Get the free Tax Information Bulletins (issued quarterly) - CDTFA - CA.gov

Get, Create, Make and Sign tax information bulletins issued

How to edit tax information bulletins issued online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax information bulletins issued

How to fill out tax information bulletins issued

Who needs tax information bulletins issued?

Comprehensive Guide to Tax Information Bulletins Issued Form

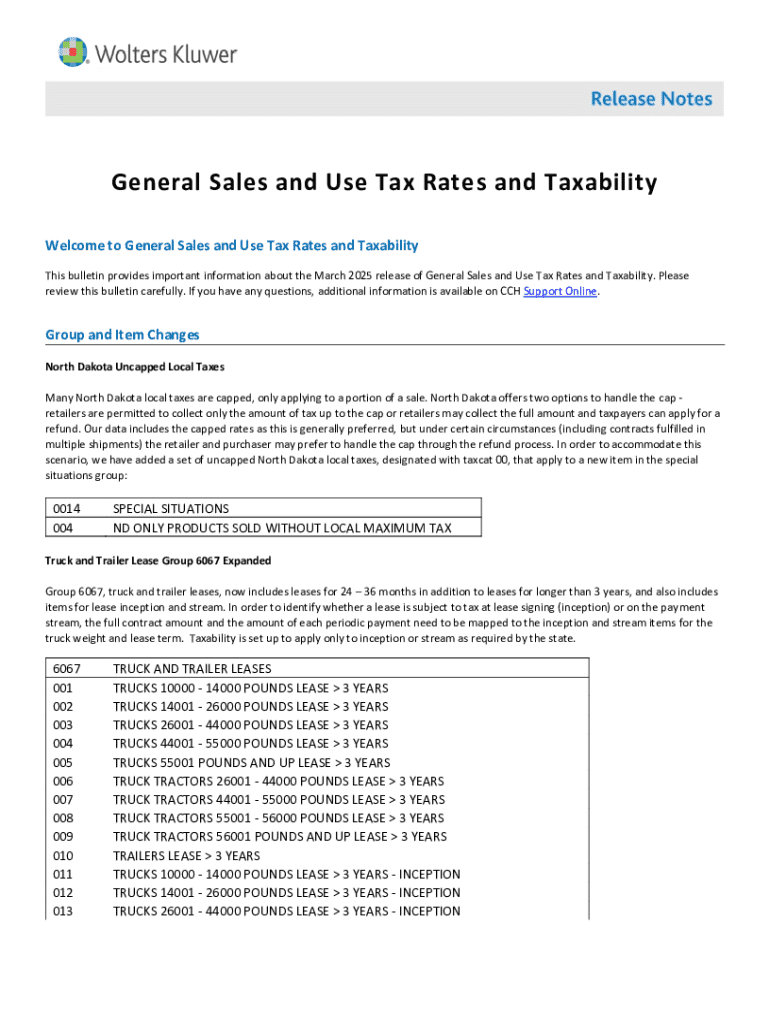

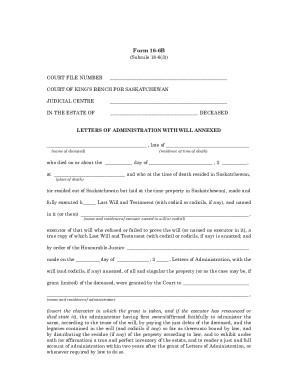

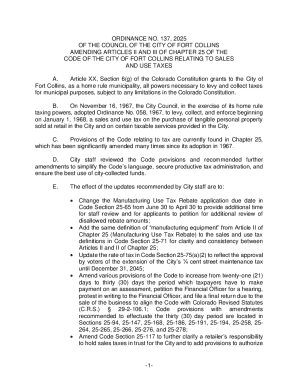

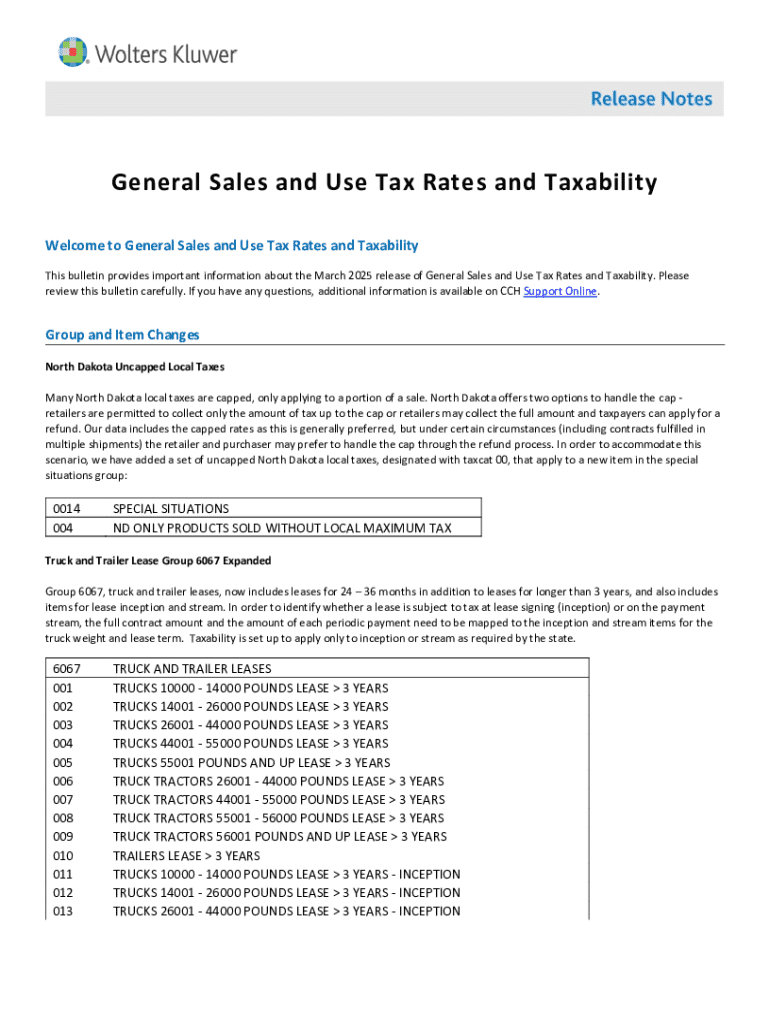

Overview of tax information bulletins

Tax Information Bulletins are official documents issued by tax authorities that provide essential information about regulations, updates, and guidelines relevant to taxpayers. Their primary purpose is to disseminate information about tax laws, changes in policies, and administrative procedures in a clear and concise format.

Staying updated with these bulletins is crucial for both individuals and businesses, as they keep you informed about new tax obligations and potential deductions or credits. Failure to comply with updated information can lead to tax issues or missed opportunities for savings.

Tax information bulletins are typically issued by federal and state tax agencies, ensuring that the information aligns with current legislative changes. Each bulletin serves as a reliable source of knowledge that taxpayers can turn to for guidance.

Types of tax information bulletins

Tax Information Bulletins can be categorized based on their frequency and purpose. Understanding these categories can help taxpayers locate relevant information quickly.

Navigating the tax information bulletins

Understanding how to read a Tax Information Bulletin is essential for effective compliance. Each bulletin is structured to provide clear guidance and typically includes several key sections.

Familiarizing yourself with common terminology is also advantageous. Terms like 'deduction,' 'credit,' and 'compliance' appear frequently and have specific implications in the context of taxation.

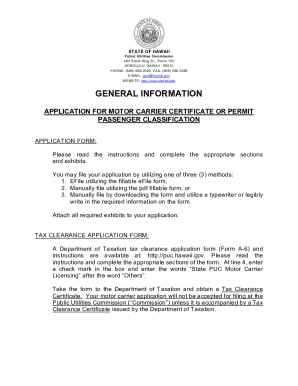

How to access tax information bulletins

Accessing Tax Information Bulletins is straightforward due to their availability online. Various government websites house these documents, making it easy for taxpayers to find needed information.

Utilizing pdfFiller for document access is particularly beneficial. With interactive features, users can easily navigate these resources, fill them out, and keep track of changes efficiently when needed.

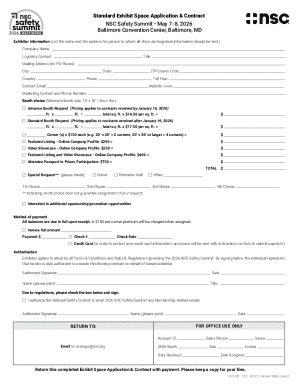

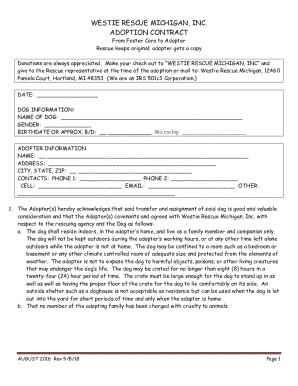

Filling out the tax information bulletins issued form

Once you have accessed the Tax Information Bulletins Issued Form, understanding how to complete it correctly is essential. This form is often asking for various personal and financial details that are important for tax compliance.

For accuracy, double-checking each section for typographical errors and ensuring all required fields are filled out will help prevent complications down the line.

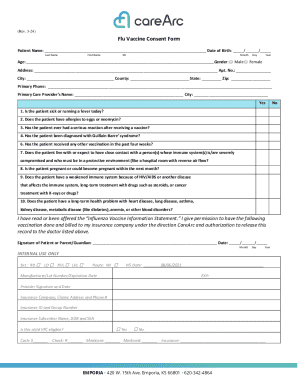

Editing and managing your tax document with pdfFiller

Editing and managing your tax documents can be a seamless task with pdfFiller's array of tools. Users can easily edit forms, collaborate with team members, and ensure that all alterations are recorded.

One of the most significant advantages of using a cloud-based document management system is the ability to access your files from anywhere, making tax seasons less stressful.

Frequently asked questions (FAQs)

As with any aspect of filing taxes, questions frequently arise regarding Tax Information Bulletins. Understanding these common queries can aid in navigating the process more smoothly.

Interactive tools and additional features

Utilizing interactive tools designed for tax preparation can significantly streamline your filing process. Many platforms, including pdfFiller, provide calculators and checklists to assist users.

These tools enhance user experience and aid in compliance, making it easier to manage tax obligations effectively.

Collaboration and support

Effective teamwork is crucial, especially in situations where multiple individuals are collaborating on tax matters. Platforms like pdfFiller offer features that allow for seamless teamwork.

With proper support and collaboration tools, managing tax compliance becomes much less daunting.

Conclusion on the importance of utilizing tax information bulletins

Utilizing Tax Information Bulletins is not just beneficial — it is essential for anyone committed to ensuring compliance with tax regulations. Keeping informed of updates can save you time, money, and unnecessary complications.

Engaging regularly with tax bulletins helps you take full advantage of tax relief opportunities and necessary deductions, ultimately benefiting your financial health. Continuous learning in this area fosters compliance, minimizes errors, and builds a foundation for trustworthy tax practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax information bulletins issued online?

How do I edit tax information bulletins issued online?

How do I edit tax information bulletins issued on an iOS device?

What is tax information bulletins issued?

Who is required to file tax information bulletins issued?

How to fill out tax information bulletins issued?

What is the purpose of tax information bulletins issued?

What information must be reported on tax information bulletins issued?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.