Get the free TC-62Q Utah Sales Tax Sourcing Schedule. Forms & Publications

Get, Create, Make and Sign tc-62q utah sales tax

How to edit tc-62q utah sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-62q utah sales tax

How to fill out tc-62q utah sales tax

Who needs tc-62q utah sales tax?

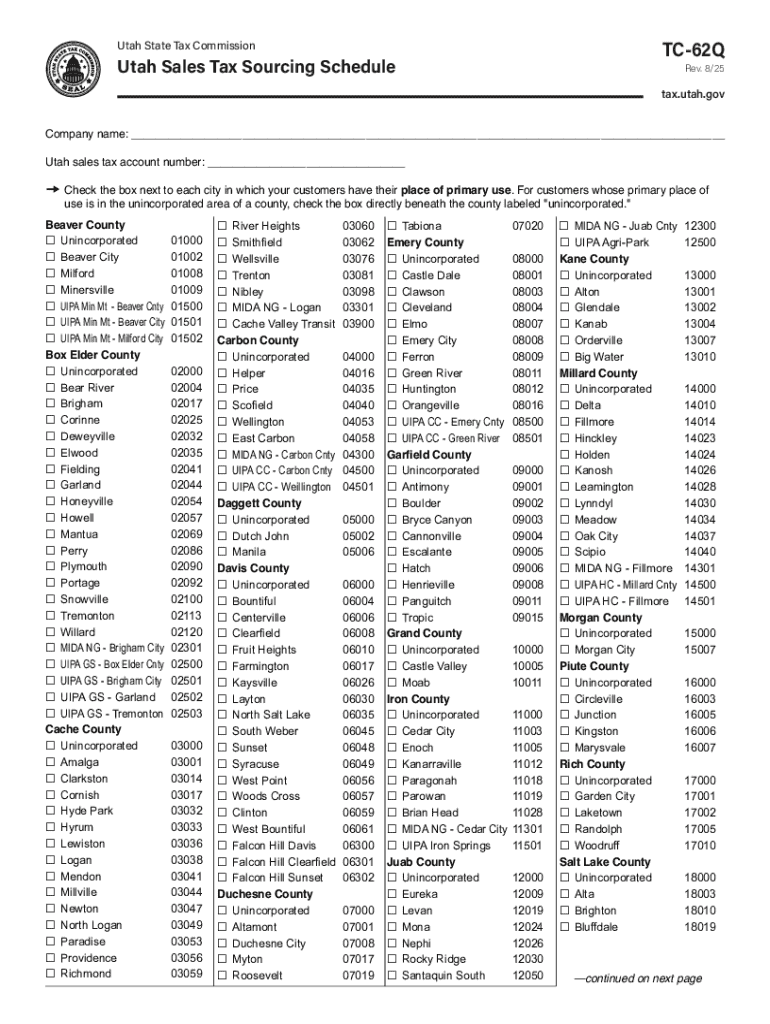

Comprehensive Guide to the TC-62Q Utah Sales Tax Form

Understanding the TC-62Q Utah Sales Tax Form

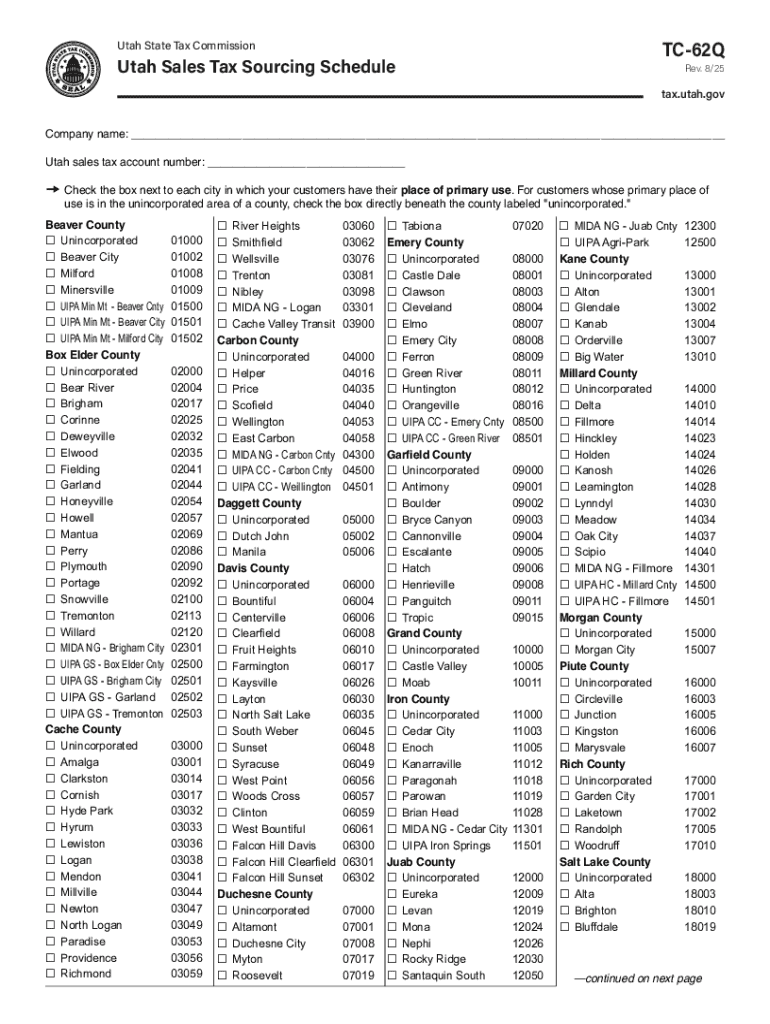

The TC-62Q Utah Sales Tax Form is a vital document for businesses operating within the state of Utah. Specifically designed for reporting and remitting sales tax, this form is crucial for ensuring compliance with state tax laws. Businesses, whether large or small, need to understand the nuances of this form to avoid penalties and ensure that their tax obligations are met.

The main purpose of the TC-62Q Form is to collect the appropriate sales tax from consumers, which is then forwarded to the Utah State Tax Commission. By accurately filing this document, businesses contribute to state revenue, which funds public services such as education and infrastructure.

Any business selling tangible goods, leases, or certain services in Utah is required to file the TC-62Q Form. This includes retail stores, online sellers, and service providers. Understanding who needs to file ensures that all businesses remain compliant and avoid costly penalties associated with late or inaccurate filings.

Key components of the TC-62Q form

The TC-62Q Form is organized into several key sections that require specific information from the taxpayer. These components include business identification, recorded sales, and the calculated tax amount owed.

The business information section gathers vital details such as the business's name, address, and tax identification number. The sales detail section requires a breakdown of total sales made during the reporting period, categorizing them by taxable and non-taxable transactions.

Common mistakes when filling out the TC-62Q Form include omitting required fields, incorrect calculations, and misunderstandings regarding taxable versus non-taxable sales. It’s essential for businesses to double-check their entries to prevent costly errors.

Step-by-step guide to completing the TC-62Q form

Before diving into the TC-62Q Form, it’s crucial to prepare adequately. Collecting necessary documentation, such as sales records and previous tax returns, streamlines completion. Moreover, understanding the current sales tax rates in Utah is essential for accurate reporting.

When filling out the TC-62Q Form, begin with Section 1: Business Information, ensuring your business details are correct. Next, move to Section 2: Reporting Sales. Here you will detail your sales figures and categorize them correctly. Finally, in Section 3: Tax Calculation, accurately compute the total sales tax due based on your recorded sales.

After filling out all sections, review the entire form for accuracy. This is a critical step that includes verifying calculations and ensuring all required information is complete. Utilize additional resources like pdfFiller to enhance your review process.

Submitting your TC-62Q form

Once the TC-62Q Form is completed, submission can be done in several ways. The most efficient method is online submission via the Utah State Tax Commission's website. This method allows for immediate confirmation of receipt and reduces the possibility of lost documents.

For those who prefer traditional methods, mail-in submission is also available. Ensure you check the mailing address and use registered mail to confirm delivery. It’s crucial to be mindful of submission deadlines, as late filings can lead to penalties.

Tools and resources for managing the TC-62Q Form

Managing the TC-62Q Form can be made significantly easier with tools like pdfFiller. This platform provides cloud-based document management, allowing users to fill out, edit, and eSign their TC-62Q forms conveniently from any device.

Interactive features offered by pdfFiller, such as document sharing options and team collaboration tools, make it easier for businesses to manage their sales tax forms efficiently. This flexibility can lead to quicker resolutions and greater accuracy in data handling.

Frequently asked questions (FAQs) about the TC-62Q form

One common question regarding the TC-62Q Form is, 'How often do I need to file?' Businesses generally need to file quarterly, but frequency can depend on total sales volume. Understanding your specific filing schedule is key to maintaining compliance.

Mistakes can happen; if you make an error on the TC-62Q Form, it’s important to amend it promptly. Amendments can often be submitted using a correction form available through the Utah State Tax Commission.

Additionally, businesses may wonder, 'Can I amend a previously submitted TC-62Q Form?' Yes, it is possible to amend a filed form, but it should be done carefully to ensure all corrected figures are accurate.

Real-world examples and case studies

Consider the case of a local retail business that diligently filed their TC-62Q Form using pdfFiller's tools. Their systematic approach ensured accurate reporting and timely payments, resulting in no penalties and favorable feedback from state auditors.

On the other hand, a service-based company overlooked some crucial sales detailed in their TC-62Q Form, leading to substantial back taxes due on audit. This case highlights the importance of attention to detail when filling out tax forms.

Conclusion on navigating the TC-62Q Utah sales tax form

Navigating the TC-62Q Utah Sales Tax Form doesn't have to be overwhelming. By understanding the components, accurately completing the form, and utilizing available resources, businesses can streamline their filing processes.

As you prepare your sales tax return, remember the tools offered by pdfFiller can help empower you to manage documents with ease. With its cloud-based capabilities, you'll be able to focus more on running your business and less on paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tc-62q utah sales tax in Gmail?

Where do I find tc-62q utah sales tax?

Can I edit tc-62q utah sales tax on an Android device?

What is tc-62q utah sales tax?

Who is required to file tc-62q utah sales tax?

How to fill out tc-62q utah sales tax?

What is the purpose of tc-62q utah sales tax?

What information must be reported on tc-62q utah sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.