, which can lead to delays or complications. Understanding the nuances of each segment will ensure accuracy and compliance.

The form comprises sections for personal identification, income details, and tax treaty applications. Each section bears significance, as even minor inaccuracies affect the outcome. For instance, failing to correctly report income or misapplying tax treaty benefits can result in improper taxation levels. Therefore, being meticulous while entering information is crucial.

How to access the 11420 W Form

Accessing the 11420 W Form is straightforward, especially through pdfFiller. Users can download and print the form by navigating to pdfFiller’s library, where the 11420 W Form is readily available. This platform ensures both printable versions and editable online formats, catering to various user preferences.

The interactive tools offered by pdfFiller highlight the benefits of cloud-based access, allowing users to work on the form from any device. Finding relevant templates is streamlined through a user-friendly interface that makes document creation hassle-free. For those who prefer a customized approach, investing time in understanding these features significantly enhances the overall experience.

Filling out the 11420 W Form

Completing the 11420 W Form accurately requires preparation and a clear understanding of the information needed. Begin by gathering appropriate documentation—such as income records, identification numbers, and any tax-related documents relevant to your situation. Filling out the form in an organized manner ensures that you remain focused and do not miss essential sections.

To avoid common pitfalls, double-check entries against supporting documents. Utilizing pdfFiller's features, such as auto-fill options based on previous entries or integrations with data sources, can dramatically improve accuracy. Moreover, customizing fields tailored to your unique circumstances leads to enhanced completeness, which is vital for successful form submission.

Editing and customizing your 11420 W Form

Editing the 11420 W Form using pdfFiller provides a suite of flexibility that is paramount for effective document management. Users can easily add, remove, or modify information as needed, ensuring alignment with changing circumstances. Using pdfFiller's annotation tools allows for maintaining communication or making reminders directly on the document.

Best practices for customization include validating compliance with regulatory standards while embedding necessary details from related contexts. Whether adjusting formatting for clarity or incorporating notes for collaborators, ensuring that the final document meets all necessary criteria is essential. Such practices enhance the validity of submitted forms and foster a professional appearance.

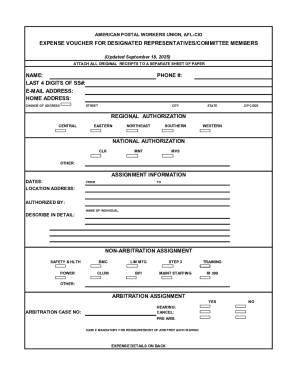

Signing and sharing the 11420 W Form

With digital transactions becoming the norm, integrating eSignature capabilities for the 11420 W Form through pdfFiller is a convenient option. Signing the form digitally streamlines the process, providing an immediate method for validating documents. Furthermore, implementing security measures—like verification prompts—ensures that your documents remain safe and tamper-proof.

Sharing options within pdfFiller also allow for real-time collaboration. Users can send the completed form for approval or share it with team members seamlessly. Enhanced document organization features help secure and store forms efficiently, paving the way for streamlined communication and accessibility.

Managing your 11420 W Form after completion

Once you've submitted the 11420 W Form, managing it properly remains essential. pdfFiller's cloud management features allow users to store and access completed forms effortlessly. Thus, ensuring your documents are organized, easily retrievable, and following best practices for digital record keeping is beneficial for future reference.

Beyond merely storing, engaging with additional actions post-submission, like tracking your form’s status or maintaining communication regarding its processing, further solidifies your documentation workflow. Utilizing tools that automate tracking can provide updates, ensuring nothing falls through the cracks and aiding effective management of your financial documentation.

Troubleshooting common issues with the 11420 W Form

While filling out the 11420 W Form can be straightforward, common issues can arise, impacting the submission process. Common mistakes include misreported income, incorrect tax identification numbers, or completed sections left blank. Addressing these concerns upfront can save time and prevent potential compliance headaches.

For those encountering problems, support resources through pdfFiller are invaluable. The platform provides tutorials, FAQs, and customer service that can assist in resolving issues swiftly. These resources not merely enhance the user's experience but also empower individuals with knowledge, ensuring competent form management.

Latest updates and news related to the 11420 W Form

Staying informed about the latest changes in regulations affecting the 11420 W Form is crucial for users. Regularly checking resources linked to IRS updates or tax regulation changes will equip you with the knowledge necessary to ensure compliance over time. As tax laws shift, adapting document requirements accordingly is essential.

Leveraging platforms like pdfFiller that continuously update their offerings ensures that you have access to the most current documents and templates. These automatic updates simplify the process of staying informed, empowering users to effectively manage their documentation needs.

Explore more forms and templates on pdfFiller

Users looking for related forms and templates can easily expand their document set through pdfFiller. This platform offers a plethora of forms tailored for various needs, making it an invaluable tool for individuals and teams alike. By cross-referencing with similar documents, users can ensure comprehensive readiness in their documentation processes.

Concluding thoughts emphasize the value that pdfFiller presents in document management. With its robust features and user-friendly design, it not only assists in filling and signing the 11420 W Form but enhances overall workflow efficiency. Capitalizing on the tools available within this platform can exponentially improve user experience and streamline transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 11420 w for eSignature?

How do I execute 11420 w online?

How do I make changes in 11420 w?

What is 11420 w?

Who is required to file 11420 w?

How to fill out 11420 w?

What is the purpose of 11420 w?

What information must be reported on 11420 w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.