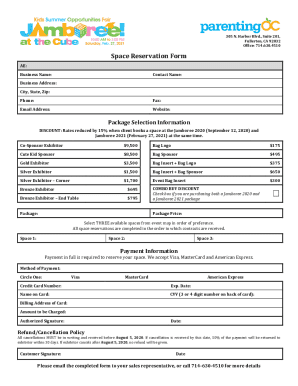

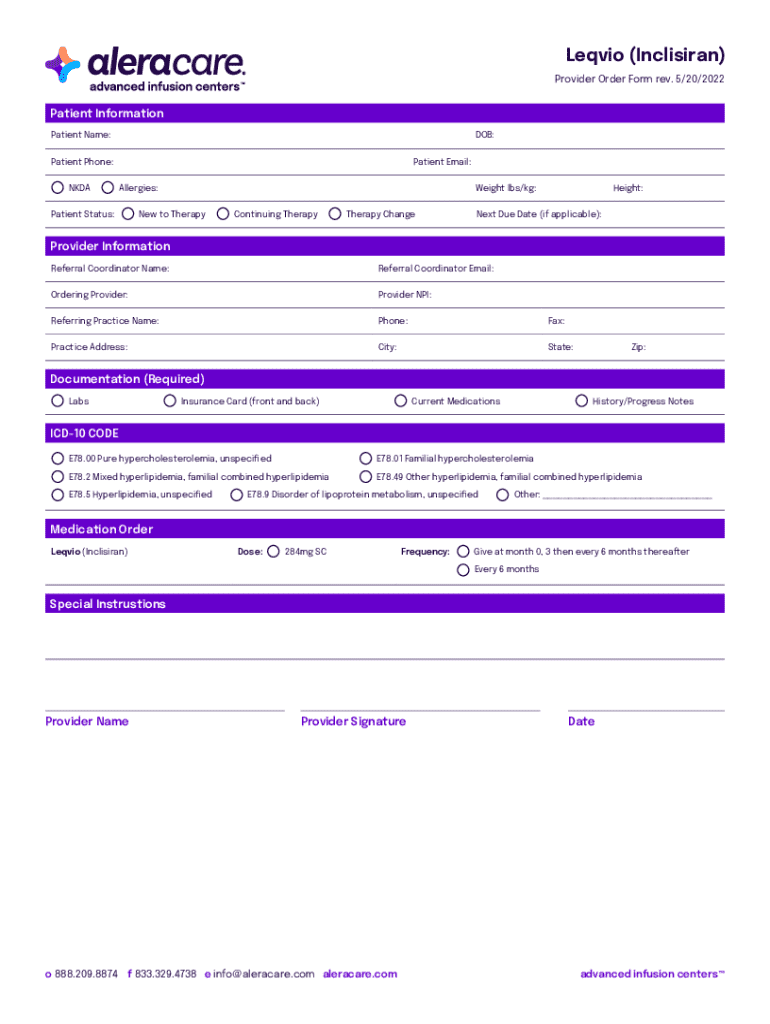

Get the free Insurance Card (front and back)

Get, Create, Make and Sign insurance card front and

How to edit insurance card front and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance card front and

How to fill out insurance card front and

Who needs insurance card front and?

Understanding Insurance Card Front and Form

Understanding the insurance card

An insurance card is a crucial document that serves as proof of insurance coverage. Its primary purpose is to provide essential details about the insured individual, the insurance policy, and the insurance provider. Whether for health, auto, or home insurance, possessing an updated insurance card is vital to accessing services and claims efficiently. An expired card may complicate emergency situations or medical visits.

Having an up-to-date insurance card not only ensures that you can access necessary medical care or claim assistance promptly but also reflects your responsibility as a policyholder. Keeping your insurance card handy allows you to present proof of coverage whenever required, reducing stress during urgent situations.

Types of insurance cards

There are various types of insurance cards that cater to specific insurance needs. Here's an overview of the most common ones:

Key elements of an insurance card

Understanding the key elements present on an insurance card can facilitate ease of use and comprehension during emergencies or when filing claims. Essential components generally found on an insurance card include:

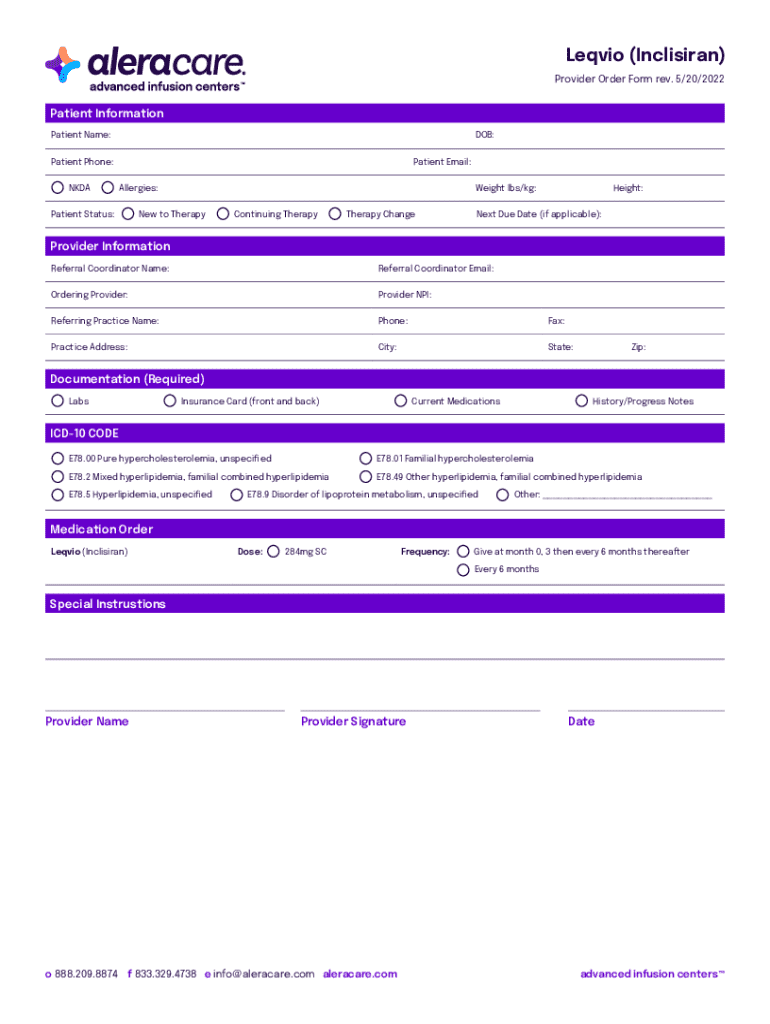

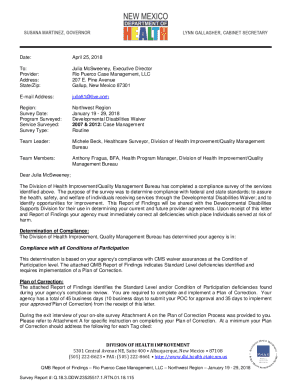

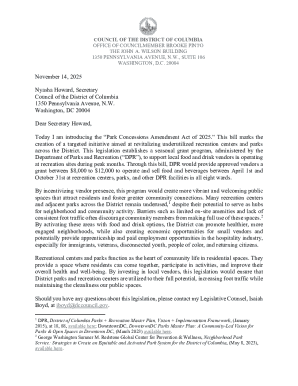

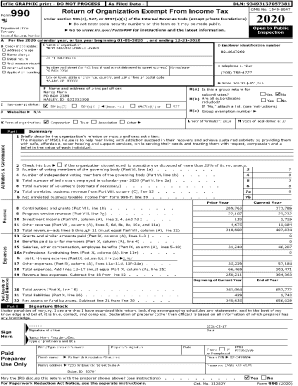

The anatomy of an insurance card front

The front of an insurance card presents vital information at a glance. A visual examination of a sample insurance card may reveal a variety of components, including the insurance company’s logo, barcodes for scanning, and contact information for customer service.

Visual breakdown of sample insurance card

Typical features include a clear display of the insurance provider's logo and a unique barcode for quick access to the policy details in databases. Understanding this layout can assist policyholders in locating necessary information rapidly. Additionally, many insurance cards display essential contact information for the insurance agency or customer service, helping facilitate claims or inquiries.

Common features on insurance card front

When examining the front of an insurance card, some common features include:

Filling out the insurance card form

Filling out an insurance card form may seem daunting, but preparing appropriately can streamline the process. Start by gathering all necessary information, such as personal identification details and specific policy information, before diving into the form.

Preparing to fill out the form

Understanding the instructions on the form is critical to ensure accuracy. Each section typically includes clearly marked fields that correspond to specific pieces of information, from your full name to policy details. Missing a piece of information can delay processing.

Step-by-step instructions for filling out

Common mistakes to avoid when filling out

Common mistakes while filling out the insurance card form include typos and inaccuracies. Before submitting, always double-check for errors, especially in policy details. Ensuring everything is correct is essential to avoid problems later when you need to rely on your insurance.

It's also advisable to confirm that the information matches what the insurance agency has on file, as discrepancies can lead to delays or complications with claims processing.

Editing and managing your insurance card

Editing your insurance card details can be crucial when changes occur, such as a change of address or a policy update. Using tools like pdfFiller allows users to edit fields securely, ensuring that all modifications align with compliance standards.

How to edit your insurance card details

With pdfFiller, you can access a straightforward platform for making revisions. Begin by uploading your existing insurance card. The tools available allow you to easily edit text such as your name, address, and policy number while ensuring the format remains professional and compliant. Once you've made your edits, saving the document in a secure format helps maintain integrity.

Maintaining accessibility with cloud management

Storing your insurance card in the cloud offers significant advantages, allowing you to access it from anywhere. With pdfFiller’s cloud management, you can safely keep your documents organized and accessible across devices, ensuring you have your insurance information at your fingertips when needed.

Having your insurance card readily accessible not only eases the stress during emergencies but also ensures you remain prepared for frequent checks associated with health care visits or vehicle requirements.

Signing your insurance card form

Once you've completed the insurance card form, you may need to sign it before submission. This step legally binds the document and confirms that the information provided is accurate and true.

Digital integration: eSigning made easy

Using pdfFiller, it's simple to incorporate electronic signatures into your forms. With tools that facilitate eSigning, you can sign your insurance card form digitally without the hassle of printing or scanning. This not only saves time but also enhances document security and compliance.

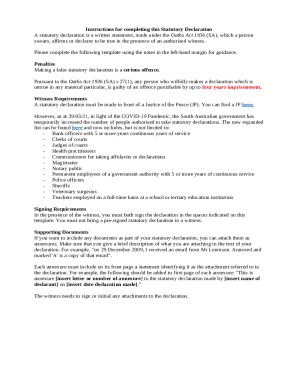

Adding witness signatures if required

In certain situations, your insurance card form may require a witness signature. This is common when the policy includes specific benefits or clauses that necessitate verification. The pdfFiller platform provides straightforward guidance on collecting witness signatures digitally, ensuring all parties are present and informed.

Step-by-step processes are in place for obtaining witness signatures, allowing for an efficient and secure method to complete your insurance documentation.

Frequently asked questions (FAQs)

When managing your insurance card, it's common to encounter questions or uncertainties. Here are some frequently asked questions to provide further clarity.

What to do if you misplace your insurance card?

If you misplace your insurance card, the first step is to contact your insurance provider for a replacement. Most insurers have processes to quickly issue new cards. Keeping a digital copy in the cloud can prevent future loss and provide reassurance.

How often should you update your insurance card?

It’s advisable to review your insurance card annually or whenever there's a change in your policy. Updates ensure that all information is current and can prevent delays during claims or emergencies. Always check new coverage details when policies are renewed.

Can you use a digital copy of your insurance card?

Yes, many states and insurance providers accept digital copies of insurance cards. However, it’s essential to confirm with your provider and understand local regulations regarding digital documentation. Keeping a digital copy stored securely can expedite access during necessary situations.

Interactive features of pdfFiller for your insurance needs

pdfFiller provides several unique interactive features specifically designed to cater to your insurance documentation needs. Utilizing cutting-edge online editing tools, users can efficiently modify their insurance cards and other related forms.

Utilizing online editing tools

The online editing tools available within pdfFiller simplify the modification process. Users can change text, add information, and ensure documents meet their requirements quickly. This capability reduces the time spent managing documents, allowing you to focus on more significant matters.

Collaboration features for teams

For businesses or teams needing to share insurance cards and documentation, pdfFiller’s collaboration features enable users to work together effectively. Team members can collaborate on documents, share proposals, and manage submissions, ensuring a streamlined process.

Tracking changes to your document

pdfFiller offers robust tracking capabilities that allow users to maintain an audit trail of changes made to documents. This ensures accountability and makes it easier to reference previous versions, providing peace of mind for businesses that need constant documentation oversight.

Navigating compliance and regulations

Understanding compliance and regulations ensures you are adequately managing your insurance documentation. Adhering to local and federal laws regarding insurance documentation is critical in safeguarding your coverage and ensuring smooth transactions.

Understanding the legal requirements

Each state may have specific laws governing the formatting and issuance of insurance documentation, including what details must be included on an insurance card. Being proactive about these requirements can diminish the risk of non-compliance and financial mishaps.

Tips for staying informed

Staying informed about changes in insurance regulations or best practices is essential for effective management. Utilize official resources from regulatory agencies and subscribe to industry newsletters that provide updates on compliance requirements, keeping you aware and prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit insurance card front and online?

Can I create an electronic signature for the insurance card front and in Chrome?

How do I complete insurance card front and on an Android device?

What is insurance card front and?

Who is required to file insurance card front and?

How to fill out insurance card front and?

What is the purpose of insurance card front and?

What information must be reported on insurance card front and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.