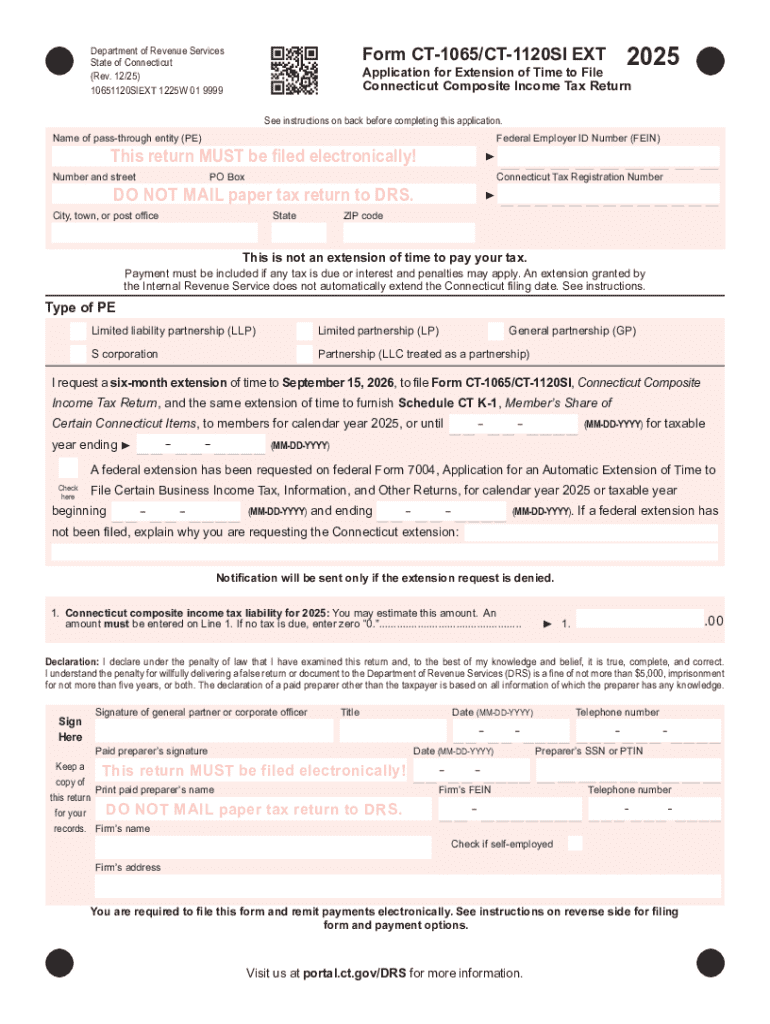

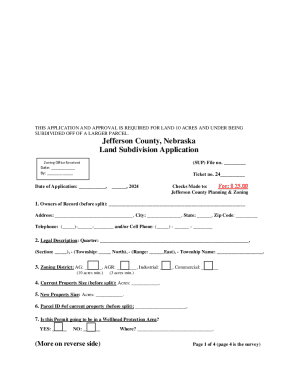

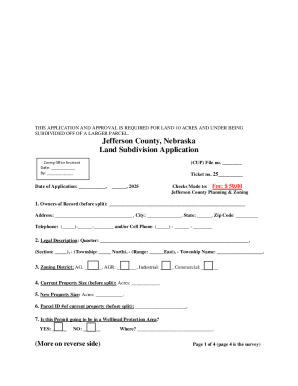

Get the free Composite Income Tax Forms

Get, Create, Make and Sign composite income tax forms

Editing composite income tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out composite income tax forms

How to fill out composite income tax forms

Who needs composite income tax forms?

A Comprehensive Guide to Composite Income Tax Forms

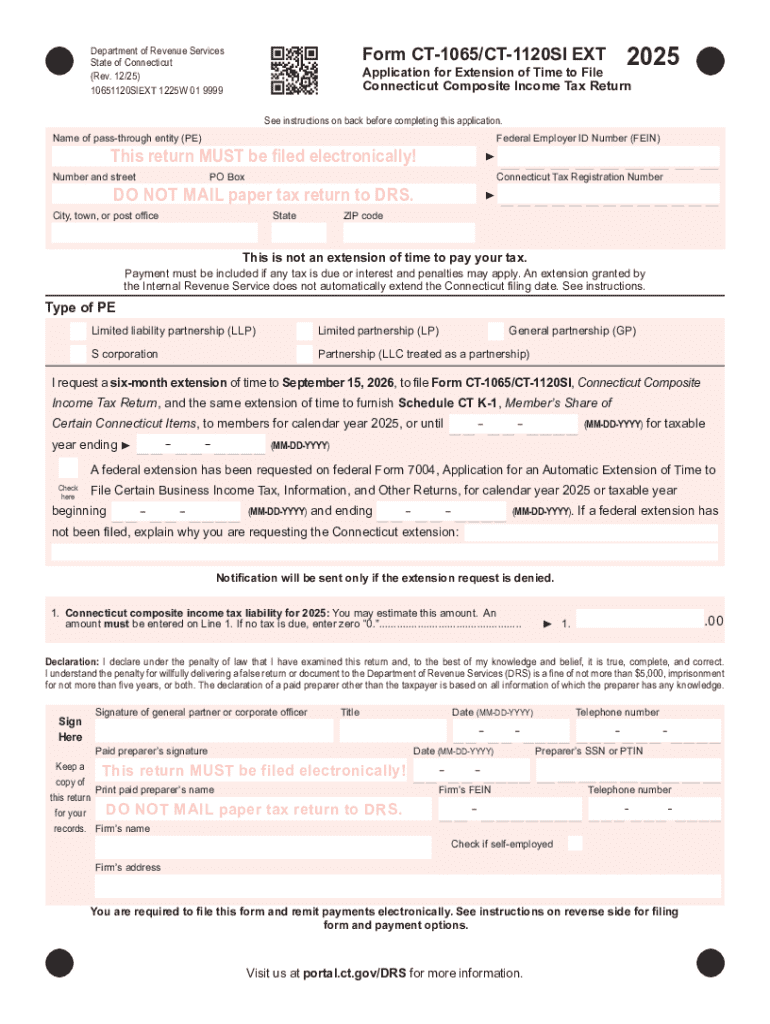

Understanding composite income tax forms

Composite income tax forms are specialized documents used to report income and taxes for multiple individuals or team members on a single tax return. These forms simplify the filing process, especially for businesses or partnerships, ensuring that all relevant income is accounted for and taxed appropriately. Their importance lies in their ability to streamline what often becomes a complex filing process for multiple parties.

Individuals such as freelancers, contractors, and entrepreneurs often utilize composite tax forms to manage their tax liabilities efficiently. In contrast, teams may opt for these forms to consolidate tax information for employees or multiple stakeholders under a single entity, thereby facilitating easier management and communication between the involved parties.

Types of composite income tax forms

There are several types of composite income tax forms that are commonly used across different states. Each state may have its own unique guidelines and forms which can lead to variations based on local regulations. For instance, states like California have specific composite forms tailored to collect income tax from partnerships effectively, while others may have simpler versions depending on the number of employees or stakeholders involved.

When choosing which composite tax form to use, understanding the differences in regulations based on state is crucial. Being aware of specific requirements such as deadlines and the type of income applicable can significantly affect your filing process and potential tax liabilities.

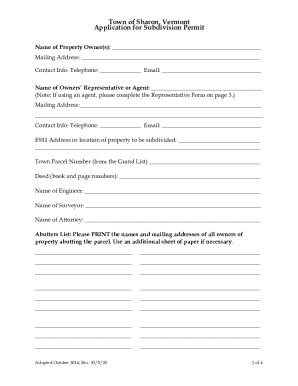

How to fill out composite income tax forms

Filling out composite income tax forms is a step-by-step process that requires meticulous attention to detail. Begin by gathering all necessary documentation, which includes items such as W-2s for employees, 1099s for freelancers, and any other relevant income statements. This step ensures that all income sources are reported accurately, ultimately impacting your total tax due.

Next, familiarize yourself with the filing requirements. Eligibility criteria may vary based on the form type, so understanding these specifics can save you from potential complications during submission. After you've reviewed the eligibility, complete the form section by section, ensuring that you fill in accurate information in each field.

Once completed, calculate your taxes using appropriate methods—this could involve software or manual calculations—before you submit. Reviewing for any possible errors, including double-checking personal information and signatures, is crucial to prevent delays or issues with the tax administration.

Tips for editing and managing your composite tax forms

Utilizing digital tools, such as pdfFiller, can remarkably enhance your experience when editing composite tax forms. The platform allows for easy access and modification of your documents, ensuring that all elements are current and accurate. It also provides features that enable collaboration with team members, which is particularly beneficial for businesses managing numerous tax-related documents.

To manage your composite forms effectively, consider creating a timeline for each stage of your tax preparation. Establish regular check-ins with your team to ensure that all necessary documents are gathered and filled out correctly. Involving team members can not only speed the process but also enhance accuracy through shared input.

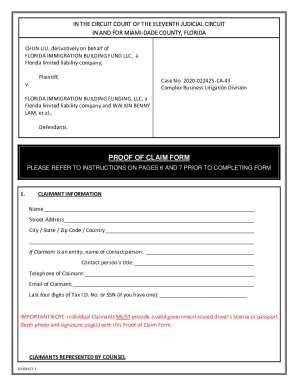

eSigning and submitting your composite tax forms

The significance of eSigning composite income tax forms cannot be overstated. Electronic signatures streamline the submission process, allowing taxpayers to finalize their forms more quickly and securely. Utilizing platforms like pdfFiller for eSigning provides a convenient and legally compliant method for signing documents remotely, which is particularly beneficial in today's fast-paced world.

To eSign your composite tax form using pdfFiller, first, upload the document, then utilize the eSigning feature to add your signature. Follow the prompts to ensure that all necessary parties sign the document before proceeding to submission. The entire process is designed for ease and efficiency, offering users peace of mind when it comes to tax filing.

Common mistakes to avoid when filing composite income tax forms

When it comes to composite income tax forms, several common mistakes can hinder a smooth filing process. Errors like incorrect personal information, missing signatures, and failure to meet the submission deadline frequently occur. These oversights not only delay processing but can also lead to penalties from the department of finance and administration.

To enhance accuracy, incorporating best practices, such as maintaining a checklist of required documents and having an additional party review your submission, can be invaluable. Make sure to regularly check for updates regarding tax regulations, including potential fee changes, as tax laws can vary widely year to year.

Tracking your composite income tax submission

Understanding submission acknowledgments is critical for tracking the status of your composite income tax forms. Most states provide a way to confirm that your form has been received, whether through online portals or direct contact with the income tax administration. Keeping a record of your submission confirmation can aid in ensuring your taxes are properly accounted for and prevent unnecessary follow-up actions.

If you encounter issues—such as a rejection or discrepancies—it's essential to act promptly. Reviewing the specific reasons for rejection outlined by the department will guide you in making necessary corrections. Additionally, utilizing resources available on pdfFiller can further assist in managing and resubmitting forms efficiently.

Advantages of using pdfFiller for composite income tax forms

Using pdfFiller as your comprehensive document management solution offers numerous advantages when handling composite income tax forms. With a user-friendly interface and cloud-based functionality, accessing your documents from anywhere becomes a breeze. It eliminates the hassle of searching through physical paperwork and ensures that all your tax documents are centralized and organized.

Moreover, pdfFiller’s tools allow for intuitive editing, collaborative capabilities, and easy signing features, which collectively enhance the user experience. This consolidation of services not only saves time but also minimizes the risk of errors, making your tax filing experience smoother and more reliable.

Case studies: Successful filing of composite income tax forms

Real-life examples shed light on how various individuals and teams effectively navigated the filing process using composite income tax forms. For instance, a small business that consolidated its employee data and utilized a composite form managed to accurately report and pay taxes while ensuring compliance with state regulations. This not only enhanced their cash flow management but also saved them from incurring hefty fines due to incorrect filings.

In another case, a freelance project team efficiently processed their income through a composite return, which allowed them to combine all their income streams. By employing pdfFiller during their preparation stages, they successfully collaborated and finalized their submission well before the deadline, demonstrating that with the right tools, complex tax situations can be streamlined.

FAQ on composite income tax forms

Common queries surrounding composite income tax forms often revolve around eligibility, filing deadlines, and the specific information required on forms. Many users are uncertain if they qualify for using composite returns, especially in circumstances involving mixed types of income. Consulting reliable sources or tax professionals can assist individuals in clarifying these uncertainties.

Further inquiries frequently touch upon the consequences of errors in filings, including penalties that can arise from missed deadlines or incorrect reporting. Engaging with resources like pdfFiller’s customer support can provide further insight and essential guidance for taxpayers looking to navigate these complexities.

Utilizing additional resources for enhanced understanding

To gain further insight into composite income tax forms, taxpayers can turn to federal and state tax authorities that offer extensive resources online. Official directories can guide users through specific state tax regulations and help them identify necessary documentation based on income type. This data is crucial for ensuring compliance with local laws and avoiding potential legal issues.

Additionally, exploring tax software comparisons can enhance understanding of available tools. pdfFiller stands out due to its user-friendly features that cater to diverse document needs, setting it apart from other tax preparation solutions. Understanding advantages and drawbacks between these platforms can empower users to make informed choices on how to best manage their composite tax submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit composite income tax forms from Google Drive?

Can I create an electronic signature for signing my composite income tax forms in Gmail?

How do I edit composite income tax forms straight from my smartphone?

What is composite income tax forms?

Who is required to file composite income tax forms?

How to fill out composite income tax forms?

What is the purpose of composite income tax forms?

What information must be reported on composite income tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.